Understanding High Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

Bank of America's recent reports offer a nuanced perspective on current stock market valuations. While acknowledging the impressive gains, BofA analysts haven't declared a universal "bubble," but they do express caution. Their analysis often involves a detailed examination of various market indices, including the S&P 500 and the Nasdaq Composite. They carefully assess the current BofA stock market valuation metrics, focusing on key indicators like Price-to-Earnings (P/E) ratios.

-

BofA's assessment of current Price-to-Earnings (P/E) ratios: BofA's analysis frequently references P/E ratios across different sectors, comparing them to historical averages and industry benchmarks. They often highlight sectors where P/E ratios appear stretched compared to fundamentals.

-

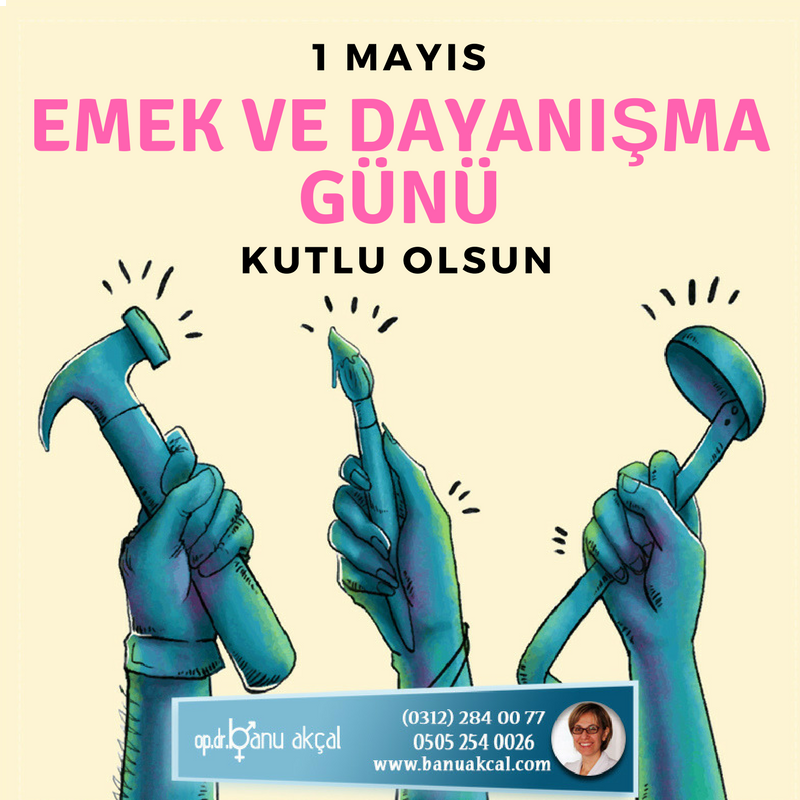

BofA's view on the impact of interest rate hikes on valuations: The Federal Reserve's monetary policy, particularly interest rate hikes, plays a significant role in BofA's outlook. Higher interest rates can impact valuations by increasing borrowing costs for companies and reducing the attractiveness of equities compared to bonds. BofA models various interest rate scenarios and their potential impact on stock prices.

-

BofA's predictions for future market performance: BofA's BofA market outlook typically involves forecasting future market performance based on their economic models and analysis of various market indicators. These predictions often come with caveats, acknowledging the inherent uncertainty in market forecasting.

-

Specific indices BofA focuses on: BofA’s analysis frequently centers on major market indices like the S&P 500 and the Nasdaq, providing detailed sector-specific analyses and projections within these broader market indicators. This allows for granular analysis of the BofA investment strategy within the context of these indices.

Factors Contributing to High Stock Market Valuations

Several underlying economic and market factors contribute to these high valuation drivers. Understanding these dynamics is crucial for making informed investment decisions.

-

Low interest rates and their impact on investor behavior: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and subsequently, prices. This increased demand has inflated valuations across various asset classes.

-

Strong corporate earnings growth (or expectations thereof): Positive corporate earnings reports and optimistic future earnings projections boost investor confidence and fuel demand for stocks, driving stock market drivers of high valuation.

-

Increased liquidity in the market: Ample liquidity, either from government stimulus packages or other sources, provides investors with more capital to invest, increasing demand and pushing valuations higher.

-

Technological advancements and their influence on valuations: Breakthroughs in technology and the continued growth of the tech sector significantly impact market valuations. Investors often place high valuations on companies poised to benefit from these advancements.

-

Geopolitical factors and their effect on investor sentiment: Global events, geopolitical instability, and trade tensions can influence investor sentiment and market volatility, impacting valuations.

Investment Strategies in a High-Valuation Environment

Navigating a market characterized by high valuation investing requires a strategic approach. Here’s how to adjust your investment strategy:

-

Importance of diversification across asset classes: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) helps reduce your overall risk exposure. Don't put all your eggs in one basket.

-

Strategies for mitigating risk in a high-valuation market: Consider strategies like hedging, using stop-loss orders, and focusing on companies with strong fundamentals and consistent earnings.

-

The role of value investing in a high-growth environment: Value investing, focusing on undervalued companies, can be a valuable approach even in a high-growth market. Identifying companies trading below their intrinsic value offers potential for higher returns.

-

Considering alternative investment options: Explore alternative investments like commodities, precious metals, or infrastructure to diversify further and potentially reduce correlation with traditional stocks.

-

The benefit of seeking professional financial advice: Consulting a qualified financial advisor can provide personalized guidance tailored to your individual risk tolerance and financial goals.

Potential Risks Associated with High Stock Market Valuations

While the market offers potential gains, it's crucial to acknowledge the market risks associated with high stock market valuations.

-

The risk of a market correction or crash: High valuations often precede market corrections or crashes. Understanding this risk is fundamental to successful investing.

-

The impact of inflation on stock valuations: Inflation erodes the purchasing power of money, which can negatively impact stock valuations, especially when interest rates rise to combat inflation.

-

The potential for interest rate increases to negatively impact the market: As mentioned earlier, higher interest rates can dampen investor enthusiasm and lead to lower stock prices.

-

The risk of overvalued specific sectors or companies: Not all sectors or companies are created equal. Some might be significantly overvalued, increasing the risk of substantial losses.

Conclusion

This article explored BofA's insights into the current high stock market valuations, examining contributing factors and potential risks. Understanding these dynamics is crucial for informed investment strategy. We've highlighted the importance of diversification, risk management, and seeking professional advice when navigating this potentially volatile market. The key takeaway is that while the market offers opportunities, a cautious and well-informed approach is vital.

Call to Action: Stay informed on the latest market trends and BofA's analysis to make well-informed decisions regarding your investment strategy in this environment of high stock market valuations. Regularly review your portfolio and adjust your approach as needed. Understanding these complexities is key to navigating the challenges and opportunities presented by this market.

Featured Posts

-

Gaza Freedom Flotilla Sos Report Of Drone Attack Off Malta

May 02, 2025

Gaza Freedom Flotilla Sos Report Of Drone Attack Off Malta

May 02, 2025 -

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Arbedeleri Bir Degerlendirme

May 02, 2025

Tuerkiye De 1 Mayis Emek Ve Dayanisma Guenue Arbedeleri Bir Degerlendirme

May 02, 2025 -

2024 Open Ai Developer Event New Tools For Voice Assistant Development

May 02, 2025

2024 Open Ai Developer Event New Tools For Voice Assistant Development

May 02, 2025 -

Analyzing Current Trends In Nuclear Litigation

May 02, 2025

Analyzing Current Trends In Nuclear Litigation

May 02, 2025 -

Tongas U 19 Womens Football Team Secures 2025 Ofc Championship Spot

May 02, 2025

Tongas U 19 Womens Football Team Secures 2025 Ofc Championship Spot

May 02, 2025