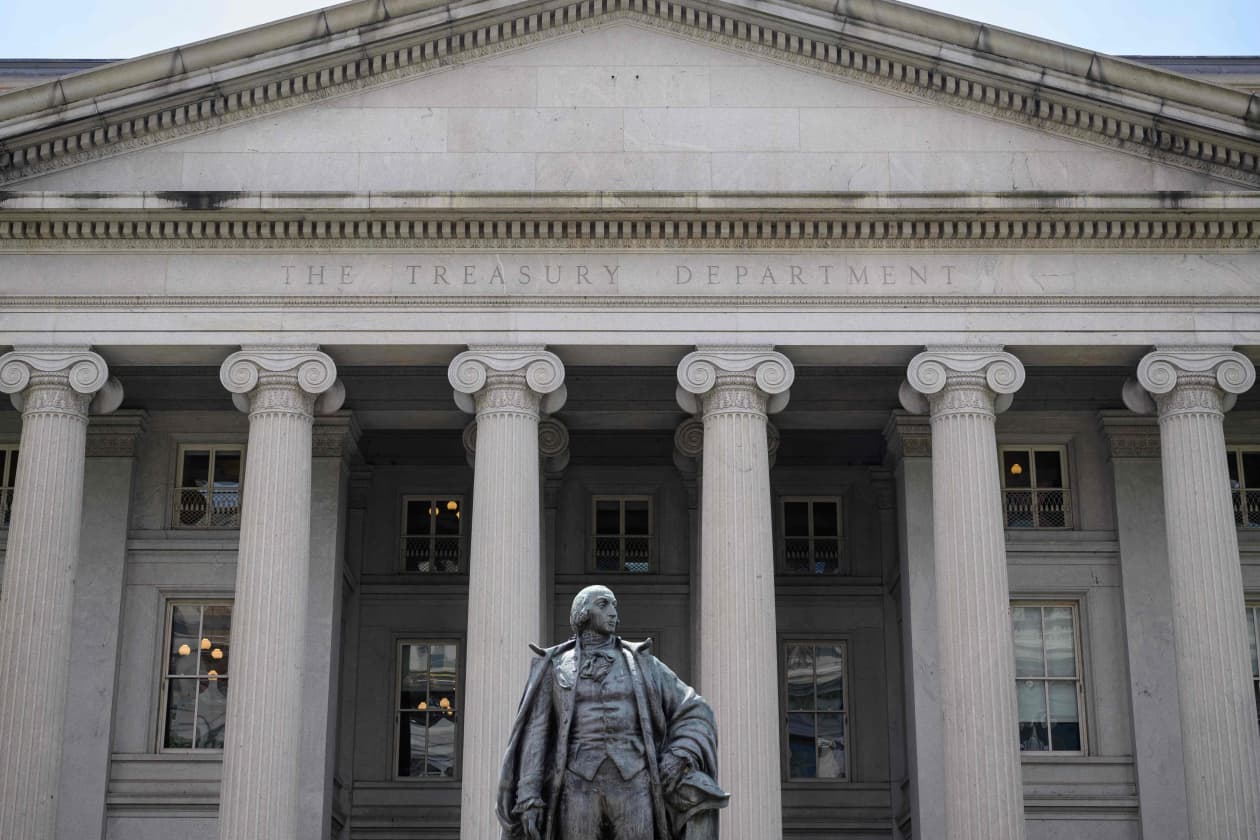

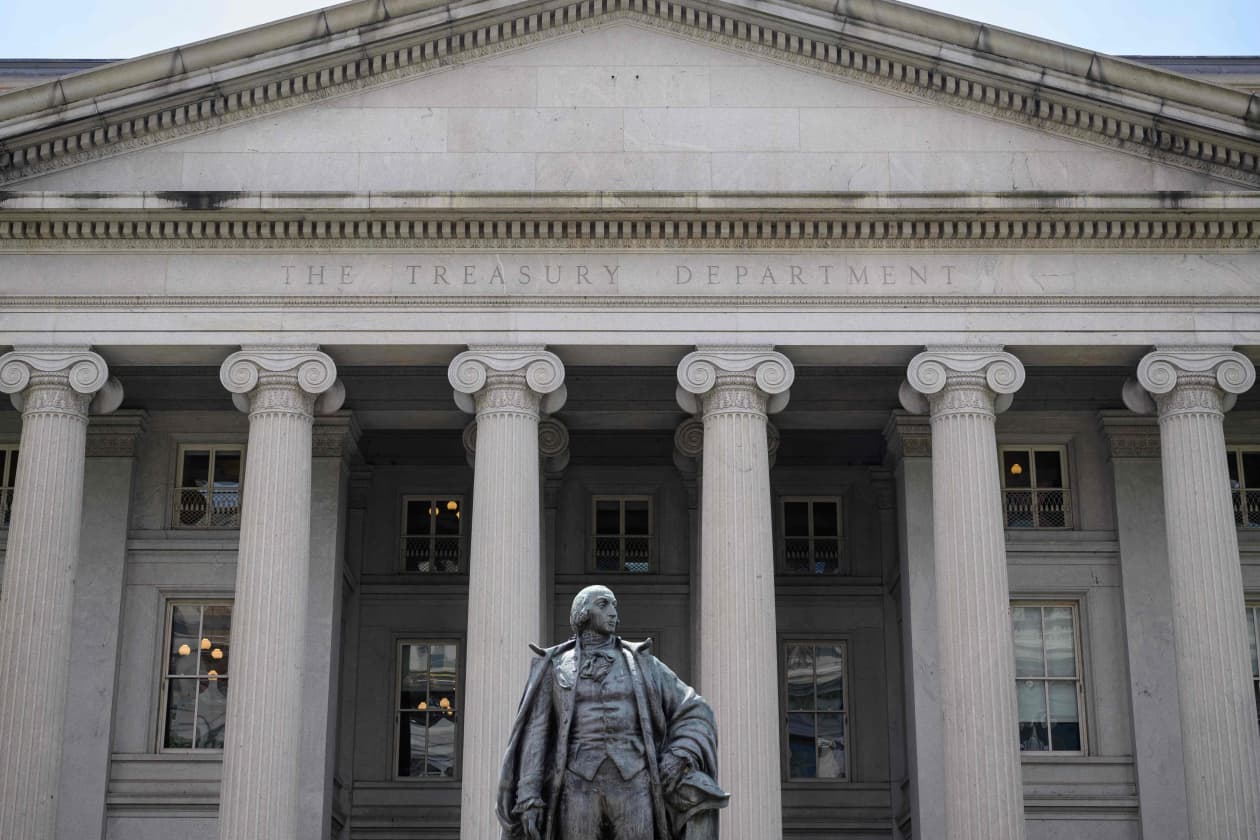

Understanding The Treasury Market After April 8th

Table of Contents

Interest Rate Adjustments and Their Impact

The behavior of the Treasury market is intrinsically linked to interest rate adjustments, both domestically and internationally.

The Federal Reserve's Role

The Federal Reserve's actions are paramount in shaping the Treasury market. Its decisions regarding interest rate policy significantly influence Treasury yields and bond prices.

- Potential Rate Hikes: The Fed's potential for future rate hikes directly impacts Treasury yields. Higher rates generally lead to higher yields on newly issued Treasury securities, while existing bonds may see their prices fall.

- Quantitative Tightening (QT): The Fed's quantitative tightening program, aimed at reducing its balance sheet, affects liquidity in the market. QT can lead to higher yields as the supply of bonds increases relative to demand. Conversely, quantitative easing (QE) has the opposite effect.

- Yield Curve Shifts: The yield curve, which plots Treasury yields against their maturities, provides insights into market expectations. Changes in the yield curve, such as flattening or inversion, often signal shifts in economic outlook and investor sentiment, impacting the Treasury market. For example, an inverted yield curve, where short-term yields exceed long-term yields, is often seen as a predictor of an economic recession.

Data from the Federal Reserve shows a clear correlation between its policy decisions and Treasury yield movements. Analyzing these historical trends is crucial for understanding future market behavior. Understanding the Federal Reserve's communication and its forward guidance is key to forecasting the Treasury market’s direction.

Global Interest Rate Environments

The US Treasury market isn't isolated; global interest rate environments exert significant influence.

- Comparison of US Rates with Other Major Economies: Differences in interest rates between the US and other major economies affect capital flows. Higher US rates attract foreign investment, increasing demand for US Treasury securities and potentially lowering yields. Conversely, lower US rates may lead to capital outflows.

- Impact of Global Economic Uncertainty: Geopolitical events and economic instability in other parts of the world can create uncertainty, prompting investors to seek the safety of US Treasury bonds, thus influencing demand and yields. This "flight to safety" effect can significantly impact the Treasury market.

Inflationary Pressures and Treasury Yields

Inflation is a major driver of Treasury yields. High inflation erodes the purchasing power of fixed-income investments, making Treasury bonds less attractive unless yields rise to compensate.

Inflation Data and Market Reactions

Inflation reports, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), significantly impact investor sentiment and Treasury yields.

- CPI and PPI Reports: Unexpectedly high inflation readings typically lead to increased expectations of future rate hikes by the Federal Reserve, resulting in higher Treasury yields. Conversely, lower-than-expected inflation can lead to lower yields.

- Market Reactions: The market's reaction to inflation data is often immediate and substantial. Sharp increases in inflation can trigger a sell-off in Treasury bonds, while unexpectedly low inflation can lead to a rally. Analyzing past market reactions to inflation reports helps predict future movements. For example, a surge in the CPI often leads to a spike in the 10-year Treasury yield.

Inflation Hedging Strategies

Investors utilize Treasury securities, particularly Treasury Inflation-Protected Securities (TIPS), to hedge against inflation risk.

- TIPS and Inflation Risk Management: TIPS adjust their principal value based on changes in the Consumer Price Index (CPI). This feature protects investors from inflation erosion, making them an attractive option during inflationary periods. Understanding the mechanics of TIPS and how they perform in different inflation environments is crucial for effective portfolio management.

Economic Forecasts and the Outlook for the Treasury Market

Economic forecasts significantly influence the demand for Treasury securities. Strong economic growth can increase inflation expectations and lead to higher yields, while a weakening economy may drive investors toward the safety of Treasuries, pushing yields lower.

Economic Growth Projections

Economic growth projections, reflected in metrics like GDP growth and unemployment rates, have a major impact on Treasury yields.

- GDP Growth Projections: Strong GDP growth projections often lead to higher inflation expectations and increased demand for higher-yielding assets, potentially driving up Treasury yields. Conversely, weak GDP growth projections often lead to lower yields.

- Unemployment Rates: Low unemployment rates can indicate a strong economy, potentially leading to higher inflation and Treasury yields. Higher unemployment rates typically signal a weakening economy, which can drive investors towards the safety of Treasuries and lower yields. Understanding these relationships is key to long-term forecasting for the Treasury market.

Geopolitical Factors and Their Influence

Geopolitical events introduce uncertainty into the market and can significantly affect Treasury yields.

- Global Instability and Market Volatility: Geopolitical tensions and global instability often cause investors to seek the safety of US Treasury bonds, increasing demand and potentially lowering yields. This "flight to safety" phenomenon can create short-term volatility in the market. Understanding the potential impact of geopolitical events is vital for navigating the complexities of the Treasury market.

Conclusion

The Treasury market's post-April 8th performance has been shaped by several key factors: interest rate adjustments by the Federal Reserve, inflationary pressures reflected in CPI and PPI data, and overarching economic forecasts influenced by geopolitical events. Understanding the interplay of these elements is crucial for investors. Key takeaways include the significant influence of the Federal Reserve's actions, the importance of monitoring inflation data, and the need to consider both domestic and global economic conditions when analyzing the Treasury market. Stay informed about the evolving Treasury market landscape and learn more about investment strategies for navigating this dynamic environment. Continue your research on the Treasury market to make informed investment decisions.

Featured Posts

-

Ambanis Reliance Beats Expectations Implications For Indian Large Cap Market

Apr 29, 2025

Ambanis Reliance Beats Expectations Implications For Indian Large Cap Market

Apr 29, 2025 -

La Garantia De Gol Entrenamiento Con Alberto Ardila Olivares

Apr 29, 2025

La Garantia De Gol Entrenamiento Con Alberto Ardila Olivares

Apr 29, 2025 -

Confirmation North Korean Troops Deployed To Russia In Ukraine War

Apr 29, 2025

Confirmation North Korean Troops Deployed To Russia In Ukraine War

Apr 29, 2025 -

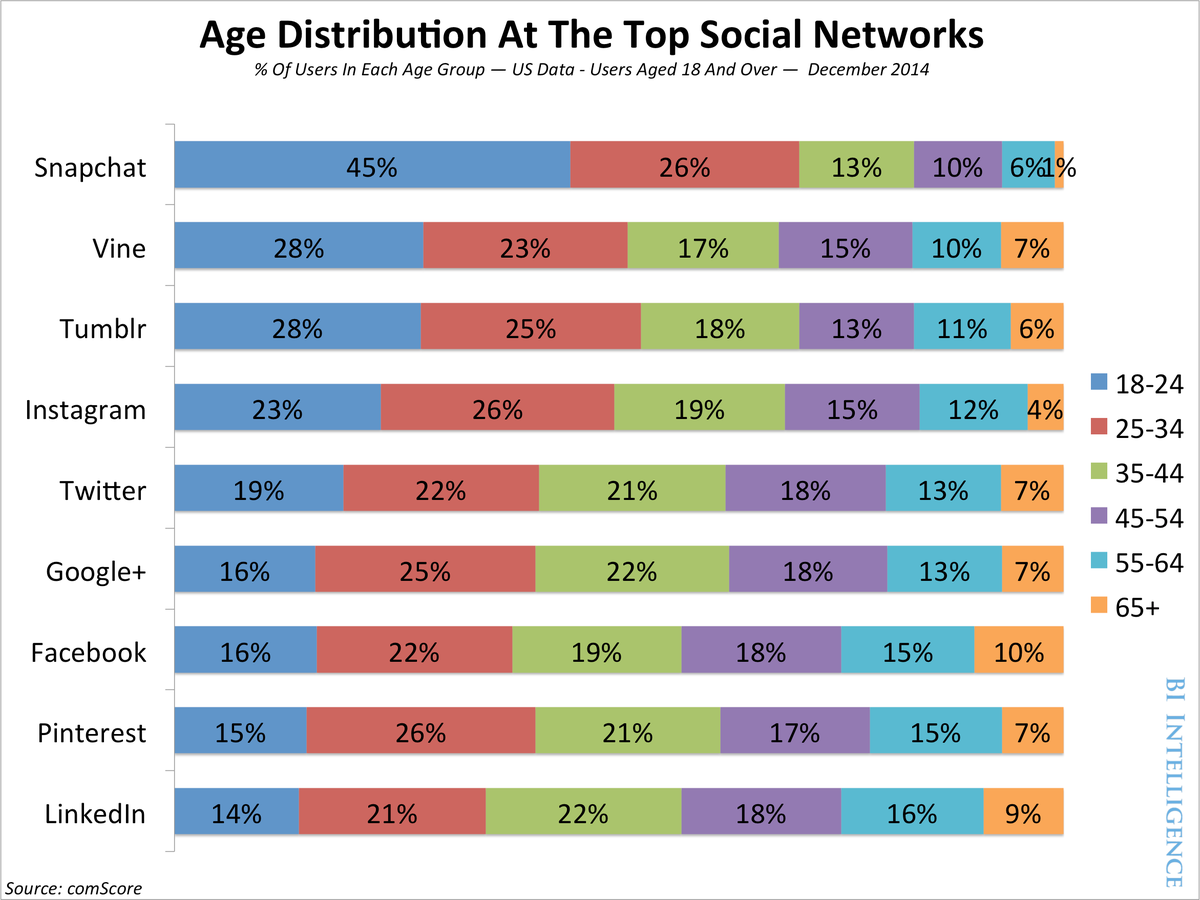

How You Tube Is Attracting A Mature Audience Nostalgia And New Content

Apr 29, 2025

How You Tube Is Attracting A Mature Audience Nostalgia And New Content

Apr 29, 2025 -

The Rise Of You Tube Among Older Demographics Nostalgia And New Discoveries

Apr 29, 2025

The Rise Of You Tube Among Older Demographics Nostalgia And New Discoveries

Apr 29, 2025

Latest Posts

-

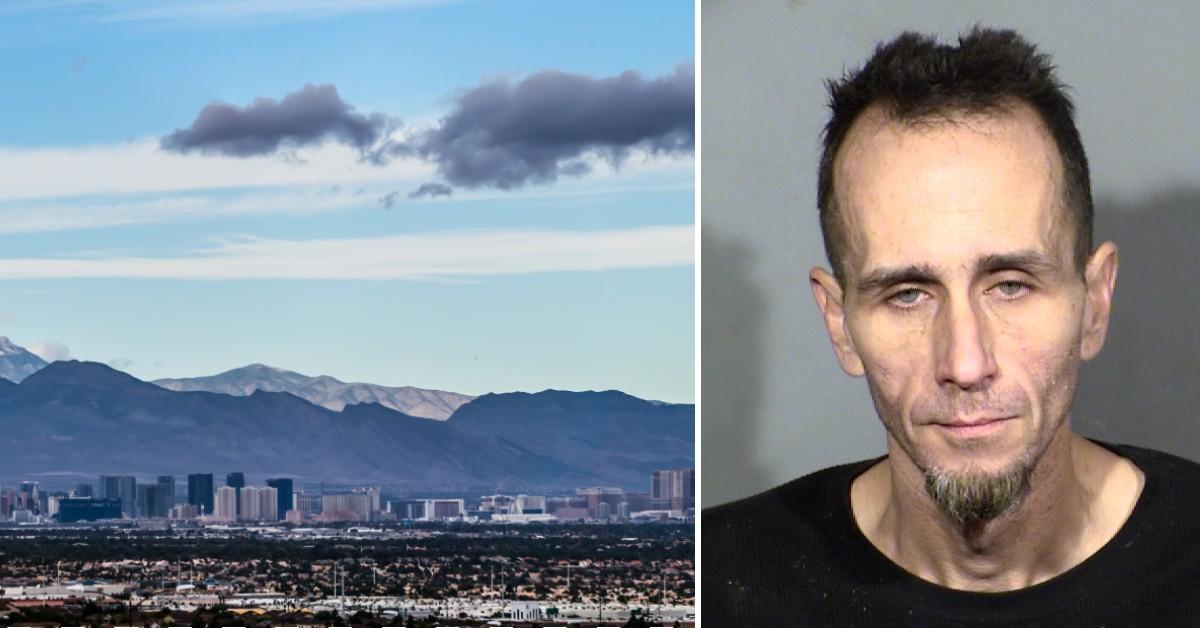

Fears Grow For Missing Midland Athlete In Las Vegas

Apr 29, 2025

Fears Grow For Missing Midland Athlete In Las Vegas

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Rights

Apr 29, 2025 -

Paralympians Safe Return After Wrestle Mania Absence

Apr 29, 2025

Paralympians Safe Return After Wrestle Mania Absence

Apr 29, 2025 -

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025

Convicted Cardinal Claims Entitlement To Vote In Next Papal Election

Apr 29, 2025 -

Missing Brit Paralympian Located Following Wrestle Mania Disappearance

Apr 29, 2025

Missing Brit Paralympian Located Following Wrestle Mania Disappearance

Apr 29, 2025