Uber Stock Recession-Proof? Analyst Insights

Table of Contents

Uber's Business Model and Recession Resilience

Uber's multifaceted business model offers a degree of diversification that may contribute to its resilience during a recession. Let's examine the key components:

The Essential Nature of Ride-Sharing Services

Ride-sharing services, the cornerstone of Uber's business, possess inherent resilience. Even during economic downturns, people still need transportation.

- Lower-income individuals: Ride-sharing often becomes a more crucial transportation option for lower-income individuals who may rely less on car ownership.

- Price sensitivity: Uber's pricing models, including surge pricing and promotions, can adapt to fluctuations in demand and consumer spending.

- Public transportation disruptions: Disruptions to public transportation systems, which can occur during economic uncertainty, could lead to increased reliance on ride-sharing alternatives.

These factors suggest that the demand for Uber rides, despite potential downturns, remains relatively consistent, contributing to the argument that Uber rides are somewhat recession-resistant. Understanding the nuances of ride-sharing recession impact is crucial for accurate assessment.

The Food Delivery Boom and its Recession-Proof Potential

Uber Eats, Uber's food delivery arm, has experienced explosive growth, further diversifying the company's revenue streams. But does this segment offer recession resistance?

- Convenience factor: Economic uncertainty often increases the demand for convenience, with consumers potentially opting for home delivery more frequently.

- Price-sensitive options: Uber Eats can leverage price-sensitive menu options and promotions to attract budget-conscious consumers.

- Intense competition: The intensely competitive food delivery market presents a challenge, requiring strategic pricing and marketing to maintain market share.

The performance of Uber Eats during a recession will depend on the balance between increased demand for convenience and the impact of reduced consumer spending. Further analysis of the online food delivery market during previous recessions is necessary.

Freight and Logistics: A Diversification Strategy

Uber Freight represents a strategic diversification into the logistics sector. Its performance during an economic downturn will depend on various factors:

- Essential services: The demand for efficient logistics remains relatively stable even during recessions, as businesses still need to transport goods.

- Supply chain disruptions: Economic downturns often exacerbate supply chain vulnerabilities, potentially impacting demand for Uber Freight's services.

- Competition from traditional trucking: Uber Freight faces competition from established trucking companies, impacting its pricing power.

Uber Freight's potential to cushion the impact of a recession on the overall business will depend on its ability to navigate the complexities of the logistics sector and maintain a competitive edge. The relationship between logistics recession and Uber Freight's success needs further examination.

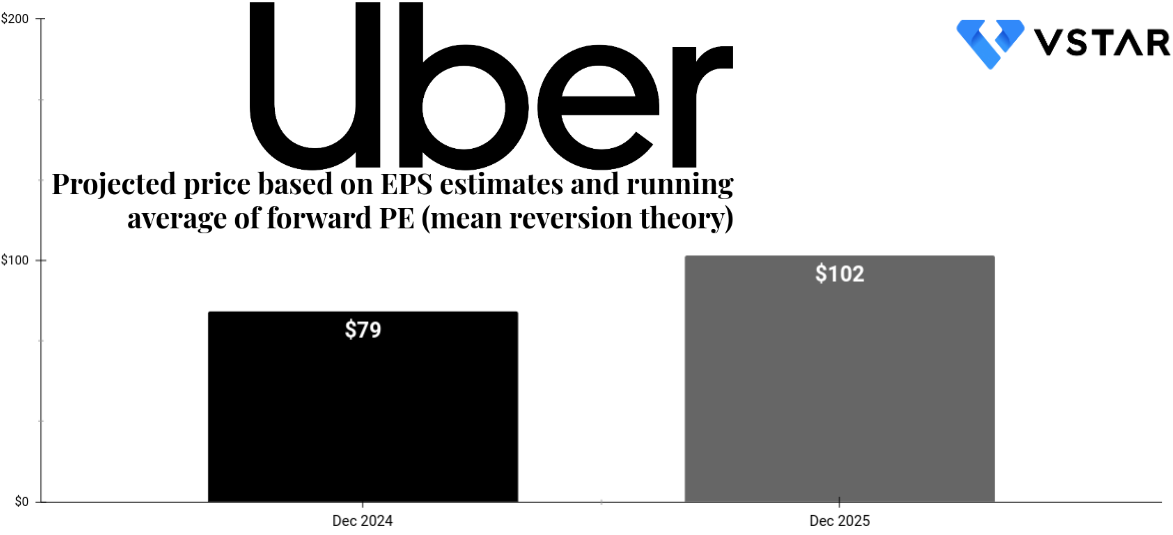

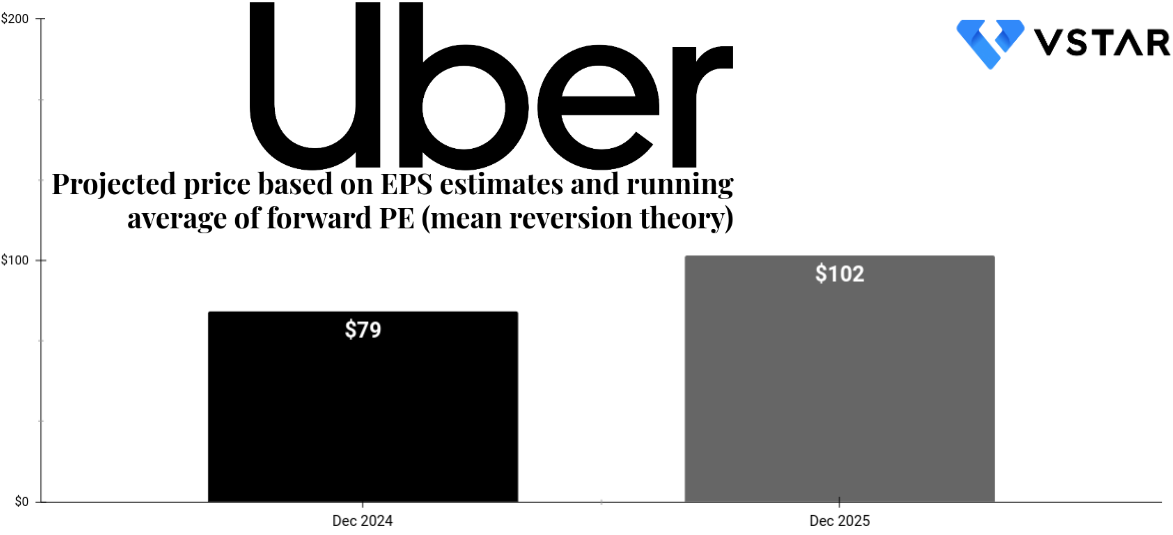

Analyst Opinions and Predictions on Uber Stock

Analyst predictions on Uber stock are divided, reflecting the inherent uncertainties surrounding the company's future performance.

Bullish Arguments for Uber Stock

Many analysts maintain a bullish outlook on Uber stock, citing:

- Long-term growth potential: Uber's diverse business model and technological innovation suggest significant long-term growth potential.

- Market share dominance: Uber holds a considerable market share in ride-sharing and food delivery, providing a strong competitive advantage.

- Expansion into new markets: The expansion into new markets and services creates further growth opportunities. Specific price targets vary across analysts, but the overall sentiment is optimistic. Understanding these Uber stock forecast details is crucial.

Bearish Arguments and Potential Risks

However, concerns exist regarding:

- Increased competition: Intense competition in all its market segments poses a significant threat to profitability.

- Regulatory challenges: Regulatory hurdles and changing legislation in different regions create uncertainty.

- Driver costs and profitability: Managing driver costs and achieving profitability remain ongoing challenges.

These factors contribute to a bearish outlook among some analysts, highlighting the significant risks associated with investing in Uber stock. Analyzing the risks related to Uber stock is essential for making informed investment choices.

Evaluating Uber's Financial Performance During Past Recessions (if applicable)

Analyzing Uber's historical financial performance during previous economic downturns could offer valuable insights. (Note: This section would include specific data and charts if such historical data were available for Uber. For example, revenue figures, earnings per share, and stock price performance during past recessions could be presented and compared with those of competitors.)

Conclusion: Is Investing in Uber Stock During a Recession a Smart Move?

The question, "Is Uber Stock Recession-Proof?" remains complex. While Uber's diversified business model offers some resilience, significant risks persist. The company's success during a recession will depend on its ability to navigate competitive pressures, regulatory challenges, and maintain profitability across its various segments. The analysis of past performance, if available, would provide additional valuable data. A balanced perspective considering both bullish and bearish arguments is crucial. Therefore, while certain aspects of Uber's business may demonstrate some resilience during economic downturns, the ultimate answer depends on your personal risk tolerance and investment strategy.

We encourage you to conduct your own thorough research, considering further analysis of "Uber stock recession-proof" investment strategies, consulting financial news websites, analyst reports, and other reliable sources before making any investment decisions. Remember that no investment is truly recession-proof, and informed decision-making is paramount.

Featured Posts

-

Diplome D Archiviste A Poitiers Programme Et Debouches

May 19, 2025

Diplome D Archiviste A Poitiers Programme Et Debouches

May 19, 2025 -

Militarizacion Del Cne Implicaciones De La Presencia Militar En La Sesion Electoral

May 19, 2025

Militarizacion Del Cne Implicaciones De La Presencia Militar En La Sesion Electoral

May 19, 2025 -

Diversity In Higher Education Examining Current Admissions Policies And Practices

May 19, 2025

Diversity In Higher Education Examining Current Admissions Policies And Practices

May 19, 2025 -

Grammy Nominees Farewell Retirement After 5 Wins Due To Health Concerns

May 19, 2025

Grammy Nominees Farewell Retirement After 5 Wins Due To Health Concerns

May 19, 2025 -

Unbeaten And Unstoppable Michael Morales Rise In The Ufc Welterweight Division

May 19, 2025

Unbeaten And Unstoppable Michael Morales Rise In The Ufc Welterweight Division

May 19, 2025