Uber (UBER): Investment Potential And Risks

Table of Contents

The ride-sharing giant, Uber (UBER), has experienced a volatile journey since its IPO. This article delves into the investment potential and inherent risks associated with investing in Uber stock, providing a balanced perspective for potential investors considering adding UBER to their portfolio. We will explore its growth trajectory, competitive landscape, financial performance, and future prospects to help you determine if Uber (UBER) is a worthwhile investment for you.

Uber's Growth and Market Position

Dominant Market Share and Global Reach

Uber's global presence is undeniable. It boasts a significant market share in numerous countries across the globe, solidifying its position as a leader in the ride-hailing industry. This dominance isn't limited to just transportation; Uber's expansion into food delivery (Uber Eats) and freight services has further diversified its revenue streams and solidified its market reach.

- Market leadership in ride-hailing: Uber maintains a dominant position in many major cities worldwide, consistently outpacing competitors in ridership and market share.

- Significant presence in food delivery (Uber Eats): Uber Eats competes aggressively with other food delivery platforms and has achieved notable market penetration in various regions.

- Expansion into autonomous vehicle technology: Uber's investment in autonomous vehicle technology represents a strategic move to potentially disrupt the transportation industry and reduce operating costs in the long term. This long-term strategy positions them for future growth, even if profitability remains elusive in the near term. Examples include their partnerships and collaborations with AV tech companies.

Competitive Landscape and Disruptive Technologies

The ride-sharing market is highly competitive. Key rivals include Lyft in the US and Didi Chuxing in China, each with regional strengths. Furthermore, the emergence of autonomous driving technologies presents both an opportunity and a threat. While autonomous vehicles could drastically reduce operational costs, the technology's development and widespread adoption remain uncertain.

- Competitive advantages: Uber's global brand recognition, extensive network effects, and technological investments provide significant competitive advantages.

- Disadvantages: Regulatory hurdles and intense competition in various markets pose challenges to Uber's continued expansion and profitability.

- Potential impact of autonomous vehicles: The successful implementation of autonomous vehicles could revolutionize the ride-sharing industry, but it also presents risks, including significant upfront investment and potential job displacement for human drivers.

- Regulatory hurdles: Navigating diverse regulations and licensing requirements across different countries remains a significant challenge for Uber, impacting its operational efficiency and potential growth.

Financial Performance and Profitability

Revenue Streams and Growth Trajectory

Uber's revenue streams are increasingly diversified, encompassing rides, Uber Eats, and freight services. While ride-sharing remains a major contributor, the growth of Uber Eats and freight services demonstrates the company's strategic diversification efforts.

- Revenue breakdown by segment: Analyzing the contribution of each segment to overall revenue is crucial in assessing Uber's performance and growth prospects. Publicly available financial statements provide this data.

- Historical revenue growth: Examining past revenue growth helps investors project future performance and assess the company's overall trajectory. Trend analysis using past financial data is key here.

- Projected future revenue: Analyst forecasts and company guidance offer insights into the projected revenue growth and potential for future profitability.

- Key performance indicators (KPIs): Metrics like revenue per ride, average order value (AOV) for Uber Eats, and freight revenue per shipment provide a deeper understanding of the company's operational efficiency and pricing strategies.

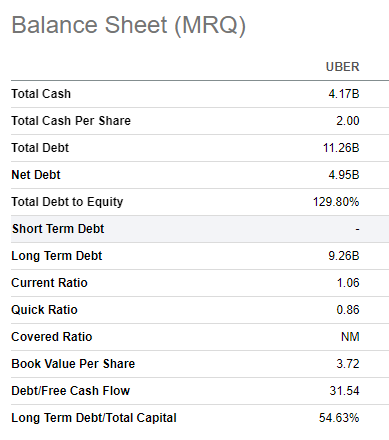

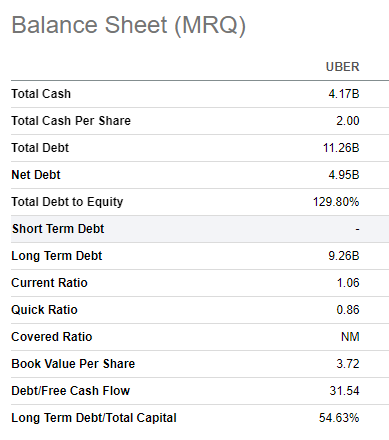

Profitability and Cost Structure

Uber's path to profitability has been challenging. Significant operating expenses, including driver payments, marketing, and technology investments, have impacted its net income.

- Operating margins: Analyzing operating margins helps investors assess the company's efficiency and ability to generate profits from its core operations.

- Profitability challenges: High driver compensation costs and intense competition continue to present challenges to achieving sustainable profitability.

- Strategies for improving efficiency and reducing costs: Uber is actively implementing various strategies to streamline operations and reduce costs, such as improving its pricing algorithms and enhancing operational efficiency.

- Long-term profitability projections: Assessing the long-term outlook for profitability requires careful consideration of factors such as market growth, competitive dynamics, and the success of cost-reduction strategies.

Risks Associated with Investing in Uber (UBER)

Regulatory Uncertainty and Legal Challenges

The ride-sharing industry faces significant regulatory uncertainty globally. Licensing requirements, labor laws, and disputes over driver classification create ongoing legal and operational challenges.

- Examples of regulatory challenges: Varied regulations across different jurisdictions pose challenges to Uber's operations and require significant adaptation and compliance efforts.

- Potential impact of legal disputes: Ongoing legal battles can negatively impact Uber's finances and reputation, potentially affecting investor confidence and the company's overall valuation.

Competition and Technological Disruption

The competitive landscape remains highly dynamic, with new entrants and existing players continuously vying for market share. Technological advancements, especially in autonomous driving, pose significant disruption.

- Potential for new entrants: The relatively low barrier to entry in certain segments of the ride-sharing and food delivery markets poses a risk to Uber's market dominance.

- Technological advancements: The rapid pace of technological innovation could render existing business models obsolete, demanding constant investment in research and development to maintain a competitive edge.

- The need for continuous innovation: Uber must consistently innovate to stay ahead of the curve and adapt to the changing technological landscape.

Economic Factors and Market Volatility

Uber's business is sensitive to economic downturns and fluctuations in fuel prices. Changes in consumer spending habits can directly impact demand for its services.

- Sensitivity of demand to economic conditions: During economic downturns, consumer spending decreases, leading to reduced demand for ride-sharing and food delivery services.

- Impact of fuel costs on operating expenses: Fluctuations in fuel prices can significantly impact operating costs, especially for ride-sharing services, impacting profitability.

- Potential for reduced consumer spending: Changes in consumer spending patterns can directly affect the demand for Uber's services, potentially impacting revenue growth.

Conclusion

Investing in Uber (UBER) presents both exciting opportunities and significant risks. While its global reach and diverse business model offer substantial growth potential, investors must carefully consider the competitive landscape, regulatory hurdles, and the inherent volatility of the technology sector. A thorough analysis of its financial performance, future projections, and the potential impact of disruptive technologies is crucial before making any investment decisions. Therefore, thoroughly research the current status of Uber (UBER) investment before committing your funds. Understanding the intricacies of the Uber (UBER) investment landscape is critical to making informed decisions.

Featured Posts

-

Black Rock Etf A Billionaires Guide To Potential 110 Returns In 2025

May 08, 2025

Black Rock Etf A Billionaires Guide To Potential 110 Returns In 2025

May 08, 2025 -

Nba Playoffs Triple Doubles Leader Quiz Test Your Basketball Iq

May 08, 2025

Nba Playoffs Triple Doubles Leader Quiz Test Your Basketball Iq

May 08, 2025 -

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025

Jayson Tatums Bone Bruise Game 2 Status Update And Report

May 08, 2025 -

Wednesday Lotto Draw Results April 9th Jackpot Numbers

May 08, 2025

Wednesday Lotto Draw Results April 9th Jackpot Numbers

May 08, 2025 -

Are You Due A Universal Credit Refund Dwp Payments Explained April May

May 08, 2025

Are You Due A Universal Credit Refund Dwp Payments Explained April May

May 08, 2025