Understanding High Stock Market Valuations: BofA's Take For Investors

Table of Contents

BofA's Assessment of Current Market Valuations

BofA's assessment of current market valuations involves a careful examination of several key metrics and their implications for investors. Their analysis helps investors understand whether the current high stock market valuations are justified or represent a potential risk.

Key Valuation Metrics Analyzed by BofA

BofA likely considers a range of valuation metrics to gauge the overall health and potential future performance of the equity market. These metrics provide a comprehensive picture, helping to avoid relying on any single indicator. Some key metrics include:

-

Price-to-earnings ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio might suggest overvaluation, while a low P/E could indicate undervaluation. However, BofA's interpretation would also consider industry benchmarks and growth prospects.

-

Price-to-sales ratio (P/S): This ratio compares a company's market capitalization to its revenue. It's useful for valuing companies with negative earnings or inconsistent profitability. High P/S ratios might signify high growth expectations, but also potentially elevated risk.

-

Price-to-book ratio (P/B): This compares a company's market value to its net asset value (assets minus liabilities). A high P/B ratio can suggest market optimism, but also the potential for a significant correction if asset values decline.

-

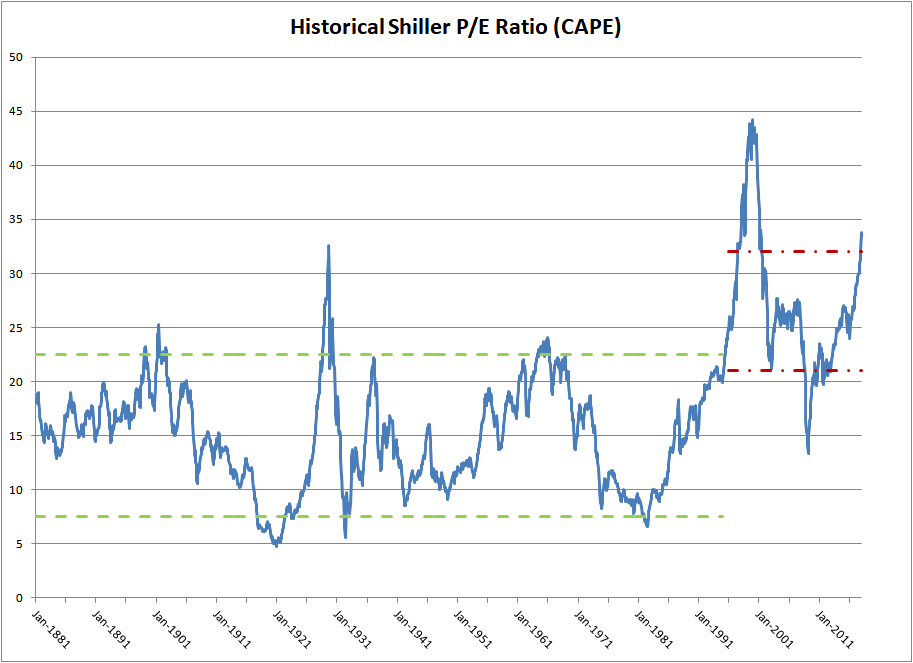

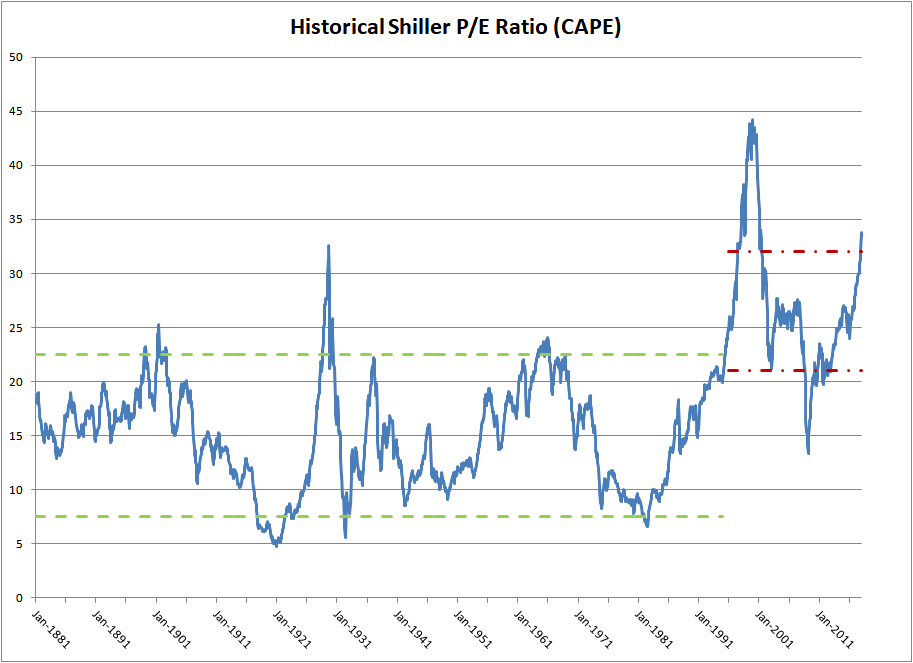

Cyclically adjusted price-to-earnings ratio (CAPE): This Shiller P/E ratio smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation. BofA may use CAPE to assess long-term valuation trends and potential bubbles.

-

Dividend yield: This indicates the annual dividend payment relative to the stock price. A high dividend yield might suggest a relatively attractive valuation, especially for income-focused investors. However, it’s crucial to consider the sustainability of dividend payouts.

It's important to note that specific data points from BofA's reports are dynamic and require accessing their current research publications for the most up-to-date information. Their interpretation of these valuation metrics considers macroeconomic factors, sector-specific trends, and individual company performance.

BofA's View on the Sustainability of High Valuations

BofA's view on the sustainability of current high stock market valuations likely depends on several interrelated factors. They might argue that current valuations are justified by:

- Strong earnings growth: Robust corporate profits can support higher stock prices, making valuations seem less extreme.

- Low interest rates: Lower borrowing costs can incentivize investment, driving up stock prices.

- Technological advancements and innovation: Disruptive technologies and innovative business models can lead to high growth potential, potentially justifying higher valuations.

However, BofA might also identify potential risks:

- Overvaluation: High P/E ratios across broad market indices could indicate a market bubble, potentially leading to a sharp correction.

- Market corrections: A sudden drop in stock prices is always possible, even in periods of apparent stability, and high valuations amplify the potential severity.

- Economic downturns: A recession could significantly impact corporate earnings, leading to a reassessment of valuations.

BofA’s reasoning and supporting data would need to be sourced from their official reports and publications.

Investment Strategies in a High-Valuation Environment

Navigating a market with high stock market valuations requires a thoughtful investment strategy. BofA's recommendations likely emphasize risk management and diversification.

BofA's Recommendations for Investors

BofA's recommendations may include:

- Sector rotation: Shifting investments towards sectors expected to outperform in the current economic climate. This might involve moving away from overvalued sectors and into undervalued or more defensive ones.

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk.

- Focus on value stocks: Seeking out companies trading at lower valuations relative to their fundamentals, potentially offering better risk-adjusted returns.

- Consider international diversification: Expanding investment horizons beyond domestic markets to reduce overall portfolio volatility.

BofA might advise against overexposure to high-growth technology stocks, which are often characterized by high P/E ratios. Instead, they could recommend sectors demonstrating more stable growth and earnings.

Managing Risk in a High-Valuation Market

Managing risk is paramount in a high-valuation environment. BofA's guidance likely emphasizes:

- Portfolio diversification: Spreading investments across different asset classes and sectors to minimize the impact of any single investment underperforming.

- Asset allocation strategies: Carefully determining the appropriate mix of stocks, bonds, and other assets based on individual risk tolerance and investment goals.

- Risk tolerance assessment: Understanding one's comfort level with potential losses before making investment decisions.

- Long-term investment plan: Sticking to a long-term investment strategy, avoiding impulsive decisions based on short-term market fluctuations.

By following a disciplined approach, investors can better navigate the inherent volatility of a high-valuation market.

Long-Term Outlook and Predictions (according to BofA)

BofA's long-term outlook and predictions regarding stock market valuations would likely be nuanced and conditional on various macroeconomic factors.

BofA's Predictions for the Stock Market

BofA’s predictions might involve a cautious outlook, acknowledging the elevated risk associated with high stock market valuations. They might forecast moderate growth, potentially punctuated by periods of correction. However, their specific predictions would be highly dependent on their economic forecasts and assumptions.

Factors that Could Impact Future Valuations

Several factors could significantly influence future stock market valuations:

- Interest rate changes: Rising interest rates tend to decrease stock valuations as investors seek higher returns from bonds.

- Inflation: High inflation erodes purchasing power and can negatively impact corporate earnings, leading to lower valuations.

- Economic growth: Strong economic growth typically supports higher stock valuations, while slow growth or recession can trigger declines.

- Geopolitical events: Unforeseen global events (wars, political instability, etc.) can cause market volatility and impact valuations significantly.

BofA's outlook would consider the interplay of these factors and their potential impact on corporate earnings and investor sentiment.

Conclusion

BofA's analysis of high stock market valuations highlights the importance of a cautious yet proactive investment approach. Their assessment likely involves a thorough review of valuation metrics, recognition of potential risks (such as overvaluation and market corrections), and recommendations for diversified investment strategies. Understanding these valuations is vital for making informed investment decisions.

Call to Action: Understanding high stock market valuations is crucial for all investors. Stay informed on BofA's analysis and other market insights to develop a robust investment strategy that aligns with your risk tolerance and long-term financial goals. Continue to monitor market trends and seek professional financial advice to navigate the complexities of high stock market valuations effectively. Don't underestimate the importance of managing your investment portfolio in a climate of high stock market valuations.

Featured Posts

-

Contempt Of Legislature Yukon Politicians Confront Mine Managers Silence

Apr 29, 2025

Contempt Of Legislature Yukon Politicians Confront Mine Managers Silence

Apr 29, 2025 -

Kuxiu Solid State Power Bank A Deep Dive Into Its Longevity And Cost

Apr 29, 2025

Kuxiu Solid State Power Bank A Deep Dive Into Its Longevity And Cost

Apr 29, 2025 -

New York Times Spelling Bee April 1 2025 Complete Gameplay Guide

Apr 29, 2025

New York Times Spelling Bee April 1 2025 Complete Gameplay Guide

Apr 29, 2025 -

Atlanta Falcons Dcs Son Apologizes For Prank Call To Cleveland Browns Shedeur Sanders

Apr 29, 2025

Atlanta Falcons Dcs Son Apologizes For Prank Call To Cleveland Browns Shedeur Sanders

Apr 29, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Development

Apr 29, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Development

Apr 29, 2025

Latest Posts

-

River Road Construction A Crisis For Louisvilles Restaurant Businesses

Apr 29, 2025

River Road Construction A Crisis For Louisvilles Restaurant Businesses

Apr 29, 2025 -

Tornado And Flooding Emergency Louisville Under State Of Emergency

Apr 29, 2025

Tornado And Flooding Emergency Louisville Under State Of Emergency

Apr 29, 2025 -

Louisville Restaurants Seek Relief From River Road Construction Delays

Apr 29, 2025

Louisville Restaurants Seek Relief From River Road Construction Delays

Apr 29, 2025 -

Louisville Tornado State Of Emergency Issued Severe Flooding Imminent

Apr 29, 2025

Louisville Tornado State Of Emergency Issued Severe Flooding Imminent

Apr 29, 2025 -

Help Louisville Restaurants Weather River Road Construction

Apr 29, 2025

Help Louisville Restaurants Weather River Road Construction

Apr 29, 2025