Understanding CoreWeave's (CRWV) Significant Stock Performance Last Week

Table of Contents

Analyzing the Factors Behind CRWV's Stock Rally

Several interconnected factors contributed to CoreWeave's impressive stock performance last week. Let's break them down:

Positive Earnings Reports and Revenue Growth

CoreWeave's latest earnings report significantly exceeded market expectations, triggering a positive reaction from investors. The report showcased robust revenue growth, exceeding analyst predictions by a considerable margin.

- Key Financial Metrics: The report highlighted impressive figures, including a [insert percentage]% increase in year-over-year revenue, exceeding [insert dollar amount] in total revenue. Earnings per share (EPS) also significantly improved compared to the previous quarter and the same period last year. Profit margins also showed healthy expansion.

- Analyst Reactions: Following the release of the earnings report, several prominent financial analysts upgraded their price targets for CRWV, citing strong growth potential and the company's leading position in the AI infrastructure market. This positive analyst sentiment further fueled the stock's rally.

- Keyword integration: CoreWeave earnings, CRWV financial results, revenue growth, profitability, EPS, year-over-year growth.

Increased Demand for AI Infrastructure

CoreWeave's strong performance is closely linked to the exploding demand for AI infrastructure. The company is a major player in providing the high-performance computing power needed to train and deploy large language models and other AI applications.

- CoreWeave's Role in AI Computing: CoreWeave offers scalable and cost-effective cloud solutions optimized for GPU computing, which is crucial for AI workloads. Their specialized infrastructure caters specifically to the demands of AI development and deployment.

- Market Trends: The global market for AI is experiencing explosive growth, driven by advancements in machine learning and deep learning. This surge in demand translates directly into increased business for companies like CoreWeave that provide the essential infrastructure.

- Partnerships and Collaborations: CoreWeave's strategic partnerships with leading AI companies provide further evidence of their market position and future growth prospects. These collaborations enhance their reach and solidify their role in the rapidly evolving AI landscape.

- Keyword integration: AI infrastructure, artificial intelligence, machine learning, cloud computing, GPU computing, AI adoption, AI development.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a vital role in shaping a company's trajectory and investor confidence. While specific details might need further investigation depending on the actual events, the potential impact is significant.

- Potential Partnerships: [Insert details of any significant new partnerships announced around the time of the stock surge]. These partnerships likely broadened CoreWeave's market reach, access to new technologies, or strengthened its competitive positioning.

- Potential Acquisitions: [Insert details of any acquisitions. If none occurred, this section can be re-focused on future acquisition potential as a positive indicator]. Acquisitions can expand CoreWeave's capabilities, technologies, or market presence, further contributing to its overall value.

- Market Reaction: The market's positive reaction to such announcements (if any) would further reinforce the positive sentiment surrounding CRWV.

- Keyword integration: CoreWeave partnerships, CRWV acquisitions, strategic alliances, mergers and acquisitions, market expansion.

Market Sentiment and Investor Confidence

The overall market sentiment and investor confidence play a significant role in driving stock prices. A positive outlook towards the tech sector, combined with confidence in CoreWeave's future prospects, contributed substantially to its recent surge.

- Overall Market Conditions: The broader market conditions at the time of the stock surge should be considered; a generally positive market environment would amplify the effect of positive company-specific news.

- Tech Sector News: Any positive news related to the overall technology sector could have indirectly boosted investor confidence in tech stocks, including CRWV.

- Investor Confidence Indicators: Factors like increased trading volume and positive media coverage also contribute to a sense of growing investor confidence.

- Keyword integration: Market sentiment, investor confidence, stock market trends, tech stock performance, trading volume.

Comparison to Competitors

Comparing CoreWeave's performance against its main competitors offers valuable insight into its competitive advantage.

- Key Competitors: [List key competitors in the cloud computing and AI infrastructure space]. Their recent performance relative to CoreWeave's can highlight CRWV's outperformance.

- Competitive Advantages: Identify what sets CoreWeave apart from its competitors, such as superior technology, stronger partnerships, better scalability, or more cost-effective solutions. Highlighting these strengths reinforces its positive market position.

- Keyword integration: Cloud computing competitors, AI infrastructure competitors, competitive landscape, market share, competitive advantage.

Conclusion: Understanding CoreWeave's (CRWV) Future Performance

CoreWeave's impressive stock performance last week can be attributed to a combination of strong financial results, the burgeoning demand for AI infrastructure, strategic partnerships, positive market sentiment, and its competitive advantages in the cloud computing sector. Understanding these factors is crucial for investors seeking to assess CRWV's future potential.

While the recent performance is encouraging, investors should maintain a balanced outlook, acknowledging the inherent risks and uncertainties in the stock market. The future performance of CRWV will depend on several factors, including continued revenue growth, maintaining its competitive edge, and navigating the evolving landscape of the AI and cloud computing industries.

Stay informed on CoreWeave (CRWV) stock performance and future trends by regularly checking reputable financial news sources and conducting thorough due diligence before making any investment decisions. Understanding CoreWeave's growth trajectory and assessing its long-term potential requires ongoing monitoring of its financial performance, market position, and strategic initiatives. Thorough research is critical before investing in CRWV or any other stock. Remember to diversify your investments and seek professional financial advice if needed. Successful CoreWeave (CRWV) investing relies on a well-informed approach.

- Keyword integration: CoreWeave investment, CRWV stock outlook, future growth prospects, risk assessment, due diligence, diversified investment.

Featured Posts

-

Franklin County Pa Extensive Damage After Chicken Barn Fire

May 22, 2025

Franklin County Pa Extensive Damage After Chicken Barn Fire

May 22, 2025 -

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025

Zakonoproekt Grem Posilennya Sanktsiynogo Tisku Na Rosiyu

May 22, 2025 -

Significant Route 581 Traffic Disruption Due To Box Truck Crash

May 22, 2025

Significant Route 581 Traffic Disruption Due To Box Truck Crash

May 22, 2025 -

Jeremie Frimpong Agrees To Transfer Liverpool Fc Yet To Make Contact

May 22, 2025

Jeremie Frimpong Agrees To Transfer Liverpool Fc Yet To Make Contact

May 22, 2025 -

Antiques Roadshow National Treasure Trafficking Case Unfolds After Shocking Appraisal

May 22, 2025

Antiques Roadshow National Treasure Trafficking Case Unfolds After Shocking Appraisal

May 22, 2025

Latest Posts

-

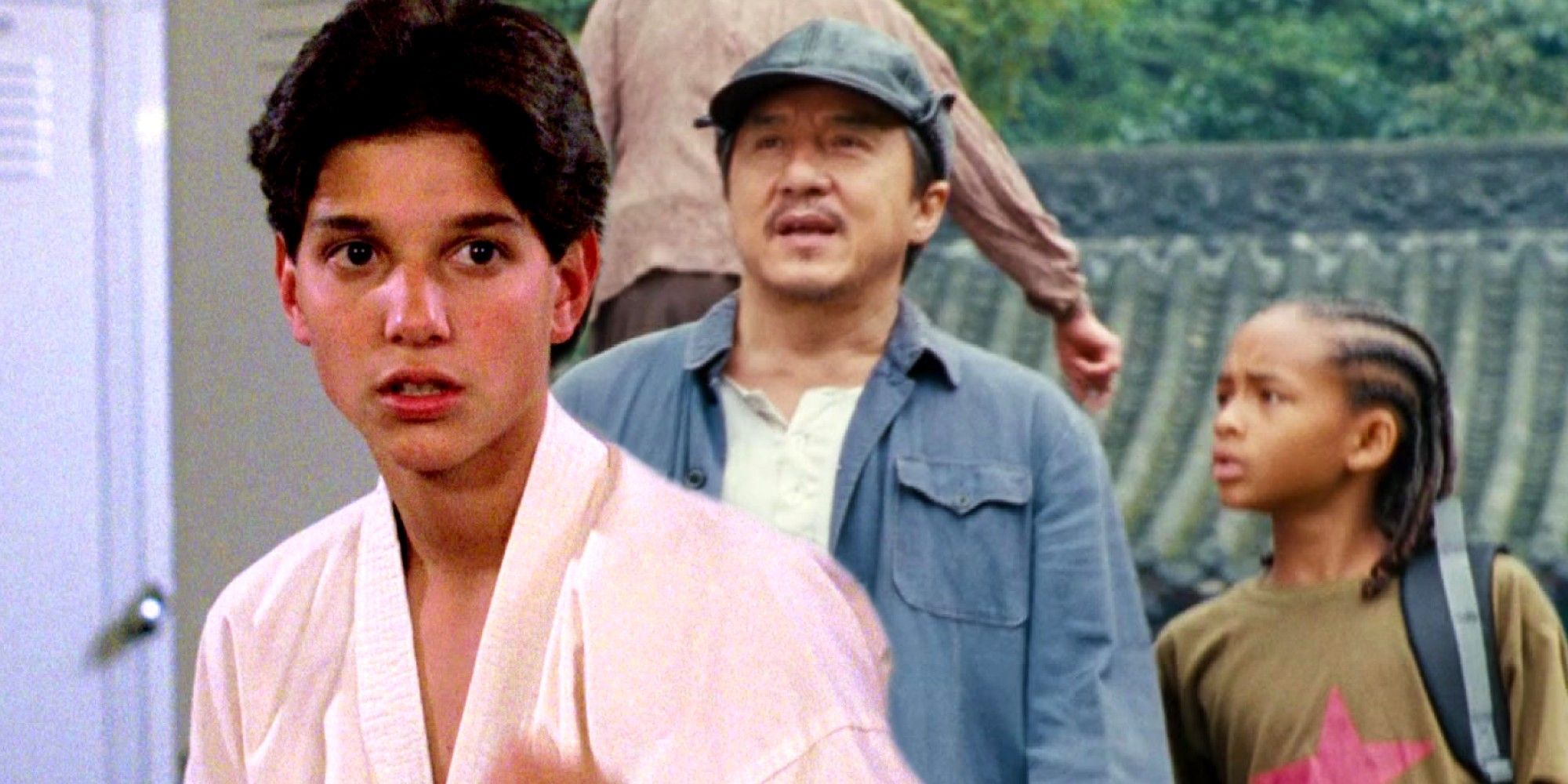

Family Honor Tradition Legacy The New Karate Kid Legends Trailer

May 23, 2025

Family Honor Tradition Legacy The New Karate Kid Legends Trailer

May 23, 2025 -

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025 -

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025 -

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025 -

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025