Uber Abandons Foodpanda Taiwan Purchase: Regulatory Hurdles Cited

Table of Contents

Regulatory Obstacles: The Primary Reason for Uber's Pullout

The primary reason for Uber's withdrawal from the Foodpanda Taiwan acquisition boils down to a series of unforeseen regulatory hurdles. These obstacles proved insurmountable, forcing Uber to abandon its plans despite initial enthusiasm for expanding its presence in the lucrative Taiwanese market.

-

Antitrust concerns raised by the Taiwanese Fair Trade Commission (FTC): The FTC, responsible for ensuring fair competition, likely raised concerns about the potential monopolistic effects of Uber acquiring Foodpanda in Taiwan. This is a common issue in mergers and acquisitions within the food delivery sector globally. The FTC's scrutiny likely involved a detailed investigation into market share, competitive dynamics, and the potential impact on consumers.

-

Difficulties in obtaining necessary merger approvals: Securing the required approvals from Taiwanese regulatory bodies proved far more challenging than initially anticipated. The lengthy and complex approval process, coupled with the FTC's concerns, ultimately led to Uber's decision to withdraw. This highlights the importance of thorough due diligence and proactive engagement with regulatory bodies when planning international acquisitions.

-

Unforeseen compliance issues related to data privacy regulations in Taiwan: Taiwan's data privacy laws are stringent and require companies to meticulously protect user data. Uber likely faced difficulties in demonstrating its full compliance with these regulations, particularly regarding the integration of Foodpanda's data into its existing systems. This aspect underscores the growing importance of data privacy in mergers and acquisitions across all sectors.

-

Potential conflicts with existing Taiwanese food delivery regulations: The Taiwanese government has specific regulations governing the food delivery industry, and it’s possible that Uber’s acquisition of Foodpanda would have clashed with existing rules around licensing, operations, or other aspects of the business. Navigating these complexities, especially for a foreign entity, adds significant time and resource constraints to the deal-making process.

The regulatory challenges faced by Uber underscore the significant impact of regulatory frameworks on foreign investment in Taiwan's dynamic food delivery market. These obstacles highlight the need for a comprehensive understanding of Taiwanese antitrust laws, merger approvals processes, data privacy regulations, and specific food delivery regulations for foreign companies considering similar ventures.

Financial Implications for Uber and Foodpanda

The failed acquisition carries significant financial implications for both Uber and Foodpanda. For Uber, the abandoned deal represents a loss of a potential opportunity to expand its market share in a competitive Asian market. This missed opportunity could impact Uber's overall investment strategy in the Asia-Pacific region, prompting a reassessment of its expansion plans in this critical market.

-

Loss of potential market share for Uber in Taiwan's competitive food delivery sector: The Taiwanese food delivery market is fiercely competitive, and acquiring Foodpanda would have given Uber a substantial advantage. The abandonment of the deal leaves Uber to compete with established players, potentially hindering its growth in this region.

-

Potential impact on Uber's overall investment strategy in Asia: This failed acquisition may lead Uber to re-evaluate its approach to acquisitions in Asia, perhaps focusing on markets with less stringent regulatory environments or pursuing alternative growth strategies.

-

Foodpanda's continued independent operation in Taiwan, and its future strategies: Foodpanda will continue operating independently in Taiwan, needing to formulate strategies to maintain its market share and compete against Uber and other players. This situation presents both challenges and opportunities for Foodpanda, requiring it to adapt to a changing competitive landscape.

-

Stock market reactions to the news for both companies (if applicable): The news likely impacted the stock prices of both companies. Investors react to such developments, often reflecting their assessment of the long-term implications on the companies' financial performance and market position.

Impact on the Taiwanese Food Delivery Market

Uber's withdrawal from the acquisition has ripple effects on the broader competitive landscape of Taiwan's food delivery market. Existing players will likely benefit from the absence of a major new competitor, although the dynamics of the market could shift further.

-

Analysis of existing competitors and their market share: The existing players, including local and international competitors, are expected to see adjustments in their market shares. This could involve either increased competition for customers or the potential for consolidation among some players.

-

Potential for increased competition or consolidation among existing players: With Uber out of the picture for now, existing competitors may feel less pressure and continue to focus on their own growth strategies. Alternatively, we might see some consolidation among smaller players to better compete against the more dominant companies.

-

The future trajectory of the Taiwanese food delivery market: The long-term impact remains to be seen. The market is likely to continue its growth trajectory but with a different competitive dynamic compared to what was anticipated with the Uber acquisition.

-

Impact on consumers – prices, service quality, range of options: Consumers might see minimal changes in the short-term. However, long-term effects on prices, service quality, and the range of options available are dependent on the competitive responses of existing players.

Conclusion: Assessing the Uber Foodpanda Taiwan Deal Fallout

The "Uber Abandons Foodpanda Taiwan Purchase" decision underscores the critical role that regulatory hurdles play in international mergers and acquisitions. The significant challenges encountered by Uber highlight the importance of thorough due diligence and a deep understanding of the local regulatory landscape. The financial implications for both companies are considerable, and the impact on Taiwan's food delivery market remains to be fully assessed. The failed acquisition serves as a stark reminder that even for powerful multinational companies, navigating regulatory complexities in foreign markets can be a significant obstacle to growth. Stay informed about developments in the Taiwanese food delivery market and the regulatory environment affecting international mergers and acquisitions. Understanding the "Uber Abandons Foodpanda Taiwan" situation provides valuable insight into the challenges and opportunities within the Taiwanese food delivery market and the wider regulatory landscape.

Featured Posts

-

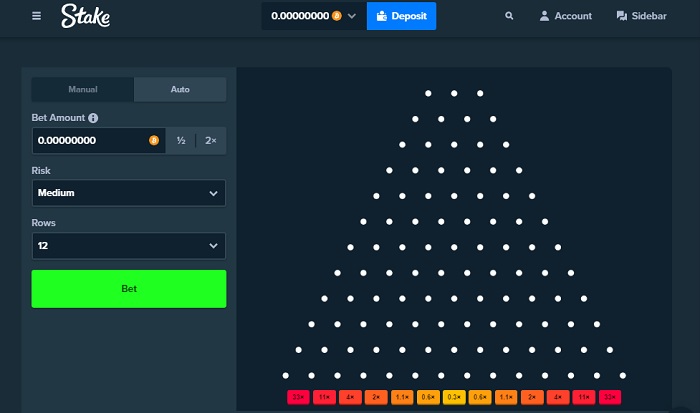

Secure Bitcoin And Crypto Casinos A 2025 Selection

May 18, 2025

Secure Bitcoin And Crypto Casinos A 2025 Selection

May 18, 2025 -

Tom Clancys The Division 2 Celebrating Six Years Of Gameplay

May 18, 2025

Tom Clancys The Division 2 Celebrating Six Years Of Gameplay

May 18, 2025 -

Eyropaiki Naytilia Megethos Epidrasi Kai Simasia

May 18, 2025

Eyropaiki Naytilia Megethos Epidrasi Kai Simasia

May 18, 2025 -

Bostons Bullpen Upgrade A Deep Dive Into The Recent Cardinals Trade

May 18, 2025

Bostons Bullpen Upgrade A Deep Dive Into The Recent Cardinals Trade

May 18, 2025 -

Solve The Nyt Mini Crossword Answers And Hints For March 13

May 18, 2025

Solve The Nyt Mini Crossword Answers And Hints For March 13

May 18, 2025

Latest Posts

-

Economic Impact Study The Case Of A Large Rave

May 19, 2025

Economic Impact Study The Case Of A Large Rave

May 19, 2025 -

March 27th Nba Orlando Magic Vs Dallas Mavericks Game Time Tv Coverage And Odds

May 19, 2025

March 27th Nba Orlando Magic Vs Dallas Mavericks Game Time Tv Coverage And Odds

May 19, 2025 -

The Unexpected Economic Upside Of Massive Rave Events

May 19, 2025

The Unexpected Economic Upside Of Massive Rave Events

May 19, 2025 -

Orlando Magic Vs Dallas Mavericks Where To Watch Game Time And Betting Preview March 27

May 19, 2025

Orlando Magic Vs Dallas Mavericks Where To Watch Game Time And Betting Preview March 27

May 19, 2025 -

How Huge Raves Boost Local Economies

May 19, 2025

How Huge Raves Boost Local Economies

May 19, 2025