Uber Stock And Recessions: A Look At Historical Performance And Future Predictions

Table of Contents

H2: Uber's Stock Performance During Past Recessions

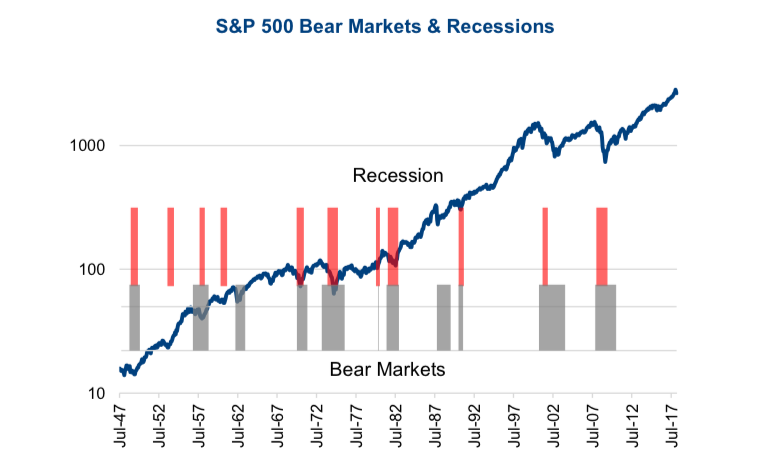

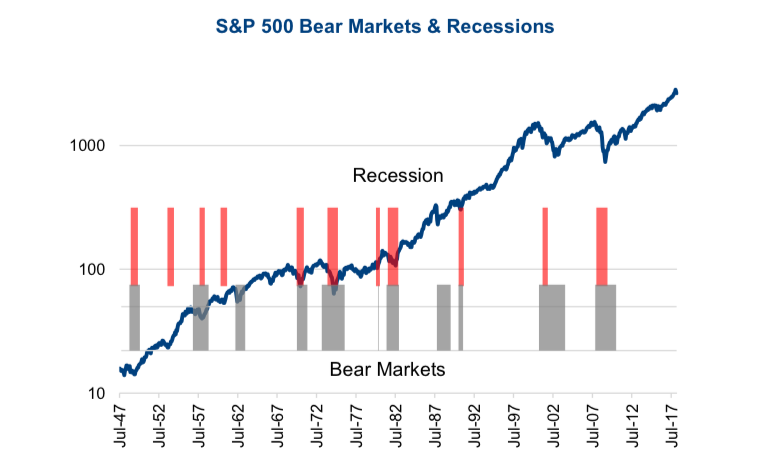

H3: The 2008 Financial Crisis: While Uber itself didn't exist in its current form during the 2008 financial crisis, analyzing its predecessors and the broader ride-sharing landscape provides valuable context. The 2008 crisis significantly impacted consumer spending, leading to a decrease in discretionary spending on transportation. Companies offering similar services likely faced reduced demand and profitability. While specific Uber stock data isn't applicable, the broader economic climate offers insight.

- Stock Price Changes: The overall market experienced a sharp decline during 2008, and comparable businesses in the transportation sector likely saw significant stock price drops.

- Revenue Fluctuations: Reduced consumer spending directly translated to lower revenues for transportation-related businesses.

- Challenges and Advantages: The lack of established ride-sharing services during 2008 meant that this sector wasn't significantly affected, although the general economic downturn certainly affected potential investment and growth.

H3: The COVID-19 Pandemic: The COVID-19 pandemic presented an unprecedented challenge. Initial lockdowns dramatically reduced ride-sharing demand, causing a significant drop in Uber's stock price. However, the surge in food delivery orders during lockdowns partially offset this decline.

- Government Restrictions: Lockdown measures severely curtailed ride-sharing activities, impacting Uber's ride-hailing business.

- Shift in Consumer Behavior: The pandemic accelerated the shift towards online food delivery, benefiting Uber Eats.

- Stock Price Fluctuations: Uber's stock experienced volatility, with initial sharp drops followed by a gradual recovery as restrictions eased and delivery services remained strong. Understanding this volatility is crucial when considering Uber stock and recessions.

H3: Lessons from Past Recessions: Uber's experience during the pandemic highlighted both its vulnerabilities and its adaptability. The reliance on discretionary consumer spending remains a key risk factor. However, the success of Uber Eats demonstrates the potential for diversification to mitigate recessionary impacts.

- Key Factors Influencing Stock Performance: Consumer confidence, fuel prices, and regulatory changes are all crucial factors influencing Uber stock performance.

- Strengths and Weaknesses: Uber's technology platform and diverse service offerings provide resilience, while reliance on consumer spending presents a vulnerability.

- Adaptability and Innovation: Uber's ability to adapt its services to changing consumer needs and market conditions will continue to be critical during economic downturns.

H2: Factors Influencing Uber Stock During Recessions

H3: Consumer Spending and Discretionary Income: Ride-sharing and food delivery are discretionary services. During recessions, consumers prioritize essential spending, reducing demand for these services.

- Statistical Data: Empirical evidence demonstrates a strong correlation between consumer spending and Uber's revenue.

- Impact on Different Service Segments: Ride-hailing is more susceptible to recessionary pressures than food delivery, which has shown more resilience.

- Price Sensitivity: During economic downturns, price sensitivity increases, affecting demand and Uber's pricing strategies.

H3: Fuel Prices and Operational Costs: Fluctuating fuel prices directly impact driver earnings and Uber's profitability. Higher fuel costs can lead to reduced driver supply and increased fares.

- Impact on Driver Earnings and Retention: Increased fuel costs can reduce driver income, leading to higher turnover.

- Pricing Strategies: Uber may need to adjust pricing to offset increased operational costs, potentially impacting demand.

- Potential for Hedging Strategies: Exploring fuel price hedging strategies could help mitigate the risk of fluctuating fuel costs.

H3: Regulatory Environment and Competition: Government regulations and intense competition from rivals influence Uber's market share and profitability during recessions.

- Impact of Regulations: Regulatory changes regarding labor laws, pricing, and licensing can significantly impact Uber's operational costs and revenues.

- Competitive Landscape: Competitive pressures from other ride-sharing and delivery platforms may intensify during economic downturns.

- Potential for Mergers and Acquisitions: Economic downturns can create opportunities for consolidation, with stronger players potentially acquiring weaker competitors.

H2: Predicting Uber's Future Performance During Potential Recessions

H3: Diversification and Future Growth Strategies: Uber's diversification into freight transportation and autonomous vehicles could lessen its reliance on ride-sharing and food delivery, mitigating risks during economic downturns.

- Reduced Reliance on Ride-Sharing: The growth of other segments reduces dependence on the cyclical nature of ride-hailing.

- Growth Prospects in Other Segments: Freight transportation and autonomous vehicle technology offer potential for significant future revenue streams.

- Risk Mitigation Strategies: Diversification across various business units helps to spread risk and stabilize performance.

H3: Financial Health and Debt Levels: Uber's financial health, including debt levels and cash reserves, will play a significant role in its ability to withstand future economic shocks.

- Debt-to-Equity Ratio: A high debt-to-equity ratio increases vulnerability during economic downturns.

- Cash Flow Analysis: Positive cash flow and strong liquidity are essential for weathering economic storms.

- Liquidity Position: Sufficient liquid assets enable Uber to navigate short-term economic challenges.

H3: Market Sentiment and Investor Confidence: Investor sentiment and confidence significantly influence Uber's stock price, particularly during periods of economic uncertainty.

- News Coverage and Its Influence: Negative news coverage can impact investor sentiment and lead to stock price drops.

- Analyst Ratings and Predictions: Analyst ratings and forecasts are important in shaping investor perceptions and expectations.

- Impact of Investor Behavior: Panic selling during economic downturns can exacerbate stock price volatility.

3. Conclusion

Uber's historical performance during past economic downturns, while limited in direct comparison to its current form, highlights the importance of understanding the impact of consumer spending, fuel prices, and regulatory environments. Its diversification strategies and financial health will be crucial in determining its resilience during future recessions. Predicting the behavior of Uber stock and recessions requires careful consideration of these factors. While Uber’s diversification offers some protection, its reliance on discretionary spending remains a key vulnerability.

Call to Action: Before making any investment decisions regarding Uber stock, conduct your own thorough research. Continuously monitor the performance of Uber stock and its responses to economic conditions. Always consider your risk tolerance when evaluating potential investments in Uber stock during times of economic uncertainty. Understanding the interplay between Uber stock and recessions is vital for informed investment choices.

Featured Posts

-

Finalen I Melodifestivalen 2025 Komplett Guide Till Artister Och Startordning

May 19, 2025

Finalen I Melodifestivalen 2025 Komplett Guide Till Artister Och Startordning

May 19, 2025 -

Jannik Sinners Hamburg Tournament A Return After Suspension

May 19, 2025

Jannik Sinners Hamburg Tournament A Return After Suspension

May 19, 2025 -

Duelo En El Tenis Nadal Lamenta El Fallecimiento De Un Idolo

May 19, 2025

Duelo En El Tenis Nadal Lamenta El Fallecimiento De Un Idolo

May 19, 2025 -

Portugal Election 2023 Third Snap Vote In Three Years

May 19, 2025

Portugal Election 2023 Third Snap Vote In Three Years

May 19, 2025 -

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025