US-China Trade Talks: Will Words Translate To Action? Market Reaction To Be Crucial

Table of Contents

The History of Stalled Negotiations and Broken Promises

The relationship between the US and China has been fraught with trade tensions for years. Past trade agreements, while sometimes presenting short-term relief, have often failed to fully address underlying issues, leading to renewed conflicts and market volatility. This history of broken promises casts a long shadow over current negotiations.

-

Specific Examples: The "Phase One" trade deal, while lauded initially, fell short of addressing many core concerns, particularly regarding intellectual property theft and technology transfer. Subsequent negotiations have yielded mixed results, often resulting in temporary truces rather than lasting solutions.

-

Impact on Market Sentiment: Each instance of stalled negotiations or broken promises has sent shockwaves through global markets. Periods of heightened trade uncertainty have been characterized by increased volatility in stock indices, fluctuations in currency exchange rates, and shifts in commodity prices. Investor confidence has repeatedly taken a hit, leading to cautious investment strategies and hampered economic growth.

-

Market Volatility Data: Studies have shown a direct correlation between escalating trade tensions and increased volatility in key market indices like the S&P 500 and the Shanghai Composite. During periods of heightened uncertainty, investors often move to safer assets, leading to capital flight and decreased investment in riskier ventures.

Key Issues on the Negotiating Table – Beyond Tariffs

While tariffs have dominated headlines, the US-China trade disputes encompass a much broader range of complex issues. These include:

-

Intellectual Property Rights: The US consistently accuses China of intellectual property theft, arguing that Chinese companies systematically infringe on US patents and copyrights, costing American businesses billions of dollars annually. Negotiations aim to strengthen intellectual property protections within China and establish stricter enforcement mechanisms.

-

Technology Transfer: Forced technology transfer, where US companies are pressured to share their technology with Chinese partners as a condition of doing business in China, is another major sticking point. The US seeks to ensure fair competition and prevent the unfair acquisition of American technological know-how.

-

Agricultural Trade: Agricultural trade is a significant component of the US-China trade relationship. The US seeks greater access to the Chinese market for its agricultural products, including soybeans and other agricultural commodities. Reaching a mutually beneficial agreement on agricultural trade is crucial for both economies.

The Role of China's Economic Slowdown

China's economic slowdown is a significant factor influencing its negotiating stance in the current US-China trade talks. The slowing growth rate creates both challenges and opportunities.

-

Impact of Slowing Economy: A slowing Chinese economy might incentivize China to make greater concessions in trade negotiations to stimulate economic growth and attract foreign investment. Conversely, internal economic pressures could also lead to a more assertive negotiating position, prioritizing domestic interests.

-

Potential for Increased Concessions: The need to maintain economic stability and avoid further disruption might push China towards greater compromise on contentious issues like intellectual property rights and technology transfer.

-

Global Economic Climate: The global economic climate significantly impacts the dynamics of these negotiations. A global recession or significant economic downturn could further complicate matters and lead to increased protectionist measures from both sides.

Market Reactions and Indicators to Watch

Monitoring key market indicators is essential for understanding the impact of the US-China trade talks. These indicators offer real-time feedback on market sentiment and expectations:

-

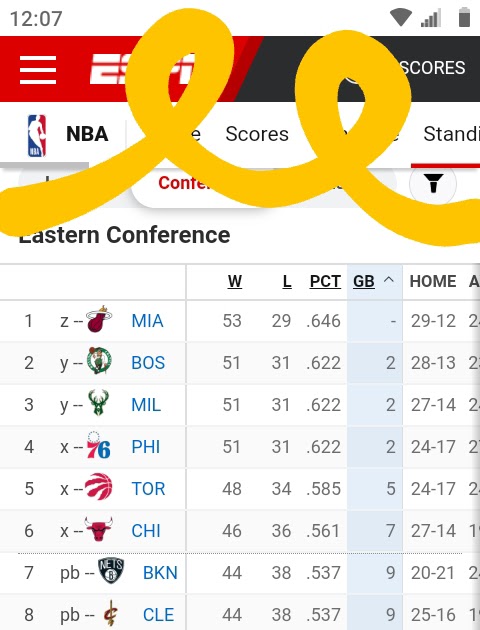

Stock Indices: The S&P 500, Dow Jones Industrial Average, and the Shanghai Composite are among the key indices to watch for volatility and shifts in investor confidence. Positive developments in trade talks are generally associated with increased stock prices, while negative news tends to lead to declines.

-

Currency Exchange Rates: The value of the US dollar relative to the Chinese yuan is a significant indicator. Changes in exchange rates reflect market sentiment towards the two economies and the potential impact of trade policies.

-

Commodity Prices: Commodity prices, particularly those of agricultural products like soybeans and energy sources like oil, are highly sensitive to trade developments. Changes in tariffs or trade agreements can significantly affect commodity prices, impacting businesses and consumers alike.

Potential Outcomes and Their Implications

The potential outcomes of the US-China trade talks range from optimistic to pessimistic scenarios:

-

Successful Resolution: A successful resolution, characterized by a comprehensive agreement addressing key concerns, would likely boost global economic growth, increase investor confidence, and lead to greater stability in global markets.

-

Continued Trade Friction: Continued trade friction, on the other hand, could lead to a prolonged period of economic uncertainty, further hindering global growth and disrupting global supply chains. This could also fuel protectionist sentiments worldwide, potentially leading to broader trade conflicts.

-

Implications for Sectors: Different economic sectors will be differentially affected. For instance, the agricultural sector in the US is highly sensitive to the outcome of these negotiations, while the tech sector faces implications related to intellectual property and technology transfer.

Conclusion

The success of the US-China trade talks remains uncertain. While both sides express a desire for resolution, the history of stalled negotiations and the complexity of the issues at stake warrant caution. Closely monitoring market reactions – stock indices, currency fluctuations, and commodity prices – will provide crucial insights into the progress and ultimate impact of these critical negotiations. Staying informed about the ongoing US-China trade talks is essential for investors and businesses alike. Understanding the intricacies of the negotiations and their potential outcomes is vital for navigating the uncertainty and making informed decisions. Keep abreast of developments in the US-China trade negotiations to protect your interests and make strategic choices in this ever-evolving economic landscape.

Featured Posts

-

Fabers U Turn Full Support For Royal Distinctions For Asylum Volunteer Program

May 12, 2025

Fabers U Turn Full Support For Royal Distinctions For Asylum Volunteer Program

May 12, 2025 -

Trump Team Pushes For Tariff Cuts And Rare Earth Access In China Trade Talks

May 12, 2025

Trump Team Pushes For Tariff Cuts And Rare Earth Access In China Trade Talks

May 12, 2025 -

Virginia Giuffre Og Prins Andrew En Skandale Som Rystet Kongehuset

May 12, 2025

Virginia Giuffre Og Prins Andrew En Skandale Som Rystet Kongehuset

May 12, 2025 -

Opponent Name Falls To Celtics Division Title Clinched

May 12, 2025

Opponent Name Falls To Celtics Division Title Clinched

May 12, 2025 -

New Hairstyle Alert Rochelle Humes Roksanda Fashion Week Appearance

May 12, 2025

New Hairstyle Alert Rochelle Humes Roksanda Fashion Week Appearance

May 12, 2025

Latest Posts

-

Tzortz Mpalntok I Sefilnt Gioynaitent Panigyrizei O Proponitis Ksesikonei To Koino

May 13, 2025

Tzortz Mpalntok I Sefilnt Gioynaitent Panigyrizei O Proponitis Ksesikonei To Koino

May 13, 2025 -

Oregon Tournament Deja Kellys Leadership Crucial For Texas

May 13, 2025

Oregon Tournament Deja Kellys Leadership Crucial For Texas

May 13, 2025 -

Deja Kelly Steps Up Leading Texas In Oregon

May 13, 2025

Deja Kelly Steps Up Leading Texas In Oregon

May 13, 2025 -

Aces Training Camp Roster Moves Forward Cut

May 13, 2025

Aces Training Camp Roster Moves Forward Cut

May 13, 2025 -

Deja Kellys Leadership Oregon Tournament Preview

May 13, 2025

Deja Kellys Leadership Oregon Tournament Preview

May 13, 2025