Understanding High Stock Market Valuations: BofA's Insights

Table of Contents

BofA's Key Indicators of High Stock Market Valuations

Bank of America, a leading financial institution, employs several key indicators to assess high stock market valuations. These metrics provide a comprehensive picture of market conditions and help determine whether current prices are justified by underlying fundamentals. Understanding these indicators is crucial for investors seeking to make informed decisions.

-

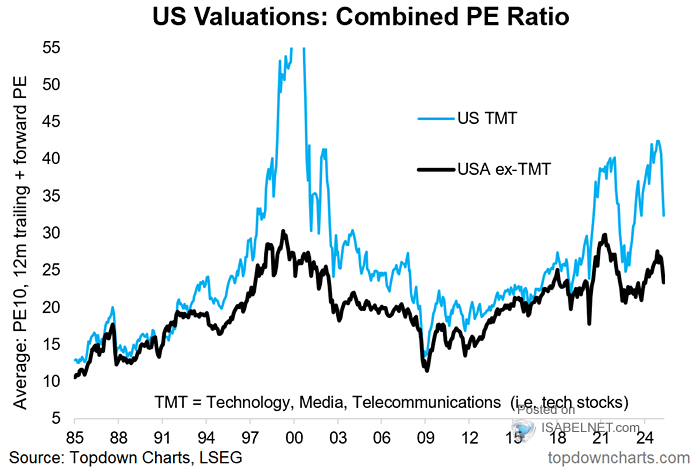

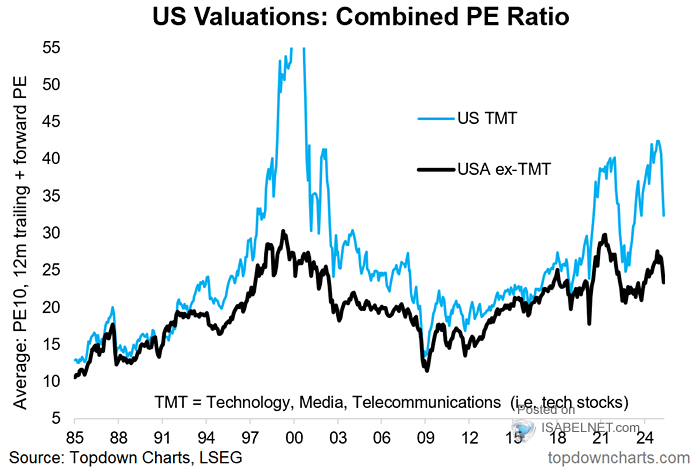

Price-to-Earnings Ratio (P/E): The P/E ratio compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating an overvalued market. BofA uses P/E ratios across various sectors to identify overvalued or undervalued segments.

-

Shiller P/E Ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, the CAPE ratio smooths out earnings fluctuations over a ten-year period. This provides a more stable measure of valuation compared to the standard P/E ratio, offering BofA a longer-term perspective on market valuation. A high CAPE ratio often suggests that the market is priced above its historical average.

-

Market Cap to GDP Ratio: This ratio compares the total market capitalization of all publicly traded companies to a country's gross domestic product (GDP). A high market cap to GDP ratio indicates that the stock market represents a large proportion of the economy's overall value, which might be a sign of overvaluation. BofA utilizes this metric to assess overall market valuation in relation to the broader economic landscape.

BofA uses these metrics in conjunction with other factors to develop a holistic view of market valuations. Their analysis helps inform their investment strategies and recommendations to clients.

Factors Contributing to High Stock Market Valuations According to BofA

Several factors, analyzed by BofA, contribute to periods of high stock market valuations. Understanding these factors is crucial for interpreting market behavior and making informed investment decisions.

-

Low Interest Rates: Low interest rates reduce the cost of borrowing, making it cheaper for companies to invest and expand. This also encourages investors to seek higher returns in the stock market, potentially pushing valuations higher. BofA closely monitors interest rate policies and their impact on stock market behavior.

-

Quantitative Easing (QE): QE involves central banks injecting liquidity into the market by purchasing assets, including government bonds. This increased liquidity can stimulate asset prices, including stocks, leading to higher valuations. BofA assesses the effects of QE programs on market dynamics and their potential long-term consequences.

-

Strong Corporate Earnings: Consistent and robust corporate earnings growth can support higher stock prices. BofA meticulously tracks corporate earnings reports and forecasts to gauge the sustainability of market valuations. Strong earnings justify higher valuations, but if earnings disappoint, corrections can follow.

-

Investor Sentiment: Positive investor sentiment, fueled by market optimism and expectations of future growth, can drive up stock prices regardless of fundamental valuations. BofA incorporates sentiment analysis into their assessments, understanding the influence of market psychology.

-

Technological Innovation: Breakthroughs in technology can drive significant growth and innovation, boosting the valuations of companies in the tech sector and potentially the broader market. BofA recognizes the impact of technological advancements on market trends and sector-specific valuations.

BofA's Outlook and Predictions on High Stock Market Valuations

BofA's outlook on high stock market valuations is nuanced and often evolves based on macroeconomic conditions and market data. Their analysis frequently incorporates a risk assessment, outlining potential pitfalls and opportunities.

-

Stock Market Forecast: BofA's forecasts vary depending on the timeframe and specific market indicators. Their predictions often involve scenarios incorporating various degrees of economic growth and interest rate changes. Specific predictions are usually available through their proprietary research reports and client briefings.

-

Market Corrections: BofA acknowledges the potential for market corrections, given that high valuations are inherently susceptible to volatility. Their risk assessments usually include probabilities of different correction scenarios and their likely impact on various asset classes.

-

Investment Recommendations: BofA's investment recommendations are usually tailored to specific risk profiles and investment horizons. While the high valuation environment might suggest caution, their recommendations will balance potential returns against associated risks.

-

Risk Assessment: Understanding the risks associated with high stock market valuations is a critical component of BofA's analysis. Their reports will likely highlight the potential for significant declines if underlying fundamentals weaken or investor sentiment shifts negatively.

-

Long-term Growth: BofA's perspective on long-term growth is crucial for investors. While acknowledging near-term risks, they usually maintain a long-term view, considering economic growth potential and technological advancements that can support sustained market expansion.

Strategies for Navigating High Stock Market Valuations

Navigating high stock market valuations requires a strategic approach focused on risk management and diversification. Investors should consider the following strategies:

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors can help reduce overall risk and mitigate potential losses in a volatile market. This is a key recommendation from BofA and other financial institutions.

-

Risk Management: Implementing effective risk management strategies, including setting stop-loss orders and regularly reviewing your portfolio's risk profile, is vital during periods of high valuations. BofA emphasizes risk management as a critical aspect of responsible investing.

-

Asset Allocation: Adjusting your asset allocation strategy to reflect the higher risk associated with a high-valuation market may involve reducing equity exposure and increasing allocation to less volatile assets. BofA provides guidance on asset allocation strategies for various risk tolerances.

-

Value Investing: Value investing focuses on identifying undervalued companies with strong fundamentals. This approach can be particularly attractive in high-valuation markets, where finding undervalued assets requires more diligent research.

-

Long-term Investing: Maintaining a long-term investment horizon can help you weather market fluctuations and potentially benefit from long-term growth. BofA strongly advocates for a long-term perspective, especially in high-valuation environments.

Conclusion

Understanding high stock market valuations requires careful analysis of key indicators and underlying factors. BofA's insights provide valuable perspectives, highlighting the influence of low interest rates, strong corporate earnings, and investor sentiment. While high valuations present potential risks, a long-term approach with diversification and prudent risk management is crucial. Staying informed on the latest analysis of high stock market valuations and adapting your investment strategy accordingly is key to successful long-term investment. Continue researching and learning about the insights offered by leading financial institutions like BofA to make well-informed investment decisions. Understanding these complex dynamics is key to successful navigation of high stock market valuations.

Featured Posts

-

Ubisoft Addresses Harassment Concerns In Assassins Creed Valhalla

May 29, 2025

Ubisoft Addresses Harassment Concerns In Assassins Creed Valhalla

May 29, 2025 -

Stranger Things The First Shadow New Images From The First Preview

May 29, 2025

Stranger Things The First Shadow New Images From The First Preview

May 29, 2025 -

Southwests Bags Fly Free Era Ends Will Punctuality Suffer

May 29, 2025

Southwests Bags Fly Free Era Ends Will Punctuality Suffer

May 29, 2025 -

Analysis Marine Le Pens Reaction To Conviction At Paris Rally

May 29, 2025

Analysis Marine Le Pens Reaction To Conviction At Paris Rally

May 29, 2025 -

The Ftcs Chat Gpt Investigation Understanding The Potential Consequences For Open Ai

May 29, 2025

The Ftcs Chat Gpt Investigation Understanding The Potential Consequences For Open Ai

May 29, 2025

Latest Posts

-

Gorillazs 25th Anniversary House Of Kong Exhibition And London Concert Dates

May 30, 2025

Gorillazs 25th Anniversary House Of Kong Exhibition And London Concert Dates

May 30, 2025 -

Ticketmaster Y Setlist Fm La Guia Definitiva Para La Experiencia Del Concierto Perfecto

May 30, 2025

Ticketmaster Y Setlist Fm La Guia Definitiva Para La Experiencia Del Concierto Perfecto

May 30, 2025 -

Gorillaz 25th Anniversary House Of Kong Exhibition And Exclusive London Gigs

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition And Exclusive London Gigs

May 30, 2025 -

Gorillazs 25th Anniversary House Of Kong Exhibition And Exclusive London Shows

May 30, 2025

Gorillazs 25th Anniversary House Of Kong Exhibition And Exclusive London Shows

May 30, 2025 -

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025