Understanding The Factors Behind D-Wave Quantum (QBTS) Stock's Thursday Drop

Table of Contents

Market Sentiment and Investor Reactions

The overall market sentiment on Thursday played a role in the D-Wave Quantum (QBTS) stock drop. While specific market-wide downturns may not have been the sole cause, a general negative sentiment across technology stocks could have exacerbated the decline in QBTS. News and announcements concerning the broader quantum computing sector also influenced investor confidence. Negative press coverage or analyst reports questioning the near-term viability of certain quantum computing technologies could have created a ripple effect, impacting D-Wave Quantum (QBTS) stock specifically.

Social media sentiment analysis revealed a mixed reaction, with some expressing concerns about D-Wave's progress relative to competitors. This online chatter, combined with traditional media coverage, likely contributed to the overall negative investor perception.

- Specific examples of negative news: Potentially, a competitor announcing a major breakthrough or a negative research report questioning D-Wave's technology could have impacted the stock price.

- Competitor actions: Aggressive marketing campaigns by competitors or the release of new, potentially superior quantum computing hardware could have negatively impacted investor confidence in D-Wave Quantum (QBTS).

- Overall market trends: A general downturn in the technology sector, particularly in companies perceived as high-risk or speculative, would have likely negatively affected D-Wave Quantum (QBTS) stock.

Company-Specific Factors Affecting D-Wave Quantum (QBTS) Stock

Several company-specific factors might have contributed to the D-Wave Quantum (QBTS) stock price decline. Any recent announcements or press releases, particularly those related to financial performance or strategic shifts, could be scrutinized by investors. For instance, a disappointing earnings report or a lower-than-expected revenue forecast could trigger selling pressure.

Concerns about D-Wave's financial health, including debt levels or operating expenses, could also have contributed to the drop. Similarly, any management changes or internal restructuring, particularly those signaling uncertainty or lack of direction, might have negatively impacted investor confidence.

- Specific financial data: Analyzing the company's recent financial reports, including revenue figures and earnings per share, is essential to understand the financial health of D-Wave and its impact on investor confidence.

- New partnerships or collaborations: A failure to secure a major partnership or a breakdown of an existing collaboration could have sent negative signals to the market. Conversely, the announcement of a new partnership, even if seemingly positive, may not immediately impact the stock price positively due to the existing negative sentiment.

- Progress in quantum computing technology: Investors closely monitor D-Wave's progress in developing its quantum computing technology. A perceived lack of progress relative to competitors could lead to a sell-off.

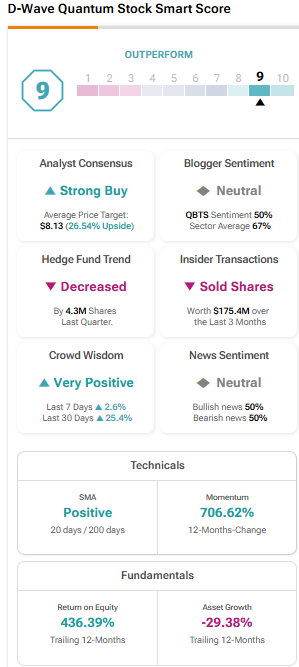

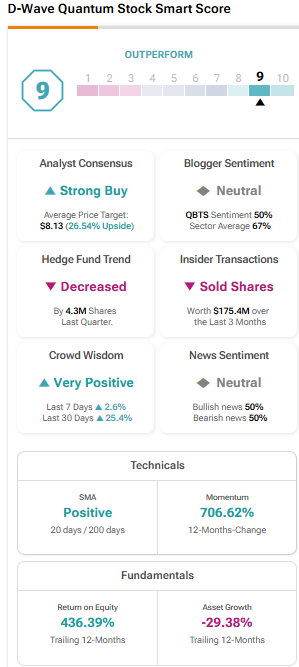

Technical Analysis of D-Wave Quantum (QBTS) Stock

Analyzing the technical aspects of the D-Wave Quantum (QBTS) stock chart reveals potential triggers for the Thursday drop. A breach of key support levels, indicating a weakening trend, coupled with negative candlestick patterns, could have signaled to traders that a significant downturn was imminent. High trading volume on Thursday suggests a substantial sell-off, further emphasizing the magnitude of the decline.

The options market also offers insights. High put option volume (options that profit from a price decline) could indicate a significant amount of short-selling or hedging activity, contributing to the downward pressure on the D-Wave Quantum (QBTS) stock price.

- Specific technical indicators: Key indicators such as Relative Strength Index (RSI), Moving Averages, and support/resistance levels can be analyzed to understand the technical reasons behind the stock price movement.

- Trading volume: Analyzing the volume traded on Thursday in relation to average daily volume can provide valuable insights into the intensity of the sell-off. Unusually high volume confirms strong selling pressure.

- Short-selling activity: A high level of short-selling indicates a bearish sentiment among traders, which can amplify downward pressure on the stock price.

The Broader Quantum Computing Market Context

The performance of other quantum computing stocks on Thursday provides context for the D-Wave Quantum (QBTS) stock decline. If other companies in the sector experienced similar drops, it suggests a broader market-driven factor affecting investor sentiment towards the entire quantum computing industry. Conversely, if D-Wave's decline was isolated, it points toward company-specific issues as the primary driver.

The overall investor sentiment towards quantum computing is dynamic and influenced by various factors, including technological breakthroughs, funding announcements, and regulatory developments. Any negative news or uncertainty within the industry can affect investor confidence in all quantum computing stocks.

- Comparison with other quantum computing companies: Comparing the performance of D-Wave Quantum (QBTS) with competitors helps determine if the drop was industry-wide or specific to the company.

- Growth and investment outlook: The overall outlook for the quantum computing sector and the level of investment it attracts directly impacts the stock prices of companies within the industry.

- Regulatory changes: New regulations or government policies that impact the quantum computing industry can influence investor sentiment and stock prices.

Conclusion

The D-Wave Quantum (QBTS) stock drop on Thursday resulted from a complex interplay of market sentiment, company-specific concerns, and technical factors. While broader market conditions and negative sentiment towards the quantum computing sector played a role, company-specific issues, such as potential concerns over financial performance or technological progress, likely exacerbated the decline. Technical indicators, including high trading volume and potential short-selling activity, further contributed to the price movement.

Investors interested in D-Wave Quantum (QBTS) stock must carefully monitor these factors to make informed investment decisions. The future performance of D-Wave will depend on its ability to address investor concerns and demonstrate continued progress in its quantum computing technology. Keep a close watch on financial reports, technological advancements, and market sentiment surrounding D-Wave Quantum (QBTS) stock for a comprehensive understanding of its performance. Continue to research D-Wave Quantum (QBTS) stock and stay informed about the evolving quantum computing landscape to navigate this dynamic market effectively.

Featured Posts

-

Former Liverpool Managers Impact Hout Bay Fcs Improved Performance

May 21, 2025

Former Liverpool Managers Impact Hout Bay Fcs Improved Performance

May 21, 2025 -

Trans Australia Run A Record Breaking Attempt In The Making

May 21, 2025

Trans Australia Run A Record Breaking Attempt In The Making

May 21, 2025 -

O Thanatos Toy Baggeli Giakoymaki To Bullying Os Aitia

May 21, 2025

O Thanatos Toy Baggeli Giakoymaki To Bullying Os Aitia

May 21, 2025 -

Abn Amro Hogere Huizenprijzen Ondanks Economische Tegenwind

May 21, 2025

Abn Amro Hogere Huizenprijzen Ondanks Economische Tegenwind

May 21, 2025 -

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025

Efimeries Giatron Stin Patra Savvatokyriako 12 13 Aprilioy

May 21, 2025

Latest Posts

-

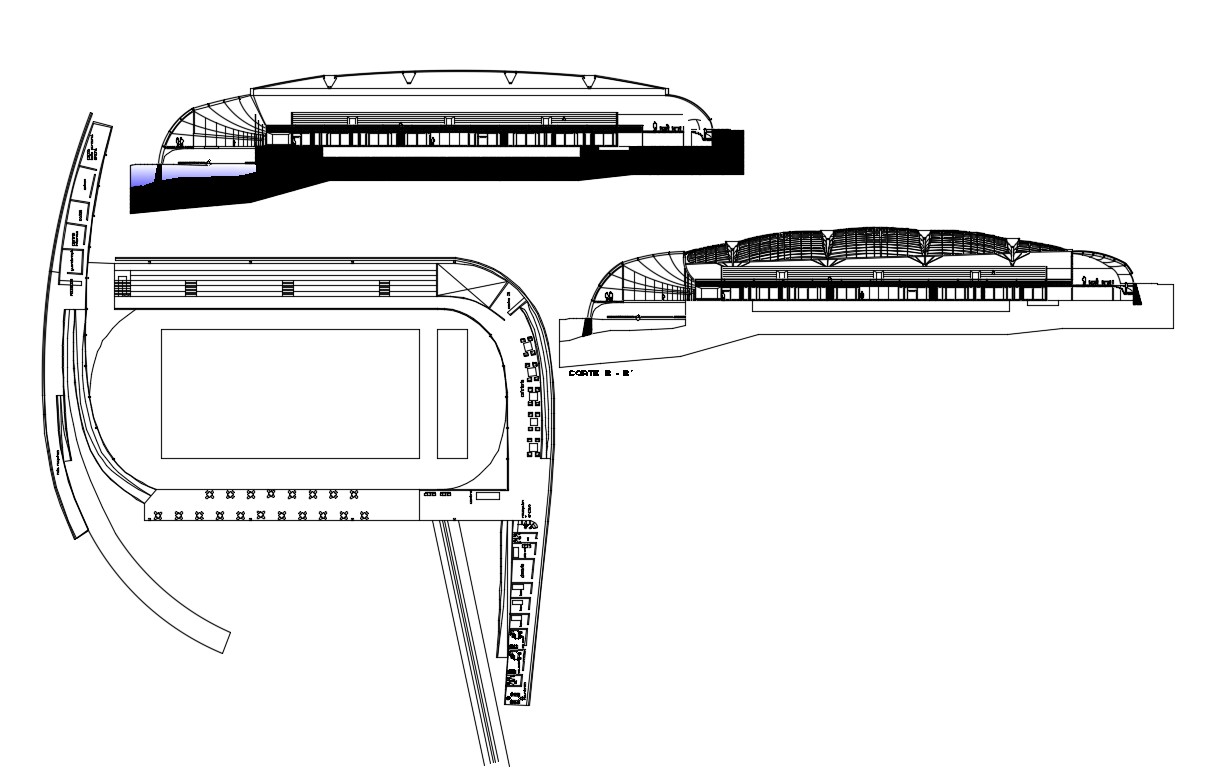

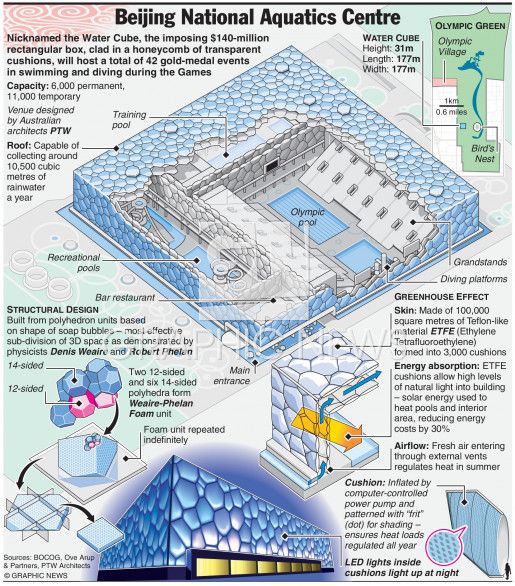

Ambitious Swimming Pool Project Set To Transform Nices Sporting Landscape

May 22, 2025

Ambitious Swimming Pool Project Set To Transform Nices Sporting Landscape

May 22, 2025 -

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025

Nices Aquatic Future An Olympic Standard Swimming Pool Project

May 22, 2025 -

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025

Nice Unveils Plans For New Olympic Sized Swimming Pool Complex

May 22, 2025 -

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 22, 2025

Nices Ambitious Olympic Swimming Pool Plan A New Aquatic Centre

May 22, 2025 -

Macrons Push For A European First Trade Strategy

May 22, 2025

Macrons Push For A European First Trade Strategy

May 22, 2025