Unlocking Maximum Profits: The Simplicity Of High-Yield Dividend Investing

Table of Contents

Understanding High-Yield Dividend Investing

High-yield dividend investing involves selecting stocks that pay out a significant portion of their earnings as dividends to shareholders. A "high yield" is generally considered to be above the average dividend yield of the overall market, though this benchmark can fluctuate. Understanding the core principles is crucial for success.

Advantages of High-Yield Dividend Investing:

- Consistent Income Stream: Dividend payments provide a predictable cash flow, offering a reliable source of income regardless of market fluctuations. This is particularly attractive for retirees or those seeking supplemental income.

- Potential for Capital Appreciation: While dividend income is a key benefit, high-yield dividend stocks can also appreciate in value over time, leading to capital gains. This dual potential for growth enhances long-term returns.

- Lower Volatility Compared to Growth Stocks: Historically, high-yield dividend stocks have exhibited lower volatility than growth stocks, offering a more stable investment option during market downturns. This stability makes them attractive for risk-averse investors.

- Tax Advantages (in some jurisdictions): Depending on your location and tax laws, qualified dividend income may be taxed at a lower rate than ordinary income, providing a potential tax benefit. Consult a tax professional for personalized advice.

Risks of High-Yield Dividend Investing:

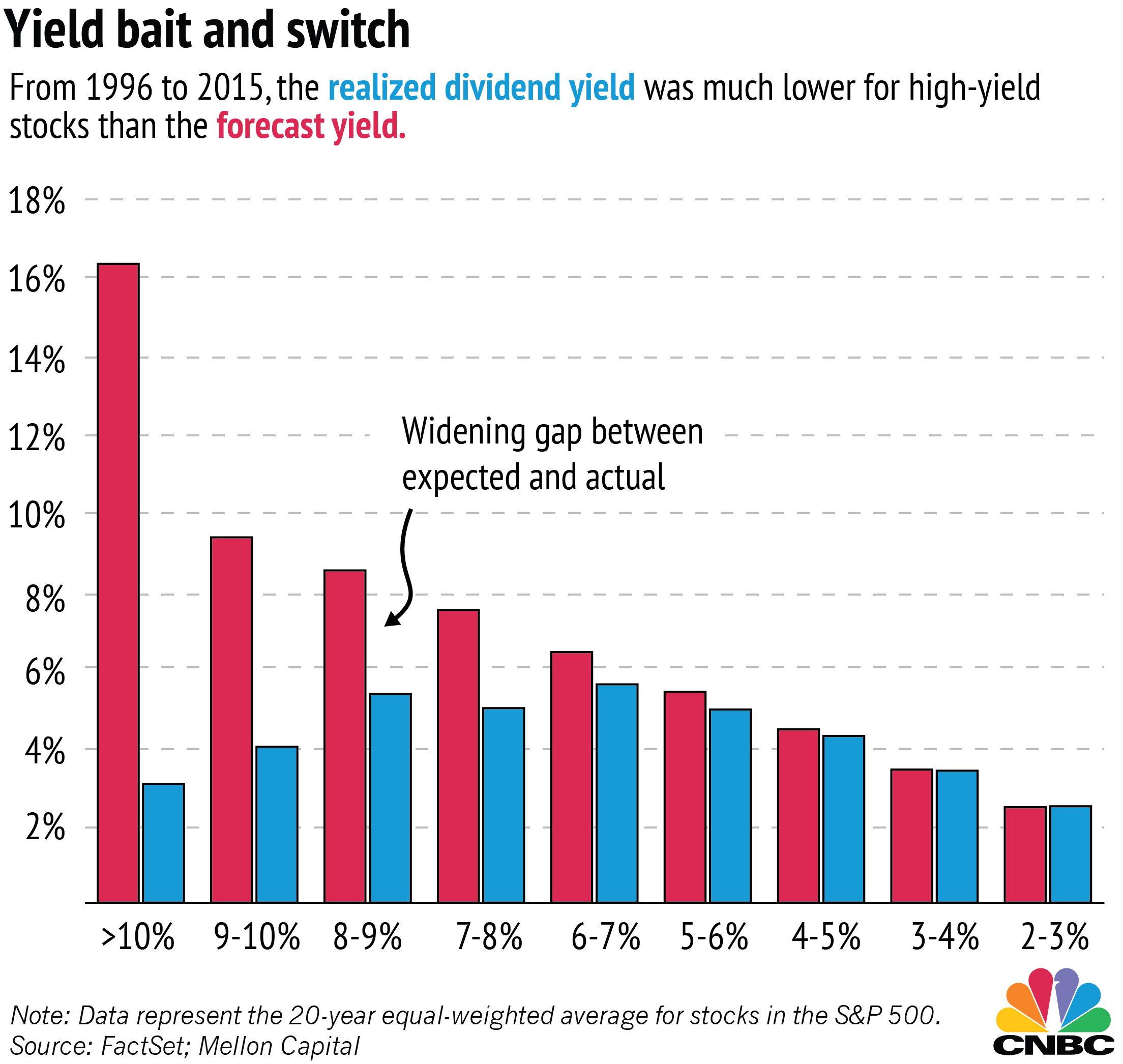

- Dividend Cuts: Companies may reduce or eliminate dividend payments due to financial difficulties or changes in business strategy. This risk necessitates careful due diligence on the financial health of the companies you invest in.

- Market Fluctuations: Even high-yield dividend stocks are susceptible to market downturns. While generally less volatile than growth stocks, their prices can still decline.

- Company-Specific Risks: Investing in individual companies carries inherent risk. Poor management, industry disruptions, or unforeseen events can negatively impact a company's performance and its ability to pay dividends.

Identifying High-Yield Dividend Stocks

Finding suitable high-yield dividend stocks requires a systematic approach. Here are some key screening strategies:

Screening Strategies:

- Dividend Yield Percentage: This is the annual dividend payment divided by the stock price. A higher percentage generally indicates a higher yield, but it's crucial to consider other factors as well.

- Dividend Growth History: A consistent history of dividend increases suggests a company's commitment to returning value to shareholders. Look for companies with a track record of growing their dividends year over year.

- Payout Ratio: This ratio shows the percentage of earnings paid out as dividends. A sustainable payout ratio (typically below 70%) indicates a company's ability to continue paying dividends without jeopardizing its financial health.

- Financial Strength: Analyze a company's financial statements (balance sheet, income statement, cash flow statement) to assess its financial health, debt levels, and profitability.

Resources for Finding High-Yield Stocks:

Several reputable resources can help you find high-yield dividend stocks. These include:

- Major financial websites (e.g., Yahoo Finance, Google Finance)

- Brokerage platforms (many offer screening tools)

- Financial news outlets (e.g., Bloomberg, The Wall Street Journal)

Building a Diversified High-Yield Dividend Portfolio

A well-diversified portfolio is crucial to mitigating risk in high-yield dividend investing. Here's how to build one:

Diversification Strategy:

- Spread your investments across different sectors (e.g., healthcare, technology, consumer goods) and companies to reduce the impact of any single company's underperformance.

- Consider geographical diversification by investing in companies from different countries.

Asset Allocation:

- Determine your risk tolerance and investment goals. A higher risk tolerance may allow for a larger allocation to higher-yield, potentially more volatile stocks.

- Adjust your asset allocation based on your age and time horizon.

Re-Investment Strategy:

- Consider a dividend reinvestment plan (DRIP) to automatically reinvest your dividend payments to purchase more shares. This strategy leverages the power of compounding to accelerate your wealth growth.

Portfolio Monitoring and Adjustment:

- Regularly monitor your portfolio's performance, paying attention to changes in dividend yields, payout ratios, and company fundamentals.

- Adjust your holdings as needed, selling underperforming stocks and reinvesting in more promising opportunities.

Minimizing Risks in High-Yield Dividend Investing

To minimize risks, remember these key strategies:

- Thorough Due Diligence: Conduct comprehensive research on each company before investing, understanding its business model, financial health, and competitive landscape.

- Diversification: Reiterate the crucial role of diversification in mitigating risk. Don't put all your eggs in one basket.

- Long-Term Perspective: High-yield dividend investing is a long-term strategy. Don't panic sell during short-term market fluctuations.

- Professional Advice: Consider consulting a qualified financial advisor for personalized guidance tailored to your circumstances.

Conclusion

Unlocking maximum profits from your investments doesn't have to be complicated. High-yield dividend investing offers a surprisingly simple yet powerful strategy for generating consistent income and building long-term wealth. By understanding the principles outlined above, identifying strong dividend-paying stocks, and building a diversified portfolio, you can harness the potential of high-yield dividend investing and achieve your financial goals. Start building your high-yield dividend portfolio today and experience the simplicity and rewards of this effective investment strategy!

Featured Posts

-

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 11, 2025

Fremont Firefighter Honored At National Fallen Firefighters Memorial Weekend

May 11, 2025 -

Mtv Movie And Tv Awards No Show In 2025 Reasons And Future Outlook

May 11, 2025

Mtv Movie And Tv Awards No Show In 2025 Reasons And Future Outlook

May 11, 2025 -

The Hertha Bsc Crisis Boateng And Kruses Conflicting Views

May 11, 2025

The Hertha Bsc Crisis Boateng And Kruses Conflicting Views

May 11, 2025 -

Ncaa Softball History Tennessee Pitcher Karlyn Pickens Throws 78 2 Mph Fastball

May 11, 2025

Ncaa Softball History Tennessee Pitcher Karlyn Pickens Throws 78 2 Mph Fastball

May 11, 2025 -

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Deres Innvirkning

May 11, 2025

Virginia Giuffre Skandalen En Analyse Av Hendelsene Og Deres Innvirkning

May 11, 2025