Uber Stock Performance And The Promise Of Autonomous Vehicles

Table of Contents

Uber's Current Stock Performance: A Detailed Look

Analyzing Uber's Stock Price Trends

Uber's stock price has experienced considerable volatility since its initial public offering (IPO). While it has seen periods of growth, it has also faced significant dips influenced by a variety of factors. [Insert relevant chart showing Uber's stock price trend over a significant period, e.g., the last 3-5 years].

- Key factors influencing stock price: Earnings reports, particularly those showcasing progress (or lack thereof) towards profitability, heavily influence Uber's stock price. Regulatory changes impacting ride-sharing and autonomous vehicle operations also create significant market fluctuations. Furthermore, broader market sentiment and investor confidence in the tech sector play a crucial role.

- Comparison with competitors: Uber's stock performance needs to be viewed within the context of its main competitors in the ride-sharing and transportation sectors like Lyft and other transportation network companies (TNCs). Comparing key performance indicators (KPIs) helps to understand Uber's relative position and market share.

Financial Performance and Profitability

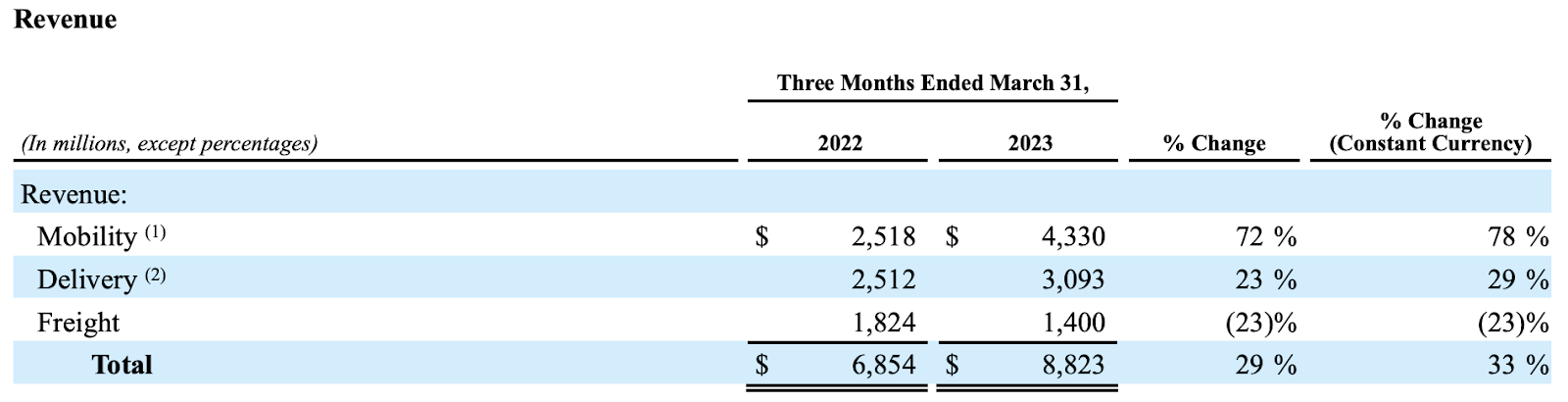

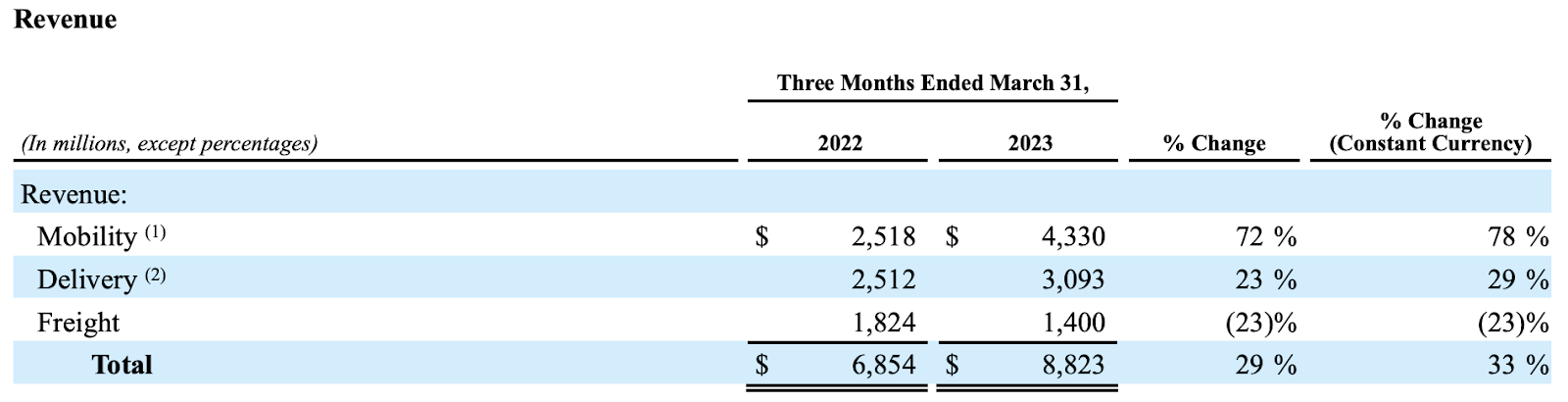

Uber's financial statements reveal a complex picture. While revenue streams from rides, Uber Eats (food delivery), and freight are significant, profitability remains a challenge. [Insert data on revenue, expenses, and net income, ideally presented visually].

- Revenue stream breakdown: A detailed analysis of revenue contributions from each segment (rides, delivery, freight) is crucial in understanding Uber's overall financial health and its dependence on each sector.

- Key financial metrics: Examining key metrics like earnings per share (EPS), revenue growth rate, and debt levels provides a more granular picture of Uber's financial performance and its ability to achieve sustainable profitability. Analyzing these metrics in conjunction with the company's guidance for future performance offers valuable insights.

The Impact of Autonomous Vehicle Technology on Uber's Future

The Potential of Autonomous Driving for Uber's Business Model

The successful implementation of autonomous driving technology has the potential to revolutionize Uber's business model, leading to significant cost reductions and increased efficiency.

- Lower labor costs: Autonomous vehicles eliminate the need for human drivers, potentially leading to substantial savings in labor costs, a major expense for ride-sharing services.

- Increased vehicle utilization: Self-driving cars could operate for longer periods without needing breaks, leading to significantly increased vehicle utilization and consequently, higher revenue generation.

- New revenue streams: Autonomous vehicles open doors to new revenue streams, such as autonomous delivery services for packages and goods, significantly expanding Uber's market reach and potential profitability.

Challenges and Risks Associated with Autonomous Vehicle Deployment

Despite the immense potential, deploying autonomous vehicles presents significant hurdles for Uber.

- High R&D costs: The development and testing of autonomous driving technology require substantial investments in research and development, posing a significant financial burden.

- Safety concerns and liability issues: Ensuring the safety and reliability of self-driving cars is paramount. Accidents involving autonomous vehicles could result in substantial legal liabilities and damage Uber's reputation.

- Regulatory delays: The regulatory landscape surrounding autonomous vehicles is constantly evolving, and delays in obtaining necessary approvals and permits can significantly impact the timeline for AV deployment.

Investor Sentiment and Market Expectations Regarding Uber's AV Investments

Analyzing Analyst Ratings and Forecasts

Analyst opinions on Uber's stock and its AV prospects are diverse. Some analysts maintain a bullish outlook, emphasizing the long-term potential of autonomous vehicles, while others hold a more cautious stance, highlighting the significant challenges and uncertainties involved. [Insert a summary of analyst ratings and target price predictions].

- Bullish vs. Bearish views: Summarize the key arguments supporting both optimistic and pessimistic predictions about Uber's future, considering the impact of AV technology.

- Target price predictions: Include a range of target price predictions from various financial analysts to illustrate the diversity of opinions and market expectations.

The Role of Autonomous Vehicles in Shaping Investor Confidence

The progress Uber makes in developing and deploying its autonomous vehicle technology significantly influences investor confidence in the company's stock.

- Successful AV deployments: Successful deployments and demonstrable progress in autonomous driving technology would likely drive up Uber's stock price, reflecting investor confidence in the company's long-term strategy.

- Setbacks and delays: Conversely, setbacks, delays, or safety concerns related to Uber's AV program could negatively impact investor sentiment and lead to a decline in the stock price.

Conclusion: Uber Stock, Autonomous Vehicles, and the Road Ahead

Uber's stock performance is intricately linked to its success in navigating the complex landscape of autonomous vehicle technology. While the potential benefits of AVs are substantial, the challenges are significant. The company's financial performance, its progress in AV development, and the broader regulatory environment will continue to shape investor sentiment and the trajectory of Uber's stock price. The long-term prospects for Uber stock heavily depend on its ability to effectively overcome these challenges and realize the transformative potential of self-driving cars.

To stay informed about Uber stock and the autonomous vehicle revolution, follow reputable financial news sources, monitor Uber's official announcements, and conduct your own in-depth research. Regularly check financial websites for updated stock information and follow industry publications for the latest developments in AV technology. Understanding the interplay between Uber's business strategy and the autonomous vehicle sector is key to making informed investment decisions.

Featured Posts

-

Claim Your Universal Credit Refund Dwps Response To 5 Billion Cuts

May 08, 2025

Claim Your Universal Credit Refund Dwps Response To 5 Billion Cuts

May 08, 2025 -

Spk Nin Aciklamasi Kripto Para Piyasalari Icin Yeni Bir Cag

May 08, 2025

Spk Nin Aciklamasi Kripto Para Piyasalari Icin Yeni Bir Cag

May 08, 2025 -

Counting Crows Snl Performance A Career Defining Moment

May 08, 2025

Counting Crows Snl Performance A Career Defining Moment

May 08, 2025 -

Recent Tariffs And Their Impact On Canadas 506 Million Trade Deficit

May 08, 2025

Recent Tariffs And Their Impact On Canadas 506 Million Trade Deficit

May 08, 2025 -

Expect Partly Cloudy Conditions Weather Advice And Preparation

May 08, 2025

Expect Partly Cloudy Conditions Weather Advice And Preparation

May 08, 2025