Understanding Stock Market Valuations: BofA's Perspective For Investors

Table of Contents

Key Valuation Metrics Used by BofA

Bank of America, a leading global financial institution, employs a range of sophisticated valuation methods to analyze investment opportunities. Understanding these metrics is key to interpreting their research and making your own informed decisions.

Price-to-Earnings Ratio (P/E):

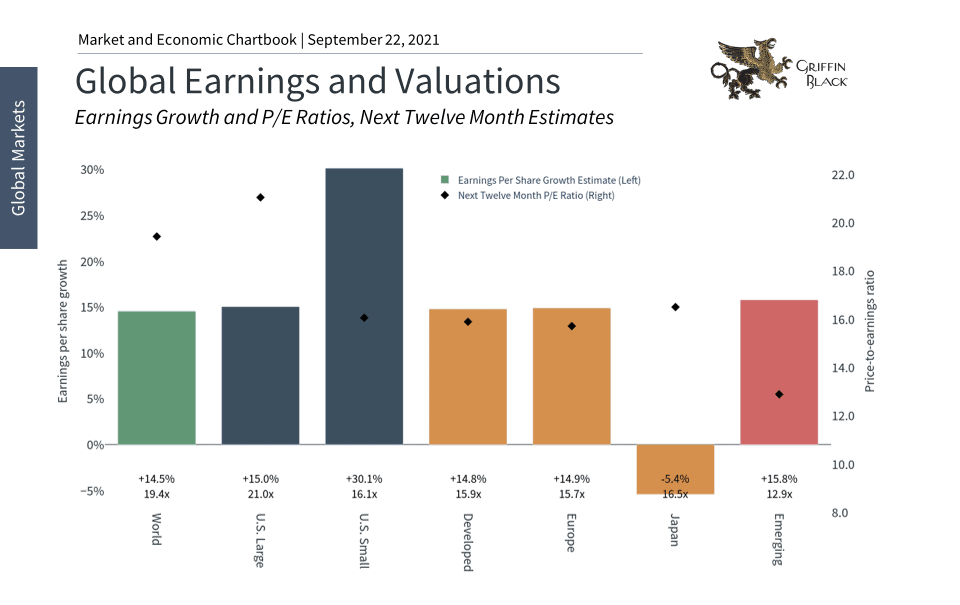

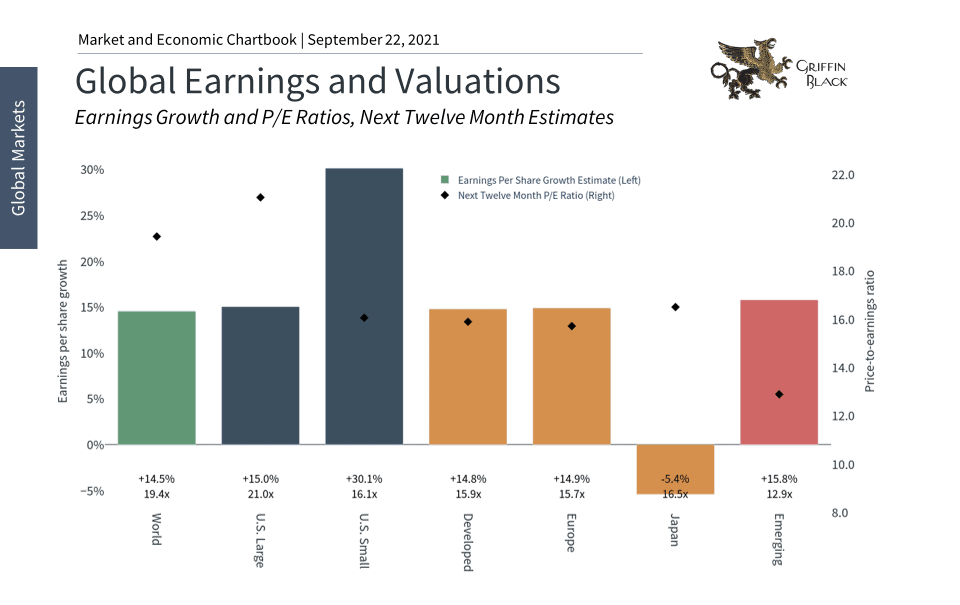

The Price-to-Earnings Ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). It essentially shows how much investors are willing to pay for each dollar of a company's earnings.

- Formula: P/E Ratio = Market Value per Share / Earnings per Share

- Interpretation: A high P/E ratio might suggest that a stock is overvalued, while a low P/E ratio could indicate undervaluation. However, this is highly dependent on the industry and growth prospects. Comparing a company's P/E to its industry average provides valuable context.

- Sector-Specific Comparisons: A high P/E ratio in a high-growth technology sector might be justified, whereas the same ratio in a mature, slow-growth industry could signal overvaluation.

- Limitations: The P/E ratio can be distorted by one-time events impacting earnings, making it crucial to analyze earnings trends over time. Companies with negative earnings will have an undefined P/E ratio, rendering this metric useless in such cases.

- BofA's Use: BofA might compare a company's P/E ratio to its industry average to determine if it's overvalued or undervalued, considering the company's growth trajectory and future earnings potential.

Price-to-Book Ratio (P/B):

The Price-to-Book Ratio (P/B) compares a company's market capitalization to its book value of equity. Book value represents the net asset value of a company as reported on its balance sheet.

- Formula: P/B Ratio = Market Capitalization / Book Value of Equity

- Interpretation: A high P/B ratio might suggest that a company's stock is overvalued relative to its assets, while a low P/B ratio could indicate undervaluation.

- Asset-Heavy Industries: The P/B ratio is particularly useful for valuing companies with significant tangible assets, such as real estate or manufacturing firms.

- Limitations: The P/B ratio doesn't reflect intangible assets, such as intellectual property or brand value, which can be substantial for certain companies. Accounting practices can also affect book value, influencing the accuracy of the P/B ratio.

- BofA's Use: BofA may use the P/B ratio to assess the value of companies with significant tangible assets, supplementing other valuation metrics for a more comprehensive analysis.

Discounted Cash Flow (DCF) Analysis:

Discounted Cash Flow (DCF) analysis is a more complex valuation method that estimates a company's intrinsic value based on its projected future cash flows. It discounts these future cash flows back to their present value using a discount rate that reflects the risk associated with the investment.

- Process: DCF analysis involves forecasting a company's future free cash flows, choosing an appropriate discount rate (often the Weighted Average Cost of Capital or WACC), and discounting those cash flows to their present value.

- Future Cash Flow Projections: Accurate forecasting of future cash flows is crucial, but inherently uncertain, making sensitivity analysis essential.

- Sensitivity Analysis: This involves testing the impact of different assumptions on the final valuation, providing a range of possible values rather than a single point estimate.

- Limitations: DCF analysis is highly sensitive to the assumptions made about future growth rates and discount rates. Small changes in these inputs can significantly affect the calculated intrinsic value.

- BofA's Use: BofA's analysts may use DCF models to project future value based on expected cash flows, considering various growth scenarios and incorporating their expertise in different sectors.

BofA's Sector-Specific Valuation Approaches

BofA tailors its valuation approaches to specific sectors, acknowledging the unique characteristics and challenges of each industry.

Technology Sector Valuations:

Valuing technology companies presents unique challenges due to their high growth potential, significant intangible assets, and often unpredictable earnings patterns.

- Revenue Growth: Rapid revenue growth is a crucial indicator for technology companies, often outweighing profitability in the short term.

- Subscription Models: Recurring revenue streams from subscription models significantly influence valuation.

- Intellectual Property: The value of patents, trademarks, and other intellectual property rights needs careful consideration.

- Future Potential: The potential for future innovation and market disruption plays a critical role in assessing the long-term value of tech companies.

- BofA's Approach: BofA might place more emphasis on future growth potential when valuing tech companies compared to mature industries, incorporating factors such as market share, technological advancements, and competitive landscape.

Financial Sector Valuations:

The financial sector presents specific challenges due to regulatory oversight, risk management, and the nature of its assets and liabilities.

- Regulatory Factors: Compliance with stringent regulations significantly impacts valuation.

- Risk Assessment: Thorough assessment of credit risk, market risk, and operational risk is crucial.

- Capital Adequacy: Maintaining sufficient capital ratios is vital for the financial health and stability of institutions.

- BofA's Approach: BofA's expertise in the financial sector likely influences its valuation methods, focusing on credit quality, regulatory compliance, and the overall risk profile of financial firms. Metrics like Return on Equity (ROE) and capital ratios play a significant role in their valuation process.

Interpreting BofA's Valuation Reports & Recommendations

BofA publishes comprehensive research reports offering insights into various companies and sectors. Understanding how to interpret these reports is critical for investors.

- Buy, Sell, Hold Recommendations: These recommendations represent the analyst's opinion on whether to buy, sell, or hold a particular stock.

- Analyst Rationale: It's vital to understand the reasoning behind the recommendations, considering the supporting evidence and assumptions.

- Comparing with Other Analysts: Don't rely solely on BofA's recommendations. Compare their views with those of other reputable analysts to gain a broader perspective.

- Due Diligence: Always conduct your own thorough research and consider your individual investment goals and risk tolerance before making any investment decisions.

- BofA's Reports as One Source: Use BofA's research as one piece of the puzzle in your investment decision-making process, supplementing it with your own in-depth analysis.

Conclusion

Successfully understanding stock market valuations is key to building a robust investment strategy. By understanding key valuation metrics like P/E, P/B, and DCF, and by utilizing insights from reputable sources like Bank of America's research, investors can make more informed decisions. Remember, while BofA's perspective offers valuable insight, always conduct thorough research and consider your own risk tolerance before investing. Start improving your understanding of stock market valuations today and build a stronger investment portfolio. Learn more about stock valuation techniques and refine your investment approach.

Featured Posts

-

Patrick Schwarzenegger Addresses White Lotus Role Amid Nepotism Claims

May 06, 2025

Patrick Schwarzenegger Addresses White Lotus Role Amid Nepotism Claims

May 06, 2025 -

Gigabyte Aorus Master 16 In Depth Review Of Performance And Cooling System

May 06, 2025

Gigabyte Aorus Master 16 In Depth Review Of Performance And Cooling System

May 06, 2025 -

Fotosessiya Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Fotosessiya Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Romania Election Update Runoff Between Far Right And Centrist Candidate

May 06, 2025

Romania Election Update Runoff Between Far Right And Centrist Candidate

May 06, 2025 -

Westpac Bank Wbc Financial Results Declining Profit Margins

May 06, 2025

Westpac Bank Wbc Financial Results Declining Profit Margins

May 06, 2025

Latest Posts

-

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025

Celtics Vs Magic Playoff Schedule Full Game Dates And Times

May 06, 2025 -

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025

Celtics Playoff Schedule Dates And Times For Magic Series Announced

May 06, 2025 -

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025

Find The Celtics Vs Suns Game Time Tv Channel And Streaming Options April 4th

May 06, 2025 -

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025 -

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025