US-China Trade War: 80% Tariff Proposal Shakes Stock Market

Table of Contents

The 80% Tariff Proposal: A Deep Dive

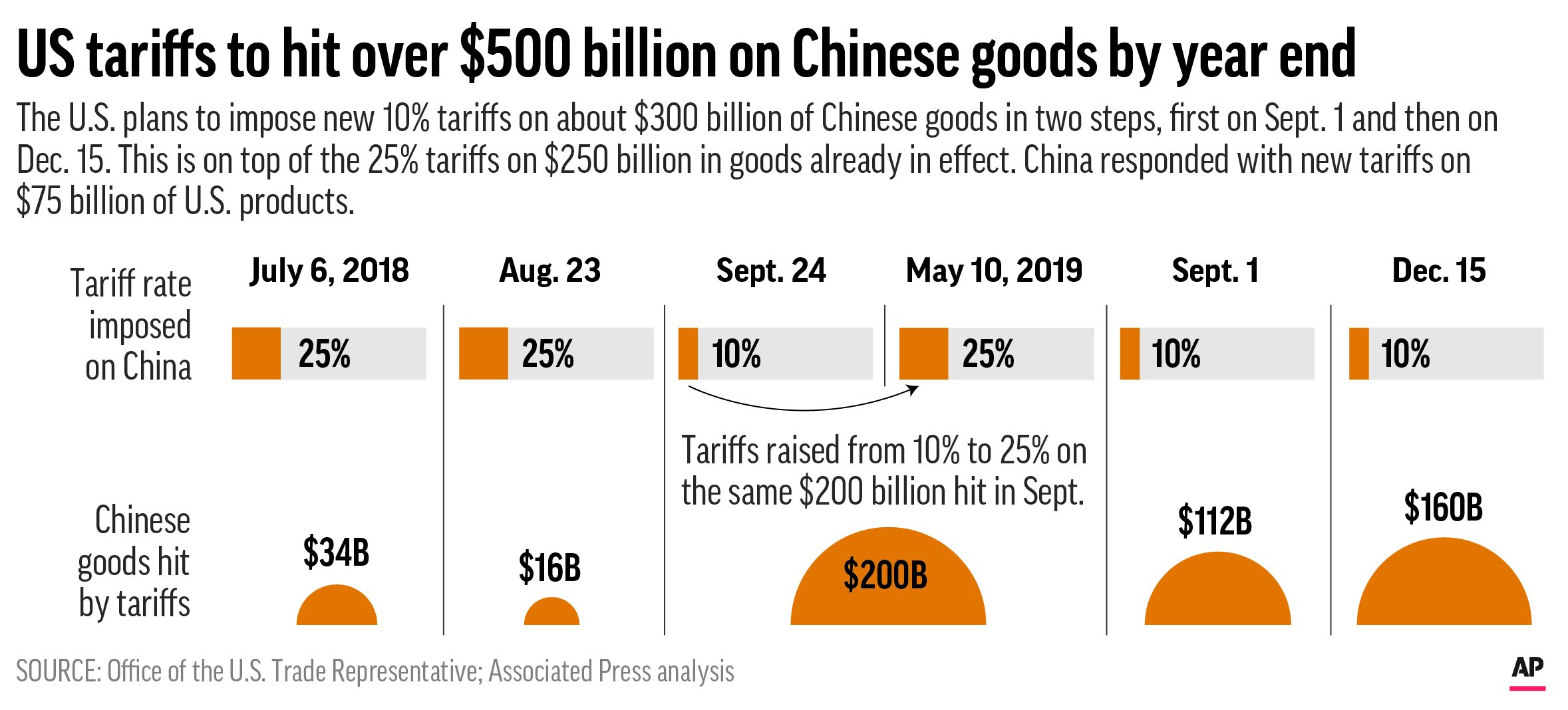

The proposed 80% tariff hike represents a significant escalation in the ongoing US-China trade war. This dramatic increase targets a wide range of Chinese goods, potentially impacting numerous industries and consumers worldwide. The sheer magnitude of the proposed increase far surpasses previous tariff actions, raising concerns about its potential to disrupt global supply chains and further inflame trade tensions.

- Targeted Goods and Industries: The proposed tariffs aim to affect various sectors, including consumer electronics, textiles, machinery, and agricultural products. Specific examples include smartphones, clothing, and certain types of industrial equipment.

- Economic Ramifications: Such a significant tariff increase would likely lead to substantially higher import costs for American businesses and consumers. This could trigger inflation, reduce consumer spending, and slow economic growth in the US and globally.

- Quantifiable Impact: The potential impact on import costs is substantial. A 80% tariff on a $100 good, for example, would increase its price to $180, making it significantly less competitive in the market.

- Exemptions and Exceptions: While the proposal is broad, there may be some exemptions or exceptions for specific goods or industries based on national security or other considerations. These exceptions, however, are likely to be limited.

Stock Market Reactions to the Tariff Proposal

The announcement of the 80% tariff proposal was met with immediate and significant market reactions. Stock markets experienced declines, reflecting investor concerns about the potential negative economic consequences. The impact varied across sectors, with some industries disproportionately affected.

- Market Declines and Volatility: Major stock market indices, such as the Dow Jones Industrial Average and the S&P 500, experienced noticeable declines following the announcement. Volatility increased significantly as investors grappled with the uncertainty.

- Sectoral Performance: Technology and consumer goods sectors, heavily reliant on imports from China, were particularly vulnerable. These sectors experienced steeper declines compared to others. Conversely, certain domestic-focused industries may have seen some benefit.

- Investor Sentiment and Confidence: Investor sentiment plummeted, reflecting a diminished confidence in the short-term and long-term economic outlook. This uncertainty led to increased risk aversion and cautious investment strategies.

- Specific Examples: Shares of companies heavily reliant on Chinese manufacturing or supply chains suffered significant losses. Conversely, some domestic producers may have seen increased demand and stock prices.

Geopolitical Implications of the Escalating Trade War

The proposed 80% tariff increase carries significant geopolitical implications that extend far beyond the stock market's immediate reaction. The escalation risks triggering retaliatory measures from China, potentially leading to a further deterioration of US-China relations.

- Retaliatory Measures: China may respond with counter-tariffs or other trade restrictions, intensifying the conflict and further disrupting global trade.

- Global Supply Chains: The trade war disrupts global supply chains, leading to increased costs, production delays, and uncertainty for businesses worldwide.

- Global Economic Growth: The ongoing trade war casts a shadow over global economic growth, potentially leading to slower expansion and decreased investment.

- Diplomatic Efforts: International diplomatic efforts to de-escalate tensions and find a mutually acceptable resolution are crucial to mitigating the negative consequences of the trade war.

Strategies for Investors During Times of Trade War Uncertainty

Navigating the uncertainty created by the US-China trade war requires careful planning and strategic investment decisions. Investors should adopt strategies to mitigate risk and protect their portfolios.

- Diversification: Diversifying investments across different asset classes and geographic regions is crucial to reduce exposure to the risks associated with the trade war.

- Defensive Stocks: Shifting towards more defensive stocks, such as those in consumer staples or healthcare, which are less sensitive to economic downturns, can help minimize losses.

- Risk Management: Employing appropriate risk management techniques, such as stop-loss orders, can help limit potential losses.

- Professional Advice: Seeking advice from qualified financial advisors is strongly recommended to develop a personalized investment strategy tailored to individual circumstances and risk tolerance.

Long-Term Economic Outlook and the US-China Trade War

The long-term consequences of the US-China trade war are difficult to predict with certainty, but several potential scenarios merit consideration.

- Reshoring and Nearshoring: Companies may consider reshoring or nearshoring manufacturing to reduce their dependence on Chinese suppliers, potentially impacting global trade patterns.

- Consumer Prices: Increased tariffs contribute to higher consumer prices, potentially impacting consumer spending and economic growth.

- Technological Decoupling: The trade war may accelerate the decoupling of US and Chinese technological sectors, leading to the development of separate technological ecosystems.

Conclusion: Understanding the US-China Trade War's Impact

The proposed 80% tariff increase significantly escalates the US-China trade war, impacting stock markets, global supply chains, and the broader global economy. Understanding the evolving situation of the US-China trade war is crucial for investors and policymakers alike. To stay informed about developments and their effects on the stock market, subscribe to our updates and read further analysis on US-China trade relations, tariff impact on stocks, and global trade war analysis. Staying informed is crucial in navigating this complex and evolving situation.

Featured Posts

-

Jessica Simpsons Stylish Airport Look A Cheetah Print And Blue Fur Coat Combination

May 11, 2025

Jessica Simpsons Stylish Airport Look A Cheetah Print And Blue Fur Coat Combination

May 11, 2025 -

Unlock Bet365 Bonus Code Nypbet Expert Knicks Vs Pistons Series Picks

May 11, 2025

Unlock Bet365 Bonus Code Nypbet Expert Knicks Vs Pistons Series Picks

May 11, 2025 -

Indy 500 Entry List Grows To 34 With Takuma Sato

May 11, 2025

Indy 500 Entry List Grows To 34 With Takuma Sato

May 11, 2025 -

Mtv Cribs Celebrity Homes And Their Architectural Marvels

May 11, 2025

Mtv Cribs Celebrity Homes And Their Architectural Marvels

May 11, 2025 -

Ufc Fight Night 315 Full Fight Card Breakdown

May 11, 2025

Ufc Fight Night 315 Full Fight Card Breakdown

May 11, 2025