Understanding High Stock Market Valuations: A BofA Perspective

Table of Contents

Factors Contributing to High Stock Market Valuations (BofA's View)

Several interconnected factors contribute to the current elevated levels of high stock market valuations, according to BofA's analysis. Let's delve into the key drivers:

The Role of Low Interest Rates

A prolonged period of low interest rates has significantly influenced equity valuations. This "low interest rate environment" makes bonds less attractive, pushing investors towards higher-yielding assets, including stocks.

- Impact of quantitative easing (QE) and subsequent monetary policy: BofA notes that the massive injection of liquidity through QE programs lowered borrowing costs and spurred investment, boosting stock prices. This artificially low interest rate environment has created a search for yield among investors.

- Comparison of current bond yields to historical averages: Currently, bond yields remain historically low compared to previous decades, making stocks a relatively more appealing investment option in the eyes of many investors. This relative attractiveness further fuels the demand for equities.

- The flight to safety effect and its impact on stock valuations: In times of economic uncertainty, investors often seek the perceived safety of established companies and larger market-cap stocks. This flight to safety increases demand, potentially driving up valuations further.

Strong Corporate Earnings and Positive Economic Outlook

Robust corporate earnings and a positive economic outlook have also fueled high stock market valuations. BofA's analysis points to several contributing factors:

- BofA's analysis of sector-specific earnings growth: Certain sectors, such as technology and healthcare, have demonstrated exceptionally strong earnings growth, pushing up overall market valuations.

- Analysis of projected future earnings and their impact on P/E ratios: Analysts' projections for future earnings growth have supported high price-to-earnings (P/E) ratios, indicating investors' optimism about future profitability.

- Discussion of potential risks to earnings growth: While the outlook is generally positive, BofA also acknowledges potential risks such as inflation, supply chain disruptions, and geopolitical uncertainty that could impact future earnings and, consequently, valuations.

Technological Advancements and Innovation

The rapid pace of technological innovation, particularly in the tech sector, has contributed to high stock market valuations, particularly for growth stocks.

- BofA's outlook on the long-term growth potential of the tech sector: BofA analysts see significant long-term growth potential in the technology sector, driven by disruptive technologies and the adoption of new business models. This expectation of future growth justifies high valuations for many tech companies.

- The impact of technological disruption on traditional industries: Technological disruption is reshaping traditional industries, creating new winners and losers and potentially impacting valuations across the board. Industries lagging in technological adoption might witness lower valuations.

- Potential risks associated with high valuations in the tech sector: However, the high valuations in the tech sector also present risks. Overvaluation in certain segments could lead to significant corrections if growth fails to meet expectations. Market analysts carefully track this sector's valuations.

Assessing the Risk of High Stock Market Valuations

While the current market environment is characterized by high valuations, it's crucial to assess the associated risks:

Potential Market Corrections and Bubbles

High valuations inevitably increase the risk of market corrections or even the formation of speculative bubbles.

- BofA's assessment of the likelihood of a market correction: BofA acknowledges the possibility of a market correction, but the timing and magnitude are uncertain, dependent on numerous factors.

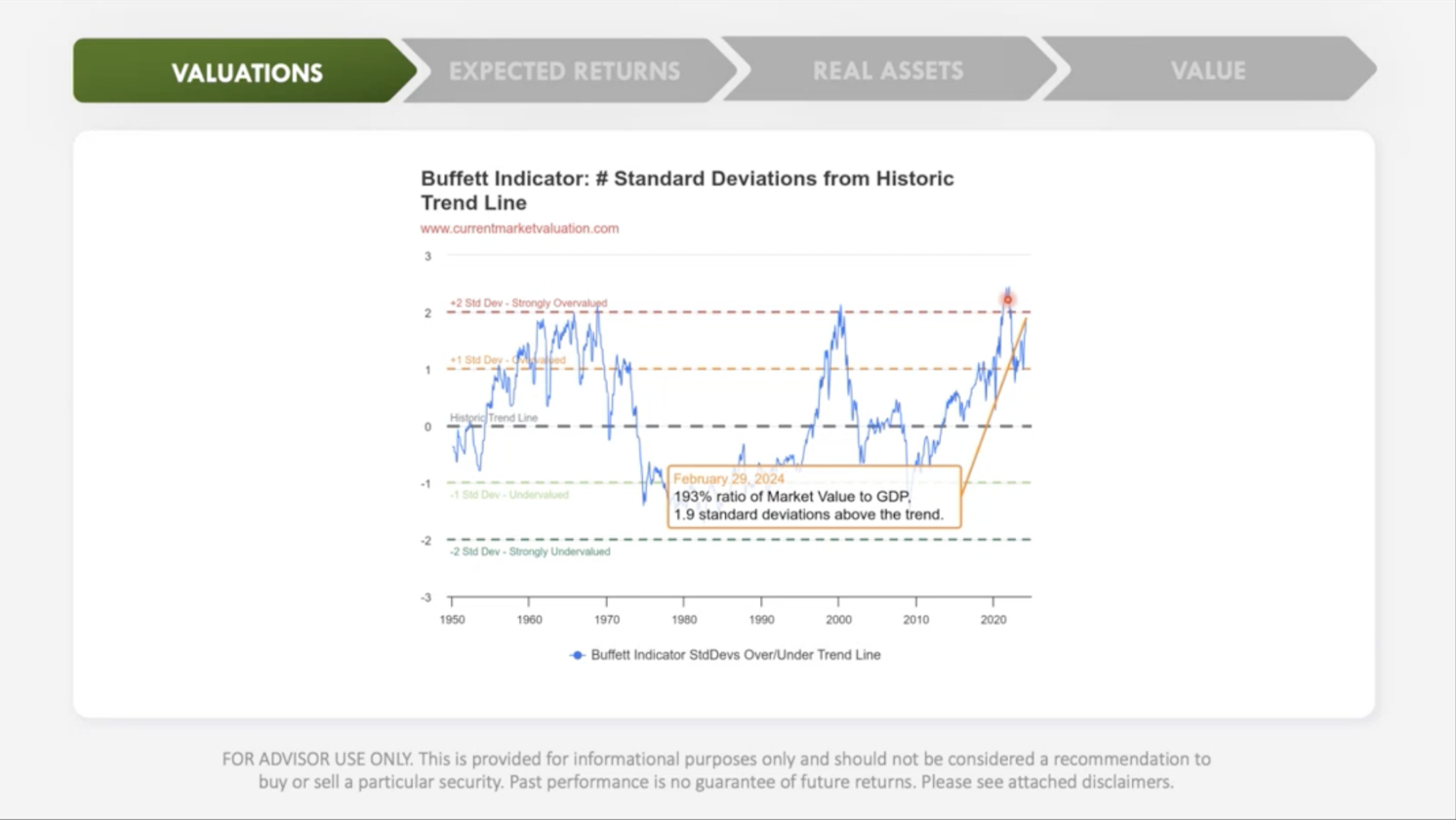

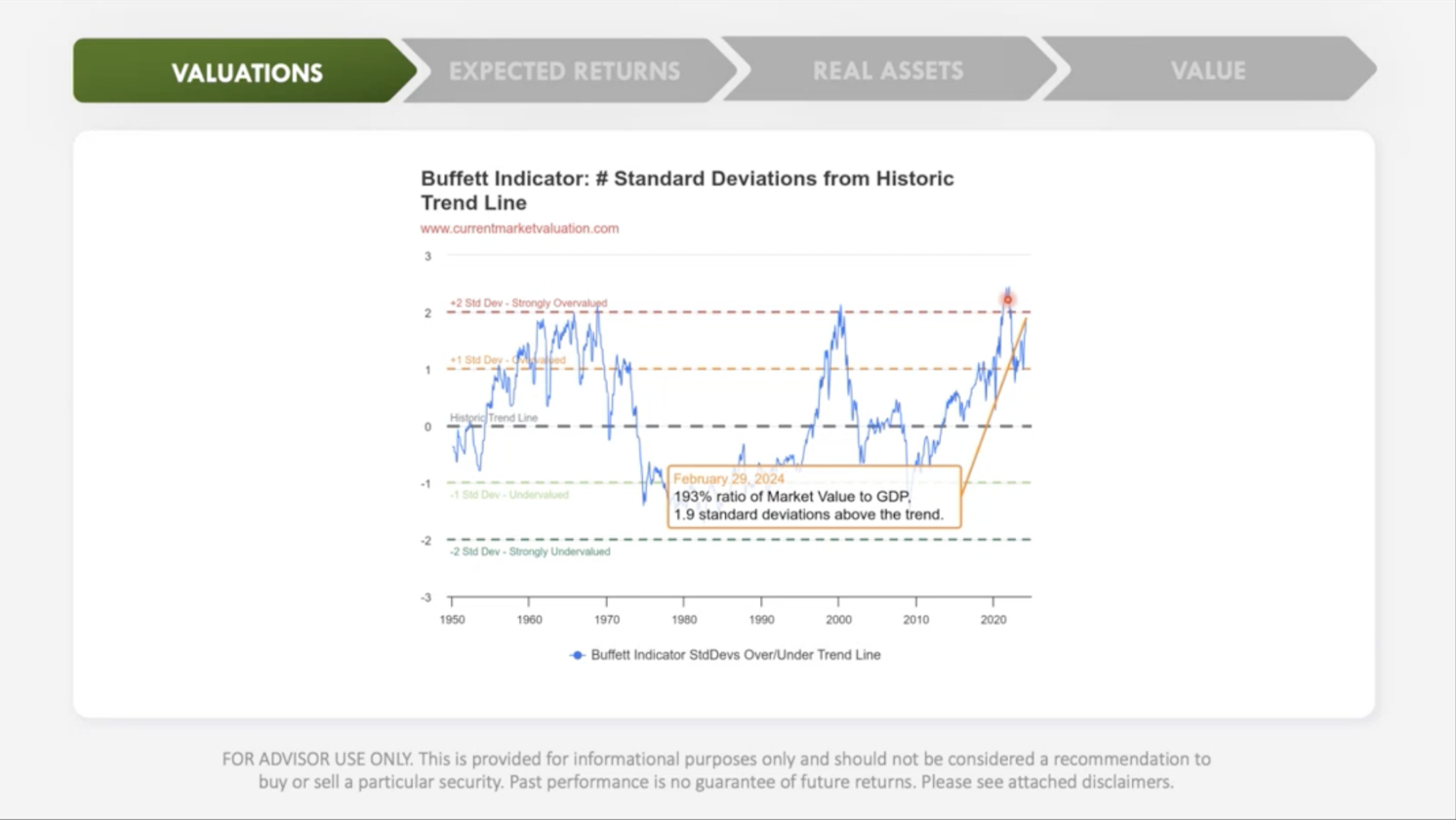

- Historical comparisons to previous periods of high valuations: BofA analysts often compare current valuation metrics with historical data to understand the potential for a correction or bubble formation. This historical context helps inform risk assessments.

- Strategies for mitigating risk in a high-valuation environment: To mitigate risk, BofA suggests diversified portfolios, careful risk management techniques, and a focus on fundamentally strong companies with sustainable growth prospects.

Sustainability of Current Valuations

BofA employs various valuation metrics to assess the sustainability of current market levels:

- BofA's preferred valuation metrics and their rationale: They rely on a combination of metrics such as the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and dividend yield to gain a holistic view of valuations.

- Comparison of current valuation metrics to historical averages: By comparing current metrics to historical averages, BofA gauges whether valuations are stretched and potentially unsustainable.

- BofA's forecast for future valuation levels: BofA provides forecasts for future valuation levels, incorporating their outlook for economic growth, corporate earnings, and interest rates. These forecasts are crucial for long-term investment strategy.

BofA's Investment Strategies in a High-Valuation Environment

Given the current high stock market valuations, BofA recommends a cautious approach to investing:

- BofA's advice on sector selection: They suggest a focus on sectors with strong fundamentals and sustainable growth prospects, potentially favoring value stocks over growth stocks in some cases.

- BofA's recommendations for managing portfolio risk: Diversification across different asset classes, including bonds and alternative investments, is crucial to manage risk effectively. Regular portfolio rebalancing is advised.

- BofA's outlook on specific asset classes (e.g., bonds, real estate, alternative investments): BofA's analysts regularly update their outlook on different asset classes, helping investors make informed decisions about their allocation strategy.

Understanding High Stock Market Valuations - Key Takeaways and Next Steps

In conclusion, BofA's analysis suggests that several factors, including low interest rates, strong corporate earnings, and technological innovation, are driving high stock market valuations. However, these high valuations also carry significant risks, including the potential for market corrections. Careful risk management, portfolio diversification, and a focus on fundamentally sound investments are crucial for navigating this environment. BofA recommends a balanced investment strategy that accounts for these factors and their potential impact on your investments.

To gain a deeper understanding of high stock market valuations and how to navigate this market environment, explore BofA's comprehensive investment resources. [Link to BofA resources]

Featured Posts

-

Hertls Double Hat Trick Powers Golden Knights Victory Over Red Wings

May 09, 2025

Hertls Double Hat Trick Powers Golden Knights Victory Over Red Wings

May 09, 2025 -

Characters Connections And The Ectomobile Arctic Comic Con 2025 Photo Highlights

May 09, 2025

Characters Connections And The Ectomobile Arctic Comic Con 2025 Photo Highlights

May 09, 2025 -

Vegas Golden Knights Defeat Blue Jackets 4 0 Behind Hills 27 Saves

May 09, 2025

Vegas Golden Knights Defeat Blue Jackets 4 0 Behind Hills 27 Saves

May 09, 2025 -

3 000 Babysitter Cost Turns Into 3 600 Daycare Bill One Mans Frustration

May 09, 2025

3 000 Babysitter Cost Turns Into 3 600 Daycare Bill One Mans Frustration

May 09, 2025 -

Dijon Cite De La Gastronomie La Ville Face Aux Problemes D Epicure

May 09, 2025

Dijon Cite De La Gastronomie La Ville Face Aux Problemes D Epicure

May 09, 2025