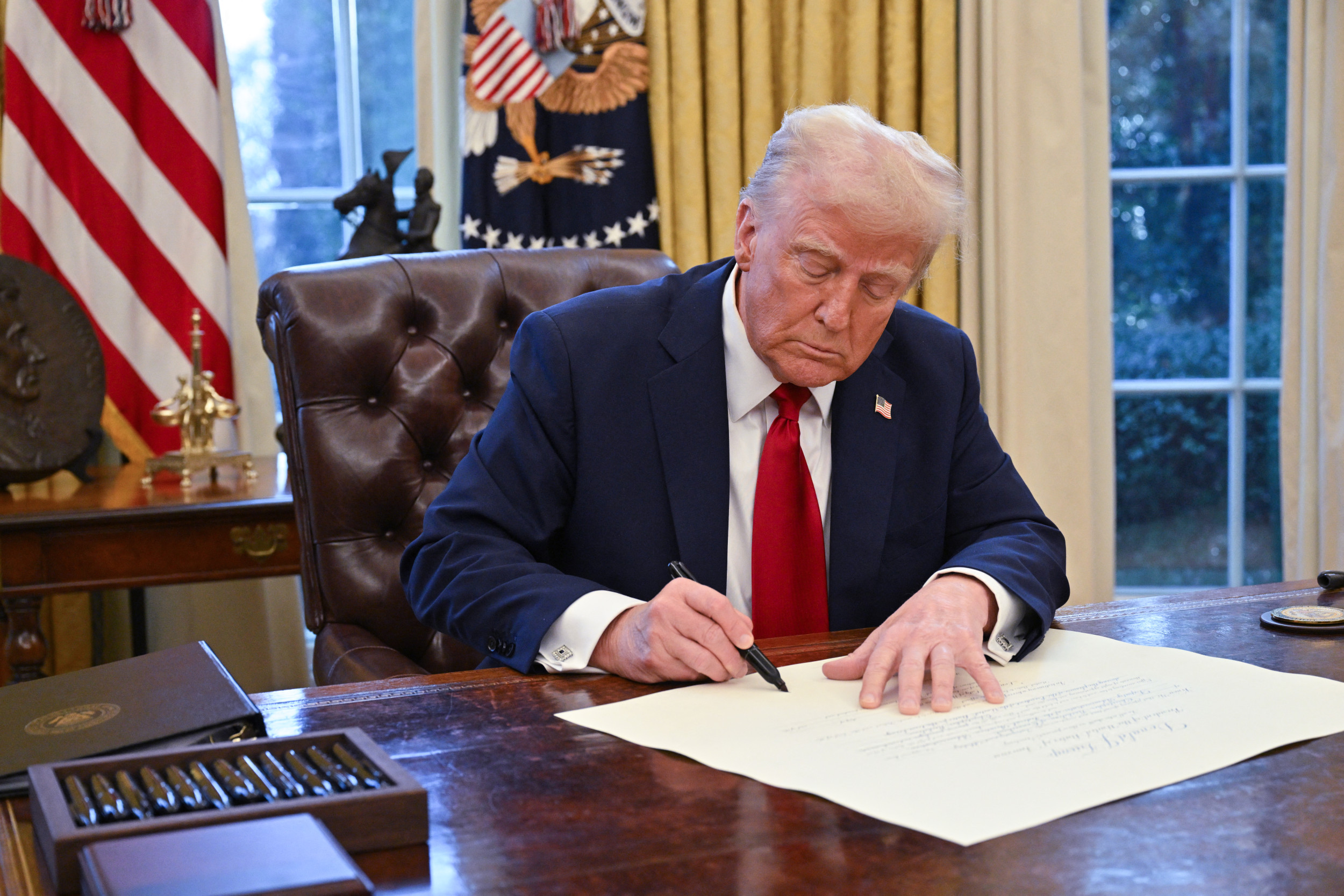

Understanding The GOP Mega Bill: Key Details And Political Fallout

Table of Contents

Key Provisions of the GOP Mega Bill

The GOP Mega Bill encompasses a wide range of policy changes, impacting various sectors of the American economy and society. Understanding its intricacies is crucial for comprehending its potential consequences.

Tax Cuts and their Impact

A central component of the GOP Mega Bill is a significant overhaul of the tax code. This "tax reform" aims to stimulate economic growth through substantial tax cuts for corporations and high-income earners.

- Corporate Tax Rate Reduction: The bill proposes lowering the corporate tax rate from its current level to a significantly reduced percentage, potentially boosting corporate profits and investment. However, critics argue this could exacerbate income inequality.

- Individual Income Tax Cuts: The bill includes reductions in individual income tax rates, particularly benefiting higher-income brackets. While proponents claim this will encourage spending and job creation, opponents express concern about its impact on the national debt and the fairness of the tax system.

- Standard Deduction Increase: An increase in the standard deduction is designed to simplify the tax code and provide tax relief to middle-class families. The actual benefit, however, remains a point of contention amongst economists.

The projected impact of these tax cuts remains a subject of intense debate. Proponents argue they will stimulate economic growth through increased investment and consumer spending, leading to job creation and higher wages. Conversely, critics warn of increased national debt, widening income inequality, and minimal impact on overall economic growth. This complex interplay of fiscal policy will undoubtedly shape the nation's economic landscape in the coming years.

Spending on Infrastructure and Defense

The GOP Mega Bill also allocates considerable funds towards infrastructure investment and national defense. This spending is justified as essential for long-term economic growth and national security.

- Infrastructure Projects: The bill earmarks billions of dollars for repairing and upgrading America's aging infrastructure, including roads, bridges, and public transportation systems. These investments aim to improve efficiency, create jobs, and boost economic productivity.

- Military Spending Increase: A significant portion of the budget is allocated to bolstering national defense, including purchasing new military equipment and increasing personnel. Supporters argue this is crucial for maintaining national security in a complex geopolitical environment.

The economic benefits of this spending are anticipated to be substantial. Infrastructure improvements will create jobs and enhance productivity, while increased defense spending will stimulate related industries and create employment opportunities. However, critics raise concerns about the potential for wasteful spending and the opportunity cost of diverting funds from other essential programs.

Social Programs and Regulations

The GOP Mega Bill proposes changes to several social programs and environmental regulations. These changes are expected to be highly contentious and will undoubtedly shape the political discourse surrounding the bill.

- Changes to the Social Safety Net: Some provisions aim to reform existing social safety net programs, potentially impacting access to healthcare, education, and other social services. Opponents argue that these changes will disproportionately harm vulnerable populations.

- Environmental Regulation Rollbacks: The bill includes measures that would weaken or repeal certain environmental regulations. Supporters claim this will reduce the regulatory burden on businesses, stimulating economic activity. However, environmental advocates warn of the potential negative consequences for the environment and public health.

Political Fallout and Public Opinion

The GOP Mega Bill has already sparked significant political controversy and divided public opinion. The long-term consequences of this legislation remain to be seen.

Reactions from Democrats and other political parties

The Democratic Party and other opposition groups have voiced strong criticism of the GOP Mega Bill, raising concerns about its impact on various sectors of society. They cite potential damage to the social safety net and the environment as serious shortcomings. The partisan divide surrounding the bill is expected to intensify the political battles in the coming months and years.

Public Perception and Media Coverage

Public opinion polls reveal a mixed response to the GOP Mega Bill, with significant partisan divisions. Media coverage has reflected this polarization, offering diverse perspectives on the bill's merits and drawbacks. Ongoing analysis of public opinion and media coverage will be critical for understanding the bill's ultimate impact.

Potential Impact on Future Elections

The GOP Mega Bill is likely to be a significant factor in future elections at all levels of government. The bill's provisions and the political battles surrounding it will influence voter preferences and shape party platforms and campaigns. The extent of its impact will likely depend on the effectiveness of communication strategies employed by each political party.

Conclusion

The GOP Mega Bill represents a sweeping attempt to reshape the American economy and society. Its impact on the nation's fiscal health, social programs, and environment will unfold over time. Its key provisions, including substantial tax cuts, increased spending on infrastructure and defense, and changes to social programs and regulations, are already sparking intense debate and political fallout. Understanding the ramifications of this legislation will require careful observation of its implementation and ongoing analysis of public opinion and political responses. Stay informed about the ongoing developments surrounding the GOP Mega Bill and its implementation to understand its full impact on you and the nation. Continue to engage in discussions and research surrounding this crucial piece of legislation.

Featured Posts

-

Examining Ontarios Proposal Permanent Gas Tax Cut And Highway 407 East Toll Removal

May 16, 2025

Examining Ontarios Proposal Permanent Gas Tax Cut And Highway 407 East Toll Removal

May 16, 2025 -

California Revenue To Plummet 16 Billion Due To Trump Tariffs

May 16, 2025

California Revenue To Plummet 16 Billion Due To Trump Tariffs

May 16, 2025 -

Trumps Tariffs A 16 Billion Hit To Californias Revenue

May 16, 2025

Trumps Tariffs A 16 Billion Hit To Californias Revenue

May 16, 2025 -

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025 -

Assessing The Economic Damage Trumps Tariffs And Californias 16 Billion Loss

May 16, 2025

Assessing The Economic Damage Trumps Tariffs And Californias 16 Billion Loss

May 16, 2025

Latest Posts

-

Who Blinked First Resolving The Us China Trade Standoff

May 16, 2025

Who Blinked First Resolving The Us China Trade Standoff

May 16, 2025 -

Hondas 15 Billion Ev Project In Ontario A Pause In Production

May 16, 2025

Hondas 15 Billion Ev Project In Ontario A Pause In Production

May 16, 2025 -

Examining Ontarios Proposal Permanent Gas Tax Cut And Highway 407 East Toll Removal

May 16, 2025

Examining Ontarios Proposal Permanent Gas Tax Cut And Highway 407 East Toll Removal

May 16, 2025 -

Is A Permanent Gas Tax Cut And Highway 407 East Toll Removal Realistic In Ontario

May 16, 2025

Is A Permanent Gas Tax Cut And Highway 407 East Toll Removal Realistic In Ontario

May 16, 2025 -

Ontarios Plan For Permanent Gas Tax Reduction And Highway 407 East Toll Elimination

May 16, 2025

Ontarios Plan For Permanent Gas Tax Reduction And Highway 407 East Toll Elimination

May 16, 2025