US-China Trade War Eases: S&P 500's 3%+ Surge Explained

Table of Contents

Reduced Trade Tensions: A Key Driver of the S&P 500 Surge

The easing of US-China trade tensions is undeniably the primary driver of the recent S&P 500 surge. Months of escalating tariffs and trade disputes created considerable uncertainty in the global marketplace. However, recent developments have signaled a shift toward de-escalation, injecting a much-needed dose of optimism into the market. This "US-China trade deal," while not a complete resolution, represents a crucial step towards stability. Specific agreements and concessions have contributed to this positive shift:

- Reduced tariffs on certain goods: The reduction or removal of tariffs on specific categories of goods has lowered costs for businesses and consumers alike, stimulating economic activity.

- Increased purchases of American agricultural products by China: This commitment from China signals a willingness to engage in mutually beneficial trade practices, boosting confidence in the agricultural sector and related industries.

- Renewed commitment to negotiations: The renewed commitment from both sides to continue negotiations demonstrates a willingness to find common ground and avoid further escalation, reducing uncertainty and fostering investor confidence.

The impact of these measures on investor sentiment is significant. Reduced uncertainty about future trade policies translates directly into increased confidence, leading to greater investment and a subsequent rise in stock prices. The positive ripple effect from these "tariff reductions" is palpable across multiple sectors.

Impact on Global Supply Chains and Businesses

The de-escalation of the US-China trade war has profoundly positive implications for global supply chains and businesses worldwide. The prolonged trade conflict created significant disruptions, impacting manufacturing, logistics, and overall business operations. The easing of tensions has started to alleviate these issues:

- Reduced disruption to manufacturing and logistics: Smoother trade flows mean less disruption to production schedules and efficient delivery of goods.

- Lower input costs for businesses: Reduced tariffs translate into lower input costs for businesses, enhancing profitability and competitiveness.

- Improved predictability for future business planning: Greater clarity in trade policies allows businesses to make more informed decisions regarding investment, production, and expansion.

The positive impact is particularly noticeable in sectors heavily affected by the trade war, such as technology and agriculture. Companies in these sectors are now better positioned to capitalize on improved market conditions and renewed business confidence. This positive trend significantly contributes to overall "economic growth."

Market Reaction and Investor Sentiment: Why the S&P 500 Jumped

The market's immediate reaction to the easing of trade tensions was swift and dramatic, reflecting the pent-up optimism among investors. The surge in investor confidence directly translated into a significant jump in stock prices, particularly within sectors previously most impacted by the trade war.

- Increased investment in previously affected sectors: Investors are now more willing to invest in sectors that previously faced uncertainty due to trade disputes.

- Positive revisions in corporate earnings forecasts: Improved trade relations have led to upward revisions in corporate earnings forecasts, further fueling the market rally.

- Increased market liquidity: Reduced uncertainty is increasing market liquidity, making it easier for investors to buy and sell assets.

This positive "S&P 500 performance" underscores the close link between geopolitical events and market sentiment. The "stock market rally" isn’t simply a reaction; it’s a reflection of improved economic prospects and renewed investor confidence.

Potential Long-Term Effects of the US-China Trade War Easing

While the recent easing of tensions is positive, it's crucial to acknowledge the ongoing uncertainties and potential challenges. The "long-term economic outlook" remains complex and dependent on several factors:

- Continued negotiation and potential future disputes: The trade relationship between the US and China is still evolving, and future disagreements cannot be ruled out.

- Impact on long-term trade relationships: The long-term implications for trade relations between the two economic giants remain to be seen.

- Effects on global economic growth: The full impact of this de-escalation on global economic growth will unfold over time.

However, this period of reduced "trade relations" tension offers a valuable opportunity to rebuild trust and foster a more stable and predictable trading environment.

Conclusion: Understanding the US-China Trade War's Impact on the S&P 500

The easing of the US-China trade war has demonstrably contributed to the S&P 500's significant 3%+ surge. Reduced trade tensions have boosted investor confidence, improved global supply chains, and fostered positive expectations for economic growth. The positive impact on "investor sentiment" is undeniable.

To remain informed about the evolving US-China trade relationship and its potential impact on the stock market and the global economy, it is crucial to follow relevant news and analysis. Continue your research on keywords like "US-China trade deal," "tariff reductions," and "global economic recovery" to stay ahead of the curve. Understanding the nuances of the US-China trade war is key to navigating the complexities of the global financial markets.

Featured Posts

-

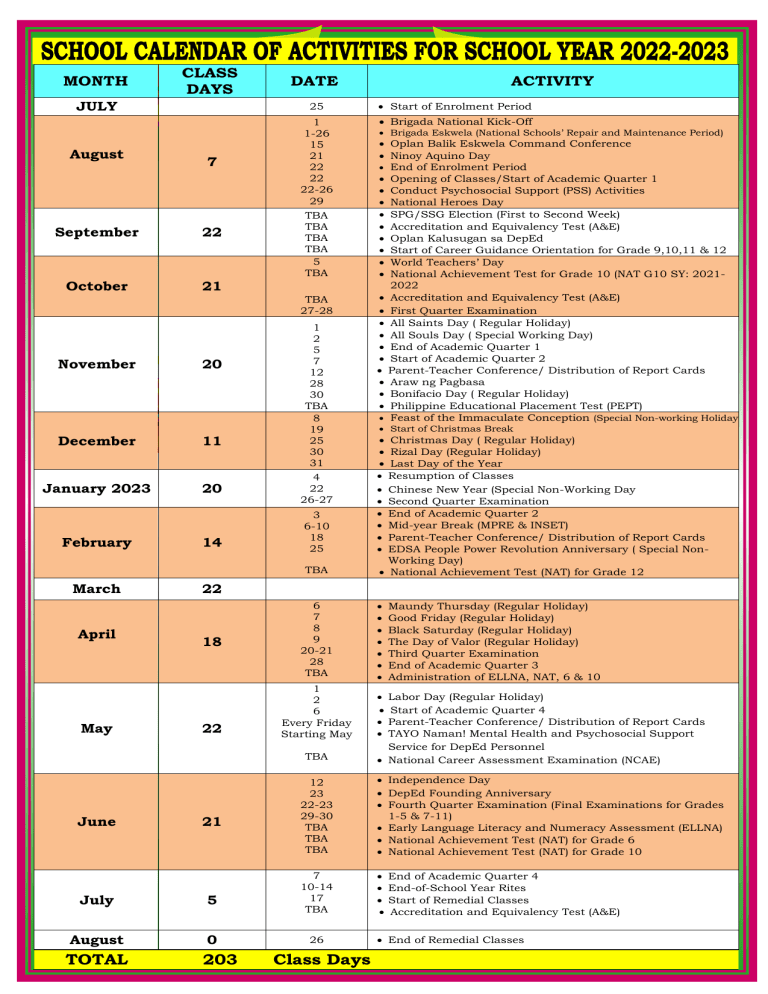

Senior Travel And Activities 2024 Calendar Of Events

May 13, 2025

Senior Travel And Activities 2024 Calendar Of Events

May 13, 2025 -

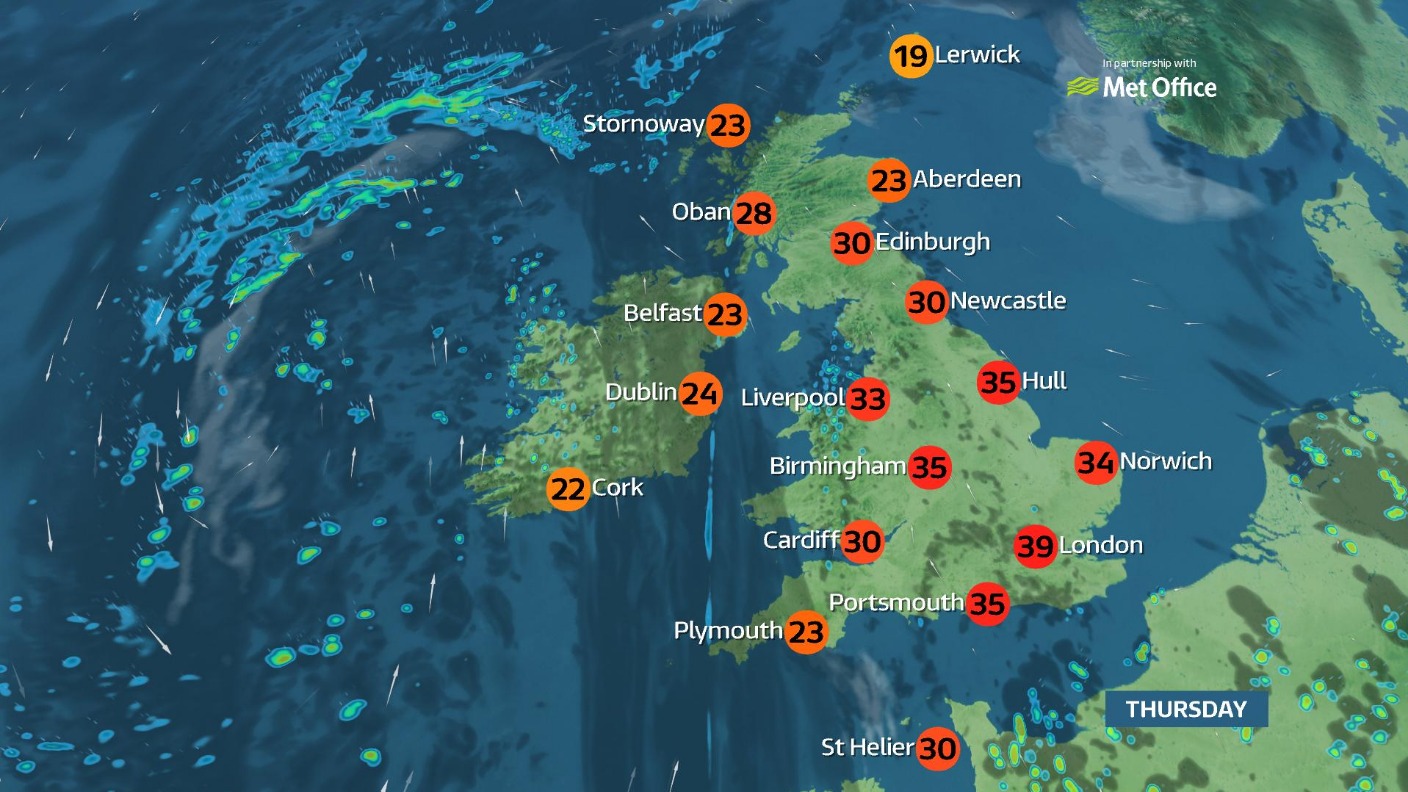

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025

Record Breaking Temperatures Scorch La And Orange Counties Heatwave Emergency

May 13, 2025 -

Ray Epps V Fox News A Deep Dive Into The Defamation Case

May 13, 2025

Ray Epps V Fox News A Deep Dive Into The Defamation Case

May 13, 2025 -

Di Caprio Se Potpuno Promijenio Reakcije Obozavatelja Na Slobodnoj Dalmaciji

May 13, 2025

Di Caprio Se Potpuno Promijenio Reakcije Obozavatelja Na Slobodnoj Dalmaciji

May 13, 2025 -

Nba Draft Lottery 2024 Philadelphia Sixers Odds Viewing Information And Analysis

May 13, 2025

Nba Draft Lottery 2024 Philadelphia Sixers Odds Viewing Information And Analysis

May 13, 2025

Latest Posts

-

Michigan Great Value Product Recall Warning

May 14, 2025

Michigan Great Value Product Recall Warning

May 14, 2025 -

Assessing Manchester Uniteds Transfer Market Prospects

May 14, 2025

Assessing Manchester Uniteds Transfer Market Prospects

May 14, 2025 -

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025 -

Warning Great Value Products Recalled In Michigan

May 14, 2025

Warning Great Value Products Recalled In Michigan

May 14, 2025 -

Manchester Uniteds Strategic Positioning For Summer Signings

May 14, 2025

Manchester Uniteds Strategic Positioning For Summer Signings

May 14, 2025