Understanding Live Now, Pay Later Services: A Comprehensive Review

Table of Contents

The rise of "live now, pay later" (LNPL) services is undeniable. A recent study showed a staggering 60% increase in LNPL usage in the past year, reflecting a shift in consumer spending habits. But what exactly are these services, and are they right for you? This comprehensive review explores live now, pay later services, outlining their benefits, risks, and how to choose the best option for your financial situation. We'll delve into the mechanics of LNPL, comparing the advantages and disadvantages to help you make informed decisions about using these increasingly popular payment methods.

H2: How Live Now, Pay Later Services Work:

Live now, pay later services offer a flexible payment option for purchases. Instead of paying the full amount upfront, you split the cost into smaller, interest-free installments, typically over a few weeks or months. But how does it all work?

H3: The Application Process:

Applying for an LNPL service is generally straightforward. Most providers offer quick online applications requiring minimal information.

- Simple application forms: Usually requiring only your name, address, date of birth, and bank details.

- Quick approval process: Many services provide instant approval decisions, allowing you to proceed with your purchase immediately.

- Varying credit score requirements: While some providers perform a soft credit check, others may have stricter requirements depending on the loan amount.

- Required documentation: You may need to provide identification (ID) and proof of income, depending on the provider and loan amount.

Once approved, you'll receive a virtual or physical card, or a unique code, to use at participating retailers. At checkout, you select the LNPL service as your payment method. The retailer receives the full payment, and you agree to repay the lender in installments according to the agreed-upon schedule. This typically involves automatic payments from your linked bank account.

H2: Benefits of Using Live Now, Pay Later Services:

LNPL services offer several compelling advantages for consumers.

H3: Improved Cash Flow Management:

LNPL can significantly improve your cash flow management.

- Spreading payments over time: Breaking down large purchases into smaller, manageable payments eases financial strain.

- Avoiding high-interest credit card debt: LNPL can be a more affordable alternative to high-interest credit cards, especially for unexpected expenses.

- Easier budgeting with predictable payments: Knowing your payment schedule in advance simplifies budgeting and helps avoid overspending.

- Access to larger purchases: LNPL enables you to afford larger purchases that might otherwise be out of reach.

H3: Convenient Shopping Experience:

LNPL services offer a seamless and convenient shopping experience, both online and in-store.

- Seamless integration with online retailers: Most major online retailers now offer LNPL as a payment option.

- One-click checkout options: LNPL frequently integrates directly into the checkout process for faster purchases.

- Fast and easy in-store payments: Many LNPL providers offer mobile payment options for quick in-store transactions.

- No need to carry large amounts of cash: LNPL offers a cashless and convenient alternative to traditional payment methods.

H2: Risks and Potential Drawbacks of Live Now, Pay Later Services:

While convenient, LNPL services come with potential risks that require careful consideration.

H3: High Fees and Interest Charges:

Missing payments can lead to significant financial consequences.

- Late payment penalties: Late payments attract substantial fees, potentially impacting your credit score.

- Potential for high APR if not paid on time: If you don’t repay on time, interest can accrue rapidly, turning a seemingly affordable payment plan into a costly debt.

- Impact on credit reports and credit scores: Consistent late payments negatively affect your credit report and credit score, making it harder to secure loans or credit in the future.

- Difficulty managing multiple LNPL accounts: Juggling multiple LNPL accounts can lead to confusion and missed payments.

H3: Debt Accumulation:

The ease of using LNPL can lead to overspending and debt accumulation.

- Impulse purchases: The readily available credit can encourage impulse buying, leading to unnecessary debt.

- Over-reliance on credit: Becoming overly dependent on LNPL can mask underlying financial issues.

- Difficulty repaying multiple loans: Managing multiple LNPL loans simultaneously can quickly become challenging.

- Potential for financial hardship: If not managed carefully, LNPL can contribute to serious financial hardship.

H2: Choosing the Right Live Now, Pay Later Service for You:

Choosing the right LNPL service is crucial to avoid financial pitfalls.

H3: Comparing Providers:

Before signing up, compare different providers.

- Interest rates and fees comparison: Scrutinize interest rates, late payment fees, and other charges.

- Customer service ratings and reviews: Check online reviews to gauge the provider's customer service responsiveness and efficiency.

- Credit score requirements: Understand the credit score thresholds for eligibility.

- Payment flexibility options: Assess the flexibility of payment schedules and options for early repayment.

H3: Responsible Use of Live Now, Pay Later:

Responsible borrowing is paramount when using LNPL.

- Only using for necessary purchases: Avoid using LNPL for non-essential items.

- Sticking to a budget: Create a budget and only use LNPL if it fits within your financial plan.

- Paying on time to avoid fees: Ensure timely payments to avoid incurring extra charges.

- Monitoring spending habits: Regularly review your spending to prevent overspending.

Conclusion:

Live now, pay later services offer a convenient payment method with benefits such as improved cash flow and a simplified shopping experience. However, they also carry significant risks, including high fees, interest charges, and the potential for debt accumulation. Responsible use is key to maximizing the benefits and mitigating the risks. Start your research on the best live now, pay later options today! Compare providers carefully, understand the terms and conditions, and always borrow responsibly. Learn more about responsible live now, pay later usage to make informed decisions.

Featured Posts

-

Bad Bunny Madrid And Barcelona Entradas A La Venta En Ticketmaster Y Live Nation

May 30, 2025

Bad Bunny Madrid And Barcelona Entradas A La Venta En Ticketmaster Y Live Nation

May 30, 2025 -

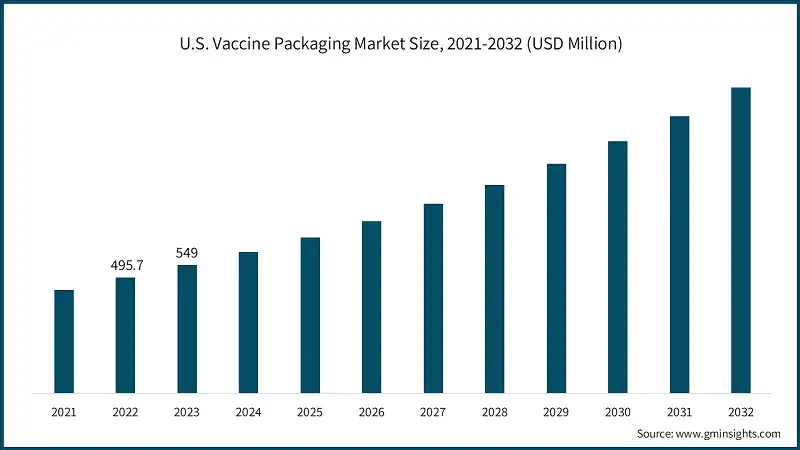

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025

The Booming Vaccine Packaging Market Trends And Opportunities

May 30, 2025 -

Ulasan Kawasaki W800 My 2025 Sentuhan Klasik Performa Modern

May 30, 2025

Ulasan Kawasaki W800 My 2025 Sentuhan Klasik Performa Modern

May 30, 2025 -

Ticketmaster Lanza Venue Virtual Mira Tu Asiento Antes De Comprar Entradas

May 30, 2025

Ticketmaster Lanza Venue Virtual Mira Tu Asiento Antes De Comprar Entradas

May 30, 2025 -

Guillermo Del Toro Game Name S World Is Unparalleled

May 30, 2025

Guillermo Del Toro Game Name S World Is Unparalleled

May 30, 2025