Ultra-Low Growth: David Dodge's Forecast For The Canadian Economy

Table of Contents

Dodge's Core Predictions and Underlying Factors

David Dodge's forecast paints a picture of subdued economic activity in Canada, projecting ultra-low growth for the foreseeable future. While precise numbers vary depending on the specific model and timeframe, his predictions consistently point to growth significantly below historical averages. This sluggish growth is not a singular event but rather the confluence of several interconnected challenges.

Key factors contributing to Dodge's prediction of ultra-low growth include:

-

Global Economic Slowdown: The global economy faces headwinds from persistent inflation, ongoing supply chain disruptions, and reduced consumer confidence. These global pressures directly impact Canada's export-oriented sectors and overall economic performance. The ripple effects of reduced global demand are a major contributor to the ultra-low growth scenario.

-

High Interest Rates: The Bank of Canada's aggressive interest rate hikes, aimed at curbing inflation, have significantly increased borrowing costs for businesses and consumers. This has dampened investment, reduced consumer spending, and contributed to a cooling housing market – all key drivers of economic growth. The impact of these higher rates on economic activity is a central aspect of the ultra-low growth prediction.

-

Geopolitical Instability: The ongoing war in Ukraine, escalating tensions in other regions, and general geopolitical uncertainty create significant risks for the Canadian economy. These uncertainties impact trade, investment flows, and commodity prices, further contributing to the challenging economic environment and the likelihood of ultra-low growth.

-

Housing Market Correction: Canada's overheated housing market has undergone a correction, characterized by declining prices and reduced sales activity. This has ripple effects throughout the economy, impacting construction, related industries, and overall consumer confidence. The housing market downturn exacerbates the already fragile economic situation, reinforcing the ultra-low growth forecast.

-

Potential for a Recession: Given the combination of these factors, the risk of a recession in Canada is a significant concern. Dodge's ultra-low growth prediction reflects this heightened recessionary risk, highlighting the potential for a prolonged period of economic stagnation.

Impact on Key Economic Sectors

Ultra-low growth will differentially affect various sectors of the Canadian economy. Understanding these impacts is crucial for navigating this challenging period.

-

Manufacturing: Canada's manufacturing sector, heavily reliant on exports, is particularly vulnerable to the global economic slowdown. Reduced demand from international markets will likely lead to decreased production, potential job losses, and reduced investment in the sector.

-

Real Estate and Construction: The ongoing housing market correction will continue to impact the construction sector, leading to potential job losses and reduced economic activity. Related industries, such as those providing materials and services to the construction industry, will also experience reduced demand.

-

Energy Sector: While Canada's energy sector may benefit from global demand for energy resources, its performance remains sensitive to fluctuating global prices and geopolitical instability. The volatility of the energy market adds to the overall economic uncertainty and contributes to the ultra-low growth forecast.

-

Tourism: Although the tourism sector experienced a recovery post-pandemic, ultra-low growth will likely temper this recovery, potentially leading to slower growth than initially anticipated. Reduced consumer spending and economic uncertainty will affect travel and tourism activity.

Policy Responses and Mitigation Strategies

Addressing the ultra-low growth challenge requires a multifaceted approach involving both fiscal and monetary policy adjustments.

-

Fiscal Policy: The government could implement fiscal stimulus measures such as targeted tax cuts or increased government spending on infrastructure projects to boost economic activity. However, the effectiveness of such measures is debated, given the already high levels of government debt.

-

Monetary Policy: The Bank of Canada’s monetary policy decisions will continue to play a critical role. While interest rate increases are intended to combat inflation, they also risk exacerbating ultra-low growth. A careful balancing act is required to manage inflation and avoid pushing the economy into a deeper recession.

-

Regulatory Reforms: Streamlining regulations and fostering a business-friendly environment can encourage investment, innovation, and job creation, contributing to long-term economic growth and mitigating the effects of ultra-low growth.

Long-Term Implications and Outlook

Prolonged ultra-low growth poses significant challenges to Canada's long-term economic prospects.

-

Job Creation and Unemployment: Reduced economic activity will likely lead to slower job creation and potentially rising unemployment rates, increasing pressure on social safety nets.

-

Inflation and Cost of Living: While high interest rates aim to combat inflation, ultra-low growth could prolong inflationary pressures, impacting the cost of living for Canadians.

-

Government Debt and Fiscal Sustainability: Reduced economic activity can lower tax revenues, increasing the strain on government finances and potentially worsening the country's debt-to-GDP ratio.

-

Standard of Living: The combined impact of slower economic growth, higher inflation, and potential job losses could negatively impact the standard of living for many Canadians.

The outlook is challenging, but not entirely bleak. Potential for future recovery hinges on effectively addressing the underlying factors and implementing appropriate policy responses. Successful navigation of this period requires a focus on adapting to global economic shifts, fostering innovation, and promoting sustainable economic growth.

Conclusion: Understanding and Addressing Ultra-Low Growth in the Canadian Economy

David Dodge's prediction of ultra-low growth for the Canadian economy highlights the significant challenges facing the country. The combination of global economic slowdown, high interest rates, geopolitical instability, a housing market correction, and the potential for a recession create a complex and uncertain economic landscape. These factors will differentially impact various economic sectors, posing challenges for job creation, inflation, and government finances. Effective policy responses, a focus on long-term sustainable growth, and adaptability will be key to mitigating the negative impacts of ultra-low growth and fostering a robust economic recovery. Stay informed about the evolving economic landscape and the ongoing debate surrounding ultra-low growth by following expert commentary and economic news. Understanding these trends is crucial for navigating the complexities of the Canadian economy in the years to come.

Featured Posts

-

Rumored 2008 Disney Game Surfaces In Ps Plus Premium Leak

May 03, 2025

Rumored 2008 Disney Game Surfaces In Ps Plus Premium Leak

May 03, 2025 -

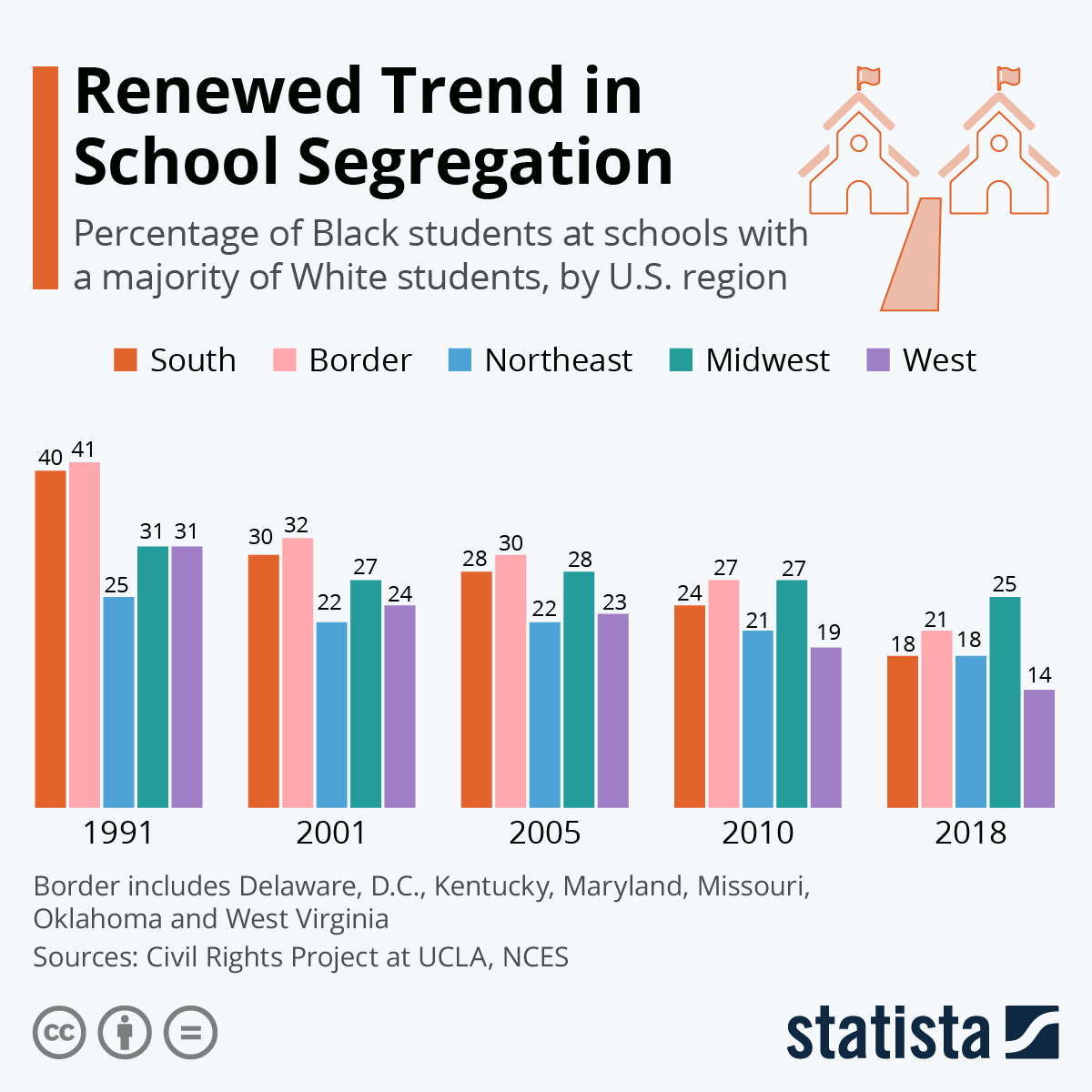

End Of School Desegregation Order A New Era In Education

May 03, 2025

End Of School Desegregation Order A New Era In Education

May 03, 2025 -

The Fight Within Reform Uk Examining The Partys Internal Struggle

May 03, 2025

The Fight Within Reform Uk Examining The Partys Internal Struggle

May 03, 2025 -

Trump Tariffs And The Bank Of Canadas April Interest Rate Deliberations

May 03, 2025

Trump Tariffs And The Bank Of Canadas April Interest Rate Deliberations

May 03, 2025 -

Where To Buy Every Dual Sense Ps 5 Controller Color In 2025

May 03, 2025

Where To Buy Every Dual Sense Ps 5 Controller Color In 2025

May 03, 2025

Latest Posts

-

Drone Strike On Aid Ship Headed To Gaza Activists Targeted

May 03, 2025

Drone Strike On Aid Ship Headed To Gaza Activists Targeted

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Could Boris Johnson Return To Power A Tory Party Resurgence

May 03, 2025

Could Boris Johnson Return To Power A Tory Party Resurgence

May 03, 2025 -

Boris Johnson Comeback Can He Save The Conservative Party

May 03, 2025

Boris Johnson Comeback Can He Save The Conservative Party

May 03, 2025 -

Malta Coast Drone Attack Aid Ship En Route To Gaza In Distress

May 03, 2025

Malta Coast Drone Attack Aid Ship En Route To Gaza In Distress

May 03, 2025