Understanding Today's Personal Loan Interest Rates: A Guide To Finding The Best Deal

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors significantly impact the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate.

-

Credit Score: Your credit score is the most crucial factor. Lenders use your credit history, reflected in your FICO score and credit report, to assess your creditworthiness. A higher credit score (generally above 700) typically qualifies you for significantly lower interest rates, while a lower score (below 600) often results in much higher rates. Excellent credit can unlock rates as low as 6%, while poor credit might lead to rates exceeding 30%.

-

Loan Amount: The amount you borrow influences your interest rate. While some lenders offer lower rates on larger loans due to economies of scale, others may charge higher rates to compensate for increased risk. It's vital to compare offers from multiple lenders across different loan amounts to find the best deal.

-

Loan Term: The repayment period (loan duration) also plays a role. Shorter-term loans typically command higher interest rates because of the increased risk for lenders. Conversely, longer-term loans often come with lower monthly payments but may result in paying more interest overall.

-

Debt-to-Income Ratio (DTI): Your DTI, calculated by dividing your monthly debt payments by your gross monthly income, reflects your ability to manage debt. A high DTI indicates a higher risk for lenders, leading to higher interest rates. For example, a DTI above 43% might make it harder to secure a favorable rate.

-

Type of Lender: Different lenders offer varying interest rates. Banks often have more stringent requirements but may offer competitive rates for qualified borrowers. Credit unions, known for their member-focused approach, might offer slightly better rates. Online lenders provide convenience but may have higher rates or less transparent fees. Carefully compare "bank loans," "credit union loans," and offers from reputable "online lenders."

How to Find the Best Personal Loan Interest Rates

Finding the best personal loan interest rates requires proactive steps and careful comparison.

-

Check Your Credit Report: Before applying, review your credit report from all three major bureaus (Equifax, Experian, and TransUnion) for errors. Correcting errors can significantly improve your score and eligibility for better rates.

-

Compare Multiple Lenders: Don't settle for the first offer. Compare offers from several banks, credit unions, and online lenders, focusing on the Annual Percentage Rate (APR). The APR reflects the total cost of borrowing, including interest and fees.

-

Negotiate Interest Rates: Don't be afraid to negotiate. Highlight your positive credit history and financial stability to potentially secure a lower rate. Having pre-approval offers from other lenders strengthens your negotiating position.

-

Consider Pre-qualification: Pre-qualification allows you to see what rates you qualify for without affecting your credit score. This helps you refine your search and focus on lenders offering competitive terms.

-

Read the Fine Print: Carefully review loan agreements for hidden fees such as origination fees, late payment penalties, and prepayment penalties. These fees can significantly increase your total loan cost. Always understand the "APR," "fees," and "charges" outlined in the loan agreement.

Understanding APR and Other Loan Costs

The Annual Percentage Rate (APR) is the annual interest rate you'll pay on the loan, expressed as a percentage. The APR calculation includes interest and most fees, providing a comprehensive picture of the total borrowing cost.

Beyond the APR, other loan costs can significantly impact the total loan cost. Origination fees are upfront charges for processing the loan. Late payment fees apply when you miss payments, and prepayment penalties may be charged if you pay off the loan early. For example, a $10,000 loan with a 10% APR and a $500 origination fee will cost more than a loan with the same APR but no origination fee. Understanding these "loan fees" and "hidden costs" is crucial for making informed decisions.

Protecting Yourself from Predatory Lending

Predatory lending involves unfair or abusive loan practices, often targeting vulnerable borrowers. These "predatory lenders" may charge excessively high interest rates, obscure fees, and use aggressive tactics.

-

Identify Red Flags: Be wary of lenders who pressure you into quick decisions, don't clearly explain terms, or offer loans with excessively high interest rates.

-

Avoid High-Interest Loans: Extremely high interest rates are a hallmark of predatory lending. Research average rates to identify outliers.

-

Report Suspicious Activity: If you suspect you're a victim of predatory lending, report it to your state's attorney general or the Consumer Financial Protection Bureau (CFPB).

Conclusion

Securing the best personal loan interest rates requires understanding the factors influencing rates and employing smart strategies. By checking your credit report, comparing multiple lenders, negotiating terms, and reading the fine print, you can find the most favorable loan for your financial situation. Remember to be wary of "predatory lenders" and focus on comparing the "APR" across various offers. Even with less-than-perfect credit, you can still find a reasonable loan— it’s just about comparing "personal loan rates" diligently and strategically to secure the best possible deal. Compare personal loan interest rates today and find the option that best suits your needs.

Featured Posts

-

Man Utds Garnacho Lyon Star Highlights Amorims Influence On His Struggles

May 28, 2025

Man Utds Garnacho Lyon Star Highlights Amorims Influence On His Struggles

May 28, 2025 -

How Ajax Blew The League A Detailed Analysis Of Nine Costly Points

May 28, 2025

How Ajax Blew The League A Detailed Analysis Of Nine Costly Points

May 28, 2025 -

Samsung Galaxy S25 256 Go Top Produit A 775 E Notre Analyse

May 28, 2025

Samsung Galaxy S25 256 Go Top Produit A 775 E Notre Analyse

May 28, 2025 -

Ranking Mlb Starting Left Fielders For 2025 A Comprehensive Preview

May 28, 2025

Ranking Mlb Starting Left Fielders For 2025 A Comprehensive Preview

May 28, 2025 -

French Open Update Alcaraz And Swiateks Winning Starts

May 28, 2025

French Open Update Alcaraz And Swiateks Winning Starts

May 28, 2025

Latest Posts

-

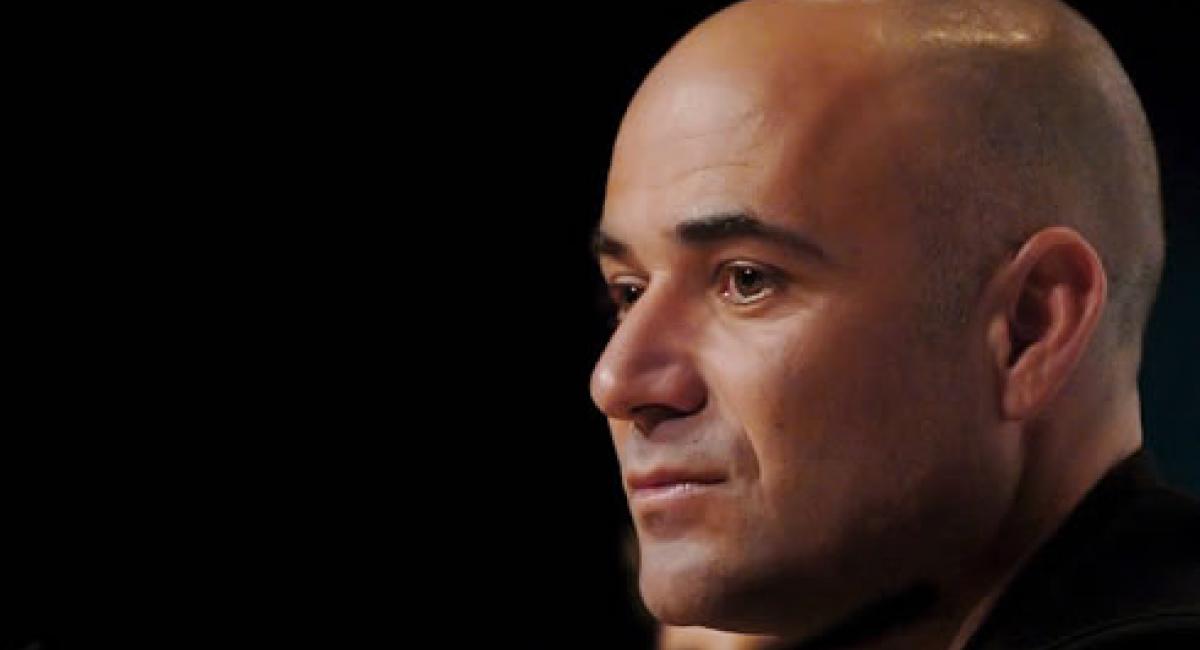

De La Pista Al Campo La Sorprendente Nueva Carrera De Andre Agassi

May 30, 2025

De La Pista Al Campo La Sorprendente Nueva Carrera De Andre Agassi

May 30, 2025 -

Un Tenista Argentino Arremete Contra Rios Un Dios Del Tenis

May 30, 2025

Un Tenista Argentino Arremete Contra Rios Un Dios Del Tenis

May 30, 2025 -

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025

El Regreso De Andre Agassi Mas Alla Del Tenis

May 30, 2025 -

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025

Erfolg Im Pickleball Die Methoden Von Steffi Graf Und Andre Agassi

May 30, 2025 -

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025

El Chino Rios Revelaciones De Un Tenista Argentino Sobre Una Leyenda

May 30, 2025