US$9 Billion Parkland Acquisition: June Shareholder Vote To Decide Fate

Table of Contents

The Proposed Acquisition: A Deep Dive into the Details

Who are the Parties Involved?

The proposed acquisition involves Parkland Health & Wellness Corp., a leading Canadian medical marijuana producer and distributor, and [Insert Name of Acquiring Company Here], a [brief description of the acquiring company, e.g., multinational pharmaceutical company, large investment firm, etc.]. [Insert a brief background on the acquiring company, focusing on its relevance to the cannabis industry and its financial strength.] This acquisition represents a significant strategic move for both parties, with potentially far-reaching implications for the future of the medical marijuana market.

Financial Implications of the $9 Billion Deal

This $9 billion acquisition is a substantial undertaking with significant financial implications.

- Estimated Valuation of Parkland: [Insert estimated valuation of Parkland based on reliable sources. Example: Based on pre-deal market analysis, Parkland's valuation is estimated at X billion dollars.]

- Financing Mechanisms: The acquisition is likely to be financed through a combination of [Specify financing mechanisms, e.g., cash, debt financing, stock issuance. Cite sources if available.]

- Potential Synergies: The merger is expected to create significant synergies through [List potential synergies, e.g., economies of scale, access to new markets, combined research and development capabilities.]

- Projected Returns on Investment: Analysts predict a [Insert projected ROI, e.g., positive ROI within X years, based on projected revenue growth and cost synergies.] [Cite sources for these projections, if available.]

The Strategic Rationale Behind the Acquisition

The strategic rationale behind this $9 billion acquisition centers around several key objectives:

- Market Expansion: [Name of Acquiring Company] aims to significantly expand its presence in the rapidly growing Canadian medical marijuana market by acquiring Parkland's established distribution network and customer base.

- Diversification: The acquisition allows [Name of Acquiring Company] to diversify its portfolio and reduce reliance on existing product lines.

- Increased Market Share: By combining resources and expertise, the merged entity is poised to capture a larger share of the medical marijuana market.

The acquisition offers benefits for both companies. Parkland gains access to [List benefits for Parkland, e.g., substantial capital investment, access to advanced technology, wider distribution network.], while [Name of Acquiring Company] benefits from immediate access to Parkland's established market share and brand recognition.

Key Concerns and Arguments For and Against the Acquisition

Potential Risks and Challenges

Despite the potential benefits, the $9 billion Parkland acquisition also presents several risks:

- Regulatory Hurdles: Navigating the complex regulatory landscape of the medical marijuana industry could pose significant challenges.

- Integration Challenges: Merging two distinct organizations can be complex and disruptive, potentially leading to inefficiencies and integration costs.

- Market Volatility: The cannabis market is volatile, subject to fluctuations in consumer demand and regulatory changes.

- Competition Analysis: Increased competition from other established and emerging players in the medical marijuana industry could impact profitability.

Arguments in Favor of the Acquisition

Proponents of the acquisition highlight several compelling reasons to support the deal:

- Long-Term Growth Potential: The medical marijuana market is expected to experience significant growth, presenting opportunities for substantial long-term returns.

- Increased Market Penetration: The combined entity will enjoy enhanced market penetration and reach.

- Access to New Technologies or Resources: Parkland may gain access to advanced technologies and resources.

- Diversification of Revenue Streams: The acquisition broadens revenue streams, reducing reliance on a single product or market.

Arguments Against the Acquisition

Critics raise several concerns about the acquisition:

- Overvaluation Concerns: Some argue that Parkland's valuation is inflated, leading to an overpayment by the acquiring company.

- Debt Burden: The acquisition may significantly increase the debt burden of the combined entity.

- Integration Risks: The integration process could be fraught with challenges, leading to unforeseen costs and delays.

- Potential for Conflict of Interest: Potential conflicts of interest between the two companies need to be carefully considered.

The June Shareholder Vote: What to Expect

The Voting Process and Timeline

Shareholders will vote on the acquisition during a meeting scheduled for June [Insert Date]. They can cast their votes either in person or through proxy voting. [Insert details about the proxy voting process and deadline.]

Predicting the Outcome

Predicting the outcome of the vote is challenging. Several factors will influence the decision, including:

- Current Market Sentiment: The prevailing market sentiment towards the cannabis industry and the acquisition itself will play a crucial role.

- Analyst Recommendations: Recommendations from financial analysts and investment firms will likely influence shareholder decisions.

- Shareholder Activism: Shareholder activism could impact the outcome, depending on the intensity and direction of the activism.

Post-Vote Scenarios and Implications

The outcome of the vote will have significant implications for both companies, the market, and the broader cannabis industry. A successful vote will lead to [Describe the implications of a successful vote, e.g., the merging of operations, expansion into new markets, etc.]. Conversely, an unsuccessful vote could lead to [Describe the implications of an unsuccessful vote, e.g., a decline in Parkland's stock price, a revised acquisition proposal, or the termination of the deal.].

Conclusion

This US$9 billion Parkland acquisition represents a significant turning point for the cannabis industry. The upcoming June shareholder vote will determine the future direction of Parkland Health & Wellness and will undoubtedly have far-reaching consequences. Understanding the key details and arguments surrounding this acquisition is crucial for investors and stakeholders alike.

Call to Action: Stay informed about the Parkland shareholder vote and its implications for the future of this major medical marijuana acquisition. Follow our updates for the latest news and analysis on this significant $9 billion deal affecting Parkland Health & Wellness Corp. Learn more about the Parkland acquisition and its potential impact.

Featured Posts

-

The Karate Kid Part Iii Comparing It To The Previous Films In The Franchise

May 07, 2025

The Karate Kid Part Iii Comparing It To The Previous Films In The Franchise

May 07, 2025 -

Driver Crashes Vehicle Into Jennifer Anistons Property

May 07, 2025

Driver Crashes Vehicle Into Jennifer Anistons Property

May 07, 2025 -

Xrp Etf Approval Analyzing The Potential For 800 Million In Initial Investment

May 07, 2025

Xrp Etf Approval Analyzing The Potential For 800 Million In Initial Investment

May 07, 2025 -

The Anthony Edwards Baby Mama Saga A Social Media Analysis

May 07, 2025

The Anthony Edwards Baby Mama Saga A Social Media Analysis

May 07, 2025 -

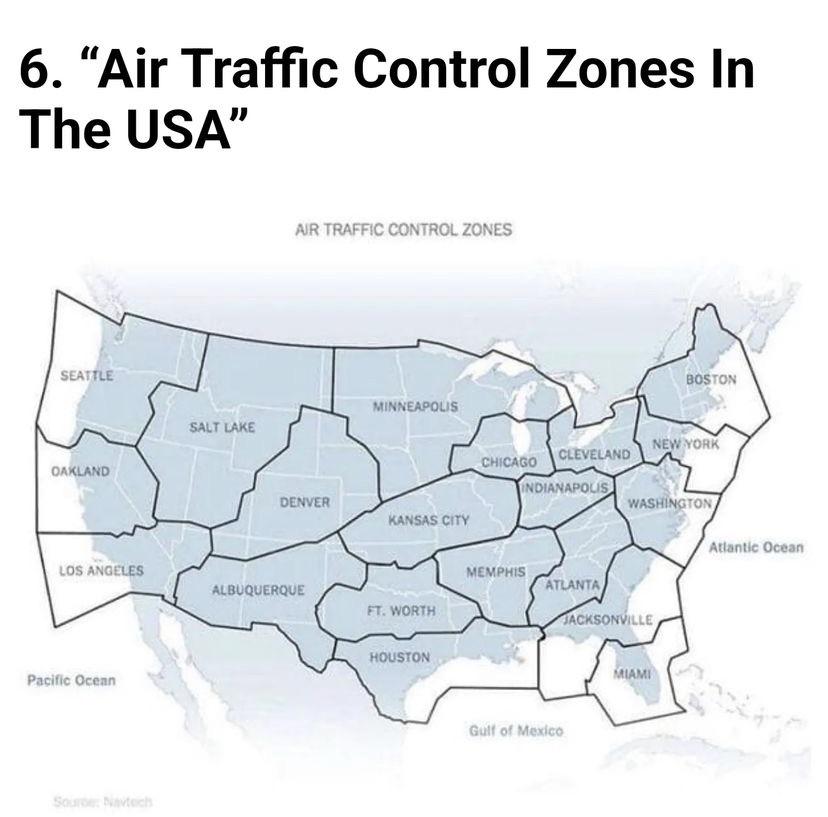

Improving Air Traffic Control Overcoming The I Dont Know Where You Are Challenge

May 07, 2025

Improving Air Traffic Control Overcoming The I Dont Know Where You Are Challenge

May 07, 2025

Latest Posts

-

Ohio Train Derailment Lingering Chemical Contamination In Nearby Buildings

May 08, 2025

Ohio Train Derailment Lingering Chemical Contamination In Nearby Buildings

May 08, 2025 -

Millions Stolen Via Office365 Federal Investigation Into Executive Data Breach

May 08, 2025

Millions Stolen Via Office365 Federal Investigation Into Executive Data Breach

May 08, 2025 -

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months

May 08, 2025

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months

May 08, 2025 -

Crook Accused Of Millions In Office365 Executive Inbox Hacks Federal Case Details

May 08, 2025

Crook Accused Of Millions In Office365 Executive Inbox Hacks Federal Case Details

May 08, 2025 -

Office365 Security Breach Millions In Losses Reported Criminal Charges Filed

May 08, 2025

Office365 Security Breach Millions In Losses Reported Criminal Charges Filed

May 08, 2025