Understanding Sovereign Bond Market Trends With Swissquote Bank

Table of Contents

Factors Influencing Sovereign Bond Market Trends

Several interconnected macro and micro factors influence sovereign bond yields and prices. Analyzing these elements is essential for anticipating market movements and making strategic investment choices.

Global Economic Growth

Global economic growth significantly impacts the demand for sovereign bonds. Strong economic growth often leads to higher interest rates, reducing the attractiveness of bonds as fixed-income investments. Conversely, fears of a recession can drive investors towards the perceived safety of sovereign bonds, increasing their demand and pushing prices higher.

- Impact of recessionary fears: During times of economic uncertainty, investors seek safe-haven assets, boosting demand for government bonds.

- Emerging market growth: Strong growth in emerging markets can increase global demand for capital, potentially putting upward pressure on interest rates.

- Global trade wars: Trade disputes and protectionist policies create uncertainty, affecting investor sentiment and impacting sovereign bond prices.

Related keywords: global interest rates, inflation, economic forecasts, recession risk.

Central Bank Policies

Central banks play a pivotal role in shaping Sovereign Bond Market Trends through their monetary policies. Their decisions regarding interest rates and quantitative easing (QE) directly affect bond yields and overall market sentiment.

- Quantitative easing (QE): QE programs, where central banks inject liquidity into the market by purchasing bonds, typically push bond prices up and yields down.

- Interest rate hikes: Raising interest rates makes bonds less attractive compared to other higher-yielding investments, typically leading to lower bond prices.

- Monetary policy announcements: Central bank announcements regarding future monetary policy actions can significantly impact market expectations and trigger immediate price changes in sovereign bonds.

Related keywords: monetary policy, interest rate hikes, quantitative tightening (QT), central bank intervention.

Geopolitical Risks

Geopolitical events significantly influence investor sentiment and, consequently, Sovereign Bond Market Trends. Periods of political instability or armed conflict often lead investors to seek the safety of sovereign bonds issued by countries perceived as stable and secure.

- Examples of geopolitical events and their impact: Wars, political upheavals, and terrorist attacks can create uncertainty and drive capital towards perceived safe-haven assets like sovereign bonds from stable economies.

- Safe-haven assets: During times of heightened geopolitical risk, investors often flock to bonds issued by countries with strong economies and political stability, driving up their prices.

Related keywords: political risk, geopolitical uncertainty, safe-haven bonds, sovereign debt crisis.

Analyzing Sovereign Bond Market Data with Swissquote Bank

Swissquote Bank provides a comprehensive suite of tools and resources to assist investors in analyzing Sovereign Bond Market Trends and making informed decisions.

Access to Real-time Data

Swissquote Bank offers access to real-time data feeds and market information, empowering investors to stay ahead of the curve.

- Platforms: User-friendly trading platforms provide access to live market data and charting tools.

- Charting tools: Advanced charting tools allow for in-depth technical analysis of sovereign bond price movements.

- Data providers: Swissquote Bank partners with leading data providers to ensure the accuracy and timeliness of its market information.

Related keywords: real-time data, trading platform, market analysis tools, live market data, charting software.

Research and Analysis

Swissquote Bank provides in-depth research and analysis on sovereign bond markets, offering valuable insights to its clients.

- Economic reports: Access to regular economic reports and forecasts helps investors assess the macroeconomic environment and its impact on bond markets.

- Market commentaries: Expert market commentaries provide insights into current market trends and potential future developments.

- Expert opinions: Swissquote Bank's analysts offer expert opinions and recommendations based on their extensive market knowledge.

Related keywords: market research, investment analysis, economic indicators, market commentary, expert analysis.

Trading Tools and Platforms

Swissquote Bank offers efficient and secure trading tools and platforms for accessing the sovereign bond market.

- User-friendly interface: Intuitive platforms simplify the trading process, even for less experienced investors.

- Order execution speed: Fast and reliable order execution ensures that investors can capitalize on market opportunities quickly.

- Security features: Robust security measures protect client accounts and transactions.

Related keywords: online trading, trading platform, secure trading, execution speed, trading interface.

Strategies for Investing in Sovereign Bonds

Successful investing in sovereign bonds requires a well-defined strategy that considers diversification, yield curve analysis, and robust risk management.

Diversification

Diversification is crucial for mitigating risk in sovereign bond investments.

- Reducing risk: Spreading investments across different sovereign bonds and maturities reduces exposure to specific country or interest rate risks.

- Managing portfolio volatility: A diversified portfolio is less susceptible to sharp price swings resulting from unforeseen events.

Related keywords: portfolio diversification, risk management, asset allocation, bond diversification strategy.

Yield Curve Analysis

Yield curve analysis provides valuable insights into future interest rate movements.

- Interpreting yield curves: Understanding the shape of the yield curve can provide clues about future interest rate expectations.

- Identifying investment opportunities: Analyzing the yield curve helps investors identify potentially undervalued bonds and optimize their investment strategies.

Related keywords: yield curve, interest rate forecasting, bond yield spread, yield curve analysis.

Risk Management

Effective risk management is crucial for protecting capital and achieving long-term investment goals in the sovereign bond market.

- Understanding credit risk: Assessing the creditworthiness of individual sovereign issuers is paramount to avoid potential defaults.

- Interest rate risk: Managing the sensitivity of bond prices to changes in interest rates is vital.

- Inflation risk: Protecting against the erosive effects of inflation on bond returns is important for long-term investment success.

Related keywords: risk assessment, credit rating, inflation hedging, interest rate risk management, credit risk analysis.

Conclusion

Understanding Sovereign Bond Market Trends is vital for successful investment in this complex asset class. Factors such as global economic growth, central bank policies, and geopolitical risks significantly influence bond yields and prices. By utilizing the resources and tools provided by Swissquote Bank, including real-time data, in-depth research, and efficient trading platforms, investors can navigate this market effectively and make informed decisions. To gain a deeper understanding of sovereign bond market trends and enhance your investment strategies, explore the resources available at [Link to Swissquote Bank's relevant webpage].

Featured Posts

-

Fbi Investigation Primary Suspect In California Fertility Clinic Bombing Believed Dead

May 19, 2025

Fbi Investigation Primary Suspect In California Fertility Clinic Bombing Believed Dead

May 19, 2025 -

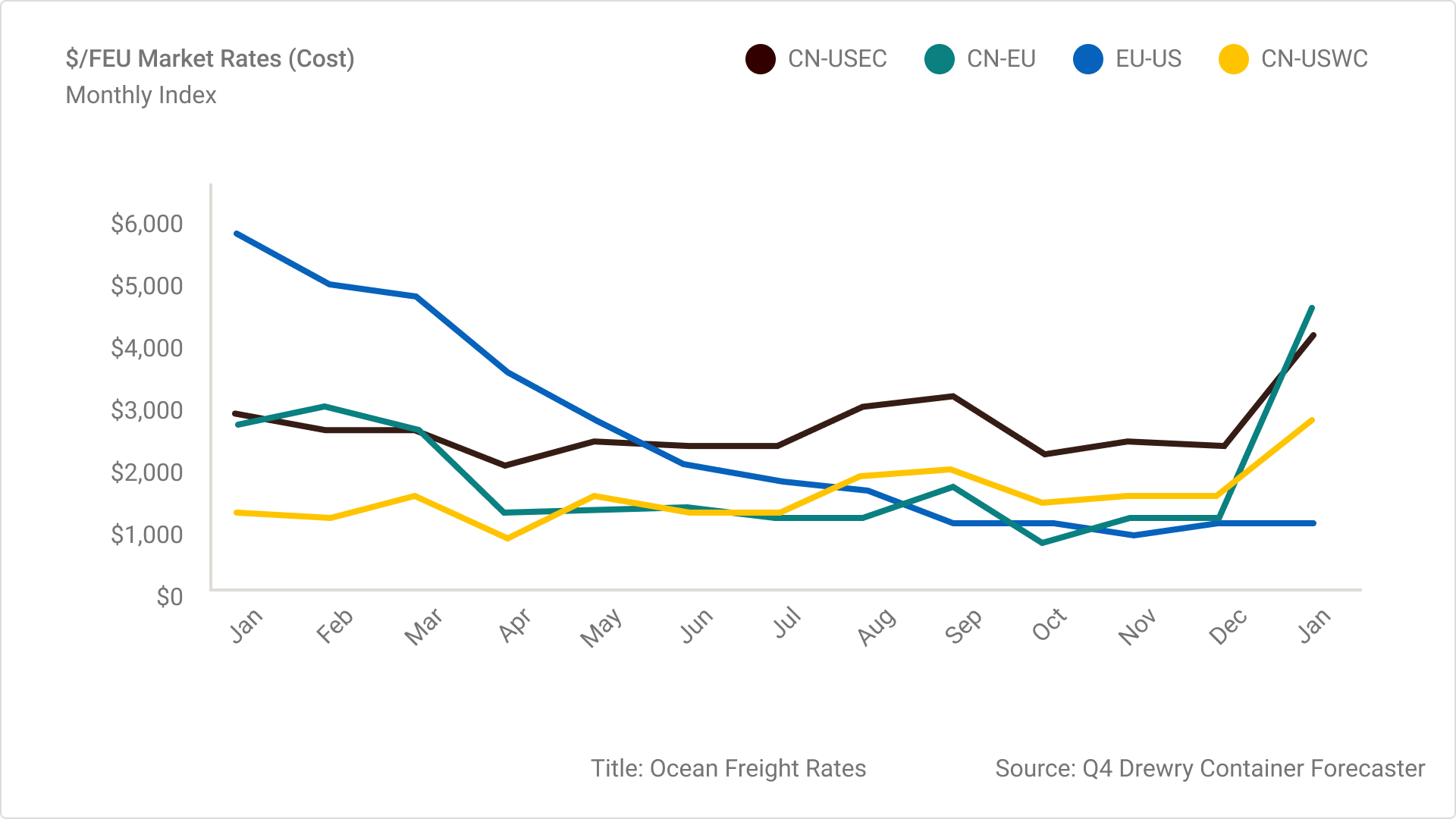

Payden And Rygel Analyzing China To Us Container Shipping Trends

May 19, 2025

Payden And Rygel Analyzing China To Us Container Shipping Trends

May 19, 2025 -

Proposed Deportation Of Migrants To Remote Island Fuels Tensions In France

May 19, 2025

Proposed Deportation Of Migrants To Remote Island Fuels Tensions In France

May 19, 2025 -

Canada Posts Future Recommendations For Daily Mail Delivery Changes

May 19, 2025

Canada Posts Future Recommendations For Daily Mail Delivery Changes

May 19, 2025 -

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiartoy Gia Kypriako Kai Proedria Ee

May 19, 2025

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiartoy Gia Kypriako Kai Proedria Ee

May 19, 2025