Uber Stock: A Deep Dive Into The Company's Autonomous Driving Strategy

Table of Contents

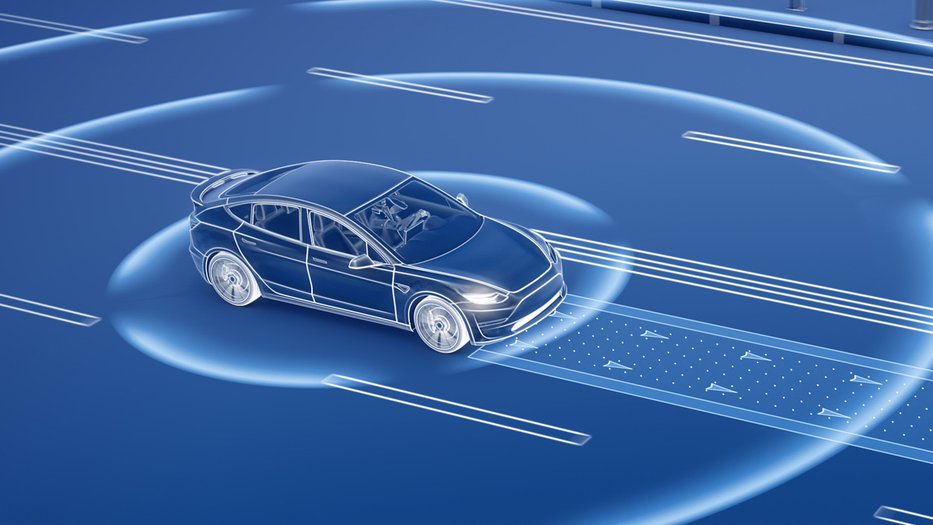

Uber's Autonomous Driving Technology: Current State and Challenges

Uber ATG (Advanced Technologies Group): A Closer Look

Uber's self-driving car program, spearheaded by its Advanced Technologies Group (ATG), has a complex history. Initially ambitious, the program faced setbacks including accidents and a significant restructuring. However, Uber ATG continues to invest heavily in developing its self-driving technology. This involves:

- Sensor Fusion: Utilizing a combination of LiDAR, radar, and cameras to create a comprehensive 3D map of the surroundings.

- AI Algorithms: Employing sophisticated machine learning algorithms to interpret sensor data, make driving decisions, and navigate complex traffic scenarios.

- Mapping Technology: Creating highly detailed and accurate maps crucial for autonomous navigation, continually updated through its fleet of vehicles.

- Partnerships: While initially operating largely independently, Uber has explored collaborations and potential acquisitions to accelerate its autonomous vehicle development.

The scale of Uber's autonomous fleet, while not publicly disclosed in full detail, represents a substantial investment in its future. The number of robotaxis deployed for testing purposes fluctuates, but the commitment remains clear. Keywords like Uber ATG, self-driving technology, sensor fusion, AI algorithms, mapping technology, and robotaxis are central to understanding Uber's progress.

Key Challenges and Hurdles in Autonomous Vehicle Development

The path to fully autonomous vehicles is fraught with challenges:

- Technological Challenges: Handling unexpected situations, such as erratic pedestrians or unforeseen road obstructions (edge cases), remains a significant hurdle. Perfecting the ability to react safely and predictably in every scenario is critical.

- Regulatory Hurdles and Legal Complexities: Navigating varying regulations across different jurisdictions poses a significant challenge. Liability in the event of accidents involving autonomous vehicles is a major legal and ethical concern.

- High Costs: Research, development, testing, and deployment of autonomous vehicle technology require massive financial investment. This poses a significant risk, especially in a competitive market.

- Safety Concerns and Public Perception: Public trust is paramount. Accidents and negative publicity can severely impact the adoption rate and overall success of autonomous driving technology. This is reflected in keywords like regulatory hurdles, safety regulations, autonomous vehicle safety, technological challenges, cost of autonomous vehicles, and liability.

Competition in the Autonomous Vehicle Market

Uber faces fierce competition from established players and emerging startups:

- Waymo: A leader in the field, Waymo boasts a significant head start and extensive testing data.

- Cruise (GM): Backed by General Motors, Cruise is another major contender with substantial resources.

- Tesla Autopilot: While not fully autonomous, Tesla's Autopilot system represents a significant step towards self-driving capabilities and poses a competitive threat.

Analyzing the strengths and weaknesses of these competitors, and the potential for partnerships or acquisitions, is crucial for understanding Uber's position in the autonomous vehicle market. Keywords such as Waymo, Cruise, Tesla Autopilot, autonomous vehicle competition, market share, and strategic partnerships highlight this competitive landscape.

The Impact of Autonomous Driving on Uber's Business Model and Stock Price

Potential Benefits of Autonomous Vehicles for Uber

Successful deployment of autonomous vehicles offers significant potential benefits:

- Cost Reduction: Eliminating the need for human drivers dramatically lowers operating costs.

- Increased Efficiency and Scalability: Autonomous vehicles can operate 24/7, increasing efficiency and allowing Uber to scale its operations more effectively.

- New Revenue Streams: Autonomous vehicles could expand into new areas like autonomous delivery services, generating additional revenue. Keywords such as cost reduction, efficiency gains, revenue streams, autonomous delivery, and ride-hailing underscore these benefits.

Risks and Uncertainties Associated with Autonomous Driving

However, significant risks are associated with Uber's autonomous vehicle strategy:

- Potential Delays in Technology Development: Technological hurdles could lead to significant delays, impacting Uber's timeline and market position.

- Impact of Unforeseen Technological Challenges: Unexpected technological problems could lead to costly setbacks and even the failure of the entire program.

- Risk of Significant Financial Losses: The massive investment required could result in substantial financial losses if the strategy fails to deliver expected returns. Keywords such as technological risk, financial risk, market uncertainty, investment risk, and return on investment represent the inherent risks.

Analyzing the Correlation Between Uber's Autonomous Driving Progress and Stock Performance

Analyzing historical stock price movements in relation to autonomous driving milestones provides insight into investor sentiment. Positive developments often lead to increased investor confidence and a rise in stock price, while setbacks can cause volatility and decrease in value. This relationship is reflected in keywords like stock price analysis, investor sentiment, market capitalization, and stock valuation.

Conclusion: Investing in Uber Stock Based on its Autonomous Driving Strategy

Uber's position in the autonomous driving race is complex. While the potential benefits are substantial, the challenges and risks are equally significant. The success of its autonomous driving strategy will significantly impact its future and, consequently, its stock price. Before making any investment decisions, thorough research into Uber stock and its autonomous driving progress is crucial. Consider the long-term implications of autonomous driving technology on the transportation sector and Uber's market position. Remember to always conduct thorough due diligence before investing in any stock, especially those with high-growth, high-risk potential like Uber stock and its commitment to autonomous vehicles.

Featured Posts

-

Gear Up For Celtics Glory Fanatics Offers The Ultimate Collection For Nba Finals Fans

May 08, 2025

Gear Up For Celtics Glory Fanatics Offers The Ultimate Collection For Nba Finals Fans

May 08, 2025 -

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025 -

Car Dealers Intensify Opposition To Electric Vehicle Mandates

May 08, 2025

Car Dealers Intensify Opposition To Electric Vehicle Mandates

May 08, 2025 -

Lahore Weather Forecast For Eid Ul Fitr 2 Day Outlook

May 08, 2025

Lahore Weather Forecast For Eid Ul Fitr 2 Day Outlook

May 08, 2025 -

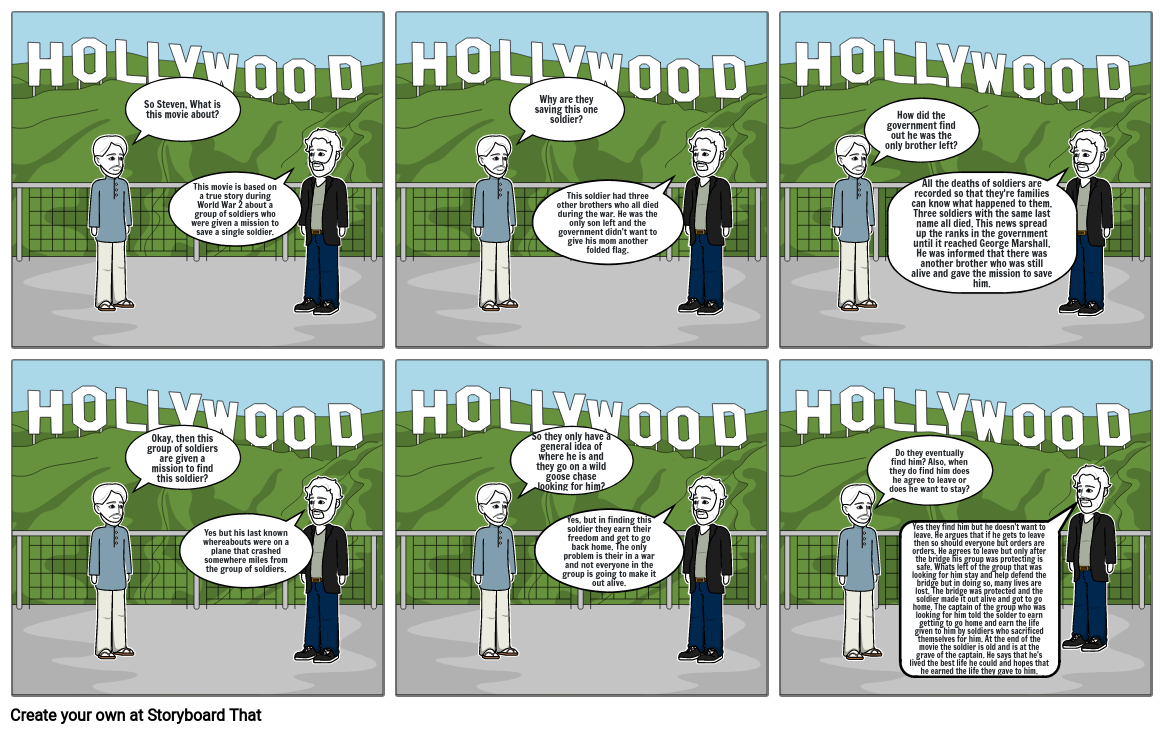

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025