Understanding The Oil Market: News And Analysis For May 16

Table of Contents

Crude Oil Price Movements

Analyzing the daily, weekly, and monthly price movements of Brent and WTI crude oil is fundamental to understanding the oil market. Visual representations, such as charts and graphs, are crucial for quickly grasping the trends.

- Specific price changes for Brent and WTI: (Insert specific data here for May 16th. Example: Brent crude closed at $75 per barrel, a 1% increase from the previous day. WTI crude finished at $72 per barrel, up 0.8%.) Make sure to cite your data source.

- Comparison to prices from the previous day, week, and month: (Insert comparative data here. Example: Compared to last week's average of $73 for Brent, this represents a slight increase. The monthly average shows a more significant upward trend.) Again, cite your source.

- Highs and lows for the day/week/month: (Insert data here. Example: Today's high for Brent was $75.50, while the low was $74.20. The weekly high was $76, and the monthly high was $78.) Cite your source.

- Significant price volatility and its potential causes: (Discuss any significant price swings and their likely causes, referencing current events and market sentiment. For instance, mention any unexpected supply disruptions, changes in OPEC+ production quotas, or major economic news that could have contributed to volatility.)

SEO Keywords: Brent Crude, WTI Crude, Crude Oil Prices, Oil Price Volatility, Crude Oil Market

Geopolitical Factors Influencing the Oil Market

Geopolitical events significantly impact oil supply and demand, creating ripples throughout the global oil market. Understanding these influences is crucial for accurate market predictions.

- Analysis of current geopolitical tensions and their influence on oil production: (Discuss specific geopolitical events such as the ongoing conflict in Ukraine, tensions in the Middle East, or any sanctions imposed on oil-producing nations. Analyze their effect on production levels and export capabilities. Example: The ongoing conflict in Ukraine continues to disrupt global energy supplies, leading to increased oil prices.)

- Significant political events that could impact oil prices in the coming weeks: (Mention any upcoming political events or potential shifts in geopolitical alliances that may significantly affect oil prices. Example: Upcoming OPEC+ meetings and the potential for changes to production quotas are a key factor to watch.)

- Impact of geopolitical risks on oil market stability and investor confidence: (Discuss how geopolitical instability affects investor sentiment and market stability. Example: Increased geopolitical risk often translates to higher oil prices as investors seek safe-haven assets.)

SEO Keywords: Geopolitical Risk, OPEC+, Oil Sanctions, Global Oil Supply, Oil Market Stability

Economic Indicators and their Influence

Macroeconomic indicators such as inflation, interest rates, and economic growth are intrinsically linked to oil prices. Understanding these relationships is critical for comprehensive oil market analysis.

- Correlation between oil prices and economic growth in key regions: (Analyze the relationship between oil prices and economic growth in major economies like the US, China, and Europe. Example: Strong economic growth in Asia often leads to increased demand for oil, driving prices higher.)

- Impact of inflation and interest rate changes on oil demand and investment: (Discuss how inflation and interest rate hikes influence oil demand and investment decisions. Example: High inflation can reduce consumer spending, thus impacting oil demand. Higher interest rates can discourage investment in oil exploration and production.)

- Analysis of any recent economic data releases and their impact on the oil market: (Analyze the impact of recent economic data releases (e.g., GDP growth figures, inflation reports) on the oil market's trajectory. Example: A stronger-than-expected GDP report could boost oil prices due to increased demand.)

SEO Keywords: Oil Demand, Economic Growth, Inflation, Interest Rates, Oil Market Analysis, Macroeconomic Indicators

Supply Chain Disruptions and their Effect

Supply chain bottlenecks and logistics issues significantly affect oil prices and availability. Understanding these disruptions is essential for a complete market overview.

- Analysis of current supply chain challenges related to oil transportation and refining: (Discuss current challenges such as port congestion, tanker shortages, or refinery maintenance impacting oil transport and refining capabilities. Example: Recent disruptions to oil tanker shipping routes have contributed to higher transportation costs.)

- Potential future disruptions and their likely impact on the oil market: (Discuss potential future disruptions such as extreme weather events or geopolitical instability impacting oil supply chains. Example: The risk of future disruptions caused by extreme weather events should not be overlooked.)

- Strategies employed by oil companies to mitigate supply chain risks: (Analyze strategies used by oil companies to mitigate risks, including diversification of supply sources, investment in logistics infrastructure, and risk management strategies. Example: Many oil companies are investing in improved logistics and storage capacity to reduce vulnerability to supply chain disruptions.)

SEO Keywords: Oil Supply Chain, Oil Transportation, Refining Capacity, Logistics, Supply Chain Disruptions

Conclusion

This analysis of the oil market on May 16th highlights the interplay of geopolitical events, economic indicators, and supply chain dynamics in shaping crude oil prices. Understanding these interconnected factors is vital for navigating the volatility inherent in the oil market. For continued updates and deeper insights into the oil market, regularly check our website for the latest news and analysis. Stay informed about the ever-changing landscape of the oil market and make well-informed decisions based on the most up-to-date information available. Learn more about the crude oil market by subscribing to our newsletter.

Featured Posts

-

New Photos Angel Reeses Close Bond With Mom Angel Webb Reese

May 17, 2025

New Photos Angel Reeses Close Bond With Mom Angel Webb Reese

May 17, 2025 -

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025

Your Guide To Austintown And Boardman News Police Blotter And More

May 17, 2025 -

May 2025 New York Daily News Accessing Past Issues

May 17, 2025

May 2025 New York Daily News Accessing Past Issues

May 17, 2025 -

New Student Loan Rules Key Changes Proposed By The Gop

May 17, 2025

New Student Loan Rules Key Changes Proposed By The Gop

May 17, 2025 -

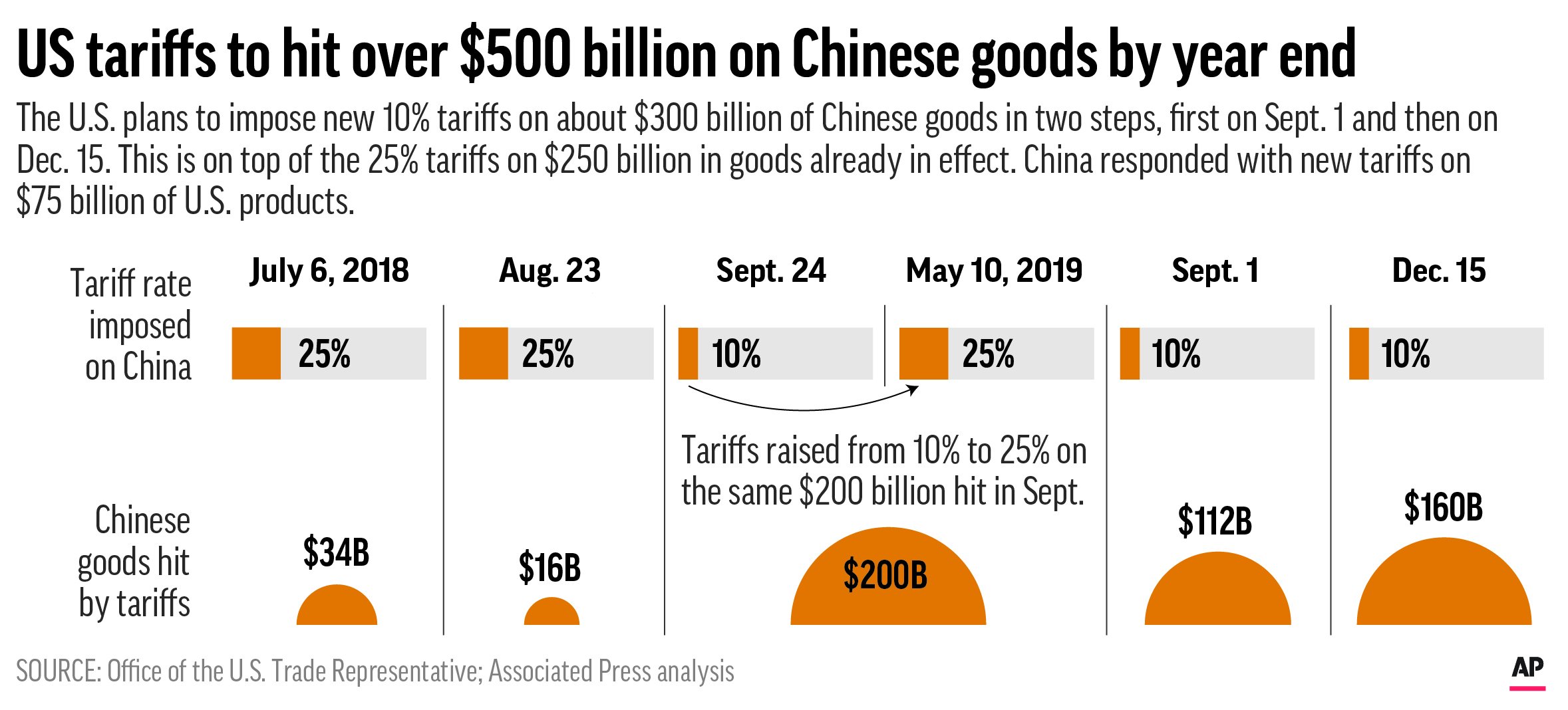

Trumps China Tariffs Projected Impact And Timeline Through 2025

May 17, 2025

Trumps China Tariffs Projected Impact And Timeline Through 2025

May 17, 2025

Latest Posts

-

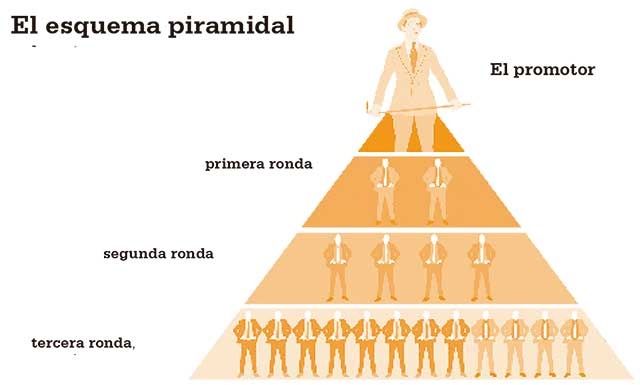

Koriun Inversiones Descifrando Su Fraudulento Esquema Ponzi

May 17, 2025

Koriun Inversiones Descifrando Su Fraudulento Esquema Ponzi

May 17, 2025 -

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025 -

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Que Fue El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025 -

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Recuperacion De Capital El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025