Understanding Canadian Mortgage Trends: The 10-Year Term Question

Table of Contents

The Current Landscape of Canadian Mortgage Rates and Terms

The Canadian mortgage market is dynamic, influenced by various economic factors. Understanding the current interest rate environment is vital before committing to a 10-year mortgage term or any other term length. Currently, a range of mortgage terms are available to Canadian borrowers, including 5-year, 10-year, and even longer terms in some cases. The optimal choice depends on individual circumstances and risk tolerance.

- Current average interest rates for different mortgage terms: As of October 26, 2023, the average interest rates vary significantly depending on the lender, your credit score, and the down payment. It's crucial to shop around and compare rates from multiple lenders. You should expect to see lower rates for longer terms, but this is not always the case. Always get several quotes.

- Factors influencing interest rate fluctuations: The Bank of Canada's key interest rate is a major driver of mortgage rates. Inflation, economic growth, and global market conditions also play significant roles. These factors can lead to significant fluctuations in rates over the life of a mortgage.

- The impact of stress testing on mortgage approvals: Stress testing, a crucial part of the mortgage approval process, simulates higher interest rates to ensure borrowers can handle potential rate increases. This significantly impacts how much you can borrow. Understanding stress test implications is vital when choosing a mortgage term.

Advantages of a 10-Year Mortgage Term in Canada

A 10-year mortgage term offers several compelling advantages, particularly for those prioritizing long-term financial stability and predictability.

Rate Certainty and Long-Term Financial Planning

- Predictable monthly payments for 10 years: With a fixed-rate mortgage, your monthly payments remain consistent for the entire 10-year term, simplifying budgeting and financial planning.

- Easier budgeting and long-term financial planning: Knowing your exact mortgage payments for a decade allows for more accurate budgeting, debt management, and long-term financial goal setting.

- Protection against potential interest rate hikes during the term: A 10-year fixed-rate mortgage shields you from the risk of rising interest rates throughout the term, providing financial security.

Potential for Lower Interest Rates (Long-term Strategy)

- Lenders may offer slightly lower rates for longer terms to incentivize borrowers: To attract borrowers who commit to a longer term, some lenders may offer slightly more competitive interest rates compared to shorter terms.

- Comparison of potential savings over a 10-year versus a 5-year term: While a small difference in the initial interest rate might seem insignificant, over 10 years, the cumulative savings can be substantial. A thorough cost comparison is essential.

Disadvantages of a 10-Year Mortgage Term

While offering advantages, a 10-year mortgage term also presents certain drawbacks that require careful consideration.

Penalty for Breaking the Mortgage Early

- Types of penalties (interest rate differential, prepayment charges): Breaking a 10-year mortgage before its maturity date typically incurs significant penalties, including interest rate differentials and prepayment charges. These penalties can be substantial, often exceeding thousands of dollars.

- Calculating potential early breakage costs: It's crucial to carefully review the mortgage agreement and understand the exact penalty calculation methods before signing. Consult a financial advisor to assess potential costs.

Risk of Interest Rate Changes After 10 Years

- Rates might be higher when it's time to renew: After 10 years, the interest rate at renewal might be significantly higher than the initial rate, potentially leading to substantially increased monthly payments.

- Importance of considering potential rate increases when budgeting: It's essential to factor in the possibility of higher interest rates when budgeting for the post-10-year period.

Limited Flexibility

- Difficulty adjusting payments or refinancing if needed: A 10-year term offers less flexibility compared to shorter terms. Adjusting payments or refinancing can be challenging and may incur penalties.

- Potential for missed opportunities to benefit from lower interest rates: If interest rates fall during the 10-year term, you won't be able to take advantage of lower rates without paying penalties.

Alternatives to a 10-Year Term: Considering Shorter Terms

Shorter-term mortgages, such as 5-year terms, offer greater flexibility and the opportunity to renegotiate rates every few years.

- Lower penalties for early breakage: Breaking a shorter-term mortgage typically involves lower penalties compared to a 10-year term.

- Opportunity to capitalize on lower interest rates in the future: Shorter terms allow you to benefit from potentially lower interest rates when you renew.

Conclusion

Choosing the right mortgage term, such as a 10-year term, is a significant financial decision for any Canadian homeowner. Understanding the current Canadian mortgage trends, including interest rate fluctuations and the advantages and disadvantages of different terms, is crucial. Weighing the benefits of long-term rate certainty against the potential penalties and inflexibility of a 10-year mortgage is key. Ultimately, the best mortgage term depends on your individual financial situation, risk tolerance, and long-term goals. Before making a decision, consult with a qualified mortgage broker to explore your options and determine the best fit for your needs. Start planning your Canadian mortgage strategy today by researching different terms and rates. Make informed decisions about your Canadian mortgage term and secure your financial future.

Featured Posts

-

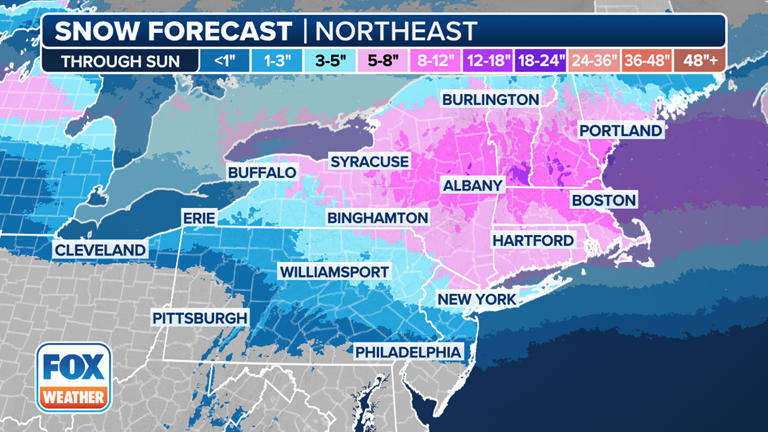

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 04, 2025

Snow Storm Forecast When Will Snow Return To Ny Nj And Ct

May 04, 2025 -

Kivinin Kabugu Tueketim Rehberi Ve Bilinmesi Gerekenler

May 04, 2025

Kivinin Kabugu Tueketim Rehberi Ve Bilinmesi Gerekenler

May 04, 2025 -

Mlb Tokyo Series Chicago Cubs Vs La Dodgers Live Stream Options

May 04, 2025

Mlb Tokyo Series Chicago Cubs Vs La Dodgers Live Stream Options

May 04, 2025 -

Anna Kendricks Crucial Role In The Accountant 3 Why The Accountant 2 Proves It

May 04, 2025

Anna Kendricks Crucial Role In The Accountant 3 Why The Accountant 2 Proves It

May 04, 2025 -

Ruth Buzzi 88 Remembering A Comedy Icon From Laugh In And Sesame Street

May 04, 2025

Ruth Buzzi 88 Remembering A Comedy Icon From Laugh In And Sesame Street

May 04, 2025

Latest Posts

-

Indy Car On Fox A New Era Begins

May 04, 2025

Indy Car On Fox A New Era Begins

May 04, 2025 -

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025 -

Fox 2 Simulcasts Red Wings And Tigers Games

May 04, 2025

Fox 2 Simulcasts Red Wings And Tigers Games

May 04, 2025 -

Foxs Indy Car Debut What To Expect This Season

May 04, 2025

Foxs Indy Car Debut What To Expect This Season

May 04, 2025 -

Indy Cars New Broadcast Partner A Look At Foxs Coverage Plans

May 04, 2025

Indy Cars New Broadcast Partner A Look At Foxs Coverage Plans

May 04, 2025