Ueda Warns Of Ripple Effects From Rising Long-Term Yields

Table of Contents

The Mechanics of Rising Long-Term Yields and their Impact

Understanding Long-Term Yield Increases

Long-term yields represent the return an investor receives on a bond with a maturity date of more than a year. Several key factors contribute to their rise:

- Inflation Expectations: Higher anticipated inflation leads investors to demand higher yields to compensate for the erosion of their purchasing power. For example, if inflation is projected to be 3%, investors may demand a yield exceeding 3% to achieve a positive real return.

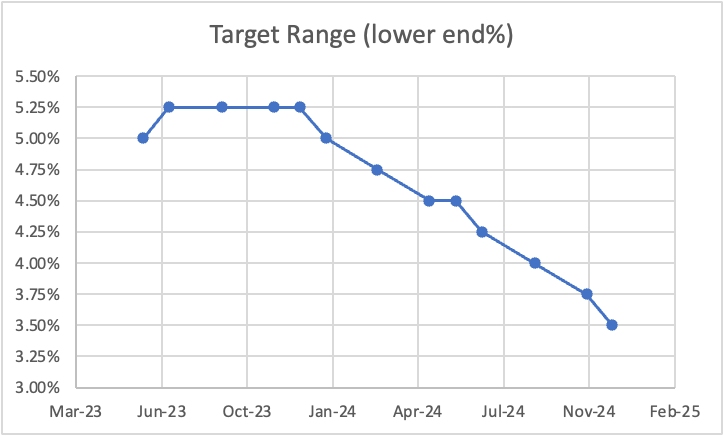

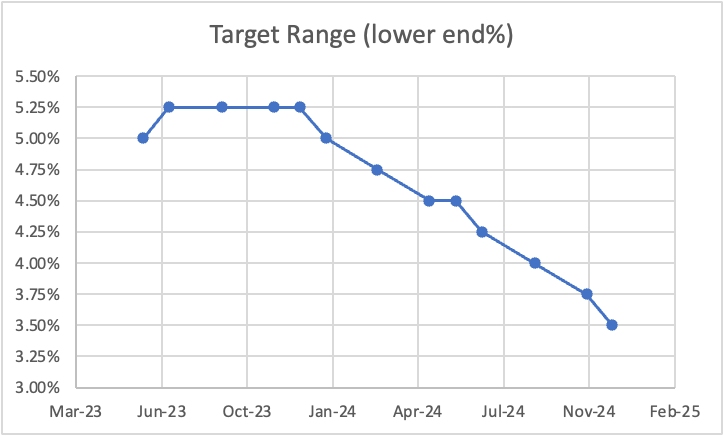

- Central Bank Policy Changes: Central banks often influence long-term yields through actions such as adjusting interest rates. Raising interest rates typically increases long-term yields, while lowering them can have the opposite effect. Recent data shows [cite relevant data source, e.g., a central bank report] a direct correlation between interest rate hikes and subsequent yield increases.

- Increased Borrowing Costs: Increased government borrowing to finance deficits or expansionary fiscal policies can increase demand for bonds, driving up yields. This increased demand can outpace the supply, pushing up prices and subsequently lowering yields.

- Global Economic Factors: Global economic uncertainty and geopolitical events can significantly influence long-term yields. For instance, concerns about global recession can lead investors to seek safer investments, increasing demand for government bonds and driving up yields.

Impact on Borrowing Costs

Rising long-term yields directly translate to higher borrowing costs for both corporations and governments.

- Increased Interest Payments: Businesses face significantly higher interest expenses on loans and bonds, reducing profitability and potentially hindering investment.

- Reduced Investment: The increased cost of capital can discourage companies from undertaking new projects, leading to a slowdown in capital expenditure and potentially impacting overall economic growth.

- Vulnerable Sectors: Sectors heavily reliant on debt financing, such as real estate and infrastructure development, are particularly vulnerable to the impact of rising borrowing costs. The construction sector, for example, may experience a significant slowdown due to the increased cost of financing new projects.

The Influence on Investment Decisions

Rising long-term yields influence investment decisions by shifting the risk-reward equation.

- Shift Towards Safer Investments: Investors may move away from riskier assets like stocks and into safer havens like government bonds, which offer higher yields.

- Reduced Risk Appetite: The increased uncertainty associated with rising yields can reduce overall risk appetite, leading to a decrease in investment across various asset classes.

- Slowdown in Economic Activity: This reduced investment can trigger a slowdown in economic activity as businesses postpone expansion plans and consumers become more cautious about spending.

Ripple Effects Across the Economy

Impact on the Housing Market

Rising long-term yields directly impact mortgage rates, making homeownership less affordable.

- Increased Mortgage Rates: Higher yields typically translate into higher mortgage rates, making it more expensive for individuals to purchase homes.

- Reduced Affordability: This reduced affordability can lead to a decrease in housing demand, potentially causing a correction in house prices.

- Market Sentiment: Negative market sentiment can further exacerbate the situation, leading to a decline in overall housing market activity. Recent data shows [cite relevant data source, e.g., a real estate report] a slowdown in housing starts and sales.

Consequences for the Stock Market

The relationship between rising long-term yields and stock market performance is complex, but often involves a "flight to safety."

- Flight to Safety: Investors may move from equities to bonds, reducing demand for stocks and potentially lowering valuations.

- Reduced Valuations: Higher yields can make future earnings appear less attractive, leading to lower valuations for companies.

- Sector-Specific Impacts: Different sectors will be affected differently; growth stocks that rely on future earnings may be disproportionately impacted.

Effects on Inflation and Economic Growth

Rising long-term yields can create a complex feedback loop with inflation and economic growth.

- Combating Inflation: Higher yields can help to curb inflation by reducing demand and slowing down economic activity.

- Exacerbating Inflation: However, higher borrowing costs can also reduce business investment and hinder economic growth, potentially leading to stagflation.

- Potential Scenarios: The interplay between these factors depends on various economic conditions and policy responses.

Potential Mitigation Strategies and Policy Responses

Central Bank Interventions

Central banks have various tools to manage rising long-term yields.

- Interest Rate Adjustments: Adjusting the policy interest rate is a primary tool; however, its effectiveness varies depending on economic circumstances.

- Quantitative Easing: Buying government bonds can increase the money supply and potentially lower yields; however, this can also have inflationary consequences.

- Forward Guidance: Communicating future policy intentions can influence market expectations and potentially mitigate yield increases.

Government Fiscal Policies

Fiscal policy plays a crucial role in managing the economic fallout from rising long-term yields.

- Stimulus Packages: Government spending can help stimulate economic activity and offset the negative effects of higher borrowing costs.

- Infrastructure Spending: Investing in infrastructure can create jobs and boost economic growth, but requires careful management to avoid further increasing debt.

Corporate Strategies for Managing Risk

Businesses can take steps to mitigate the risks associated with rising long-term yields.

- Hedging Strategies: Employing hedging strategies can help reduce exposure to interest rate fluctuations.

- Debt Restructuring: Refinancing existing debt at fixed rates can provide protection against rising interest rates.

Conclusion

Ueda's warnings about the ripple effects of rising long-term yields underscore the gravity of the situation. These yield increases significantly impact borrowing costs, investment decisions, and the stability of various sectors, including the housing market and the stock market. The complex interplay between rising yields, inflation, and economic growth necessitates careful consideration of mitigation strategies, including central bank interventions and responsible fiscal policies. Understanding the implications of rising long-term yields is crucial for navigating the current economic landscape. Stay informed about the evolving situation with rising long-term yields to make informed decisions.

Featured Posts

-

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025

Shiny Pokemon In Pokemon Tcg Pocket Rarity Methods And Tips

May 29, 2025 -

Victor Fernandez Su Presente Y Contribuciones

May 29, 2025

Victor Fernandez Su Presente Y Contribuciones

May 29, 2025 -

Analyzing Morgan Wallens One Thing At A Time A Chart Topping Comeback

May 29, 2025

Analyzing Morgan Wallens One Thing At A Time A Chart Topping Comeback

May 29, 2025 -

Arcane League Of Legends 4 K Blu Ray Steelbook 50 Off Amazon Deal

May 29, 2025

Arcane League Of Legends 4 K Blu Ray Steelbook 50 Off Amazon Deal

May 29, 2025 -

Division Streets Air Max 95 97 Ducks Of A Feather Everything You Need To Know About The Release

May 29, 2025

Division Streets Air Max 95 97 Ducks Of A Feather Everything You Need To Know About The Release

May 29, 2025

Latest Posts

-

Setlist Fm Ticketmaster Mejor Experiencia De Compra De Entradas

May 30, 2025

Setlist Fm Ticketmaster Mejor Experiencia De Compra De Entradas

May 30, 2025 -

Ticketmaster Y Setlist Fm Se Unen Para Optimizar La Experiencia Del Usuario

May 30, 2025

Ticketmaster Y Setlist Fm Se Unen Para Optimizar La Experiencia Del Usuario

May 30, 2025 -

Ticketmaster Y Setlist Fm Nueva Alianza Para Facilitar La Compra De Boletos

May 30, 2025

Ticketmaster Y Setlist Fm Nueva Alianza Para Facilitar La Compra De Boletos

May 30, 2025 -

Setlist Fm Se Integra Con Ticketmaster Mejoras Para Los Fans

May 30, 2025

Setlist Fm Se Integra Con Ticketmaster Mejoras Para Los Fans

May 30, 2025 -

Setlist Fm Y Ticketmaster Se Unen Mejor Experiencia Para Fans

May 30, 2025

Setlist Fm Y Ticketmaster Se Unen Mejor Experiencia Para Fans

May 30, 2025