Understanding AIMSCAP's Approach To The World Trading Tournament (WTT)

Table of Contents

AIMSCAP's Trading Methodology in the WTT

AIMSCAP employs a multifaceted trading methodology in the WTT, combining elements of day trading and swing trading, primarily focusing on the Forex and futures markets. Their approach isn't rigidly defined; instead, it's highly adaptable to changing market conditions. This flexibility is a key component of their AIMSCAP trading strategy.

-

Specific indicators or technical analysis tools used: AIMSCAP leverages a combination of technical indicators, including moving averages (both short-term and long-term), relative strength index (RSI), and MACD, to identify potential entry and exit points. They also incorporate candlestick patterns and volume analysis into their decision-making process. This blend of AIMSCAP trading techniques allows for a comprehensive market assessment.

-

Example trades illustrating their methodology: One successful trade involved identifying a bullish pennant pattern in EUR/USD, coupled with a positive RSI divergence. This signaled a potential upward breakout, prompting AIMSCAP to enter a long position. The subsequent price movement confirmed their analysis, resulting in a significant profit. Another example involves shorting a highly volatile futures contract following a clear bearish trend reversal identified via MACD and volume analysis. This shows their willingness to employ both long and short AIMSCAP forex strategy positions.

-

Adaptation of strategy based on market conditions: During periods of high volatility, AIMSCAP may adjust their strategy, focusing on shorter-term trades with tighter stop-losses. Conversely, in calmer markets, they may employ longer-term swing trading techniques, capitalizing on larger price movements. This ability to adapt showcases the robustness of their AIMSCAP stock trading approach.

Risk Management: A Cornerstone of AIMSCAP's WTT Success

Risk management forms the bedrock of AIMSCAP's success in the WTT. Their commitment to preserving capital is evident in their meticulous approach to position sizing, stop-loss orders, and diversification. This robust AIMSCAP risk management strategy minimizes potential losses and maximizes long-term profitability.

-

Specific risk-to-reward ratios employed: AIMSCAP typically aims for a risk-to-reward ratio of 1:2 or better. This means that for every dollar risked, they aim to potentially gain at least two dollars. This careful AIMSCAP trading risk assessment is a key to their success.

-

Examples of how they manage losses and protect capital: The use of stop-loss orders is paramount. These orders automatically close a position when a predetermined price level is reached, limiting potential losses. Moreover, AIMSCAP diversifies their portfolio across multiple markets and assets to prevent catastrophic losses from affecting the entire account. This diversified approach to managing risk in WTT is crucial.

-

Importance of emotional control in trading decisions: AIMSCAP emphasizes the importance of emotional discipline. They recognize that fear and greed can lead to poor decision-making. Strict adherence to their trading plan, regardless of market fluctuations, is a cornerstone of their discipline.

Technological Advantage: AIMSCAP's Algorithmic Approach

AIMSCAP utilizes a sophisticated algorithmic trading system to enhance their trading capabilities. This automated trading WTT system plays a crucial role in their success.

-

Description of the algorithms and their functions: Their algorithms analyze vast quantities of market data in real-time, identifying potential trading opportunities far faster than a human trader could. These algorithms are designed to execute trades with precision and speed, capitalizing on fleeting market inefficiencies. This aspect of their AIMSCAP algorithmic trading strategy provides a significant edge.

-

How algorithms enhance speed and accuracy in trading execution: The speed of execution is critical in the WTT. AIMSCAP's algorithms allow them to enter and exit trades with minimal latency, maximizing profits and minimizing slippage. The accuracy of the algorithms, honed through extensive backtesting and optimization, further contributes to their success. This shows the power of WTT AI trading when implemented effectively.

-

Integration of AI or machine learning (if applicable): AIMSCAP's system incorporates machine learning techniques to continuously learn and adapt to changing market dynamics. This allows the algorithms to refine their trading strategies over time, improving their overall performance.

Team Dynamics and Collaboration within AIMSCAP

The success of AIMSCAP in the WTT isn't solely attributable to their trading strategies; it's also a testament to their strong team dynamics and collaborative approach.

-

Structure of the team (analysts, traders, managers): AIMSCAP's team comprises experienced analysts, skilled traders, and dedicated managers. Each member plays a vital role in the overall success of the team. This collaborative structure strengthens their AIMSCAP team dynamic.

-

Methods of information sharing and decision-making: Efficient communication and information sharing are crucial. AIMSCAP employs sophisticated communication channels to ensure that all team members are aware of market developments and trading strategies. Decisions are made collaboratively, leveraging the expertise of each member.

-

Importance of communication and mutual support: Open communication and mutual support foster a positive and productive work environment. Team members regularly discuss their trades, providing feedback and learning from one another's experiences. This demonstrates the importance of WTT collaboration and successful trading teams.

Conclusion

This article has explored AIMSCAP's comprehensive approach to the World Trading Tournament (WTT), highlighting their sophisticated trading methodologies, robust risk management practices, and the importance of team collaboration. Their success demonstrates the crucial role of a well-defined AIMSCAP WTT strategy and a disciplined approach in achieving top performance in the competitive world of trading tournaments. Their adaptability, technological integration, and team synergy represent a winning formula.

Call to Action: Want to learn more about successful AIMSCAP WTT strategies and how to improve your own trading approach? Stay tuned for further analyses and insights into the AIMSCAP WTT strategy! Follow us for updates on future WTT events and competitor strategies. Learn from the best and elevate your own trading game with a deeper understanding of AIMSCAP's winning formula.

Featured Posts

-

Wtt Announces Innovative Competitive Model At Press Conference

May 22, 2025

Wtt Announces Innovative Competitive Model At Press Conference

May 22, 2025 -

The World Trading Tournament Wtt Aimscaps Success Story

May 22, 2025

The World Trading Tournament Wtt Aimscaps Success Story

May 22, 2025 -

Addressing Tariff Barriers Switzerland And Chinas Collaborative Approach

May 22, 2025

Addressing Tariff Barriers Switzerland And Chinas Collaborative Approach

May 22, 2025 -

The Goldbergs A Comprehensive Guide To Every Season

May 22, 2025

The Goldbergs A Comprehensive Guide To Every Season

May 22, 2025 -

Une Nouvelle Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Essai En Cours

May 22, 2025

Une Nouvelle Navette Gratuite Entre La Haye Fouassiere Et Haute Goulaine Essai En Cours

May 22, 2025

Latest Posts

-

New Attempt To Break The Trans Australia Running Record

May 22, 2025

New Attempt To Break The Trans Australia Running Record

May 22, 2025 -

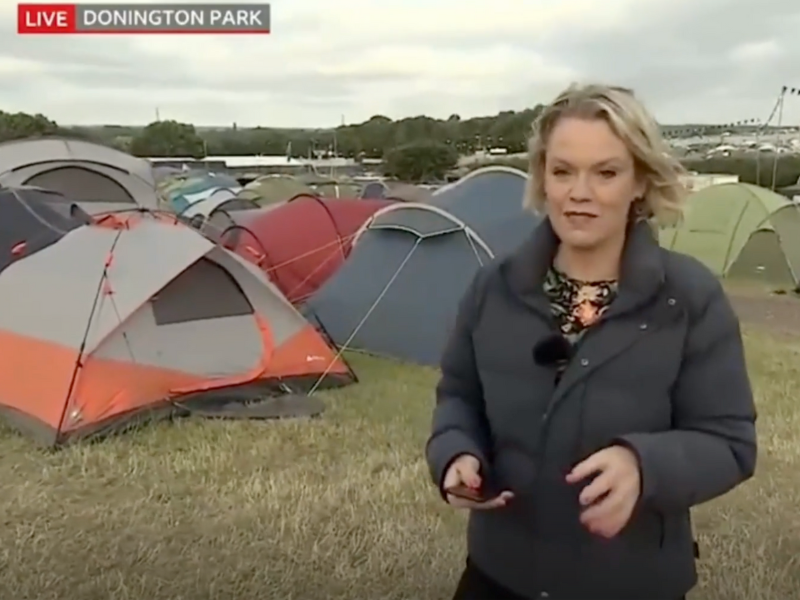

Bbc Breakfast Guest Interrupts Live Show Are You Still There

May 22, 2025

Bbc Breakfast Guest Interrupts Live Show Are You Still There

May 22, 2025 -

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025

Unexpected Moment Guest Interrupts Bbc Breakfast Live

May 22, 2025 -

Trans Australia Run World Record An Update

May 22, 2025

Trans Australia Run World Record An Update

May 22, 2025 -

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025

British Ultrarunners Bid For Australian Crossing Speed Record

May 22, 2025