Understanding The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

Defining Net Asset Value (NAV) and the Amundi MSCI World II UCITS ETF Dist

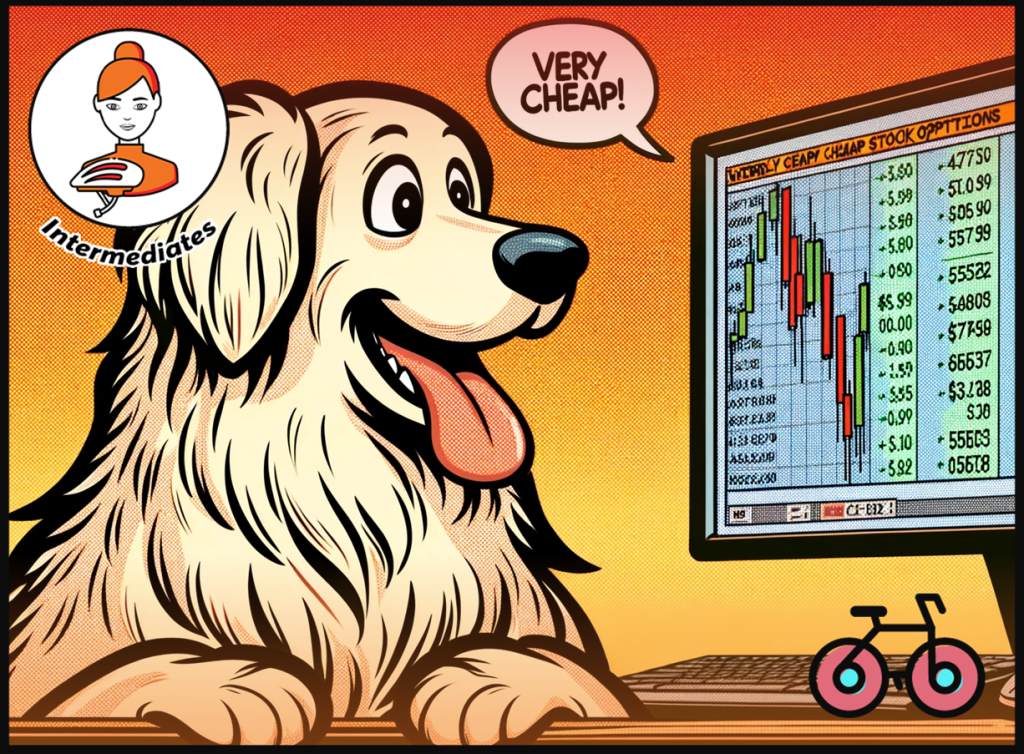

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. In simpler terms, it's the total value of everything the ETF owns (stocks, bonds, etc.) less any debts or expenses, divided by the number of outstanding shares. This Amundi MSCI World II UCITS ETF Dist NAV provides a snapshot of the fund's underlying asset value. The Amundi MSCI World II UCITS ETF Dist is a UCITS ETF that tracks the MSCI World Index, offering investors broad exposure to a large number of global companies across developed markets. Understanding its ETF NAV is key to assessing its performance and making informed investment choices.

Calculating the Net Asset Value (NAV) of Amundi MSCI World II UCITS ETF Dist

Calculating the Amundi MSCI World II UCITS ETF NAV involves a straightforward process:

- Assets: This includes the market value of all the securities held within the ETF portfolio. This comprises the combined market value of its holdings in stocks, bonds, and other assets.

- Liabilities: These are the fund's expenses, including management fees, administrative costs, and any other outstanding debts.

- Formula: The basic formula is: Assets - Liabilities = NAV. This NAV is then divided by the total number of outstanding shares to arrive at the NAV per share.

The Amundi MSCI World II UCITS ETF NAV calculation is typically performed daily, reflecting the closing market prices of its underlying assets. Investors can find the daily NAV on the Amundi website, through major financial news sources, and usually within their brokerage accounts. This daily NAV provides a crucial metric for assessing the ETF's valuation and performance.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF Dist

Several factors influence the Amundi MSCI World II UCITS ETF NAV:

- Market Fluctuations: Changes in the market value of the underlying assets directly impact the ETF's NAV. A rising market generally leads to a higher NAV, while a falling market results in a lower NAV, reflecting the NAV volatility inherent in market-linked investments.

- Currency Exchange Rates: Because the Amundi MSCI World II UCITS ETF Dist invests globally, fluctuations in currency exchange rates can significantly affect the NAV, especially when dealing with non-domestic currencies. This is a crucial aspect of currency risk for internationally diversified ETFs.

- Dividend Distributions: When the underlying companies in the ETF pay dividends, the NAV typically decreases by the amount of the distribution, as the fund's assets are reduced. However, investors receive these dividends separately.

- Management Fees and Expenses: The ETF's management fees and operating expenses reduce the fund's overall assets and, consequently, lower the NAV. The expense ratio is a crucial factor to consider when comparing different ETFs.

Interpreting the NAV of Amundi MSCI World II UCITS ETF Dist

Understanding the relationship between the Amundi MSCI World II UCITS ETF NAV and its share price is essential. Ideally, the share price should closely track the NAV. However, a small difference, known as tracking error, can occur due to trading costs and other market factors. Investors can utilize NAV information to make informed investment decisions, for instance, comparing the current NAV to their purchase price to assess their investment's performance. Monitoring the NAV over time helps in evaluating the effectiveness of your investment strategy and portfolio performance.

Where to Find the NAV of Amundi MSCI World II UCITS ETF Dist

Several reliable sources provide the Amundi MSCI World II UCITS ETF NAV:

- Official Sources: Amundi's official website is the primary source for real-time and historical NAV data.

- Financial Data Providers: Reputable financial data providers, such as Bloomberg or Refinitiv, usually include NAV information for this and other ETFs.

- Brokerage Accounts: Most brokerage accounts display the current NAV of the ETFs held within an investor's portfolio.

Conclusion: Mastering the Net Asset Value (NAV) of Amundi MSCI World II UCITS ETF Dist

Understanding the Amundi MSCI World II UCITS ETF NAV is vital for making informed investment decisions. This article has covered the calculation process, the factors that affect the NAV, and the various sources where you can find this crucial information. Regularly monitor your Amundi MSCI World II UCITS ETF Dist NAV, compare it to your purchase price, and understand how factors like market fluctuations and currency exchange rates influence its value. By mastering your ETF NAV, you can optimize your ETF investment strategy and achieve your financial goals. Learn more about ETF investing and NAV analysis to enhance your investment journey.

Featured Posts

-

Annie Kilners Solo Outing After Kyle Walkers Night With Mystery Women

May 25, 2025

Annie Kilners Solo Outing After Kyle Walkers Night With Mystery Women

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist An In Depth Analysis

May 25, 2025 -

Ezen A Porsche 911 Esen 80 Millio Forintba Kerueltek Az Extrak

May 25, 2025

Ezen A Porsche 911 Esen 80 Millio Forintba Kerueltek Az Extrak

May 25, 2025 -

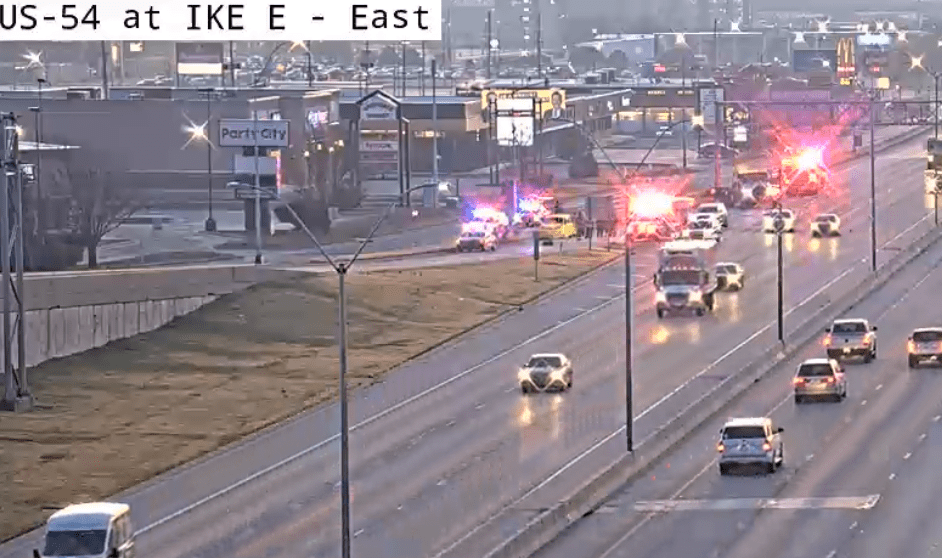

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025 -

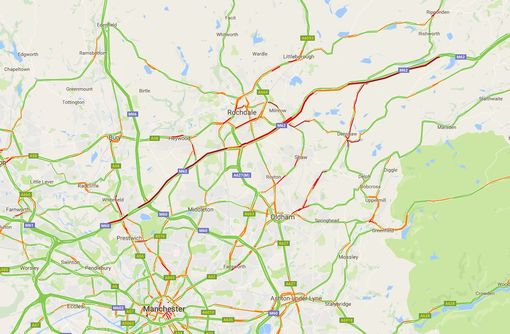

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 25, 2025

Live M56 Traffic Updates Motorway Closed Following Serious Accident

May 25, 2025

Latest Posts

-

Princess Road Accident Emergency Services On Scene Latest Updates

May 25, 2025

Princess Road Accident Emergency Services On Scene Latest Updates

May 25, 2025 -

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025 -

Princess Road Incident Pedestrian Hit By Vehicle Live Updates

May 25, 2025

Princess Road Incident Pedestrian Hit By Vehicle Live Updates

May 25, 2025 -

Roadworks M62 Westbound Closed Manchester To Warrington For Resurfacing

May 25, 2025

Roadworks M62 Westbound Closed Manchester To Warrington For Resurfacing

May 25, 2025 -

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 25, 2025

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 25, 2025