Uber Stock And Recession: Why Analysts See Resilience

Table of Contents

Uber's Diversified Revenue Streams as a Recession Hedge

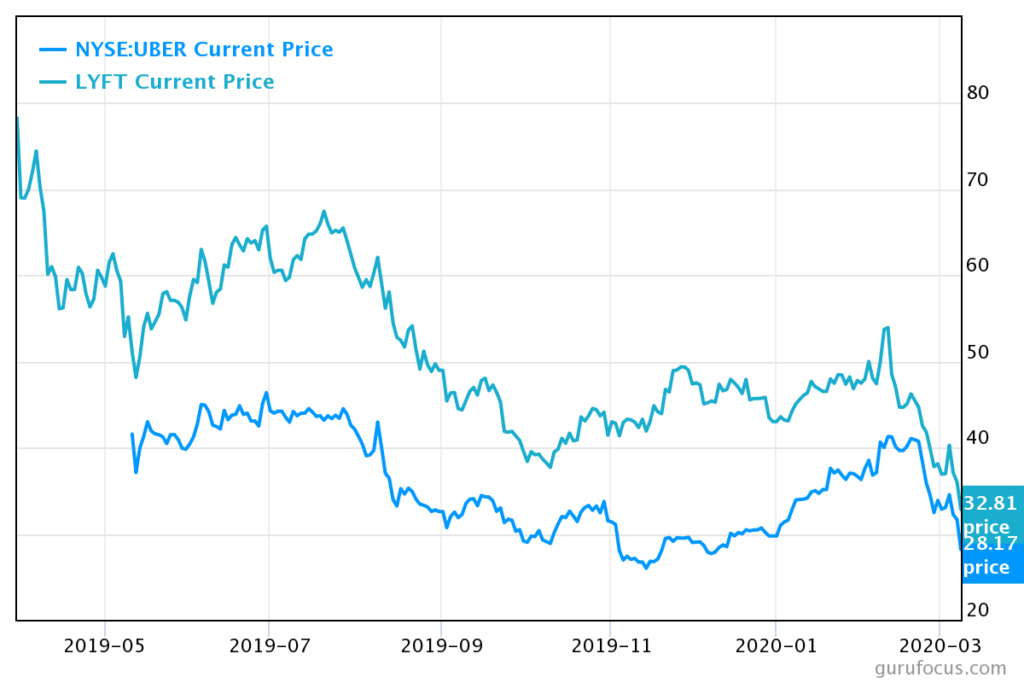

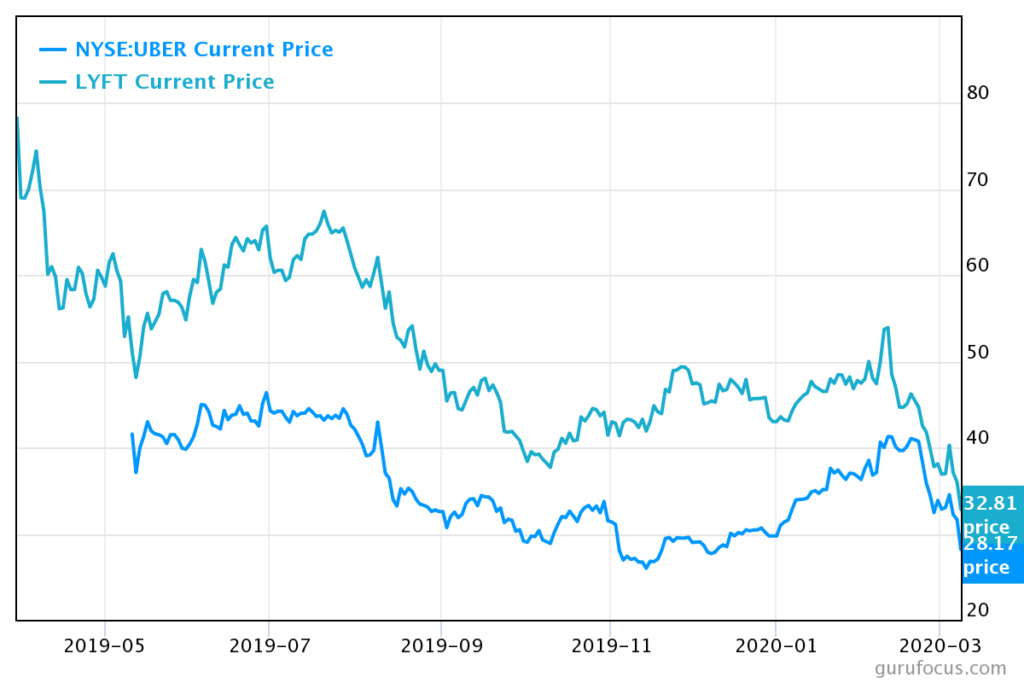

One of the primary reasons analysts are optimistic about Uber stock during a potential recession is its diversified revenue streams. Unlike companies reliant on single product lines or sectors vulnerable to economic downturns, Uber operates across multiple, relatively resilient markets.

Ridesharing Remains Robust, Even During Economic Slowdowns

- Essential Travel Remains: Even during economic downturns, essential travel persists. Commuting to work, airport transfers, and urgent medical appointments remain relatively unaffected by economic fluctuations.

- Dynamic Pricing Strategies: Uber's sophisticated pricing algorithms adjust to fluctuating demand, ensuring profitability even during periods of reduced ridership.

- Market Dominance: Uber maintains a significant market share in the ridesharing industry, giving it a competitive edge and enabling it to withstand economic pressures more effectively than smaller players. While precise ridership data during past recessions is difficult to isolate completely, anecdotal evidence and general trends suggest a continued, though perhaps reduced, demand for ridesharing services.

The Growing Power of Uber Eats and Delivery Services

The food delivery and grocery delivery sectors demonstrate remarkable resilience during economic downturns. While consumers might cut back on expensive restaurant meals, the convenience of food delivery often remains a priority.

- Increased Demand: The demand for home delivery services, including groceries and prepared meals, tends to increase during economic uncertainty, as consumers seek to save time and minimize trips to physical stores.

- Strategic Partnerships: Uber's strategic partnerships and expansion within the delivery sector strengthen its position and contribute to its growth potential even during a recession. This includes partnerships with various restaurants and grocery chains.

- Growth Potential: The delivery segment is poised for continued expansion, making it a significant contributor to Uber's overall resilience.

Freight Services as a Counter-cyclical Business

Uber Freight operates within the logistics industry, a sector often less sensitive to immediate economic fluctuations than others.

- Consistent Demand: The transportation of goods remains consistently in demand, even during economic downturns, as businesses still need to move products and materials. This makes Uber Freight relatively insulated from the effects of reduced consumer spending.

- Essential Infrastructure: The logistics industry is integral to the functioning of the economy, which means that demand for freight services, while perhaps not booming, remains consistent.

Cost-Cutting Measures and Operational Efficiency

Uber’s commitment to operational efficiency and cost-cutting measures further enhances its ability to navigate a recessionary environment.

Technological Advancements Driving Efficiency

- Route Optimization: Uber's investments in advanced technology, including route optimization algorithms and improved driver matching systems, contribute significantly to cost savings.

- Streamlined Operations: These technologies improve the overall efficiency of Uber’s operations, reduce operational expenses, and enhance profitability.

Strategic Workforce Management

- Demand-Based Staffing: Uber's capacity to adjust its driver base according to fluctuating demand helps avoid overstaffing during slower periods.

- Labor Cost Control: This flexible workforce management strategy directly contributes to controlling labor costs and maintaining profitability, even during periods of reduced demand.

Long-Term Growth Potential and Market Position

Uber's long-term growth prospects and strong market position contribute significantly to its resilience against economic shocks.

Expansion into New Markets and Services

- Geographic Expansion: Uber continues to expand into new geographical markets, broadening its revenue base and reducing its reliance on any single region.

- New Service Offerings: Diversification into new areas such as autonomous vehicles and micro-mobility initiatives creates further opportunities for growth and resilience.

Strong Brand Recognition and Customer Loyalty

- Widespread Brand Awareness: Uber enjoys significant brand recognition and widespread consumer awareness, contributing to sustained demand.

- Convenience Factor: The convenience offered by Uber's services fosters customer loyalty, which is crucial during uncertain economic times.

Conclusion

While a recession presents challenges for many businesses, analysts see reasons for optimism regarding Uber stock. Its diversified revenue streams, strategic cost-cutting measures, and substantial growth potential contribute to a more resilient outlook compared to companies heavily reliant on discretionary spending. The continued expansion of its delivery services, along with its technological advancements and strategic workforce management, position Uber favorably to weather economic downturns. Therefore, considering the overall picture of Uber stock and recession resilience, now might be a strategic time to further investigate investing in Uber stock. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to Uber stock recession resilience.

Featured Posts

-

Jeffrey Dean Morgan Discusses His Fortnite Negan Role

May 17, 2025

Jeffrey Dean Morgan Discusses His Fortnite Negan Role

May 17, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 17, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1050 Cost Surge

May 17, 2025 -

Tony Bennett His Impact On Music And The People Who Inspired Him

May 17, 2025

Tony Bennett His Impact On Music And The People Who Inspired Him

May 17, 2025 -

Play At The Best Online Casino In Ontario Mirax Casino

May 17, 2025

Play At The Best Online Casino In Ontario Mirax Casino

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Latest Posts

-

Stock Market Winners Rockwell Automation Leads The Charge

May 17, 2025

Stock Market Winners Rockwell Automation Leads The Charge

May 17, 2025 -

In Depth La Lakers Coverage News Analysis And More Vavel United States

May 17, 2025

In Depth La Lakers Coverage News Analysis And More Vavel United States

May 17, 2025 -

Jalen Brunson Recovery Update Expected To Play Sunday

May 17, 2025

Jalen Brunson Recovery Update Expected To Play Sunday

May 17, 2025 -

Knicks Narrow Escape A Look At The Overtime Loss

May 17, 2025

Knicks Narrow Escape A Look At The Overtime Loss

May 17, 2025 -

Market Surge Rockwell Automation Angi And Other Top Performers

May 17, 2025

Market Surge Rockwell Automation Angi And Other Top Performers

May 17, 2025