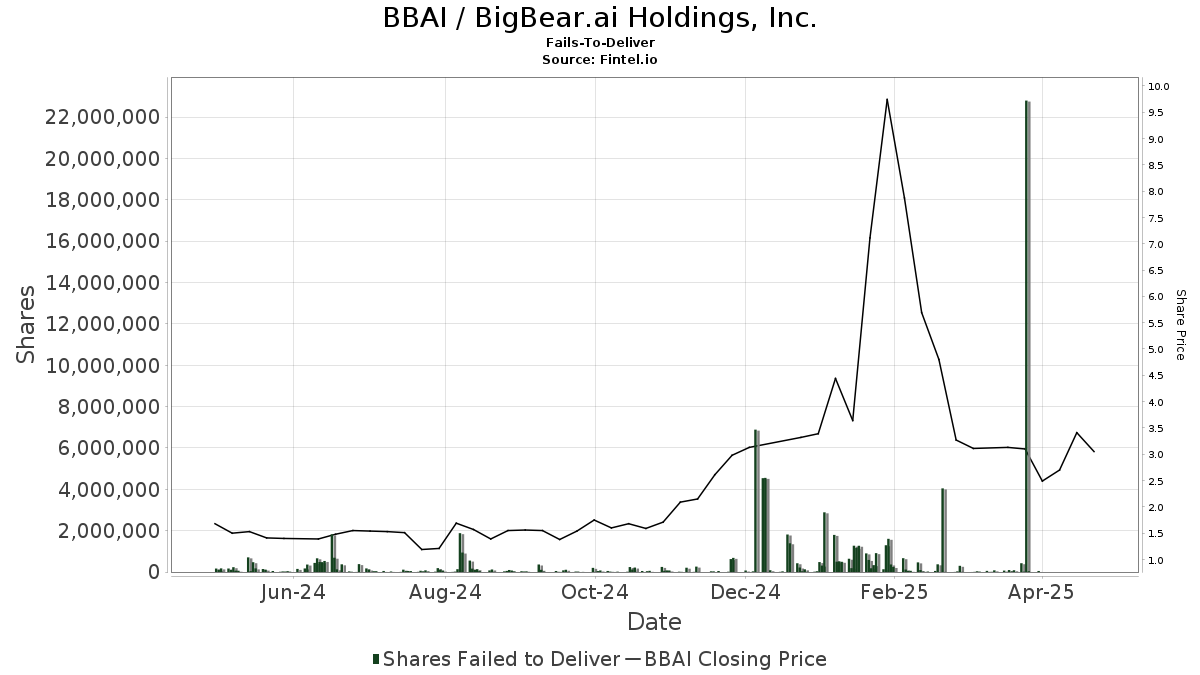

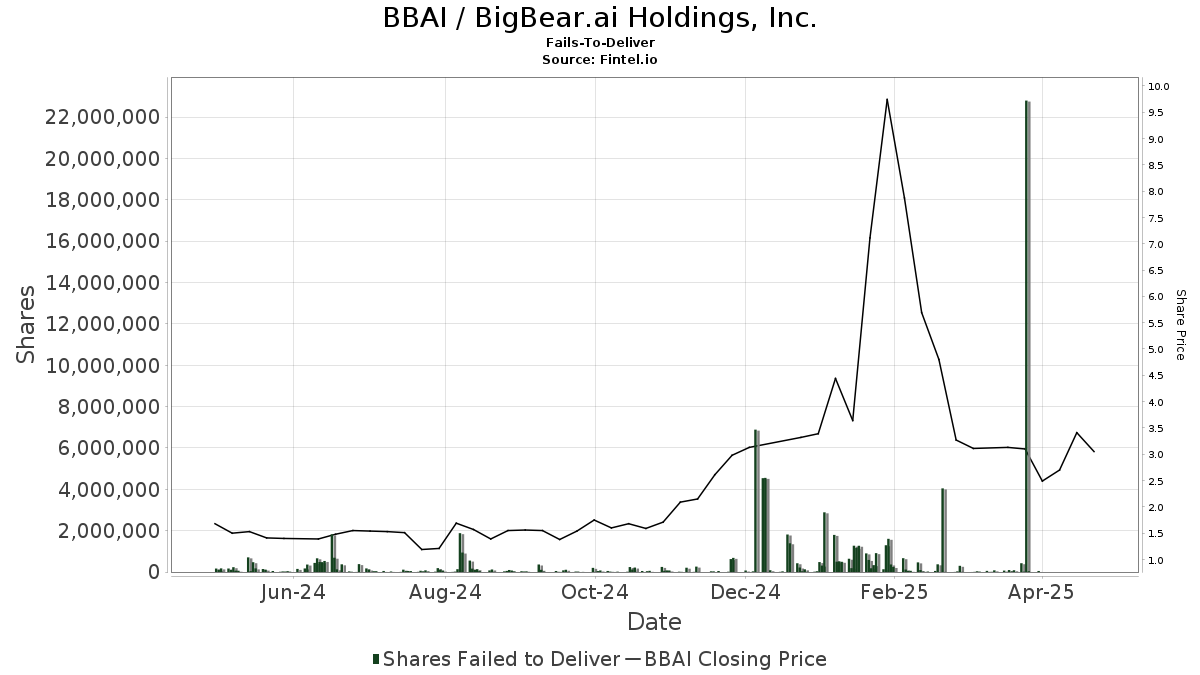

Understanding The BigBear.ai (BBAI) Stock Drop In 2025

Table of Contents

Macroeconomic Factors Contributing to the BBAI Stock Drop

The BBAI stock drop in 2025 wasn't solely a company-specific issue; broader macroeconomic headwinds played a significant role. Understanding these external pressures is crucial for a complete picture.

Impact of Interest Rate Hikes

Rising interest rates implemented by central banks globally to combat inflation had a chilling effect on the stock market, particularly impacting high-growth tech stocks like BBAI.

- Reduced investor appetite for risk: Higher interest rates make bonds more attractive, diverting capital away from riskier assets like tech stocks. Investors shifted to safer, higher-yielding investments.

- Increased borrowing costs: BBAI, like many tech companies, relies on borrowing to fund growth and innovation. Higher interest rates increased these borrowing costs, squeezing profitability.

- Impact on future earnings projections: Increased costs and reduced investor confidence led to downward revisions of future earnings projections, further depressing the BBAI stock price. Keywords: Interest rate hikes, inflation, monetary policy, risk aversion, tech stock valuations.

General Market Volatility and Recession Fears

Widespread market uncertainty and growing fears of a recession created a risk-off environment, negatively impacting even fundamentally sound companies.

- Investor sentiment: Negative news and economic forecasts fueled a wave of pessimism, leading to a sell-off across various sectors. The BBAI stock price was not immune to this broader market trend.

- Flight to safety: Investors moved their money into safe-haven assets like government bonds and gold, further reducing demand for riskier investments.

- Market corrections: The overall market experienced significant corrections, pulling down even relatively stable stocks like BBAI. Correlation with broader market indices (e.g., S&P 500, Nasdaq) was undeniable. Keywords: Market volatility, recession, investor sentiment, market correction, risk-off sentiment.

Company-Specific Factors Affecting BBAI Stock Price

Beyond macroeconomic factors, several company-specific issues contributed to the BBAI stock price decline in 2025.

Missed Earnings Expectations

BigBear.ai's failure to meet projected earnings expectations significantly eroded investor confidence.

- Specific examples of missed targets: (Insert specific hypothetical examples here, referencing potential revenue shortfalls or unexpected expenses).

- Explanations for underperformance: (Provide plausible explanations, such as delays in contract awards, increased competition, or unforeseen operational challenges).

- Impact on investor confidence: Missed targets signaled a potential lack of effective execution and future uncertainty, leading to a sell-off by investors. Keywords: Earnings report, revenue shortfall, financial performance, guidance, investor confidence.

Competitive Landscape and Market Share

The intensely competitive AI solutions market presented significant challenges for BigBear.ai.

- Key competitors: (List major competitors and their strategies).

- Market share trends: (Discuss potential loss of market share to competitors offering more innovative solutions or better pricing).

- Innovative developments from competitors: The rapid pace of innovation in the AI sector meant that BBAI needed to constantly innovate to maintain its competitive edge; failure to do so resulted in a shrinking market share. Keywords: Competition, market share, competitive advantage, AI solutions market, disruptive technologies.

Contractual Challenges and Government Spending

BigBear.ai's reliance on government contracts made it vulnerable to changes in government spending and contracting procedures.

- Impact of government budget cuts: Potential cuts in defense or technology budgets could have directly impacted BBAI's revenue streams.

- Delays in contract awards: Unforeseen delays in securing new contracts could have created revenue shortfalls and negatively impacted investor perception.

- Competitive bidding processes: Increased competition for government contracts could have resulted in lower profit margins and reduced revenue. Keywords: Government contracts, government spending, budget cuts, defense spending, contract delays.

Conclusion: Navigating the Future of BigBear.ai (BBAI) Stock

The BBAI stock drop in 2025 stemmed from a confluence of macroeconomic headwinds and company-specific challenges. Rising interest rates, broader market volatility, missed earnings, intense competition, and potential government contracting issues all contributed to the decline.

While the situation presents risks, opportunities may also exist for long-term investors. Thorough due diligence is crucial. Analyze future earnings projections, monitor the competitive landscape, and assess the impact of any changes in government policy on BBAI’s future contracts. Understanding these factors is key to making an informed decision.

Understand the complexities of the BBAI stock before making any investment decisions. Learn more about the factors influencing the BBAI stock drop and conduct your own comprehensive research to determine whether BBAI aligns with your risk tolerance and investment strategy. Informed investment decisions concerning BigBear.ai (BBAI) stock are paramount in navigating the volatile nature of the AI sector.

Featured Posts

-

Katalogos Efimereyonton Giatron Patras 12 And 13 Aprilioy

May 20, 2025

Katalogos Efimereyonton Giatron Patras 12 And 13 Aprilioy

May 20, 2025 -

Mirra Andreeva Biografiya Pobedy I Luchshie Machi

May 20, 2025

Mirra Andreeva Biografiya Pobedy I Luchshie Machi

May 20, 2025 -

Ecowas Economic Priorities Defined At Niger Strategic Retreat

May 20, 2025

Ecowas Economic Priorities Defined At Niger Strategic Retreat

May 20, 2025 -

Chinas Fury Examining The Us Missile Launcher Deployment

May 20, 2025

Chinas Fury Examining The Us Missile Launcher Deployment

May 20, 2025 -

Leeds Back On Top Tottenham Loanees Impact

May 20, 2025

Leeds Back On Top Tottenham Loanees Impact

May 20, 2025

Latest Posts

-

Home Office Alebo Kancelaria Produktivita A Spokojnost Zamestnancov

May 20, 2025

Home Office Alebo Kancelaria Produktivita A Spokojnost Zamestnancov

May 20, 2025 -

Synedria Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

Synedria Gia Ti Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

79 Manazerov Preferuje Osobny Kontakt Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Preferuje Osobny Kontakt Home Office Vs Kancelaria

May 20, 2025 -

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025

Esperida Megalis Tessarakostis Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 20, 2025

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 20, 2025