Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

Key Factors Driving High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Let's examine some of the most significant:

Low Interest Rates

Historically low interest rates have played a pivotal role in boosting stock valuations. Lower borrowing costs incentivize companies to invest more aggressively, leading to increased earnings and higher stock prices. This effect is amplified in several ways:

- Impact on Corporate Debt: Companies can borrow money cheaply to fund expansion, acquisitions, and stock buybacks, thus increasing their earnings per share.

- Increased Stock Buybacks: With low interest rates, companies often find repurchasing their own shares a more attractive use of capital than investing in other ventures, reducing the number of shares outstanding and boosting earnings per share.

- Effect on Investor Behavior: Low yields on bonds and other fixed-income investments push investors towards higher-yielding assets like stocks, increasing demand and driving up prices. This search for yield contributes to higher Price-to-Earnings (P/E) ratios.

Keywords: Low interest rates, monetary policy, bond yields, stock buybacks, yield curve, quantitative easing.

Strong Corporate Earnings

Robust corporate earnings provide a fundamental underpinning for high stock valuations. Several factors contribute to this strong earnings environment:

- Revenue Growth: Many companies are experiencing substantial revenue growth, fueled by strong consumer spending and global economic recovery.

- Cost-Cutting Measures: Companies have implemented various cost-cutting strategies, improving profit margins even amidst increased input costs.

- Increased Productivity: Technological advancements and improved efficiency have driven productivity gains, contributing to higher earnings.

- Impact of Technological Advancements: The digital transformation across industries has created new avenues for revenue generation and cost optimization.

Keywords: Earnings growth, profit margins, revenue growth, corporate performance, economic growth, productivity gains.

Increased Investor Sentiment and Speculation

Psychological factors and speculative behavior also play a significant role in driving up market valuations.

- Fear of Missing Out (FOMO): As stock prices rise, investors fear missing out on potential gains, further fueling the upward momentum. This creates a positive feedback loop.

- Increased Retail Investor Participation: The rise of online brokerage platforms has led to a surge in retail investor participation, increasing market liquidity and potentially contributing to speculative bubbles.

- Impact of Social Media Sentiment: Social media platforms have amplified investor sentiment, sometimes leading to herd behavior and price volatility.

- Potential for Speculative Bubbles: In certain sectors, valuations might be driven more by speculation and hype than by fundamental value.

Keywords: Investor sentiment, market psychology, speculation, FOMO, retail investors, social media sentiment, market bubbles, momentum investing.

Assessing the Risks Associated with High Valuations

While high valuations reflect positive economic indicators, it is crucial to acknowledge the associated risks:

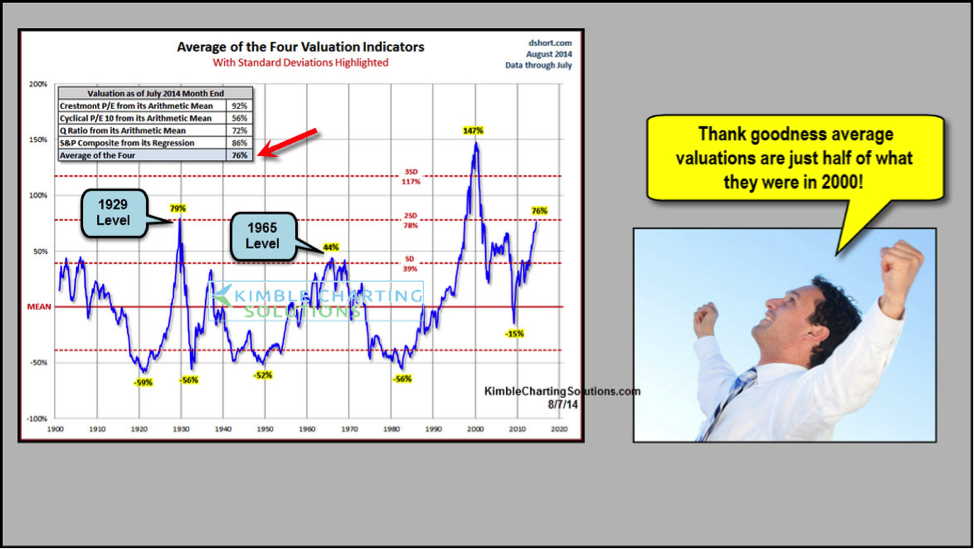

Valuation Metrics and Their Limitations

Common valuation metrics like the P/E ratio and Price-to-Sales ratio are often used to assess whether the market is overvalued. However, these metrics have limitations:

- Different Methodologies: Various methodologies exist for calculating these metrics, leading to discrepancies in interpretation.

- Sector-Specific Variations: Appropriate valuation multiples vary significantly across different sectors, making comparisons challenging.

- Limitations of Historical Data: Using historical data to predict future growth can be misleading, especially in rapidly changing market conditions.

- Difficulty in Predicting Future Growth: Accurately predicting future earnings growth is inherently difficult, making it hard to assess true intrinsic value.

Keywords: P/E ratio, Price-to-Sales ratio, valuation multiples, market capitalization, discounted cash flow, intrinsic value, relative valuation, fundamental analysis.

Potential for a Market Correction

Given the current high valuations, the risk of a market correction or even a more significant downturn remains a concern. Potential triggers include:

- Rising Interest Rates: A rapid increase in interest rates could curb corporate investment and reduce consumer spending, negatively impacting earnings and valuations.

- Inflation: Persistently high inflation erodes purchasing power and can lead to central bank intervention, potentially triggering a market correction.

- Geopolitical Instability: Unexpected geopolitical events can create market uncertainty and trigger sell-offs.

- Unexpected Economic Downturn: An unforeseen economic recession could lead to a sharp decline in stock prices.

Keywords: Market correction, market crash, bear market, risk assessment, economic indicators, interest rate hikes, inflation, geopolitical risk, recession.

BofA's Specific Insights

BofA's analysis ( insert specific details from BofA's report here, citing the source ) suggests that while the current economic climate is strong, the high valuations warrant caution. Their analysis might highlight specific sectors that are particularly vulnerable to a correction or identify factors that could mitigate the risks. (Insert specific data points and predictions from BofA's report)

Conclusion

Understanding high stock market valuations requires careful consideration of various factors, including low interest rates, strong corporate earnings, and heightened investor sentiment. While these factors have contributed to the current market strength, BofA's analysis highlights the potential risks associated with these elevated levels, including the possibility of a market correction triggered by rising interest rates, inflation, or geopolitical events.

Key Takeaways: The current high stock market valuations are a complex issue with multiple contributing factors. While strong earnings and low interest rates have played a significant role, the potential for a market correction remains a substantial risk. Investors should carefully assess their risk tolerance and diversify their portfolios.

Call to Action: Understanding high stock market valuations requires careful consideration of various factors. Further research and monitoring of key economic indicators are crucial for informed investment decisions. Consult BofA's resources and other reputable financial analysis for additional insights into navigating these high valuations and making sound investment choices.

Featured Posts

-

Ai Powered Podcast Creation From Repetitive Scatological Documents To Engaging Content

May 05, 2025

Ai Powered Podcast Creation From Repetitive Scatological Documents To Engaging Content

May 05, 2025 -

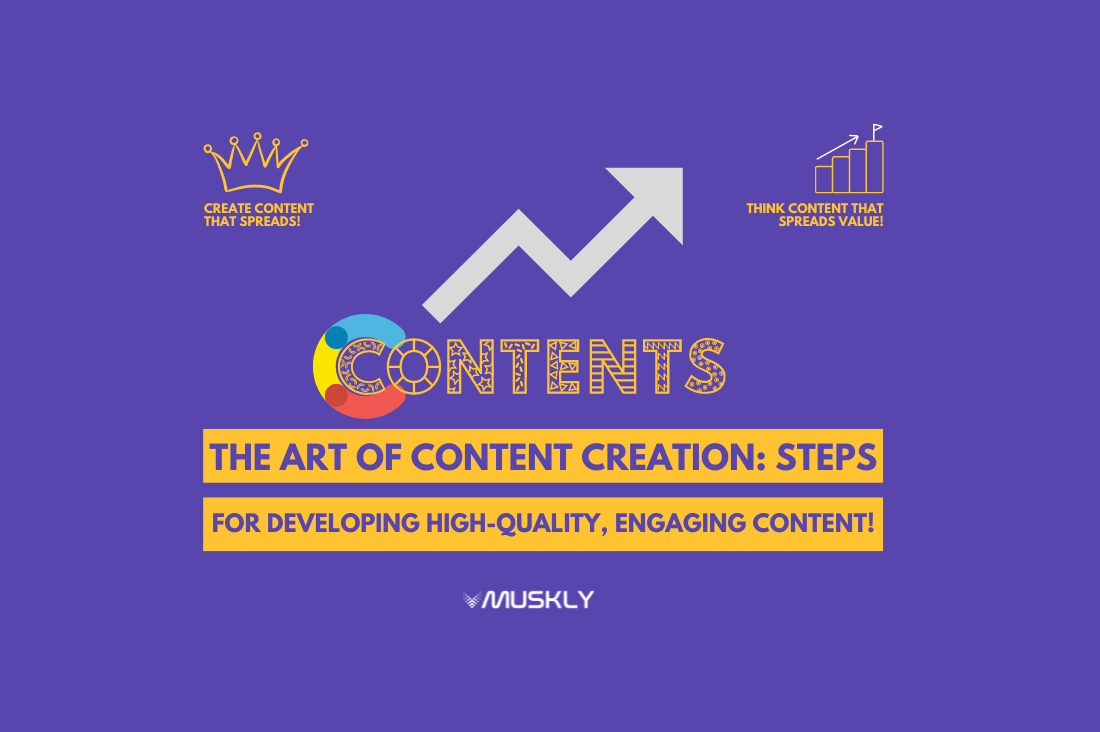

Analyzing Australias Election The Global Anti Trump Context

May 05, 2025

Analyzing Australias Election The Global Anti Trump Context

May 05, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

May 05, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction

May 05, 2025 -

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 05, 2025

Ev Mandate Opposition Car Dealers Double Down On Concerns

May 05, 2025 -

Opting Out Of Google Ai Training Does It Really Work

May 05, 2025

Opting Out Of Google Ai Training Does It Really Work

May 05, 2025

Latest Posts

-

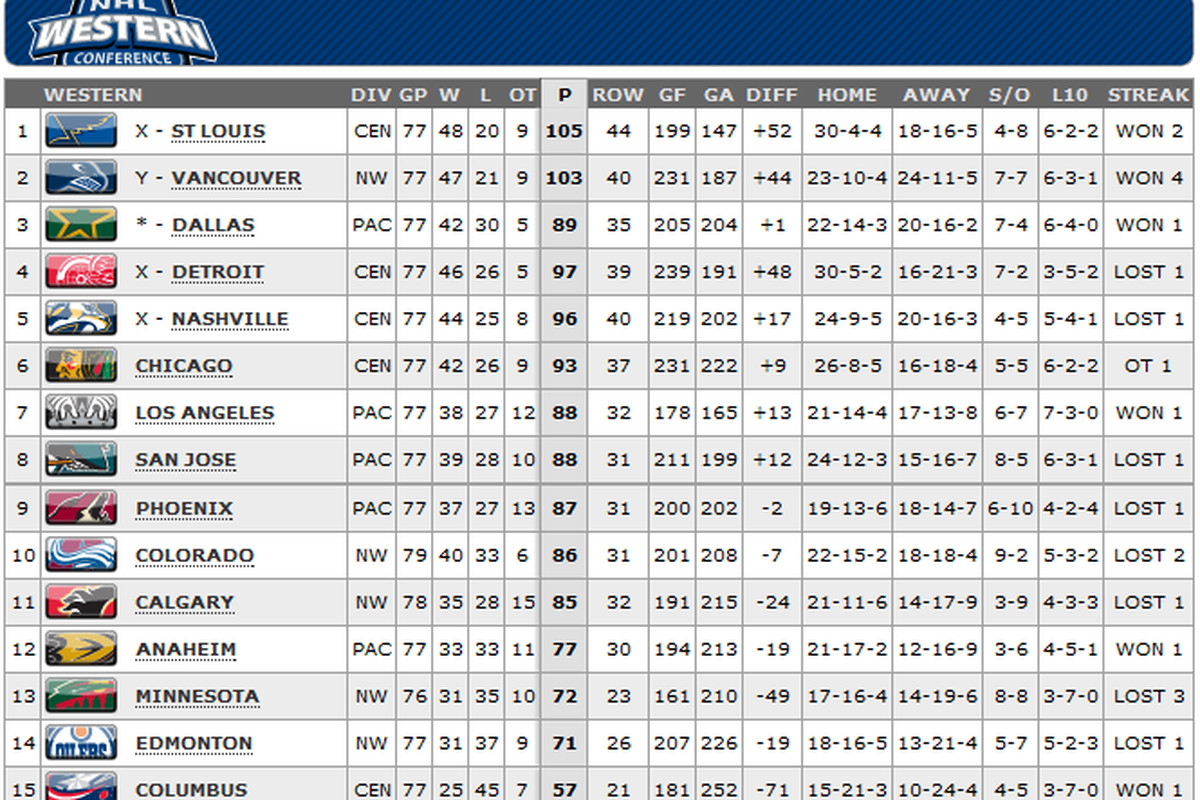

Fridays Nhl Games Impact On Playoff Standings

May 05, 2025

Fridays Nhl Games Impact On Playoff Standings

May 05, 2025 -

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025

Barkley Predicts Oilers And Leafs Playoff Success

May 05, 2025 -

Nhl Playoffs Fridays Crucial Games And Standings Implications

May 05, 2025

Nhl Playoffs Fridays Crucial Games And Standings Implications

May 05, 2025 -

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025

Nhl Standings The Western Conference Wild Card Contenders

May 05, 2025 -

10 Year Mortgages In Canada Reasons For Limited Interest

May 05, 2025

10 Year Mortgages In Canada Reasons For Limited Interest

May 05, 2025