Understanding The Growing Bond Market Crisis

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

The relationship between interest rates and bond prices is inversely proportional. This means that as interest rates rise, bond prices fall, and vice versa. This fundamental principle is at the heart of the current bond market crisis. Higher interest rates make newly issued bonds more attractive to investors because they offer a higher yield. Consequently, the demand for existing bonds with lower yields decreases, pushing their prices down.

-

The Role of Central Banks: Central banks, like the U.S. Federal Reserve, raise interest rates as a primary tool to combat inflation. By increasing borrowing costs, they aim to cool down an overheating economy and curb inflationary pressures. These interest rate hikes, however, have a direct impact on bond markets.

-

Yield Curve Implications: The yield curve, which plots the yields of bonds with different maturities, provides insights into market expectations and future interest rates. A steepening yield curve typically suggests expectations of future interest rate increases, which can put downward pressure on existing bond prices. Conversely, an inverted yield curve (where short-term yields exceed long-term yields) is often seen as a recessionary warning sign.

-

Impact on Different Bond Types: The impact of rising interest rates varies across different types of bonds. Government bonds, generally considered less risky, may experience price declines, but typically less dramatic than corporate bonds. Corporate bonds, especially those with lower credit ratings, are more vulnerable to interest rate hikes and increased default risk.

-

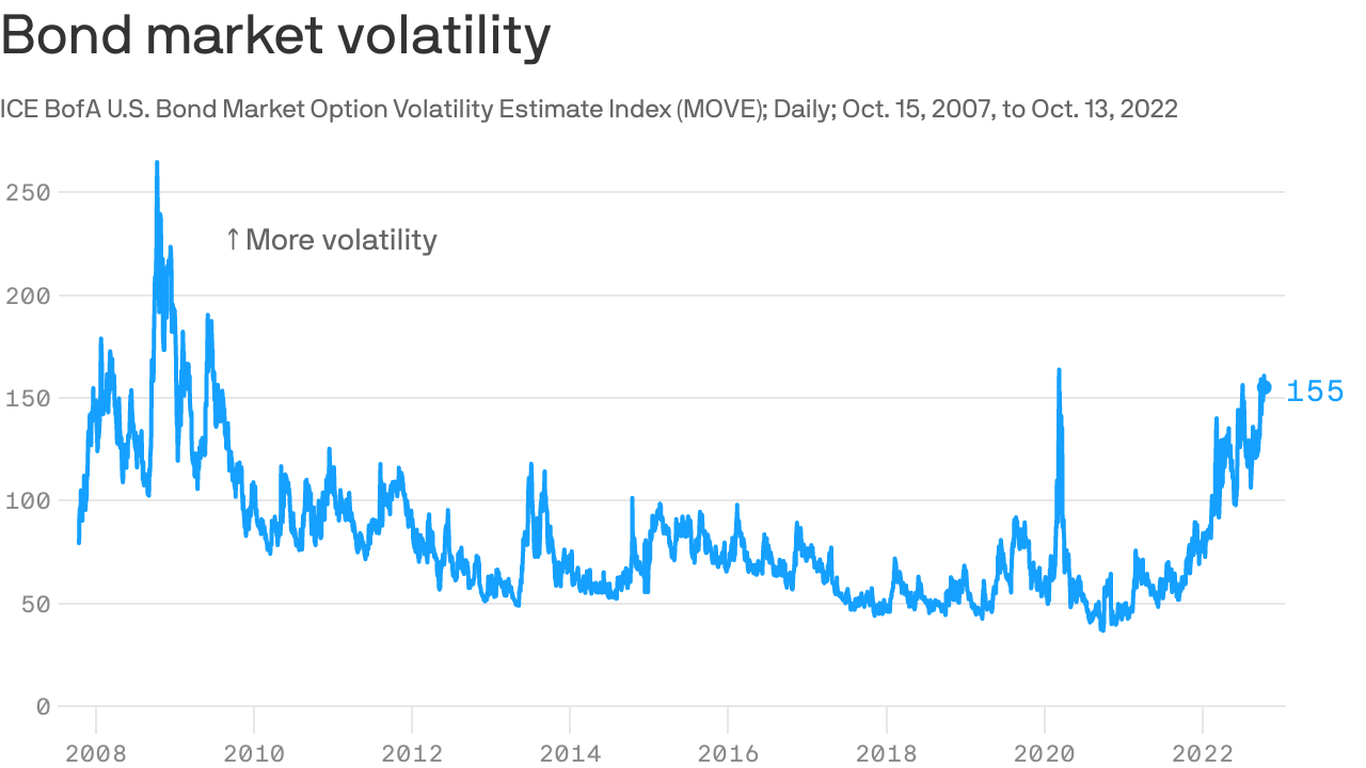

Recent Rate Hikes and Their Effects: The recent aggressive interest rate hikes implemented by central banks worldwide have already led to significant volatility in the bond market. We've witnessed substantial price declines in many bond categories, highlighting the sensitivity of fixed-income investments to monetary policy changes.

The Inflationary Environment and its Pressure on Bond Yields

Persistent inflation erodes the purchasing power of fixed-income investments like bonds. This means that the real return (yield adjusted for inflation) on bonds decreases, making them less attractive to investors seeking to preserve their capital. To compensate for this loss of purchasing power, investors demand higher yields on new bonds, putting further downward pressure on the prices of existing bonds.

-

Inflation and Real Yields: Real yield is the return on an investment after adjusting for inflation. High inflation directly reduces real yields, making bonds less appealing compared to other assets that can better keep pace with rising prices.

-

Inflation Expectations: Market participants' expectations about future inflation significantly influence bond yields. If inflation is expected to remain high, investors will demand higher yields to compensate for the anticipated erosion of purchasing power.

-

Impact of Inflation Metrics: Different inflation metrics, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), provide insights into inflationary pressures. These metrics influence investor sentiment and, consequently, bond market behavior.

-

High Inflation's Impact on Bond Investors: High inflation is forcing bond investors to re-evaluate their strategies. Many are seeking higher-yielding bonds or exploring alternative investments to protect against the diminishing value of their bond holdings.

Geopolitical Uncertainty and its Destabilizing Effect

Geopolitical events introduce significant uncertainty into the bond market. Wars, political instability, sanctions, and energy crises can all trigger volatility and affect investor confidence. This uncertainty leads to flight-to-safety trades, where investors shift their investments into perceived safe havens, potentially driving up yields on government bonds while simultaneously impacting other segments of the bond market.

-

The War in Ukraine's Impact: The ongoing war in Ukraine has had a profound impact on global bond markets, increasing uncertainty and volatility. Sanctions imposed on Russia have disrupted global supply chains and energy markets, contributing to inflationary pressures.

-

Sanctions and Bond Yields: Economic sanctions can significantly impact the bond yields of sanctioned countries, leading to higher borrowing costs and potentially default risk.

-

Energy Price Volatility: Volatility in energy prices, largely fueled by geopolitical events, creates uncertainty about future inflation and economic growth, impacting investor sentiment in the bond market.

Assessing the Risks and Potential Consequences of the Bond Market Crisis

A major bond market crisis carries significant systemic risks, potentially leading to widespread financial instability. The interconnectedness of financial markets means that a crisis in one sector could easily spill over into others.

-

Systemic Risk: The interconnectedness of global financial markets means a significant bond market downturn could trigger a cascade effect, impacting banks, financial institutions, and the broader economy.

-

Contagion Effects: A crisis in one segment of the bond market could trigger a contagion effect, spreading to other sectors and markets.

-

Increased Credit and Default Risk: Rising interest rates and economic uncertainty increase the risk of defaults by corporate borrowers, leading to potential losses for bondholders.

-

Recessionary Risks: A severe bond market crisis could exacerbate existing economic weaknesses and trigger or worsen a recession, further impacting the bond market and the global economy.

Conclusion

The growing bond market crisis is a complex issue driven by a confluence of factors: rising interest rates, high inflation, and geopolitical uncertainty. These elements create a volatile environment with significant risks for investors and the global economy. The potential for systemic risk, contagion, and widespread defaults necessitates careful monitoring and proactive risk management. Understanding the intricacies of this bond market crisis is crucial for investors and policymakers alike. Stay informed about the latest developments and consider diversifying your investment portfolio to mitigate potential risks. Further research into the bond market crisis and its implications is vital for navigating these turbulent times.

Featured Posts

-

Bayrn Mywnykh Yuhsm Sfqt Jwnathan Tah Qryba

May 29, 2025

Bayrn Mywnykh Yuhsm Sfqt Jwnathan Tah Qryba

May 29, 2025 -

Russia Labels Trumps Remarks On Putin As Emotionally Driven

May 29, 2025

Russia Labels Trumps Remarks On Putin As Emotionally Driven

May 29, 2025 -

Investing In Live Nation Entertainment Lyv A Comprehensive Guide

May 29, 2025

Investing In Live Nation Entertainment Lyv A Comprehensive Guide

May 29, 2025 -

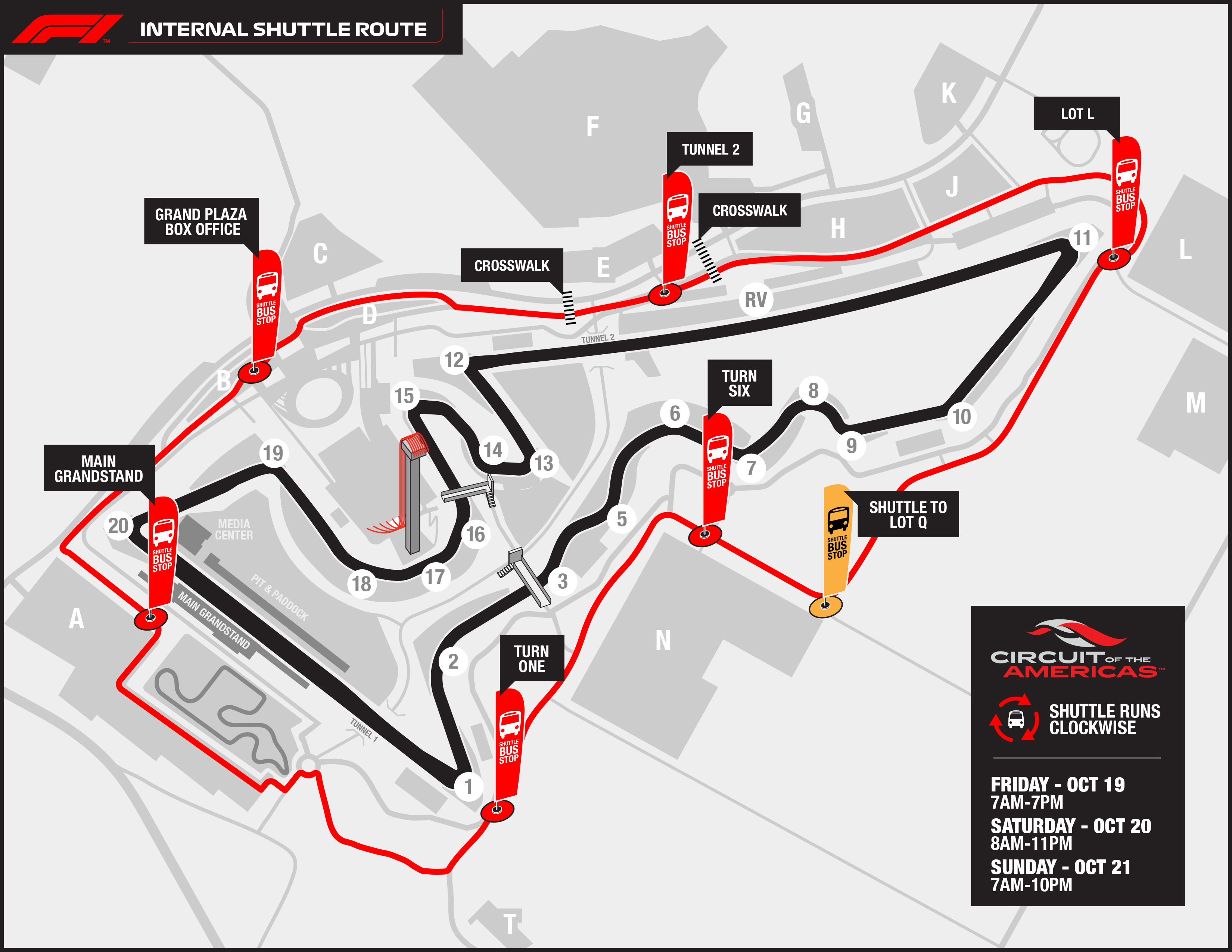

Zarcos Transformation Analyzing His Improved Performance At The Circuit Of The Americas

May 29, 2025

Zarcos Transformation Analyzing His Improved Performance At The Circuit Of The Americas

May 29, 2025 -

Elon Musk Criticizes Trumps Agenda Impact On Dogecoin

May 29, 2025

Elon Musk Criticizes Trumps Agenda Impact On Dogecoin

May 29, 2025

Latest Posts

-

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025

Nyt Mini Crossword Answers Saturday May 3rd

May 31, 2025 -

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Saturday May 3rd Clues And Answers

May 31, 2025 -

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025

Todays Nyt Mini Crossword Clues And Answers Saturday May 3rd

May 31, 2025 -

Complete Guide Nyt Mini Crossword Answers For Saturday April 19th

May 31, 2025

Complete Guide Nyt Mini Crossword Answers For Saturday April 19th

May 31, 2025 -

Nyt Mini Crossword Saturday April 19th Full Solutions And Hints

May 31, 2025

Nyt Mini Crossword Saturday April 19th Full Solutions And Hints

May 31, 2025