U.S. Penny Circulation To End By Early 2026: An Exclusive Report

Table of Contents

The Mounting Costs of Penny Production and Circulation

The decision to potentially eliminate the penny stems largely from the escalating costs associated with its production and circulation. These costs significantly outweigh the penny's actual value, representing a considerable financial burden on the U.S. government.

Production Costs Exceed Value

The cost of producing a single penny currently surpasses its one-cent value, resulting in substantial annual losses for the U.S. Mint.

- Material Costs: The primary materials used in penny production—zinc and copper—fluctuate in price, impacting production costs. The current composition makes minting expensive.

- Minting Processes: The complex machinery and labor involved in the minting process add to the overall expense. These processes are not cost-effective for such a low-value coin.

- Annual Loss: Estimates suggest the annual loss incurred by the government due to penny production reaches millions of dollars, a figure that continues to rise. This represents a significant drain on taxpayer money.

Transportation and Handling Costs

Beyond production, the distribution and handling of pennies pose significant logistical challenges and expenses for banks and businesses.

- Weight and Volume: The sheer weight and volume of pennies make transportation costly, requiring substantial fuel and vehicle resources. This is especially problematic for large-scale shipments.

- Storage and Handling: Banks and businesses require considerable storage space to accommodate large quantities of pennies. The labor involved in counting, sorting, and managing pennies adds to operational expenses.

- Environmental Impact: The transportation of pennies contributes to carbon emissions, raising environmental concerns. Reducing penny circulation would lessen this environmental burden.

Arguments for and Against Penny Elimination

The debate surrounding penny elimination is multifaceted, with compelling arguments on both sides. Understanding these perspectives is crucial to fully grasping the implications of this potential monetary change.

Arguments in Favor of Eliminating the Penny

Proponents of penny elimination emphasize the substantial economic benefits that would result.

- Cost Savings: Eliminating the penny would lead to significant cost savings for the government, potentially freeing up resources for other essential programs. This represents a considerable fiscal advantage.

- Environmental Benefits: Reduced transportation and production would lessen the environmental impact associated with the penny. This aligns with broader sustainability initiatives.

- Increased Efficiency: Removing the penny would streamline cash transactions, reducing processing time and handling costs for businesses and banks. This would boost operational efficiency.

Arguments Against Eliminating the Penny

Opponents raise valid concerns regarding the potential negative consequences of penny elimination.

- Impact on Low-Income Individuals: Concerns exist that rounding up prices to the nearest nickel could disproportionately affect low-income individuals, potentially increasing their expenses.

- Impact on Small Businesses: Small businesses, which often handle significant cash transactions, may face additional challenges in adapting to a pennyless system. This could present operational difficulties.

- Sentimental Value: Some individuals express a sentimental attachment to the penny, viewing its elimination as a loss of a piece of American history and cultural heritage. This aspect must be considered alongside the economic implications.

What Happens Next? Potential Alternatives and the Future of Small Transactions

The potential elimination of the penny necessitates exploring alternative solutions and considering the future of small-value transactions.

The Role of Digital Payments

The rise of digital payment methods is steadily diminishing the reliance on physical cash, including pennies.

- Mobile Payment Systems: The increasing popularity of mobile payment apps like Apple Pay and Google Pay is reducing cash transactions significantly. These provide convenient, cashless alternatives.

- Credit and Debit Card Usage: The widespread adoption of credit and debit cards further contributes to a cashless society, minimizing the need for coins. This trend continues to accelerate.

- Potential for Cashless Transactions: The continued growth of digital payments could ultimately render physical coins obsolete, including the penny. This represents a major shift in consumer habits.

Rounding Up/Down

If the penny is eliminated, rounding up or down to the nearest nickel would likely be implemented.

- Impact on Consumers and Businesses: The method of rounding (up or down) will have varying impacts on consumers and businesses. This needs careful consideration to ensure fairness.

- Potential Economic Effects: While the overall economic impact is debated, some predict minimal effects on larger transactions. However, small transactions could see slight price adjustments.

- Different Rounding Methods: Various rounding methods could be considered, each with its own potential effects on consumer spending and business practices. The selection of the optimal method is critical.

Alternative Solutions

While elimination is the most discussed option, alternatives could mitigate some of the issues associated with penny circulation.

- Alternative Materials: Exploring less expensive materials for penny production could reduce costs without eliminating the coin entirely. This would require significant research and development.

- Different Coin Designs: Modifying the penny's design to reduce production costs might be another option. However, this might not address the logistical challenges.

- Cost-Saving Measures: Implementing cost-cutting measures within the current minting process could help reduce losses, though this may not be enough to completely offset the losses.

Conclusion

The potential end of U.S. penny circulation by early 2026 presents a complex issue with significant economic and social implications. While eliminating the penny offers substantial cost savings and efficiency gains, concerns remain about its effects on certain segments of the population and the broader economy. The transition will require thoughtful consideration of alternative strategies to ensure a smooth and equitable shift toward a more efficient and sustainable monetary system. Stay informed about future developments concerning the U.S. penny and its eventual fate. Understanding the arguments for and against penny elimination is vital as this major monetary change approaches. Continue following our reports for updates on the future of U.S. penny circulation and the debate surrounding its elimination.

Featured Posts

-

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 24, 2025

Borsa Italiana Banche Deboli Italgas In Rialzo Dopo I Conti

May 24, 2025 -

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025

Ferrarin Uusi Kyky 13 Vuotias Kuljettaja Liittyy Tiimiin

May 24, 2025 -

Frankfurt Stock Exchange Dax Ends Trading Below 24 000

May 24, 2025

Frankfurt Stock Exchange Dax Ends Trading Below 24 000

May 24, 2025 -

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025

Three Day Slump Amsterdam Stock Exchange Faces Significant Losses

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Latest Posts

-

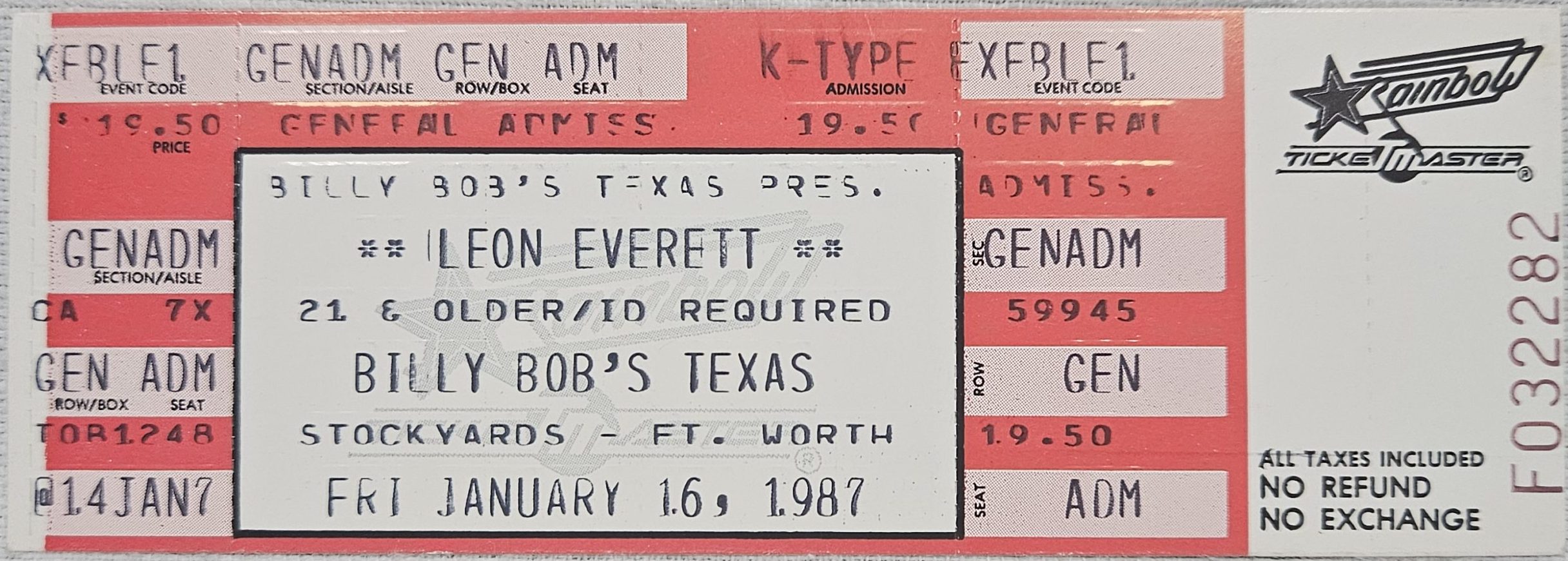

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025 -

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025 -

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025 -

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025