Uber Stock And Recession: Why Analysts Are Bullish

Table of Contents

Uber's Resilience During Economic Downturns

Uber's ability to weather economic storms is a key factor in the bullish sentiment surrounding its stock. This resilience stems from two primary sources: increased demand for affordable transportation and diversified revenue streams.

Increased Demand for Affordable Transportation

Recessions often force consumers to tighten their belts, seeking more budget-friendly alternatives. This trend significantly benefits Uber.

- Budget-Conscious Consumers: During economic downturns, individuals and families often cut back on expenses like car ownership and maintenance. Uber's ride-sharing services offer a cost-effective alternative, especially for occasional trips or commutes.

- Gig Economy Surge: Periods of high unemployment often lead to a surge in the gig economy. Many individuals turn to ride-sharing as a source of income, increasing demand for Uber's services. This dual-sided market dynamic provides resilience.

- Data-Driven Insights: Studies have shown a positive correlation between increased Uber usage and periods of economic contraction. This data provides strong evidence supporting the company's recession-resistant nature. For example, during the 2008 financial crisis, the initial drop in ridership was quickly followed by a resurgence as people sought cost-effective transportation solutions.

Diversified Revenue Streams

Uber's strategic expansion beyond ride-sharing into other sectors is another critical factor contributing to its resilience. This diversification mitigates the risk associated with relying on a single revenue source.

- Uber Eats' Steadfast Performance: The food delivery sector, particularly Uber Eats, tends to show greater resilience during economic downturns. Even when people cut back on dining out, food delivery remains a popular option.

- Uber Freight and Other Ventures: Uber Freight, catering to the logistics industry, adds another layer of diversification. The performance of this segment is less directly tied to consumer spending habits and provides a buffer during economic uncertainty.

- Future Revenue Streams: Uber is constantly exploring new opportunities for growth and revenue generation. This proactive approach is vital in maintaining financial stability and supporting a bullish outlook even in the face of economic challenges.

Long-Term Growth Potential

Beyond its immediate resilience, Uber possesses significant long-term growth potential driven by technological advancements and expanding market penetration.

Technological Advancements and Innovation

Uber's commitment to technological innovation is a powerful engine for future growth.

- Autonomous Vehicle Technology: Ongoing investments in self-driving technology promise significant long-term cost reductions and operational efficiencies.

- App Enhancements and User Experience: Continuous improvements to the Uber app, enhancing user experience and streamlining processes, will attract and retain customers.

- Competitive Advantage: Uber's technological prowess gives it a significant competitive advantage, allowing it to continually improve its services and attract new users.

Expanding Market Penetration

Uber's global presence provides enormous potential for expansion and increased market share.

- Untapped Markets: Many emerging markets represent significant growth opportunities for Uber. Expanding into these regions can significantly increase its user base and revenue.

- Market Share Growth: Strategies focusing on improving service quality, targeted marketing, and competitive pricing can further enhance Uber's market share in existing regions.

- Regulatory Landscape: Navigating the regulatory environment in different countries remains a challenge. However, Uber’s experience in overcoming such hurdles demonstrates its adaptability and strengthens its long-term prospects.

Analyst Sentiment and Valuation

Positive earnings reports and future projections significantly influence analyst sentiment towards Uber stock.

Positive Earnings Reports and Future Projections

Recent Uber earnings reports have generally been positive, showcasing growth across various segments.

- Key Financial Indicators: Analyzing key financial indicators like revenue growth, profitability margins, and user engagement offers valuable insights into the company's financial health and future prospects.

- Analyst Predictions: Many analysts predict continued growth and increasing profitability for Uber in the coming years.

- Valuation Compared to Competitors: A comparative analysis of Uber's valuation against its competitors helps to gauge its investment attractiveness.

Addressing Concerns and Risks

While the outlook is generally bullish, it's crucial to acknowledge potential concerns and risks.

- Driver Compensation and Labor Relations: Ongoing debates regarding driver compensation and worker classification remain a potential challenge. Uber’s response to these concerns will be crucial to maintaining positive investor sentiment.

- Regulatory Challenges and Future Legislation: Changes in regulations impacting ride-sharing and food delivery services can significantly affect Uber’s operations.

- Economic Headwinds: Despite its resilience, significant economic downturns could still negatively impact Uber's performance.

Conclusion

While economic uncertainty persists, a number of factors point towards a bullish outlook for Uber stock. Its resilience during downturns, diverse revenue streams, and significant long-term growth potential driven by technological advancements and market expansion make it an attractive investment for many. However, potential risks and challenges should be carefully considered. Further research into the intricacies of Uber stock and the current economic climate is crucial before making any investment decisions. Conduct thorough due diligence before investing in Uber stock and stay updated on any significant developments influencing the company's financial performance and future prospects. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Voter Information And Resources For Southeast Texass May 2025 Municipal Elections

May 18, 2025

Voter Information And Resources For Southeast Texass May 2025 Municipal Elections

May 18, 2025 -

7 Bit Casino A Contender For Best Online Casino Canada 2025

May 18, 2025

7 Bit Casino A Contender For Best Online Casino Canada 2025

May 18, 2025 -

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025

Moncada And Soriano Power Angels To 1 0 Win Against White Sox

May 18, 2025 -

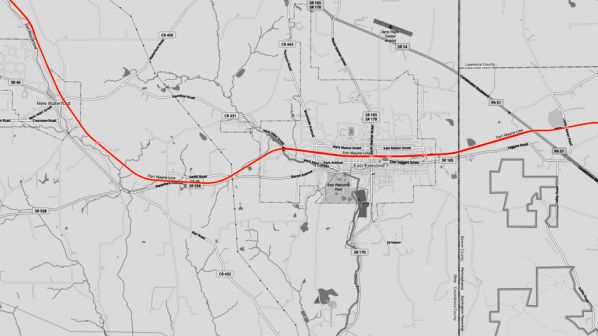

Ohio Derailment Investigation Into Persistent Toxic Chemical Contamination

May 18, 2025

Ohio Derailment Investigation Into Persistent Toxic Chemical Contamination

May 18, 2025 -

Spring Breakout 2025 A Comprehensive Roster Preview

May 18, 2025

Spring Breakout 2025 A Comprehensive Roster Preview

May 18, 2025

Latest Posts

-

Daily Lotto Winning Numbers Monday 28th April 2025

May 18, 2025

Daily Lotto Winning Numbers Monday 28th April 2025

May 18, 2025 -

Check The Daily Lotto Results Tuesday April 29 2025

May 18, 2025

Check The Daily Lotto Results Tuesday April 29 2025

May 18, 2025 -

April 28 2025 Daily Lotto Winning Numbers

May 18, 2025

April 28 2025 Daily Lotto Winning Numbers

May 18, 2025 -

Tuesday April 29th 2025 Daily Lotto Results

May 18, 2025

Tuesday April 29th 2025 Daily Lotto Results

May 18, 2025 -

Check The Daily Lotto Results For Monday April 28 2025

May 18, 2025

Check The Daily Lotto Results For Monday April 28 2025

May 18, 2025