Understanding The Recent Volatility In Riot Platforms (RIOT) Stock

Table of Contents

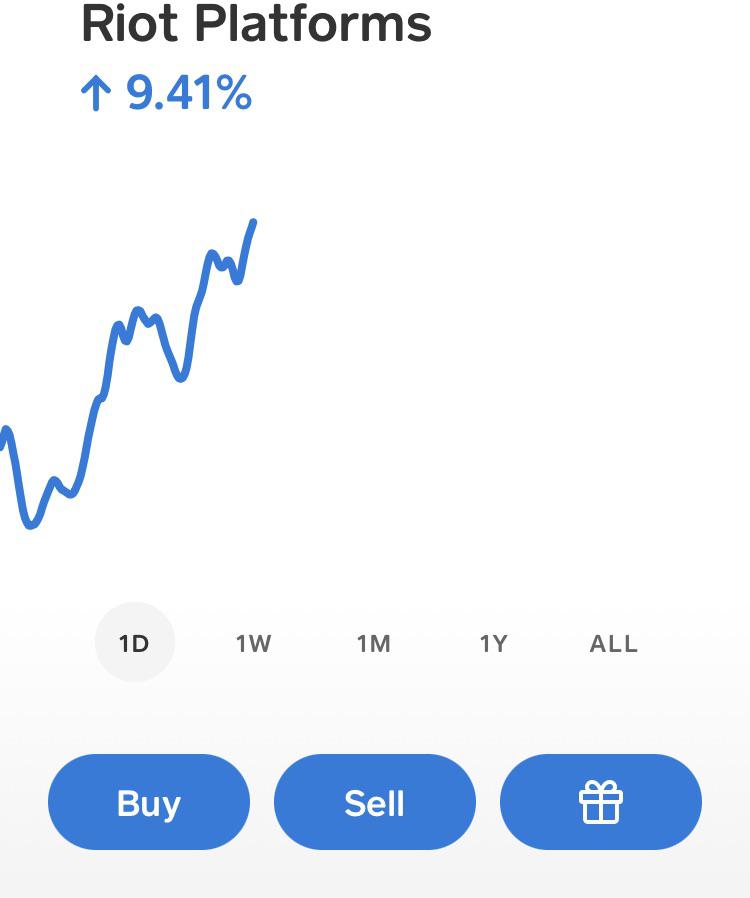

Bitcoin Price Fluctuations and Their Impact on RIOT

Riot Platforms' revenue is directly tied to Bitcoin mining profitability. Therefore, a decrease in Bitcoin's price often leads to decreased RIOT stock value, and vice-versa. This inherent correlation makes understanding Bitcoin's price movements paramount for any RIOT investor.

The Correlation Between Bitcoin and RIOT Stock:

-

A sharp drop in Bitcoin's price directly impacts the value of Riot's Bitcoin holdings and its future mining revenue. Riot Platforms, like other Bitcoin miners, holds a significant amount of Bitcoin as part of its operations. A decrease in Bitcoin's market value directly translates to a decrease in the company's asset value, impacting its balance sheet and investor confidence. This is a key driver of RIOT stock volatility.

-

Increased Bitcoin price volatility translates into increased volatility for RIOT stock. Even minor fluctuations in Bitcoin's price can trigger significant swings in RIOT's stock price due to the leveraged nature of the Bitcoin mining business. This amplified volatility makes RIOT a higher-risk investment for some.

-

Analyzing Bitcoin price trends is crucial for predicting potential movements in RIOT stock. By monitoring Bitcoin's price action, technical indicators, and market sentiment, investors can gain valuable insights into potential future price movements of RIOT stock. Tools like moving averages, RSI, and MACD can aid in this analysis.

Bitcoin Mining Difficulty and its Effect on RIOT's Profitability:

Increased mining difficulty reduces the efficiency of Bitcoin mining, impacting the profitability of companies like Riot Platforms. This is a crucial factor influencing RIOT's stock performance.

-

Higher difficulty requires more energy and resources to mine Bitcoin, potentially impacting RIOT's margins. As the Bitcoin network's hash rate increases, the difficulty of mining increases proportionately, making it more expensive to acquire each Bitcoin. This directly impacts Riot's profitability and its ability to generate revenue.

-

Understanding the ongoing difficulty adjustments is key to assessing RIOT's future earnings potential. Bitcoin's mining difficulty adjusts approximately every two weeks, making it vital to stay informed about these changes and their potential impact on RIOT's operations.

-

Investors should monitor network hash rate and mining difficulty reports to gauge RIOT's operational efficiency. Regularly tracking these metrics offers valuable insights into RIOT's ability to maintain profitability amidst changing mining conditions.

Regulatory Uncertainty and its Influence on RIOT Stock

Government regulations impacting cryptocurrency mining operations can significantly impact RIOT's operations and profitability, leading to fluctuations in RIOT stock price. Navigating this regulatory landscape is crucial for understanding RIOT's risk profile.

The Impact of Changing Regulations on Cryptocurrency Mining:

-

Changes in environmental regulations concerning energy consumption can affect mining operations and RIOT's stock price. Increasing scrutiny of energy consumption in Bitcoin mining could lead to stricter regulations, potentially impacting Riot's operational costs and profitability.

-

Tax policies and legal frameworks concerning cryptocurrency trading can influence investor sentiment towards RIOT. Changes in tax laws or regulatory frameworks around cryptocurrencies can significantly affect the investment appeal of companies like Riot Platforms.

-

Staying informed about emerging regulations in major markets is crucial for understanding RIOT's risk profile. Investors must remain aware of regulatory developments in key jurisdictions where Riot operates to assess the potential impact on its business.

Public Perception and Media Coverage:

Negative media attention or regulatory crackdowns can negatively influence investor sentiment and RIOT stock performance. Conversely, positive news can boost investor confidence.

-

Negative news cycles often lead to sell-offs, increasing stock volatility. Negative media coverage or regulatory actions can trigger a wave of selling pressure, increasing volatility in RIOT stock.

-

Positive developments, such as new partnerships or successful operational milestones, can improve investor confidence. Positive news, such as expansion into new markets or technological advancements, can increase investor confidence and drive up RIOT's stock price.

-

Monitoring public perception and media coverage of RIOT is essential for understanding market sentiment. Keeping track of news and sentiment analysis concerning RIOT can provide valuable insights into market sentiment and potential future price movements.

Market Sentiment and Investor Behavior

The cryptocurrency market is highly susceptible to speculative trading, often resulting in significant price swings in RIOT stock. Understanding investor behavior and broader market trends is key to navigating this volatility.

Speculative Trading and its Role in RIOT Stock Volatility:

-

Increased trading volume often correlates with higher volatility. Higher trading volume often indicates increased speculation, which can lead to amplified price swings in RIOT stock.

-

Understanding market sentiment through technical analysis can offer insights into potential future price movements. Technical analysis, which involves studying price charts and indicators, can help investors gauge market sentiment and predict potential price movements.

-

Investor confidence significantly influences RIOT stock prices. Positive investor sentiment can lead to buying pressure, pushing the price up, while negative sentiment can trigger selling and price declines.

Macroeconomic Factors and Their Influence:

Broader economic conditions, such as inflation and interest rate hikes, can also influence investor appetite for risky assets like RIOT stock.

-

Periods of economic uncertainty often lead investors to move towards safer investments. During times of economic uncertainty, investors often shift away from riskier assets like RIOT stock in favor of safer options.

-

Macroeconomic factors can indirectly impact the price of Bitcoin and consequently RIOT stock. Factors like inflation and interest rates can influence the overall market sentiment towards cryptocurrencies, indirectly impacting Bitcoin's price and RIOT's stock price.

-

Monitoring key macroeconomic indicators is important for a holistic view of RIOT's prospects. Considering macroeconomic factors alongside cryptocurrency-specific factors provides a more comprehensive perspective on RIOT's future performance.

Conclusion:

The volatility in Riot Platforms (RIOT) stock is a complex issue influenced by various interconnected factors, including Bitcoin's price, regulatory uncertainty, market sentiment, and broader macroeconomic conditions. Understanding these elements is crucial for investors seeking to navigate the risks and opportunities associated with this investment. By carefully considering the factors discussed and staying informed about market developments, investors can make more informed decisions regarding their Riot Platforms (RIOT) stock holdings. Continue to monitor the Riot Platforms (RIOT) stock volatility and its correlation with Bitcoin's price for optimal investment strategies. Understanding Riot Platforms (RIOT) stock volatility requires diligent research and a keen awareness of market dynamics.

Featured Posts

-

Englands Late Show Secures Dramatic Victory Against France

May 02, 2025

Englands Late Show Secures Dramatic Victory Against France

May 02, 2025 -

Saudi Arabias Abs Market Post Regulatory Change Analysis And Future Outlook

May 02, 2025

Saudi Arabias Abs Market Post Regulatory Change Analysis And Future Outlook

May 02, 2025 -

Us Health Officials Launch Vaccine Monitoring Amid Measles Rise

May 02, 2025

Us Health Officials Launch Vaccine Monitoring Amid Measles Rise

May 02, 2025 -

Mental Health Literacy Education Empowering Individuals And Communities

May 02, 2025

Mental Health Literacy Education Empowering Individuals And Communities

May 02, 2025 -

Zyr Khnjr Shh Rg Ayksprys Ardw Ke Mtabq Hqyqt Kya He

May 02, 2025

Zyr Khnjr Shh Rg Ayksprys Ardw Ke Mtabq Hqyqt Kya He

May 02, 2025