Understanding The Surge In The Venture Capital Secondary Market

Table of Contents

Increased Liquidity for Limited Partners (LPs): A Key Driver

Venture capital investments are notoriously illiquid, traditionally tying up capital for extended periods, often seven to ten years or more, before a portfolio company exit (IPO or acquisition). This presents a significant challenge for LPs seeking to access their invested capital before the eventual realization of returns. The venture capital secondary market provides a critical solution to this problem, offering avenues for LPs to achieve liquidity and diversify their portfolios.

- Enhanced Liquidity: The secondary market enables LPs to sell all or a portion of their stakes in venture capital funds, realizing returns earlier than traditional exit strategies allow. This is particularly beneficial for LPs with specific liquidity needs, such as those facing redemption requests from their investors.

- Portfolio Rebalancing: The secondary market allows LPs to rebalance their portfolios, shifting capital from underperforming investments or sectors to more promising opportunities. This strategic reallocation can enhance overall portfolio performance.

- Tax Optimization: Depending on the specific structure of the transaction, secondary market sales can offer potential tax advantages, further enhancing the appeal of this liquidity solution.

- Transaction Types: Secondary transactions can take various forms, including direct sales to other LPs or institutions, participation in portfolio auctions managed by specialized firms, or utilizing established secondary market platforms.

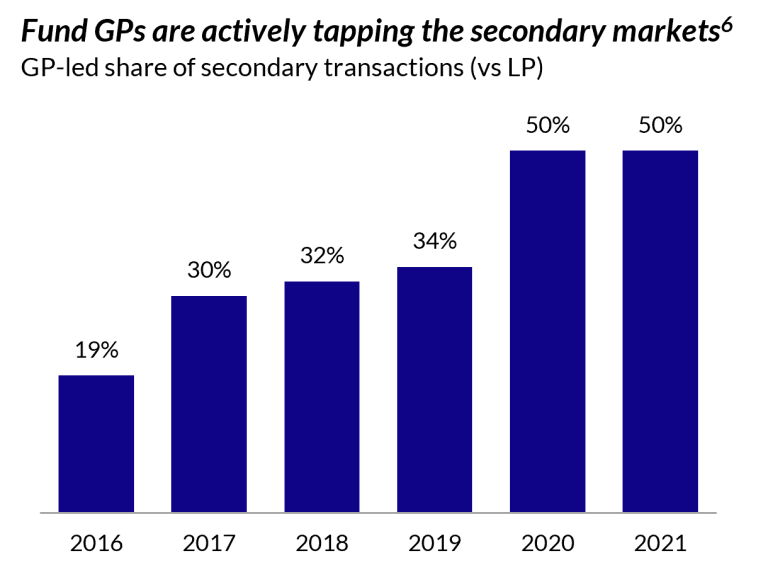

Strategies for General Partners (GPs) in the Secondary Market

The venture capital secondary market isn't just beneficial for LPs; it also presents strategic advantages for GPs. Sophisticated GPs can leverage secondary transactions to enhance their fund performance and manage their portfolios effectively.

- Capital Recycling: Secondary sales allow GPs to recycle capital from mature or less promising investments, freeing up resources to invest in new, high-growth opportunities within their existing portfolio companies or to pursue promising new ventures.

- Fundraising Enhancement: A well-executed secondary transaction can demonstrate confidence in a fund's performance, potentially making future fundraising rounds easier and more attractive to potential investors.

- Improved Fund Performance Metrics: Strategic secondary sales can enhance a fund's overall performance metrics by removing underperforming assets and concentrating capital on its most promising holdings. However, it's crucial to carefully consider the implications for reported returns and ensure transparency with investors.

- Risks and Considerations: GPs must carefully weigh the potential risks associated with secondary transactions, such as impacting fund continuity or triggering negative signals to investors. Transparency and a well-defined strategy are paramount.

The Role of Technology and Marketplaces in Facilitating Secondary Transactions

Technology has revolutionized the venture capital secondary market, driving increased efficiency, transparency, and accessibility. Specialized online platforms and marketplaces have emerged, connecting buyers and sellers more effectively than ever before.

- Increased Transparency: These platforms provide greater transparency into pricing, deal flow, and market trends, empowering both LPs and GPs to make more informed decisions.

- Data Analytics and Valuation Tools: Sophisticated data analytics and valuation tools are integrated into these platforms, facilitating more accurate and efficient valuation of illiquid venture capital assets.

- Reduced Transaction Costs: Technology streamlines the transaction process, reducing administrative costs and accelerating deal execution times.

- Examples of Platforms: Several successful platforms are facilitating secondary transactions, offering a range of services and features to cater to various needs within the VC secondary market.

Valuation and Pricing in the Venture Capital Secondary Market

Valuing illiquid venture capital assets poses unique challenges. Accurate valuation is critical for both buyers and sellers in secondary transactions, ensuring fair pricing and minimizing disputes.

- Valuation Methodologies: Several valuation methodologies are used, including discounted cash flow (DCF) analysis, comparable company analysis, and precedent transactions. The choice of methodology depends on the specifics of the underlying asset and the available data.

- Importance of Accuracy: Inaccurate valuations can lead to significant financial implications for both parties. Buyers may overpay, while sellers may undervalue their assets.

- Role of Independent Experts: Independent valuation experts play a crucial role in providing objective assessments and mitigating valuation risks.

Regulatory and Legal Considerations

Navigating the legal and regulatory landscape is crucial for successful secondary transactions. Compliance with relevant regulations is paramount to ensure the validity and enforceability of agreements.

- Legal Framework: The legal framework governing secondary transactions varies across jurisdictions. Understanding these differences is essential for structuring compliant transactions.

- Documentation and Compliance: Meticulous legal documentation is essential to protect the interests of both buyers and sellers. Compliance with all applicable regulations is crucial to avoid legal challenges.

Conclusion: Navigating the Opportunities in the Venture Capital Secondary Market

The venture capital secondary market is experiencing phenomenal growth, driven by increased LP liquidity needs, sophisticated GP strategies, and technological advancements. This market offers significant opportunities for both LPs seeking liquidity and GPs aiming for strategic portfolio management. By understanding the intricacies of valuation, navigating the legal landscape, and leveraging available technologies, stakeholders can successfully navigate this dynamic market and unlock its potential. To learn more about navigating the opportunities and challenges within the venture capital secondary market and exploring available resources, [insert link to relevant resources here].

Featured Posts

-

China Approves Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025 -

Jan 6 Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 29, 2025

Jan 6 Witness Cassidy Hutchinson Announces Fall Memoir Release

Apr 29, 2025 -

Black Hawk And Jet Crash A Bombshell Report Exposes Key Factors Leading To 67 Deaths

Apr 29, 2025

Black Hawk And Jet Crash A Bombshell Report Exposes Key Factors Leading To 67 Deaths

Apr 29, 2025 -

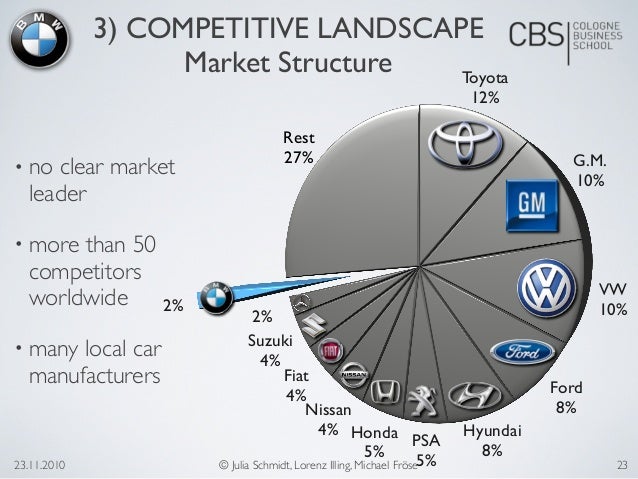

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

Apr 29, 2025

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

Apr 29, 2025 -

Chainalysis Acquisition Of Alterya Enhancing Blockchain Security With Ai

Apr 29, 2025

Chainalysis Acquisition Of Alterya Enhancing Blockchain Security With Ai

Apr 29, 2025

Latest Posts

-

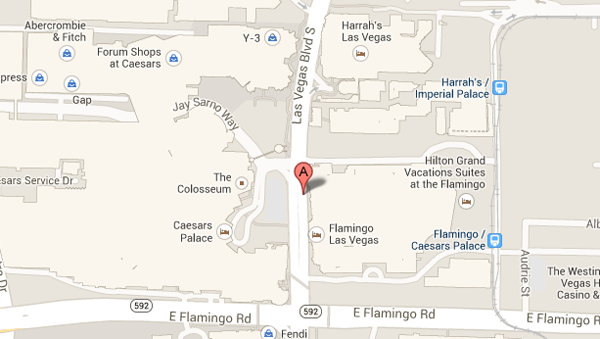

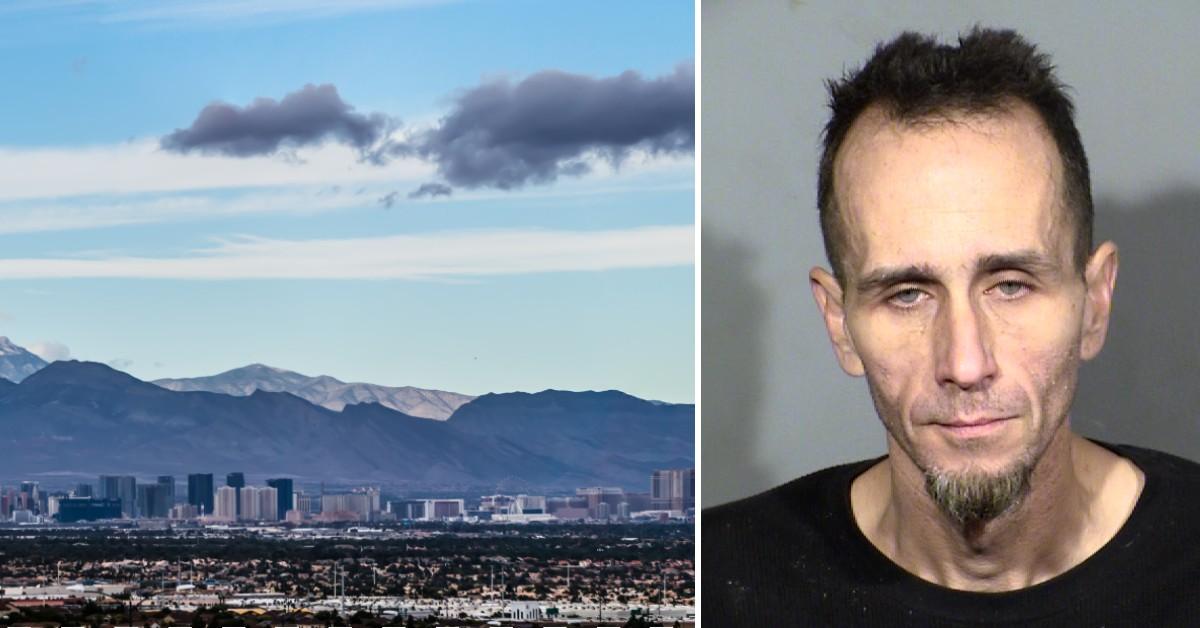

British Paralympian Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Missing In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Missing British Paralympian Las Vegas Authorities Appeal For Information

Apr 29, 2025

Missing British Paralympian Las Vegas Authorities Appeal For Information

Apr 29, 2025 -

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025 -

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025