US-China Trade War Impact: Dow Futures And Economic Outlook Today

Table of Contents

Impact on Dow Futures

The unpredictable nature of the US-China trade war creates significant volatility in Dow futures. This uncertainty makes it challenging for investors to plan long-term strategies and significantly impacts market sentiment.

Volatility and Uncertainty

- Sudden tariff announcements: Unexpected tariff increases or escalations lead to sharp and immediate fluctuations in Dow futures, creating a highly volatile trading environment. Investors react swiftly to news related to trade negotiations, often resulting in significant daily price swings.

- Eroded investor confidence: The prolonged nature of the trade war has eroded investor confidence, leading to a more risk-averse market. Uncertainty about the future makes investors hesitant to commit to long-term investments.

- Difficult long-term planning: The lack of predictability makes long-term investment planning extremely difficult. Businesses and investors struggle to forecast future profits and returns, hindering strategic decision-making.

Sector-Specific Impacts

The US-China trade war doesn't impact all sectors equally. Some industries are disproportionately affected, leading to a varied response in the Dow futures market.

- Technology sector: Technology companies are heavily impacted by restrictions on technology exports and intellectual property concerns. This has led to significant challenges for some of the largest technology companies listed on the Dow.

- Agriculture: The agricultural sector faces retaliatory tariffs on its exports to China, severely impacting farmers and related businesses. This has created significant economic hardship in specific agricultural regions of the US.

- Manufacturing: Manufacturing businesses face supply chain disruptions and increased costs due to tariffs on imported materials and components. This can lead to production slowdowns and price increases.

Predicting Future Dow Movements

While analyzing historical data alongside current trade developments can offer some insight, predicting future Dow movements remains incredibly challenging during periods of trade conflict.

- Diverging expert opinions: Experts hold widely differing opinions on the long-term effects of the trade war, making it difficult to form a consensus view.

- Market sentiment: Market sentiment, heavily influenced by news related to trade negotiations, plays a pivotal role in determining Dow futures prices. Positive news can lead to rallies, while negative news can trigger sharp declines.

- Geopolitical events: Geopolitical events outside the trade war itself can significantly impact the market's reaction to trade news, making predictions even more complex.

Broader Economic Outlook

The US-China trade war's influence extends far beyond the Dow futures market, impacting the global economic outlook in several significant ways.

Global Economic Slowdown

The trade war contributes to a global economic slowdown through several mechanisms:

- Disrupted supply chains: Reduced international trade directly disrupts global supply chains, impacting businesses' ability to produce and distribute goods efficiently.

- Reduced purchasing power: Increased tariffs lead to higher consumer prices, reducing purchasing power and dampening consumer spending.

- Decreased business investment: Uncertainty about future trade policies discourages business investment and hiring, slowing economic growth.

Inflationary Pressures

Tariffs significantly increase the cost of imported goods, creating inflationary pressures within the economy:

- Higher consumer prices: Consumers face higher prices for a wide range of products, impacting their budgets and overall economic well-being.

- Monetary policy adjustments: Central banks may respond to inflationary pressures by adjusting monetary policy, potentially raising interest rates.

- Higher interest rates: Higher interest rates can further dampen economic growth by increasing borrowing costs for businesses and consumers.

Job Market Implications

The trade war's impact on the job market is uneven, affecting different sectors differently:

- Job losses in targeted sectors: Industries directly affected by tariffs experience job losses as businesses struggle to compete.

- Potential job creation in other sectors: Some sectors may experience job creation as businesses adapt and focus on domestic production.

- Overall impact on employment: The overall impact on employment depends heavily on the trade war's duration and intensity.

Mitigation Strategies and Future Outlook

Addressing the negative impacts of the US-China trade war requires a multifaceted approach involving government policies, business adaptation, and investor strategies.

Government Policies

Government policies play a crucial role in mitigating negative impacts:

- Financial support: Providing support for affected industries through subsidies, tax breaks, and other forms of financial assistance.

- Trade negotiations: Engaging in negotiations to de-escalate trade tensions and reach mutually beneficial agreements.

- Investment in domestic production: Investing in infrastructure and technology to boost domestic production and reduce reliance on imports.

Business Adaptation

Businesses are adapting strategies to navigate the challenges:

- Supply chain diversification: Diversifying supply chains to reduce reliance on specific countries and mitigate disruptions.

- Investment in automation: Investing in automation and technology to improve efficiency and reduce costs.

- Exploring new markets: Actively exploring new markets to reduce dependence on trade with China and other affected regions.

Investor Strategies

Investors need to adapt their portfolios accordingly:

- Diversification across asset classes: Diversifying investment portfolios across different asset classes to reduce risk exposure.

- Stock selection: Carefully selecting stocks and sectors less vulnerable to trade war impacts.

- Hedging strategies: Considering hedging strategies to protect against potential losses due to trade war volatility.

Conclusion

The US-China trade war significantly impacts Dow futures and the broader economic outlook, creating volatility, uncertainty, and inflationary pressures. Understanding the multifaceted effects of this conflict is vital for informed decision-making. By analyzing the impact on various sectors, considering potential mitigation strategies, and adapting investment strategies, individuals and businesses can navigate this challenging period. Stay informed about the latest developments in the US-China trade war to make well-informed decisions about your investments and business strategies. Monitor Dow futures and the global economic outlook closely for further insights into the evolving situation and its impact on the global economy. Understanding the nuances of the US-China trade war impact is key to navigating the current economic climate successfully.

Featured Posts

-

Ray Epps Sues Fox News For Defamation Jan 6th Allegations At The Heart Of The Case

Apr 26, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations At The Heart Of The Case

Apr 26, 2025 -

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

Apr 26, 2025

Alterya Acquired By Chainalysis Boosting Blockchain Security With Ai

Apr 26, 2025 -

Transatlantic Ai Divide Trump Administrations Opposition To Eu Ai Rulebook

Apr 26, 2025

Transatlantic Ai Divide Trump Administrations Opposition To Eu Ai Rulebook

Apr 26, 2025 -

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025

Gold Price Record Rally Bullion As A Trade War Safe Haven

Apr 26, 2025 -

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 26, 2025

Microsoft Activision Deal Ftcs Appeal And Its Implications

Apr 26, 2025

Latest Posts

-

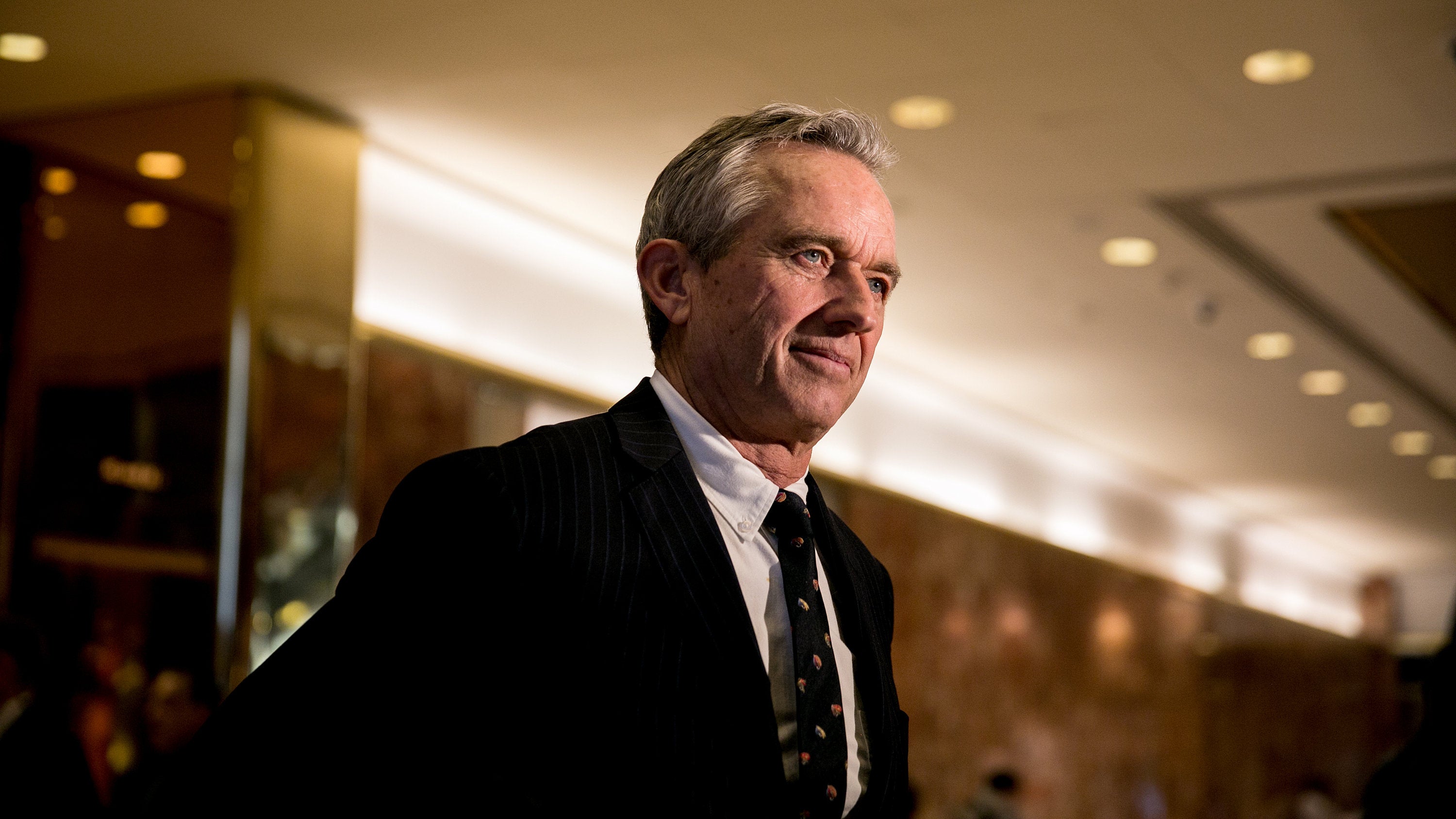

Sources Reveal Hhss Controversial Choice For Autism Vaccine Study

Apr 27, 2025

Sources Reveal Hhss Controversial Choice For Autism Vaccine Study

Apr 27, 2025 -

Anti Vaccine Advocates Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025

Anti Vaccine Advocates Role In Hhs Autism Vaccine Review Raises Concerns

Apr 27, 2025 -

Hhss Controversial Choice Anti Vax Advocate To Examine Debunked Vaccine Autism Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vax Advocate To Examine Debunked Vaccine Autism Claims

Apr 27, 2025 -

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Nbc 5 Report

Apr 27, 2025

Hhs Appoints Anti Vaccine Activist To Review Autism Vaccine Link Nbc 5 Report

Apr 27, 2025 -

Government Agency Taps Anti Vaccine Advocate To Investigate Disproven Vaccine Autism Link

Apr 27, 2025

Government Agency Taps Anti Vaccine Advocate To Investigate Disproven Vaccine Autism Link

Apr 27, 2025