Understanding High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

Factors Contributing to High Stock Market Valuations

Several interconnected factors have contributed to the current state of high stock market valuations. Understanding these drivers is essential for assessing the sustainability of these levels and forming effective investment strategies.

Low Interest Rates and Quantitative Easing

Historically low interest rates and quantitative easing (QE) policies implemented by central banks globally have significantly influenced equity markets. These policies aimed to stimulate economic growth by making borrowing cheaper and increasing the money supply.

- Increased demand for higher-yielding assets: With bond yields near zero or even negative in some countries, investors sought higher returns in the equity market, driving up demand and prices.

- Reduced borrowing costs for companies: Lower interest rates allowed companies to borrow money at cheaper rates, leading to increased investment in expansion and innovation, ultimately boosting earnings.

- Impact of near-zero interest rates on bond yields: The inverse relationship between interest rates and bond prices means that low interest rates pushed bond prices higher, making equities a relatively more attractive investment option.

- BofA's perspective on the sustainability of these policies: BofA analysts continually assess the long-term effects of these monetary policies and their potential impact on future market valuations. Their reports offer insights into the potential for shifts in monetary policy and their implications for equity markets.

Strong Corporate Earnings and Profitability

Robust corporate earnings and increased profitability have played a significant role in supporting high stock market valuations. Many companies have demonstrated strong performance, particularly in technology and certain consumer sectors.

- Analysis of key sectors driving earnings growth: BofA's research identifies key sectors, such as technology, healthcare, and consumer staples, that have demonstrated significant earnings growth.

- Comparison of current earnings to historical trends: Comparing current earnings per share (EPS) growth to historical averages provides context for assessing the sustainability of current valuations. Are these earnings growth rates unusually high, suggesting potential overvaluation?

- BofA's forecast for future corporate earnings: BofA's analysts provide forecasts for future corporate earnings, which are critical in predicting future stock market performance.

- Impact of technological advancements on corporate profitability: Technological innovations have driven efficiency improvements and revenue growth for many companies, impacting their profitability and influencing market valuations.

Increased Investor Sentiment and Market Optimism

Positive investor sentiment and market optimism significantly impact stock valuations. A generally optimistic outlook can lead to higher risk appetite and increased demand for equities.

- Discussion of market sentiment indicators: Market sentiment indicators, such as investor surveys and volatility indices, provide insight into prevailing market moods.

- Analysis of investor behavior and risk appetite: BofA's analysis explores investor behavior, assessing whether current valuations reflect rational expectations or an overestimation of future growth.

- BofA's assessment of prevailing market sentiment: BofA regularly publishes reports assessing overall market sentiment and its potential impact on future market movements.

- Potential impact of geopolitical events on investor sentiment: Geopolitical events, such as trade wars or political instability, can significantly impact investor sentiment and affect stock market valuations.

Assessing the Risks of High Stock Market Valuations

While high valuations can reflect strong economic fundamentals, they also present significant risks. Understanding these risks is crucial for prudent investment decision-making.

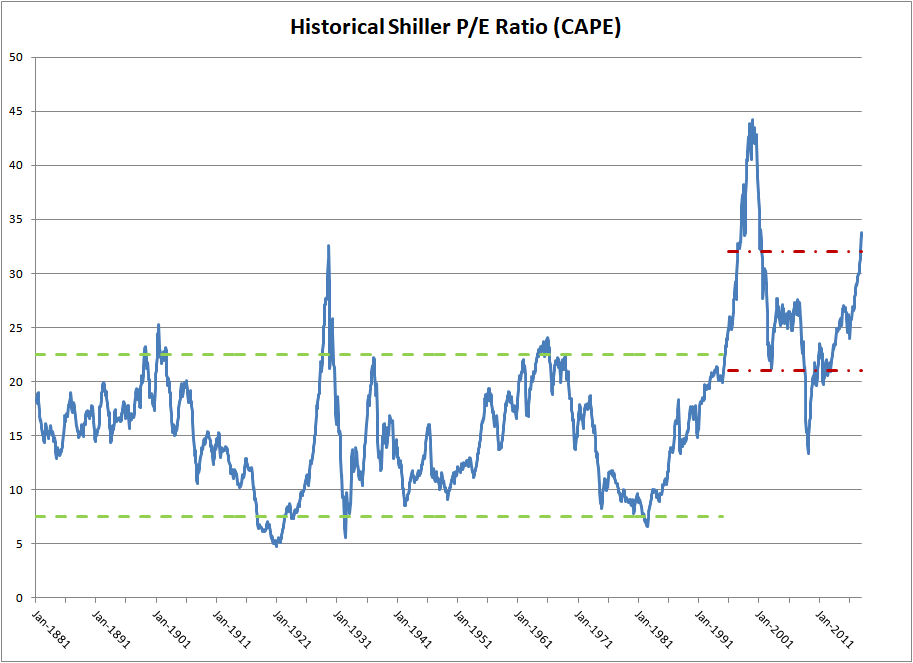

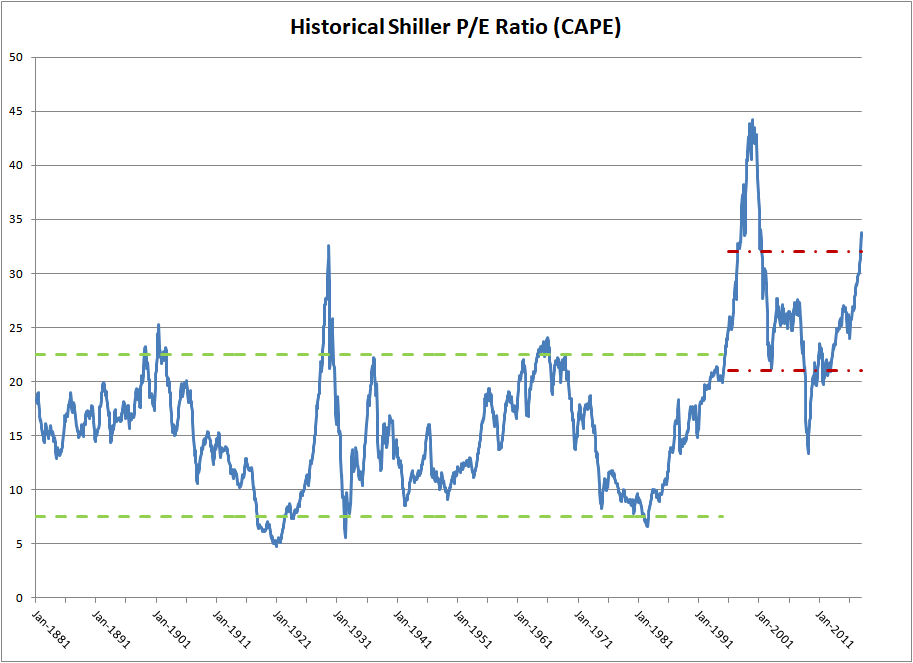

Valuation Metrics and Their Implications

Several key valuation metrics help assess whether the market is overvalued. BofA's analysis utilizes these metrics to assess the current market environment.

- Analysis of current P/E ratios across different sectors: Price-to-earnings (P/E) ratios are widely used to assess whether a stock or sector is overvalued or undervalued relative to its earnings.

- Comparison with historical averages and industry benchmarks: Comparing current P/E ratios to historical averages and industry benchmarks helps determine whether current valuations are unusually high.

- Discussion of potential overvaluation in specific sectors: BofA's research identifies specific sectors that may be particularly vulnerable to a market correction due to high valuations.

- BofA's perspective on the sustainability of current valuations: BofA analysts offer their perspective on the long-term sustainability of current market valuations, considering both positive and negative factors.

Potential for Market Corrections or Crashes

High valuations often precede market corrections or crashes. While predicting the timing and magnitude of such events is impossible, understanding the potential triggers is crucial.

- Historical precedents for market corrections following periods of high valuation: History demonstrates that periods of high valuations have often been followed by market corrections.

- Potential triggers for a market downturn: Rising interest rates, unexpected economic slowdowns, geopolitical instability, or a sudden shift in investor sentiment can trigger market downturns.

- BofA's risk assessment and potential scenarios: BofA's analysts provide various scenarios and risk assessments, considering different potential triggers for a market correction.

- Strategies to mitigate potential losses during a market correction: Diversification, hedging, and stop-loss orders can help mitigate losses during a market correction.

Investment Strategies in a High-Valuation Market

Navigating a high-valuation market requires a cautious and strategic approach. Diversification and risk management are paramount.

Diversification and Risk Management

Diversification across asset classes and risk management strategies are essential for protecting portfolios in a high-valuation environment.

- Importance of diversifying across different asset classes: Diversifying into asset classes like bonds, real estate, and commodities can help reduce overall portfolio volatility.

- Strategies for managing portfolio risk: Techniques such as hedging, stop-loss orders, and careful position sizing can help manage risk effectively.

- BofA's recommendations for risk management: BofA offers specific recommendations for managing risk in the current market environment.

- Importance of a long-term investment horizon: A long-term investment horizon allows investors to weather short-term market fluctuations and benefit from long-term growth.

Identifying Undervalued Opportunities

Even in a high-valuation market, opportunities exist for identifying undervalued assets. Thorough research and analysis are crucial.

- Focus on companies with strong fundamentals and growth potential: Focus on companies with strong balance sheets, consistent earnings growth, and a competitive advantage.

- Analyzing industry trends and identifying sectors poised for growth: Identify sectors that may be less susceptible to market corrections due to their strong fundamentals and future growth potential.

- Utilizing fundamental analysis and valuation techniques: Use fundamental analysis and valuation techniques to identify undervalued companies with strong potential for future growth.

- BofA's recommendations for identifying undervalued opportunities: BofA's research can help identify potentially undervalued stocks and sectors.

Conclusion

High stock market valuations present both opportunities and risks for investors. While strong corporate earnings and low interest rates have contributed to the current market conditions, understanding valuation metrics and potential market corrections is crucial. BofA's analysis highlights the importance of diversification, risk management, and a long-term investment strategy in navigating this complex environment. By carefully analyzing market trends and utilizing sound investment principles, investors can potentially mitigate risks and capitalize on opportunities within this high-valuation market. Continue learning about understanding high stock market valuations and develop a robust investment strategy based on thorough research and professional advice.

Featured Posts

-

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025

Untangling Sister Faith And Sister Chance In Andrzej Zulawskis Possession A Lady Killers Podcast Analysis

Apr 27, 2025 -

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025

Cdc Vaccine Study Is A Discredited Agent Involved

Apr 27, 2025 -

Renewed Opposition To Ev Mandates From Car Dealerships

Apr 27, 2025

Renewed Opposition To Ev Mandates From Car Dealerships

Apr 27, 2025 -

Novak Djokovics Straight Sets Defeat At Monte Carlo Masters 2025

Apr 27, 2025

Novak Djokovics Straight Sets Defeat At Monte Carlo Masters 2025

Apr 27, 2025 -

10

Apr 27, 2025

10

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025