Understanding The 'Liberation Day' Tariffs: Their Current And Future Impact On Stock Prices

Table of Contents

Current Impact of 'Liberation Day' Tariffs on Specific Sectors

The "Liberation Day" tariffs have had a multifaceted impact, affecting various sectors differently. Understanding these sector-specific impacts is critical for targeted investment strategies.

The Technology Sector

The technology sector, heavily reliant on global supply chains, has been significantly impacted by the "Liberation Day" tariffs. Increased production costs due to tariffs on imported components are squeezing profit margins. This pressure could lead to:

- Increased production costs: Higher costs for imported raw materials and components directly translate to reduced profitability.

- Reduced profit margins: Companies may absorb some costs, impacting their profitability, or pass them on to consumers, potentially impacting demand.

- Potential for price increases for consumers: To offset increased costs, technology companies may raise prices for their products, potentially dampening consumer demand.

- Impact on consumer spending: Higher prices for tech products could lead to a decrease in consumer spending in this sector.

- Stock price fluctuations of major tech companies: The uncertainty surrounding the tariffs' long-term impact is causing significant stock price volatility for major tech companies like Apple, which relies heavily on manufacturing in tariff-affected regions. For example, Apple's reliance on components sourced from affected regions could significantly impact their production costs and, subsequently, their stock price.

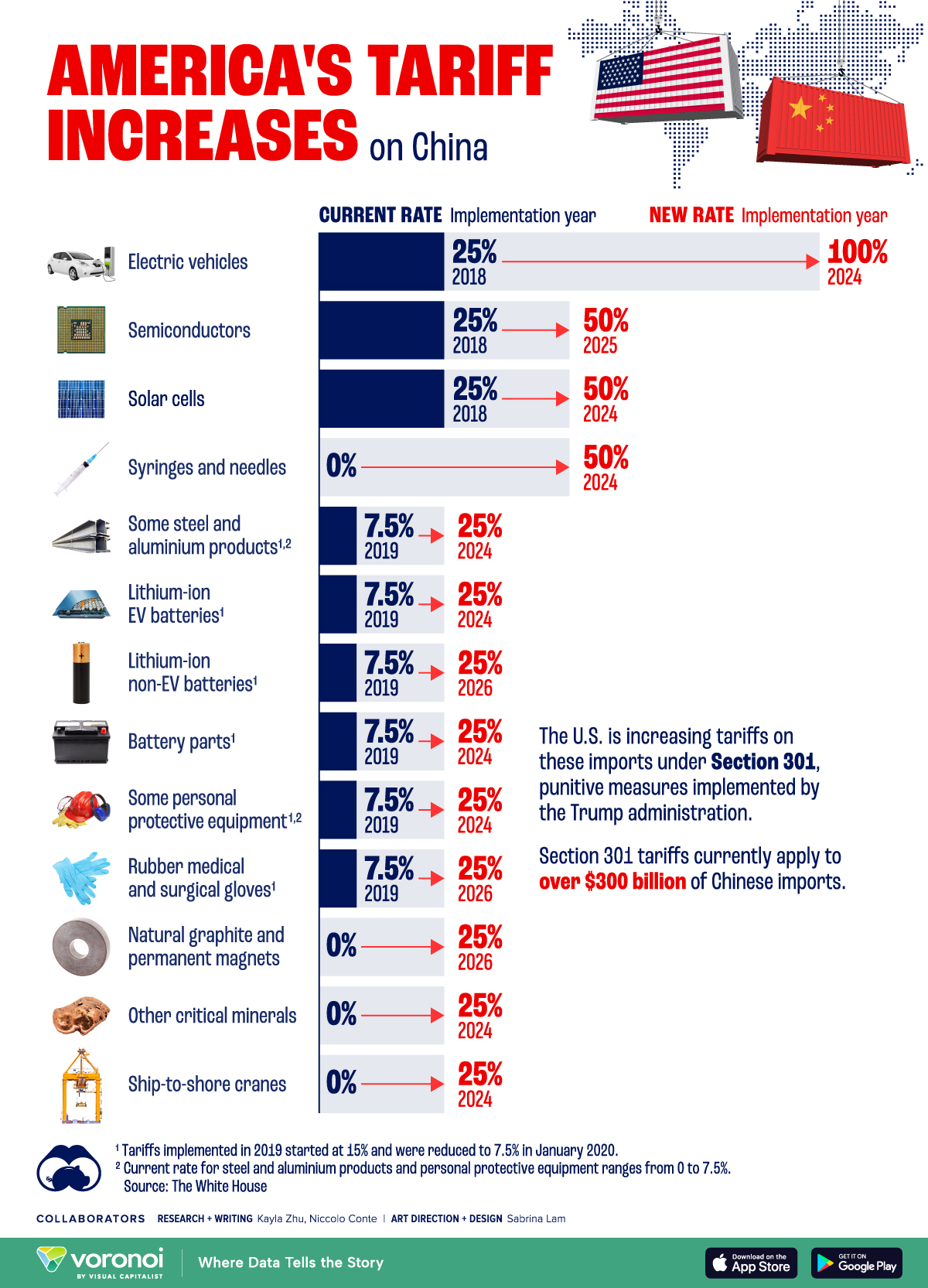

The Automotive Industry

The automotive industry faces similar challenges, with increased costs for imported parts affecting both manufacturing and sales. Key impacts include:

- Increased costs of imported parts: Tariffs on imported engines, electronics, and other components inflate vehicle production costs.

- Reduced competitiveness: Higher production costs make domestically produced vehicles less competitive in both domestic and international markets.

- Potential job losses: Reduced competitiveness and decreased production could lead to job losses within the industry.

- Impact on consumer demand: Higher vehicle prices due to tariffs may suppress consumer demand, further impacting the sector's performance.

- Stock performance of major auto manufacturers: Uncertainty surrounding future tariff policies creates considerable risk and volatility in the stock prices of major auto manufacturers.

The Agricultural Sector

The agricultural sector is also significantly affected, with both export and import opportunities impacted by the "Liberation Day" tariffs. This translates into:

- Reduced export opportunities: Tariffs imposed by other countries on agricultural exports reduce market access for farmers.

- Increased import costs: Higher tariffs on imported agricultural goods increase production costs for food processors and consumers.

- Impact on farm incomes: Decreased export opportunities and increased import costs directly affect farm incomes and profitability.

- Government subsidies: Governments might introduce subsidies to support affected farmers and mitigate some of the negative effects.

- Stock valuations of agricultural companies: The uncertainty caused by tariffs creates volatility in the stock valuations of agricultural companies. For example, companies heavily reliant on specific crops affected by tariffs will experience a disproportionate impact.

Predicting the Future Impact of 'Liberation Day' Tariffs

Predicting the future impact of the "Liberation Day" tariffs requires considering various factors and employing different analytical approaches.

Economic Modeling and Forecasting

Economic models play a crucial role in forecasting the stock market's future behavior under different tariff scenarios. However, it's important to acknowledge their limitations:

- Different forecasting methodologies: Various econometric models, including time series analysis and structural models, can be used, each with its strengths and weaknesses.

- Limitations of economic models: Models rely on assumptions that may not always hold true, leading to inaccuracies in predictions.

- Factors influencing accuracy: The accuracy of predictions depends on the quality of data used, the model's complexity, and unforeseen external factors.

- Potential scenarios based on different tariff outcomes: Models can simulate different scenarios based on various tariff outcomes, including escalation, de-escalation, or a complete removal of tariffs.

Geopolitical Factors and Their Influence

International relations and trade negotiations significantly influence future tariff policies. Factors to consider include:

- Trade negotiations: The outcome of ongoing trade negotiations will greatly influence future tariff policies and their impact on stock prices.

- International agreements: New international trade agreements could lead to adjustments or even the removal of the tariffs.

- Potential for escalation or de-escalation: The possibility of further tariff increases or de-escalation of trade tensions influences market sentiment and investor behavior.

- Impact on investor confidence: Geopolitical instability and uncertainty surrounding trade policies negatively affect investor confidence, increasing market volatility.

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in shaping market reactions to the "Liberation Day" tariffs.

- Fear and uncertainty: Uncertainty regarding the long-term consequences of tariffs creates fear and uncertainty among investors.

- Market corrections: Negative investor sentiment can trigger market corrections, leading to temporary drops in stock prices.

- Flight to safety: Investors may move their funds towards safer assets, such as government bonds, during periods of increased uncertainty.

- Impact on long-term investment strategies: The volatility caused by the tariffs necessitates a reassessment of long-term investment strategies.

Strategies for Navigating the 'Liberation Day' Tariff Landscape

Investors can employ several strategies to mitigate risks and potentially capitalize on opportunities presented by the "Liberation Day" tariffs.

Diversification and Portfolio Management

A well-diversified portfolio is key to mitigating risk associated with tariff-induced market volatility:

- Investing in different sectors and asset classes: Diversification across different sectors reduces reliance on any single sector susceptible to tariff impacts.

- International diversification: Investing in international markets can help mitigate the impact of tariffs focused on specific countries or regions.

- Hedging strategies: Employing hedging strategies can help protect against potential losses from tariff-related market fluctuations.

Fundamental Analysis and Stock Selection

Thorough fundamental analysis is crucial for identifying resilient companies:

- Assessing financial health: Analyze companies' financial statements to assess their ability to withstand increased costs and reduced demand.

- Identifying companies with strong competitive advantages: Focus on companies with strong brands, innovative products, or efficient operations that can better absorb cost increases.

- Evaluating long-term growth potential: Invest in companies with strong long-term growth potential, even if they experience short-term setbacks due to tariffs.

Staying Informed and Adapting to Change

Continuous monitoring of economic news and market trends is essential:

- Following market trends: Stay informed about the latest developments related to the tariffs and their impact on different sectors.

- Utilizing financial news sources: Use reputable financial news sources to obtain timely and accurate information.

- Consulting financial advisors: Seek guidance from financial advisors to develop and adjust investment strategies based on evolving market conditions.

Conclusion

The "Liberation Day" tariffs present a complex and evolving challenge for investors. Understanding their current and projected impact on various sectors is crucial for making informed decisions. By diversifying portfolios, conducting thorough fundamental analysis, and staying abreast of economic developments, investors can mitigate risks and potentially capitalize on opportunities within this dynamic market. Continue to monitor the effects of the 'Liberation Day' tariffs and adjust your investment strategy accordingly to navigate this period of market uncertainty. Remember to consult with a financial advisor before making any major investment decisions related to the 'Liberation Day' tariffs and their impact on stock prices.

Featured Posts

-

Ekonomi Haberleri Bakan Simsek Kripto Varliklara Dair Yeni Aciklamalari

May 08, 2025

Ekonomi Haberleri Bakan Simsek Kripto Varliklara Dair Yeni Aciklamalari

May 08, 2025 -

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025

James Gunns Superman 5 Minute Krypto The Superdog Preview Released

May 08, 2025 -

Lotto 6aus49 Ergebnisse Mittwoch 09 04 2025

May 08, 2025

Lotto 6aus49 Ergebnisse Mittwoch 09 04 2025

May 08, 2025 -

Tatums Candid Comments On Larry Birds Impact On The Boston Celtics

May 08, 2025

Tatums Candid Comments On Larry Birds Impact On The Boston Celtics

May 08, 2025 -

Breaking Bread With Scholars Insights Into Academic Networking And Mentorship

May 08, 2025

Breaking Bread With Scholars Insights Into Academic Networking And Mentorship

May 08, 2025