Understanding The House Republican Plan For Trump-Era Tax Cuts

Table of Contents

Core Tenets of the Proposed Plan

The overarching goal of the House Republican plan regarding the Trump-era tax cuts remains largely undefined at this time, pending the release of specific legislative proposals. However, based on statements from various House Republicans, we can anticipate a plan that likely focuses on some combination of extension, modification, and perhaps even targeted replacement of certain provisions. The exact details remain fluid and subject to ongoing internal negotiations within the party.

-

Specific tax cuts targeted for extension or revision: While specifics are scarce, potential targets could include individual income tax rates, particularly those reductions enacted in 2017, and potentially the lower corporate tax rate. The extent of any extension or modification remains uncertain.

-

Projected impact on the national debt and deficit: The plan's impact on the national debt and deficit is a subject of intense debate. Proponents argue that economic growth spurred by the tax cuts would offset the revenue loss. Critics, however, contend that the tax cuts would significantly exacerbate the already substantial national debt. Independent economic analyses are crucial to forming an informed opinion on this critical aspect of the plan.

-

Proposed changes to tax credits or deductions: Details on changes to specific tax credits and deductions are limited. However, based on past proposals, potential adjustments could include modifications to the child tax credit, the standard deduction, or other tax breaks. The goal may be to streamline the tax code or to target specific demographic groups.

-

The stated economic rationale behind the plan: House Republicans generally argue that the tax cuts stimulate economic growth through increased investment, job creation, and consumer spending. They may cite the economic performance following the 2017 tax cuts as evidence to support their claims. However, opponents argue that these claims are not substantiated by sufficient empirical evidence and that other factors contributed to the economic growth during that period.

Impact on Different Income Brackets

Analyzing the differential impact on various income levels requires a deep dive into the specifics of any proposed legislation, which are yet to be fully released. However, historical patterns offer some clues. The 2017 tax cuts disproportionately benefited higher-income earners, and a similar effect could occur with any extension or modification under consideration.

-

Changes in tax rates for high, middle, and low-income earners: Depending on the specifics of the plan, tax rates for different income brackets could be adjusted differently. High-income earners might see relatively larger tax reductions, while the impact on low and middle-income earners could be less significant or even neutral.

-

Impact on after-tax income for different demographics: The changes in after-tax income will vary widely based on factors such as family size, income source, and deductions. Families with children, for example, may be affected differently by changes to the child tax credit.

-

Potential for increased inequality or reduced inequality: Depending on the details of the tax plan, it could potentially exacerbate or mitigate income inequality. Economists will offer varied projections depending on their assumptions about the plan's specific components.

-

Specific examples illustrating the impact on different family types: Concrete examples illustrating the plan's impact on specific family types are unavailable until details of the proposed legislation become clear.

Potential Economic Consequences

The predicted economic consequences of the House Republican plan are highly debated and depend heavily on the specifics of the proposed legislation, the prevailing economic climate, and various economic models used for forecasting.

-

Impact on economic growth (GDP): Supporters of the plan typically predict increased economic growth fueled by increased investment and consumer spending. However, critics argue that the revenue loss could outweigh any positive stimulus. The result is contingent on several economic factors and the efficacy of supply-side economics.

-

Effects on job creation and investment: The plan's impact on job creation and investment is also a subject of debate. Proponents claim it would boost both, while opponents express concerns that the benefits might be limited or offset by other factors.

-

Potential inflationary pressures: A significant tax cut could increase aggregate demand, potentially leading to inflationary pressures. The Federal Reserve's response to such pressures could influence the overall economic impact.

-

Analysis of competing economic models and forecasts: Different economic models and forecasting techniques will produce diverse projections. Analyzing these competing models and forecasts is crucial for a balanced understanding of the plan's potential consequences.

Comparison to the Original Trump Tax Cuts

The House Republicans' plan, if it prioritizes extending the 2017 tax cuts, would likely have some similarities. However, modifications are likely, driven by several factors, including political realities and economic changes since 2017.

-

Specific changes to tax rates, deductions, or credits: Any differences would depend on the specifics of the new plan. Changes may include adjustments to thresholds, rates, or eligibility requirements for certain tax benefits.

-

Reasons behind any proposed alterations: Modifications may arise from attempts to address perceived flaws in the 2017 tax cuts, changes in economic conditions, or pressures from various political factions.

-

Analysis of the long-term implications of these changes: A critical factor is understanding the long-term implications of any proposed changes. Short-term economic boosts might not necessarily translate into sustainable long-term growth and could create long-term budget challenges.

Political Ramifications and Likelihood of Passage

The political landscape surrounding the House Republican plan is complex and uncertain. The proposal's fate hinges on several factors.

-

Support from within the Republican party: Even within the Republican party, there may be disagreements over the specifics of the plan. Internal factions could create significant hurdles to its unified support.

-

Potential opposition from Democrats: Democrats are almost certain to oppose a plan perceived as benefiting the wealthy disproportionately and exacerbating the national debt. Their opposition could be a significant obstacle to passage.

-

Influence of lobbying groups: Various lobbying groups, representing different economic interests, will exert considerable influence on the legislative process. Their lobbying efforts will shape the debate and the eventual shape of any legislation.

-

Projected timeline for legislative action: The legislative timeline is uncertain, dependent on the political calendar and the willingness of Congress to prioritize this issue.

Conclusion

The House Republican plan for Trump-era tax cuts presents a complex mix of economic promises, potential risks, and political challenges. The plan's core tenets remain largely undefined, leading to widely divergent projections on its potential impact on different income brackets, the national debt, and the overall economy. The comparison to the original Trump tax cuts reveals a potential for both continuity and substantial alteration. The plan's political ramifications are significant, with the likelihood of passage subject to internal Republican divisions, Democratic opposition, and intense lobbying efforts. Understanding the intricacies of the House Republican Trump Tax Cuts is essential for informed civic participation. Stay informed about the ongoing developments and advocate for policies that align with your economic priorities. Continue your research on the House Republican Trump Tax Cuts to make your voice heard in the political process.

Featured Posts

-

2025 Nba Draft Lottery Predicting The No 1 Pick And Where To Watch

May 13, 2025

2025 Nba Draft Lottery Predicting The No 1 Pick And Where To Watch

May 13, 2025 -

Der Braunschweiger Schoduvel Ein Umfassender Guide Zum Karnevalsumzug

May 13, 2025

Der Braunschweiger Schoduvel Ein Umfassender Guide Zum Karnevalsumzug

May 13, 2025 -

Norfolk Catholics Loss To Archbishop Bergan In District Final Game

May 13, 2025

Norfolk Catholics Loss To Archbishop Bergan In District Final Game

May 13, 2025 -

Spanish Border Regions Confront Economic Disaster Following Brexit Deal

May 13, 2025

Spanish Border Regions Confront Economic Disaster Following Brexit Deal

May 13, 2025 -

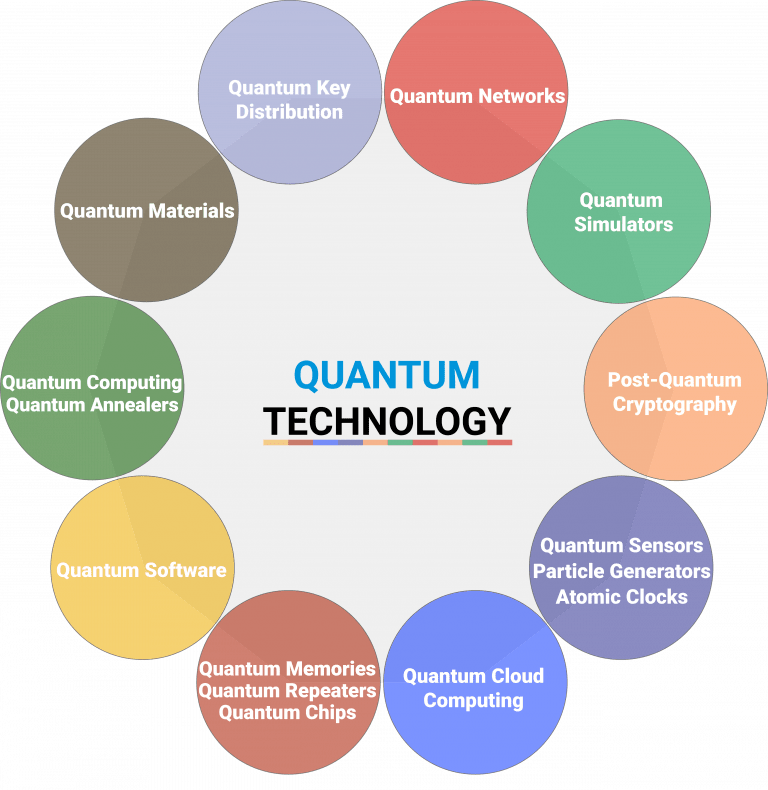

Post Quantum Cryptography Market To Reach Billions By 2030 Impact Of New Standards And Migration Timelines

May 13, 2025

Post Quantum Cryptography Market To Reach Billions By 2030 Impact Of New Standards And Migration Timelines

May 13, 2025

Latest Posts

-

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025

Dodgers Defeat Diamondbacks 14 11 Ohtanis Crucial Home Run

May 14, 2025 -

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025

Dodgers Ohtani 3 Run Homer Fuels Comeback Win Against Diamondbacks

May 14, 2025 -

Ohtanis Late Game Heroics Power Dodgers To 14 11 Victory

May 14, 2025

Ohtanis Late Game Heroics Power Dodgers To 14 11 Victory

May 14, 2025 -

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025

Ohtanis Power Surge 6 Run 9th Fuels Dodgers Comeback

May 14, 2025 -

Dramatic Dodgers Win Ohtanis 6 Run 9th Seals Victory

May 14, 2025

Dramatic Dodgers Win Ohtanis 6 Run 9th Seals Victory

May 14, 2025