Understanding The D-Wave Quantum (QBTS) Stock Dip On Monday

Table of Contents

Market Sentiment and the Overall Tech Sector

Monday's decline in the QBTS stock price wasn't isolated; it mirrored a broader downturn in the technology sector. The overall market sentiment played a significant role, impacting many tech stocks, including those in the promising but still developing quantum computing space. This general negative "Monday's market" mood likely contributed to the QBTS stock dip.

- Nasdaq Performance: The Nasdaq Composite, a key indicator of the tech sector's health, also experienced a decline on Monday, indicating a broader market trend influencing QBTS.

- Tech Sector Downturn: Data from major financial news outlets showed a significant drop across various tech sub-sectors, suggesting a widespread investor apprehension. For instance, [link to relevant financial news source] reported a [percentage]% decrease in the tech sector.

- Investor Sentiment: Many analysts noted a cautious investor sentiment towards growth stocks, particularly in sectors like quantum computing, where profitability remains largely prospective. This risk aversion contributed to selling pressure across the board, impacting the QBTS stock price.

Analyzing D-Wave Quantum's Recent News and Announcements

While the broader market certainly influenced the QBTS stock dip, it's crucial to examine any company-specific news that might have exacerbated the decline. Analyzing D-Wave's recent announcements helps paint a complete picture.

- Absence of Positive News: The absence of significant positive news or announcements around earnings or technological breakthroughs might have contributed to the dip. Investors often react negatively to periods of quiet, particularly in a speculative sector like quantum computing.

- No Major Press Releases: A review of D-Wave's official website and SEC filings revealed no major press releases or announcements immediately preceding Monday's dip that would directly explain the price drop. [Link to D-Wave's website/SEC filings].

- Investor Reaction: The lack of positive news, coupled with the negative market sentiment, created a perfect storm leading to sell-offs in QBTS stock.

Competitive Landscape and Industry Trends

The competitive landscape within the quantum computing industry is dynamic and influences investor sentiment. Advances or setbacks by competitors can directly or indirectly affect the perception of D-Wave and, subsequently, its stock price.

- Competitor Activity: While no single competitor made a major announcement directly impacting D-Wave on Monday, the overall progress of companies like IBM, Google, and IonQ continues to shape the investor narrative. News about their advancements might influence the perceived value of D-Wave's technology.

- Industry Optimism: Investor enthusiasm for the quantum computing sector can fluctuate based on technological breakthroughs and the timeline for commercial applications. Any perceived slowdown in industry progress could lead to a reduction in investment in all quantum computing stocks, including QBTS.

- Impact on QBTS: The competitive dynamics and overall industry sentiment play a crucial role in shaping investor confidence in QBTS and influence its stock valuation.

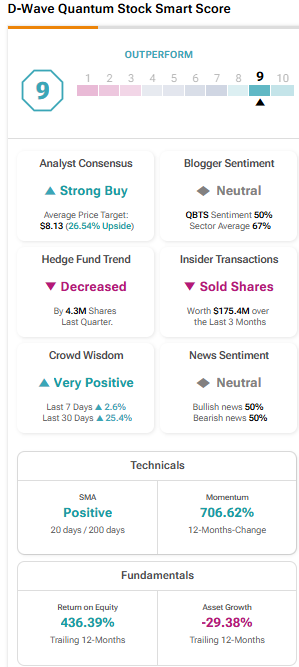

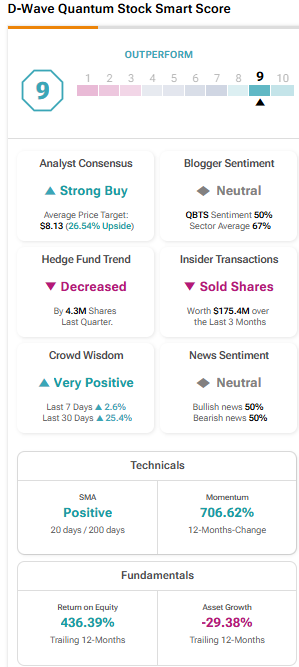

Technical Analysis of QBTS Stock Chart

A brief look at the QBTS stock chart on Monday might reveal technical reasons for the dip. (Note: Technical analysis is not a foolproof predictor, and this section offers a simplified overview).

- Support Levels: Potential breaches of key support levels on the chart might have triggered automatic sell orders, exacerbating the price decline.

- Trading Volume: Increased trading volume on Monday, coupled with the price drop, might suggest a significant number of investors selling their QBTS shares.

- Candlestick Patterns: Certain candlestick patterns could indicate bearish sentiment among traders, further contributing to the price decline. (Note: This requires expertise to interpret accurately)

Conclusion: Understanding and Navigating Future QBTS Stock Fluctuations

Monday's D-Wave Quantum (QBTS) stock dip was likely a result of a confluence of factors: a broader tech sector downturn, the absence of positive company news, the competitive dynamics within the quantum computing industry, and potential technical indicators. Understanding both macro (market sentiment, industry trends) and micro (company-specific news) factors is vital for interpreting stock movements. Further research and monitoring of QBTS and the wider quantum computing sector are crucial for informed investment decisions.

Stay informed on future D-Wave Quantum (QBTS) stock movements by regularly reviewing financial news and company updates. Understanding the factors influencing QBTS stock performance is key to making informed investment decisions. Remember to conduct thorough research before making any investment choices related to QBTS or any other quantum computing stock.

Featured Posts

-

Behind The Scenes Why Tony Hinchcliffes Wwe Report Fell Flat

May 20, 2025

Behind The Scenes Why Tony Hinchcliffes Wwe Report Fell Flat

May 20, 2025 -

Cocaine Found At White House Secret Service Wraps Up Investigation

May 20, 2025

Cocaine Found At White House Secret Service Wraps Up Investigation

May 20, 2025 -

Plongez Dans L Integrale D Agatha Christie Vie Et Uvre

May 20, 2025

Plongez Dans L Integrale D Agatha Christie Vie Et Uvre

May 20, 2025 -

Jalkapallo Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Jalkapallo Friis Paljastaa Avauskokoonpanon Kamara Ja Pukki Vaihtopenkillae

May 20, 2025 -

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Latest Posts

-

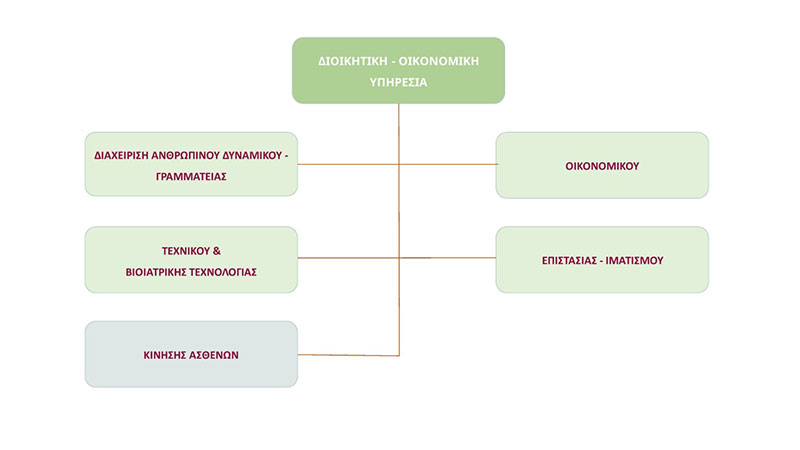

Poy Tha Vreite Efimereyontes Giatroys Stin Patra 10 And 11 Maioy

May 20, 2025

Poy Tha Vreite Efimereyontes Giatroys Stin Patra 10 And 11 Maioy

May 20, 2025 -

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025

Breite Efimereyonta Giatro Stin Patra 10 And 11 Maioy

May 20, 2025 -

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025 -

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025

I Tragodia Giakoymaki Mathimata Gia Tin Prostasia Tis Aksias Toy Atomoy

May 20, 2025 -

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025

Baggelis Giakoymakis Kai I Simasia Toy Sevasmoy Stin Anthropini Aksioprepeia

May 20, 2025