Understanding Westpac's (WBC) Profit Decline: A Deep Dive

Table of Contents

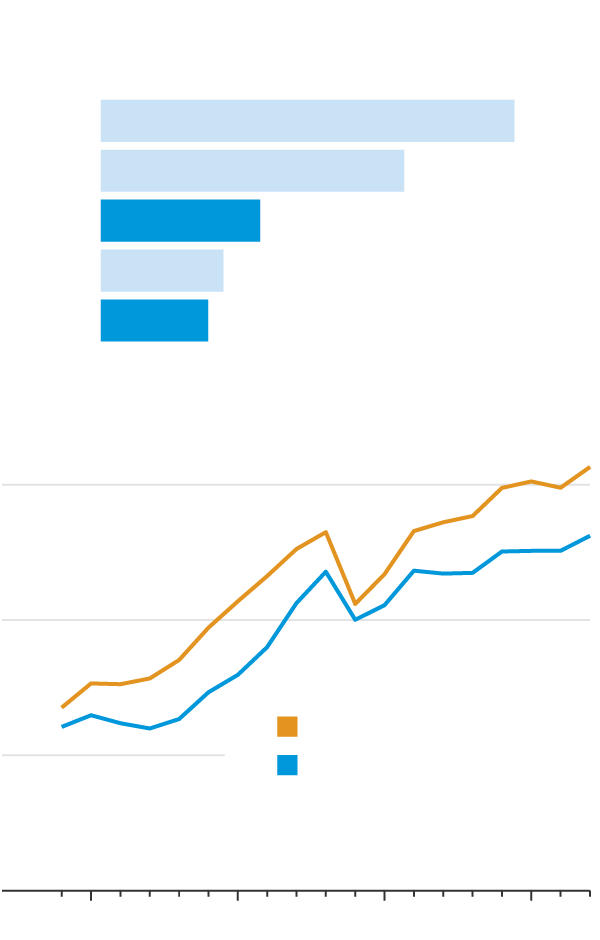

Increased Competition in the Australian Banking Sector

The Australian banking sector is experiencing a period of intense competition. Westpac faces significant pressure not only from other major banks like the Commonwealth Bank and ANZ, but also from the rapid rise of innovative fintech companies. This heightened competitive landscape is significantly impacting Westpac's market share and forcing adjustments to its pricing strategies.

- Loss of Market Share: Aggressive campaigns and attractive offerings from competitors are leading to a gradual erosion of Westpac's market dominance. The bank has seen a noticeable shift in customer preference towards rival institutions.

- Pressure on Net Interest Margins: The need to remain competitive has forced Westpac to lower its lending rates, squeezing its net interest margin – the difference between the interest it earns on loans and the interest it pays on deposits. This directly impacts profitability.

- Increased Investment in Technology: To stay relevant and compete with agile fintech firms offering innovative digital banking solutions, Westpac is forced to invest heavily in upgrading its technology infrastructure and developing new digital products. This represents a significant financial burden.

Impact of Rising Interest Rates on Westpac's Profitability

The Reserve Bank of Australia's (RBA) recent series of interest rate hikes have significantly impacted Westpac's profitability. While higher rates generally boost net interest income, the complexities are far-reaching.

- Increased Cost of Funds: Rising interest rates increase the cost of funds for Westpac, as it has to pay more to attract deposits and borrow money in the wholesale markets.

- Impact on Loan Demand: Higher interest rates can dampen loan demand, particularly in sectors sensitive to interest rate fluctuations, such as housing. This can affect revenue generation.

- Potential for Increased Loan Defaults: Higher interest rates increase the risk of loan defaults, as borrowers may struggle to manage their repayments. This can lead to significant losses for the bank. The management of potential loan defaults is crucial to mitigate losses during this period of rising interest rates and its impact on Westpac net interest income.

Regulatory Changes and Increased Compliance Costs

The Australian banking sector is subject to stringent regulations designed to enhance stability and consumer protection. These regulations, while necessary, increase compliance costs for institutions like Westpac.

- Increased Capital Requirements: Stricter capital adequacy ratios necessitate Westpac to hold more capital, reducing funds available for lending and investment.

- Higher Compliance Costs: Meeting the demands of numerous regulatory bodies like the Australian Prudential Regulation Authority (APRA) requires significant investment in compliance infrastructure and personnel.

- Impact of Fines and Penalties: Failure to comply with regulations can result in substantial fines and penalties, directly impacting Westpac's profitability and overall financial health. This adds pressure to efficiently manage regulatory compliance.

Operational Inefficiencies and Cost Management Challenges

Westpac faces challenges in optimizing its operational efficiency and managing costs effectively. A leaner and more agile organization is needed to thrive in the competitive environment.

- Overheads and Staffing Costs: Reviewing operational overheads and staffing levels is crucial for cost optimization. This may involve restructuring and streamlining operations.

- Technology Investments and Upgrades: While necessary, technology investments represent significant upfront costs. Strategic planning to maximize the return on these investments is critical.

- Branch Network Optimization Strategies: Maintaining a large branch network is expensive. Strategies like branch closures or consolidation can reduce costs, but require careful consideration of customer convenience. Westpac cost cutting measures are likely to be a focus going forward.

Conclusion: Understanding Westpac's (WBC) Profit Decline – Key Takeaways and Future Outlook

Westpac's profit decline is a multifaceted issue stemming from increased competition in the Australian banking sector, the impact of rising interest rates, increased regulatory burdens, and the need for improved operational efficiency. Understanding these factors is essential for assessing Westpac's future prospects. The bank's ability to adapt to these challenges, including strategically managing costs and capital, will significantly influence its future financial performance.

Understanding Westpac's (WBC) profit decline requires continuous monitoring of the economic landscape and regulatory changes. Stay informed about Westpac's strategic responses to these challenges by following financial news and conducting further research on Westpac stock performance and the broader Australian banking sector analysis.

Featured Posts

-

Pratt Comments On Schwarzeneggers White Lotus Performance

May 06, 2025

Pratt Comments On Schwarzeneggers White Lotus Performance

May 06, 2025 -

Democratic Party In Fighting Tensions Rise Over Older Lawmakers

May 06, 2025

Democratic Party In Fighting Tensions Rise Over Older Lawmakers

May 06, 2025 -

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025 -

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025 -

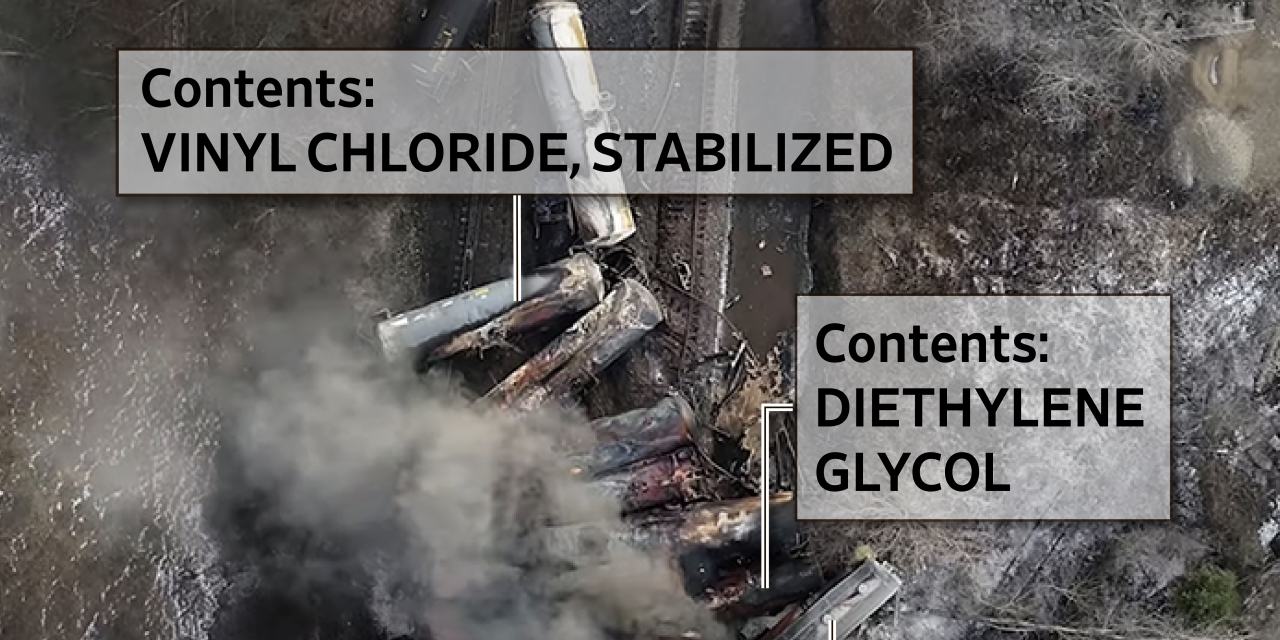

Investigation Into Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 06, 2025

Investigation Into Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 06, 2025

Latest Posts

-

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025

Joseph Baena A Fitneszvilag Feltoerekvo Csillaga Arnold Schwarzenegger Fia

May 06, 2025 -

Schwarzenegger Family Arnolds Take On Patricks Nude Photos

May 06, 2025

Schwarzenegger Family Arnolds Take On Patricks Nude Photos

May 06, 2025 -

Arnold Schwarzenegger Bueszke Lehet Joseph Baenara

May 06, 2025

Arnold Schwarzenegger Bueszke Lehet Joseph Baenara

May 06, 2025 -

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025

Arnold Schwarzenegger On Patrick Schwarzeneggers Nude Photography

May 06, 2025 -

Fotosessiya Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Fotosessiya Patrika Shvartseneggera I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025