Uber Stock: A Comprehensive Investment Analysis

Table of Contents

Uber's Financial Performance and Growth Prospects

Uber's business model centers around a multifaceted approach, encompassing ride-sharing, food delivery (Uber Eats), and freight transportation. Understanding the financial performance of each segment is crucial for assessing the overall health of Uber stock.

Revenue Streams and Growth

Uber's revenue generation stems from various sources, each exhibiting unique growth trajectories:

- Rides: While still a significant revenue contributor, the rides segment faces challenges like increased competition and fluctuating fuel costs. Year-over-year growth rates have shown some variability, dependent on global economic conditions and local regulations.

- Uber Eats: This segment has demonstrated strong and consistent growth, fueled by increasing demand for food delivery services and strategic partnerships with restaurants. Market share gains in key regions have significantly boosted overall revenue.

- Freight: Uber Freight targets the logistics sector, leveraging technology to optimize shipping and delivery. This segment presents a long-term growth opportunity, although it currently contributes less to overall revenue than Rides or Eats.

Factors influencing future revenue growth include: expansion into new international markets, technological advancements in ride-matching algorithms and delivery optimization, and strategic partnerships with businesses and delivery providers.

Profitability and Margins

Uber's path to profitability has been a long and challenging one. While revenue has increased significantly, achieving consistent net income has proven difficult. Key factors impacting profitability include:

- Driver Compensation: Balancing driver earnings with competitive pricing remains a constant challenge.

- Fuel Prices: Fluctuations in fuel prices directly impact the operating costs of the rides segment.

- Regulatory Changes: Varying regulations across different jurisdictions impact operational costs and profitability.

Analyzing Uber's operating margins, net income, and free cash flow is vital to understanding its financial health and its ability to generate sustainable profits. Cost-cutting measures, operational efficiencies, and dynamic pricing strategies play crucial roles in improving profitability.

Key Financial Metrics

To thoroughly evaluate Uber stock, investors must analyze key financial ratios:

- Price-to-Earnings (P/E) Ratio: This ratio provides insight into the market's valuation of Uber relative to its earnings.

- Debt-to-Equity Ratio: This metric assesses Uber's financial leverage and risk.

- Free Cash Flow: This indicates Uber's ability to generate cash after accounting for capital expenditures.

Comparing these metrics to competitors like Lyft offers valuable context and allows for a comparative analysis of Uber stock's performance and valuation.

Understanding the Risks Associated with Uber Stock

Investing in Uber stock involves significant risks, which potential investors must carefully consider:

Regulatory and Legal Risks

Uber operates within a complex and evolving regulatory landscape. Challenges include:

- Licensing Issues: Securing and maintaining necessary licenses and permits across various jurisdictions can be costly and time-consuming.

- Labor Disputes: The classification of drivers as independent contractors versus employees remains a contentious legal issue impacting operational costs and potential liabilities.

- Antitrust Concerns: Concerns regarding Uber's market dominance and potential anti-competitive practices could lead to legal challenges and regulatory scrutiny.

Changes in regulations could significantly impact Uber's operating model, profitability, and overall business strategy.

Competition and Market Saturation

Uber faces intense competition in all its market segments:

- Ride-sharing: Lyft and other emerging ride-sharing services pose a direct competitive threat.

- Food Delivery: DoorDash, Grubhub, and other delivery platforms compete for market share in the food delivery sector.

- Freight: Established players and new entrants in the freight sector pose competitive pressures.

Market saturation in specific regions could limit future growth and intensify competitive pricing pressures.

Economic and Geopolitical Risks

Macroeconomic factors can significantly affect Uber's performance:

- Recessions: Economic downturns can lead to reduced consumer spending, impacting demand for ride-sharing and food delivery services.

- Inflation: Rising inflation increases operational costs, potentially squeezing profitability.

- Geopolitical Events: Global events can disrupt operations and negatively impact revenue generation in affected regions.

Uber's business model is inherently sensitive to broader economic trends and geopolitical instability.

Valuation and Investment Strategy for Uber Stock

Determining the appropriate valuation for Uber stock requires a multi-faceted approach:

Discounted Cash Flow (DCF) Analysis

A DCF analysis (optional but highly recommended) projects future cash flows and discounts them back to their present value to estimate the intrinsic value of Uber stock. This approach helps to determine if the current market price fairly reflects the company's long-term potential.

Comparable Company Analysis

Comparing Uber's key financial metrics (P/E ratio, revenue growth, etc.) to those of its competitors provides context for valuation and helps to identify potential over- or undervaluation.

Investment Recommendations

Based on the thorough financial analysis, a balanced assessment of the risks and rewards is needed to formulate an investment strategy. The recommendation could range from "buy" (if the stock is undervalued and possesses significant growth potential), "hold" (if the stock is fairly valued), or "sell" (if the stock is overvalued or faces significant downside risks). The rationale behind the recommendation should be clearly articulated, considering the factors discussed above.

Conclusion: Should You Invest in Uber Stock?

This analysis has provided a comprehensive overview of Uber stock, examining its financial performance, growth prospects, and associated risks. While Uber's innovative business model and dominant market position in certain segments present significant opportunities, the intense competition, regulatory challenges, and macroeconomic vulnerabilities necessitate a cautious approach. Remember, the investment recommendations provided here are based on the current analysis, and market conditions are ever-changing. Conduct thorough due diligence, considering your own risk tolerance and financial goals, before making any investment decisions related to Uber stock. Remember, investing in Uber stock, or any stock, involves inherent risks, and past performance is not indicative of future results.

Featured Posts

-

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025

Lottozahlen 6aus49 Vom 19 April 2025 Ziehungsergebnis Und Quoten

May 08, 2025 -

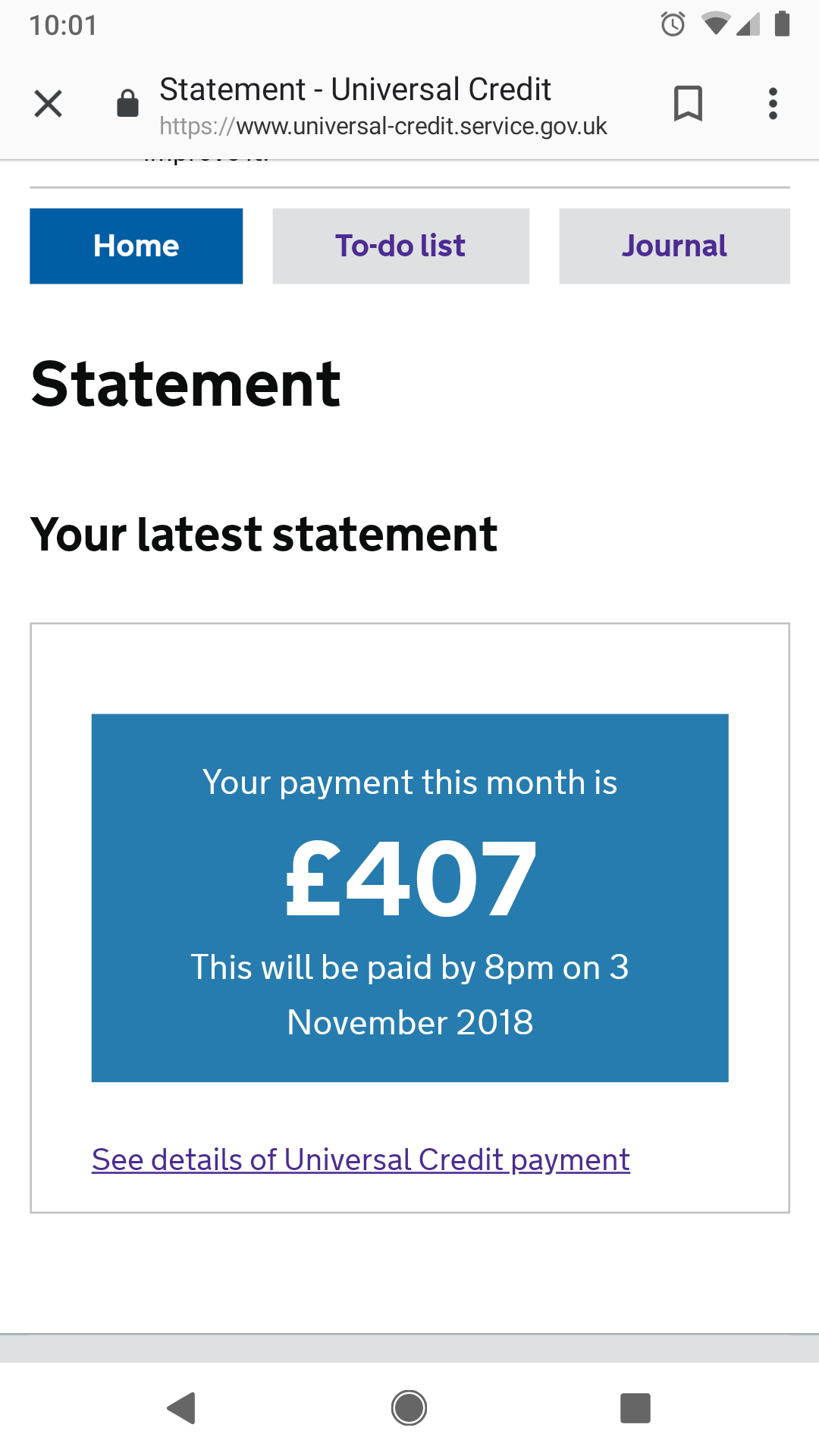

Review Your Universal Credit Hardship Payments Potential Refunds

May 08, 2025

Review Your Universal Credit Hardship Payments Potential Refunds

May 08, 2025 -

Universal Credit Historical Payments Check Your Entitlement

May 08, 2025

Universal Credit Historical Payments Check Your Entitlement

May 08, 2025 -

Lotto And Lotto Plus Winning Numbers 12th April 2025

May 08, 2025

Lotto And Lotto Plus Winning Numbers 12th April 2025

May 08, 2025 -

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025

Barcelona Vs Inter Milan Six Goal Thriller In Champions League Semi Final

May 08, 2025