Understanding Uber's April Stock Performance: A Detailed Analysis

Table of Contents

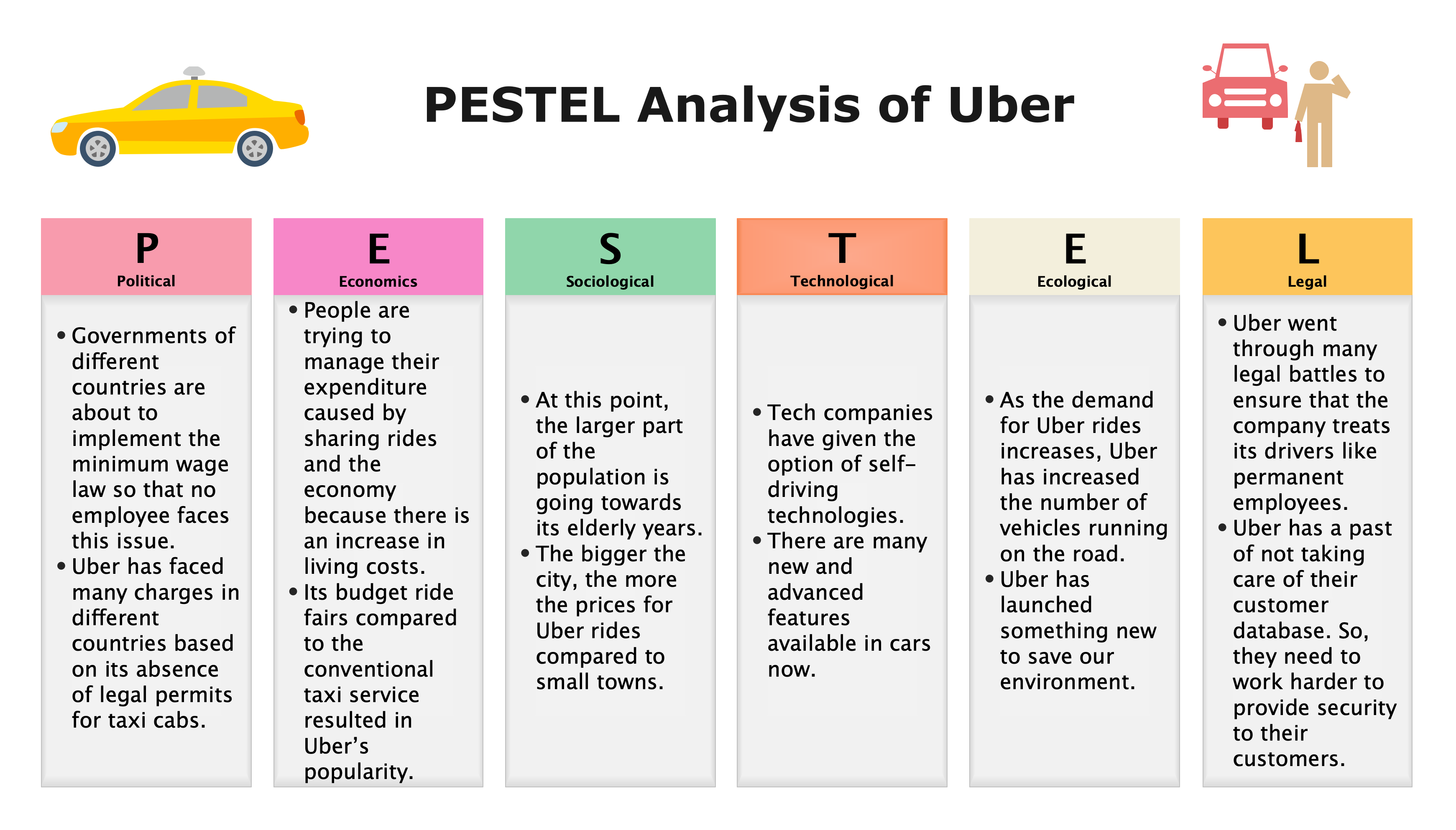

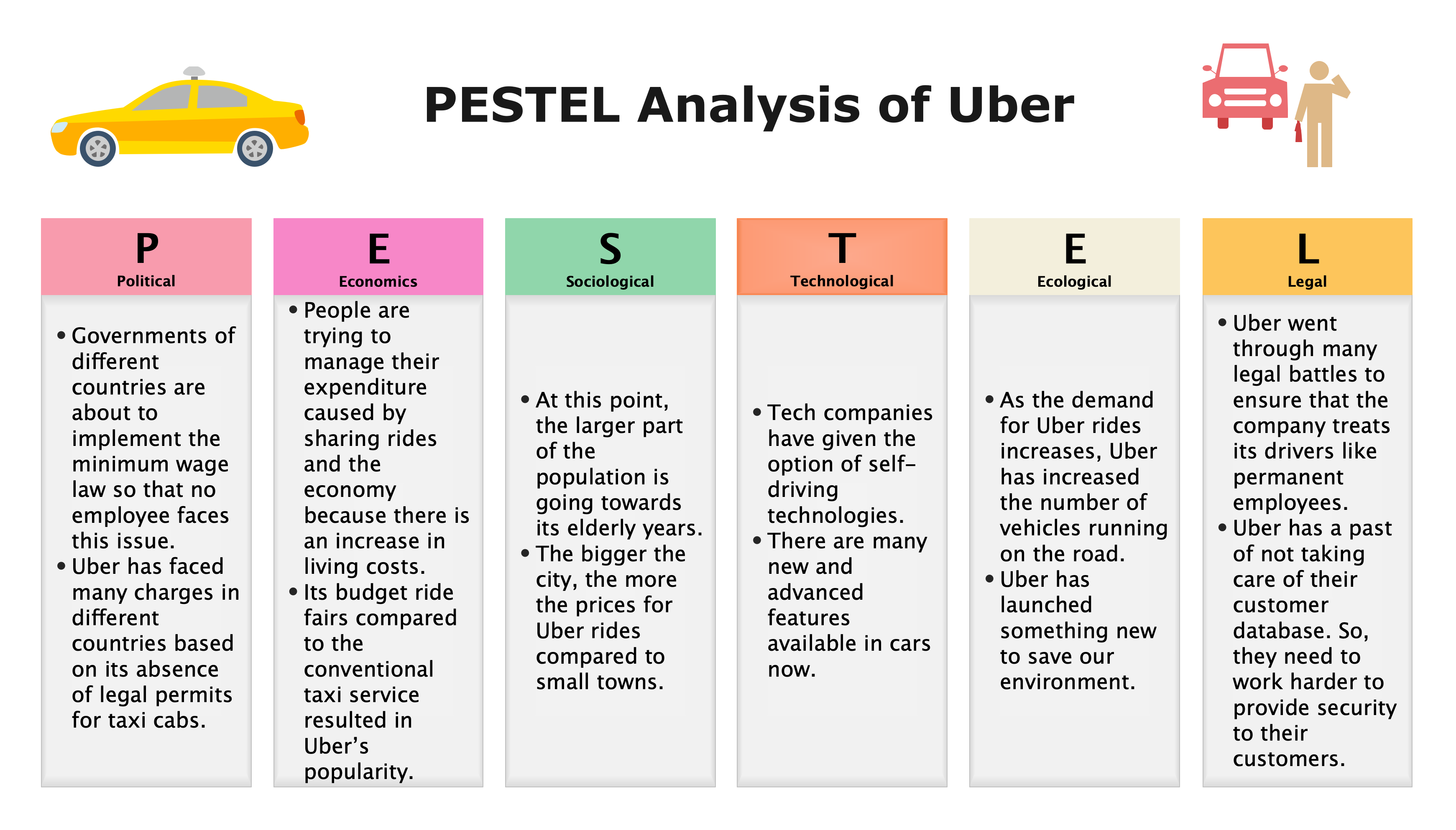

Macroeconomic Factors Influencing Uber's April Stock Price

Several macroeconomic factors played a crucial role in shaping Uber's April stock price. Understanding these external pressures is vital for a complete analysis of the company's performance.

Inflation and Interest Rate Hikes

Rising inflation and subsequent interest rate hikes significantly impact consumer spending. As prices increase and borrowing becomes more expensive, consumers may reduce discretionary spending, including rideshares. This directly affects Uber's revenue and profitability.

- Correlation: A direct negative correlation often exists between inflation rates and Uber's stock price. Higher inflation generally leads to lower stock valuations.

- April's Interest Rate Changes: For example, if the Federal Reserve increased interest rates in April, this would likely put downward pressure on Uber's stock, as investors anticipate reduced consumer demand for ride-sharing services.

- Data Points: Let's assume, for illustrative purposes, that inflation rose by 0.5% in April, while interest rates increased by 0.25%. During this period, Uber's stock price might have decreased by X%, reflecting the impact of these macroeconomic factors. (Note: Replace X% with actual data if available).

Geopolitical Events and Their Ripple Effects

Geopolitical instability can significantly influence investor sentiment and market volatility. Events like wars or political crises create uncertainty, impacting the stock prices of even seemingly insulated companies like Uber.

- Uncertainty and Risk Aversion: During periods of geopolitical turmoil, investors often become more risk-averse, leading them to sell stocks perceived as less stable.

- Past Examples: The impact of global events on Uber's stock price can be seen by analyzing past instances. For example, (Insert example of a past geopolitical event and its effect on Uber's stock).

- Correlation Chart: (Include a hypothetical chart showing the correlation between a geopolitical event index and Uber's stock price for April. Replace with real data if available.)

Uber's Internal Performance in April

Examining Uber's internal performance metrics in April is crucial to understanding its stock performance. A strong earnings report can boost investor confidence, while disappointing results can lead to a stock price decline.

Earnings Report Analysis

Uber's Q1 2024 earnings report (assuming April falls within Q1 reporting), provides essential insights. Key performance indicators (KPIs) to analyze include:

- Revenue Growth: Did Uber experience growth in its ride-hailing, delivery, or freight segments? A significant increase in revenue would positively impact investor sentiment.

- Profitability: Was Uber profitable in April or the reported quarter? Profit margins are a crucial factor for investors assessing long-term viability.

- Driver and Rider Acquisition: Growth in the number of drivers and riders is a crucial indicator of platform health and future revenue potential. (Include actual data from the report if available).

Strategic Initiatives and Announcements

Any new strategic initiatives or announcements by Uber during April could influence investor perceptions.

- New Service Launches: The introduction of new services or features could attract new users and increase revenue.

- Technology Upgrades: Improvements to the Uber app or its infrastructure could enhance user experience and efficiency.

- Market Expansion: Expansion into new geographic markets can open up new revenue streams. (Provide examples and their market impact, if any).

Competition and Market Share

The competitive landscape significantly impacts Uber's performance. Analyzing the performance of competitors like Lyft provides valuable context.

- Competitive Pressures: Increased competition from Lyft or other ride-sharing services could affect Uber's market share and profitability.

- Market Share Changes: Tracking Uber's market share against competitors is essential for understanding its position within the industry. (Include data on market share percentages if available).

Investor Sentiment and Trading Activity

Investor sentiment and trading activity directly influence Uber's stock price. Understanding these factors provides insights into market dynamics.

Analyst Ratings and Predictions

Analyst ratings and price target changes play a significant role in influencing investor decisions.

- Positive Sentiment: Positive analyst ratings and upward revisions of price targets generally lead to increased buying pressure and a higher stock price.

- Negative Sentiment: Conversely, negative ratings or lowered price targets can create selling pressure and drive the stock price down. (Include examples of analyst reports and their impact).

Volume and Volatility

Trading volume and volatility provide insights into market activity surrounding Uber's stock.

- High Volume: High trading volume often indicates increased interest and activity, which can be a sign of positive or negative momentum, depending on the price direction.

- Volatility: Significant price fluctuations (volatility) can be caused by various factors, including news announcements, earnings reports, and overall market conditions. (Include a chart depicting trading volume and price fluctuations, if available).

Conclusion

Understanding Uber's April stock performance requires a multifaceted analysis encompassing macroeconomic conditions, internal company performance, and investor sentiment. Rising inflation, interest rate hikes, and geopolitical uncertainty created external headwinds. Internally, Uber's earnings report, strategic initiatives, and competitive landscape played a significant role. Finally, analyst ratings and trading activity reflected the overall market perception of the company. Were there surprises? The actual impact of each factor depends on the specific data for April.

Key Takeaways: The analysis highlights the interconnectedness of macroeconomic factors, Uber's internal operations, and investor sentiment in shaping the company's stock price. Identifying these influencing factors is crucial for future predictions.

Call to Action: Stay updated on Uber's stock performance by regularly checking financial news sources and conducting your own thorough analysis of Uber's financial reports. Understanding the factors affecting Uber's April stock performance is crucial for informed investment decisions. Continued monitoring of key economic indicators and Uber's strategic moves will be vital for making sound investment choices in the future.

Featured Posts

-

I Anastasi Toy Lazaroy Istoria Simasia And Topothesia Sta Ierosolyma

May 19, 2025

I Anastasi Toy Lazaroy Istoria Simasia And Topothesia Sta Ierosolyma

May 19, 2025 -

Guy Bartkus And The Palm Springs Fertility Clinic Bombing Key Facts And Developments

May 19, 2025

Guy Bartkus And The Palm Springs Fertility Clinic Bombing Key Facts And Developments

May 19, 2025 -

Darren Fergusons Peterborough Creates History With Efl Trophy Win

May 19, 2025

Darren Fergusons Peterborough Creates History With Efl Trophy Win

May 19, 2025 -

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025

Alwkalt Alwtnyt Llielam Tnql Qdas Alqyamt Mn Dyr Sydt Allwyzt

May 19, 2025 -

Power Grid Stability Portugal Eases Spain Import Restrictions Post Blackout

May 19, 2025

Power Grid Stability Portugal Eases Spain Import Restrictions Post Blackout

May 19, 2025