Understanding The 2025 Market Downturn For D-Wave Quantum Inc. (QBTS)

Table of Contents

Factors Contributing to Potential 2025 Market Downturn for QBTS

Several factors could contribute to a potential market downturn for QBTS in 2025. A comprehensive understanding of these challenges is critical for any investor considering a position in QBTS stock.

Competition in the Quantum Computing Market

The quantum computing market is becoming increasingly competitive. Giants like IBM, Google, and IonQ are aggressively pursuing their own quantum computing technologies, creating a challenging environment for D-Wave. This competition impacts D-Wave's market share and revenue generation.

- IBM's advancements in superconducting qubit technology: IBM's consistent progress in scaling up the number of qubits and improving coherence times poses a significant threat to D-Wave's market position.

- Google's pursuit of quantum supremacy: Google's ambitious goal of achieving quantum supremacy could divert investor attention and resources away from D-Wave's quantum annealing approach.

- IonQ's progress in trapped-ion quantum computing: IonQ's unique approach to quantum computing offers a different path to quantum advantage, potentially attracting investors seeking alternative technologies.

- The emergence of new players: Smaller, innovative companies could also disrupt the market with novel approaches and technologies, further intensifying competition for QBTS.

These competitive pressures impact QBTS market share and directly influence revenue projections, making it crucial for investors to carefully assess the competitive landscape. Understanding the dynamics of quantum computing competition is vital for evaluating the QBTS market share and its vulnerability to competitors like those mentioned.

Technological Advancements and Challenges

D-Wave faces significant technological hurdles. Scaling its quantum annealing technology to achieve true quantum advantage remains a significant challenge. Breakthroughs in other quantum computing approaches could further render quantum annealing less competitive.

- Qubit coherence and scalability: Improving the coherence time and scalability of D-Wave's qubits is crucial for achieving wider adoption and practical applications. Setbacks in this area would negatively impact QBTS.

- Algorithm development and optimization: Developing efficient quantum algorithms tailored for D-Wave's architecture is crucial for demonstrating its practical value. Slow progress in this area could hinder QBTS growth.

- Error correction and mitigation: Addressing errors and noise in quantum computations is essential for reliable results. Insufficient progress in error correction could limit the applicability of D-Wave's technology.

These technological risks directly affect D-Wave's ability to deliver on its promises and achieve profitability, therefore impacting the future of QBTS technology and its investment appeal.

Macroeconomic Factors and Market Sentiment

Broader macroeconomic conditions significantly influence investment decisions. A recession or increased interest rates could reduce investment in riskier assets like QBTS stock. Negative investor sentiment toward the overall tech sector could also impact QBTS's stock price.

- Interest rate hikes: Rising interest rates make borrowing more expensive, potentially reducing investment in research and development for quantum computing companies like D-Wave.

- Economic recession: During an economic downturn, investors often move towards safer investments, potentially leading to a decline in QBTS stock price.

- Shifting investor focus: Investor interest might shift towards other, more mature technologies if the quantum computing industry fails to deliver on its promised advancements within a reasonable timeframe.

Careful consideration of macroeconomic factors is crucial for investors assessing QBTS stock price volatility and potential market volatility.

Regulatory Landscape and Governmental Policies

Government regulations and funding policies significantly impact the quantum computing industry. Changes in government support or new regulations could influence D-Wave's operations and growth trajectory.

- Government funding cuts: Reduced government funding for quantum computing research could hinder D-Wave's progress and financial stability.

- Export controls and national security concerns: Regulations concerning the export of quantum computing technology could restrict D-Wave's access to international markets.

- Data privacy and security regulations: The increasing focus on data privacy and security could impact how D-Wave's technology is implemented and used.

Understanding the quantum computing regulation and government funding landscape is vital for predicting the QBTS policy impact on the company’s future.

Mitigating Risks and Potential Opportunities for QBTS in 2025

While the challenges are significant, D-Wave can mitigate some risks and capitalize on opportunities.

Strategic Partnerships and Collaborations

Strategic alliances are essential for D-Wave's success. Collaborations can provide access to new markets, technologies, and resources.

- Partnerships with industry leaders: Collaborating with major companies in diverse sectors could demonstrate the practical applications of D-Wave's technology and drive adoption.

- Joint research initiatives: Collaborating with universities and research institutions could accelerate technological advancements and provide access to cutting-edge expertise.

Strategic partnerships and QBTS collaborations are key to risk mitigation and market expansion.

Product Development and Innovation

Continuous innovation is critical for QBTS's long-term success. New product launches and advancements can improve market penetration and competitiveness.

- Development of new applications: Focusing on practical applications across various industries, such as drug discovery or materials science, could attract more customers and investors.

- Improvements in qubit performance: Continuous improvements in qubit coherence and scalability would enhance the overall performance of D-Wave’s systems.

Product innovation and the launch of QBTS new products are pivotal for improving market penetration and enhancing competitiveness.

Conclusion: Preparing for the Future of D-Wave Quantum Inc. (QBTS)

Several factors could contribute to a 2025 market downturn for QBTS, including intense competition, technological challenges, macroeconomic conditions, and the regulatory landscape. However, strategic partnerships and continuous product innovation can mitigate these risks. Understanding these factors is crucial for investors considering QBTS. To make informed investment decisions, stay informed about QBTS, understand the QBTS market outlook, and evaluate the risks and rewards of investing in QBTS. Conduct thorough research before making any investment decisions in this exciting but volatile sector.

Featured Posts

-

Social Media Age Limits Texas House Takes Action

May 20, 2025

Social Media Age Limits Texas House Takes Action

May 20, 2025 -

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025 -

Synedria Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

Synedria Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Pro D2 Le Maintien En Jeu Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025

Pro D2 Le Maintien En Jeu Decryptage De La Situation De Valence Romans Et Su Agen

May 20, 2025 -

Jose Mourinho Nun Tadic Ve Dzeko Ya Yoenelik Degerlendirmesi

May 20, 2025

Jose Mourinho Nun Tadic Ve Dzeko Ya Yoenelik Degerlendirmesi

May 20, 2025

Latest Posts

-

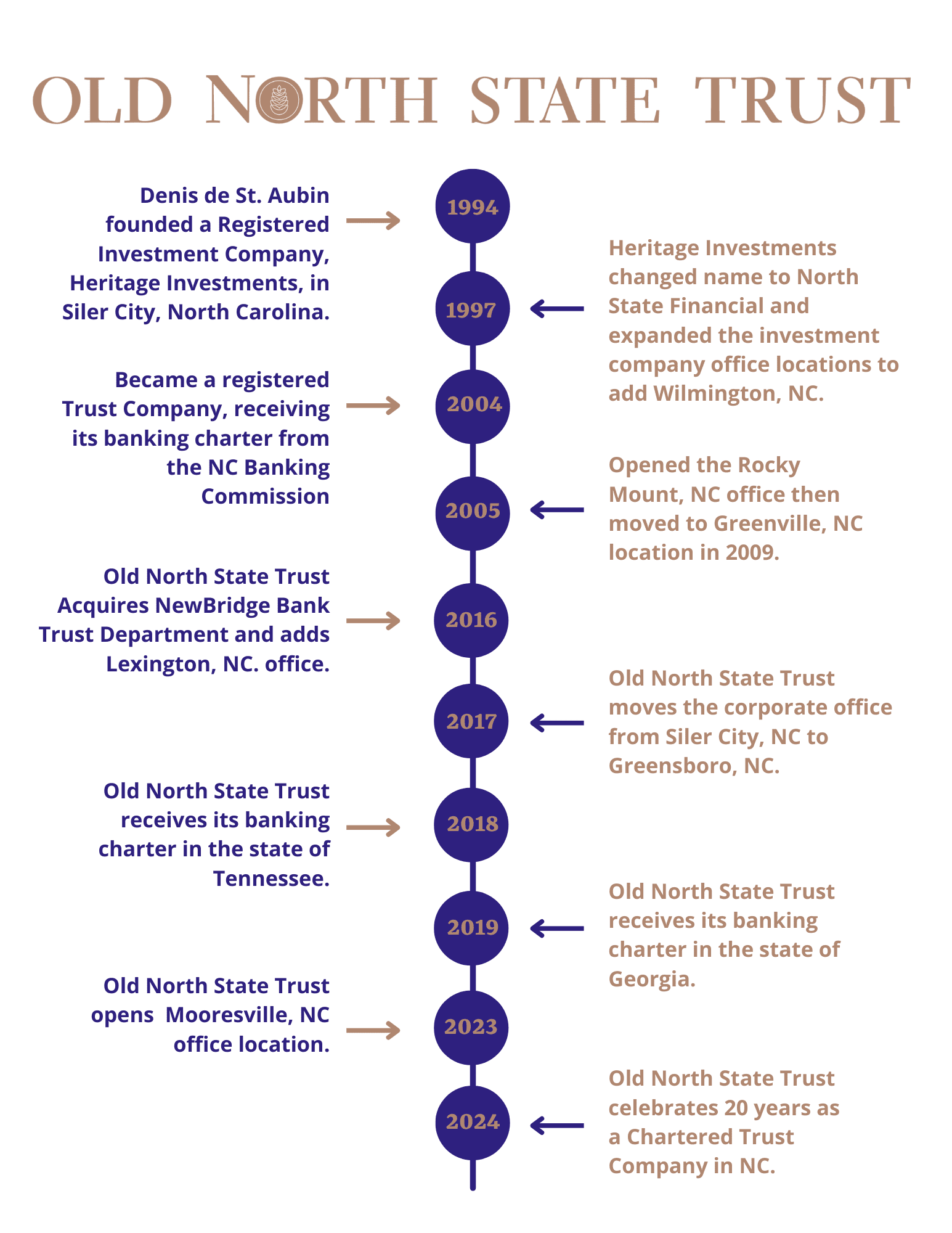

The Old North State Report A Look Back At May 9 2025

May 20, 2025

The Old North State Report A Look Back At May 9 2025

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Old North State Report A Summary Of May 9 2025 Events

May 20, 2025

Old North State Report A Summary Of May 9 2025 Events

May 20, 2025 -

Mnaqsht Tqryry Dywan Almhasbt Alnwab Ytkhdhwn Mwqfa Bshan Almkhalfat 2022 W 2023

May 20, 2025

Mnaqsht Tqryry Dywan Almhasbt Alnwab Ytkhdhwn Mwqfa Bshan Almkhalfat 2022 W 2023

May 20, 2025 -

Comprehensive Old North State Report For May 9 2025

May 20, 2025

Comprehensive Old North State Report For May 9 2025

May 20, 2025