US Data Weakness Spurs Gold (XAUUSD) Rally: Rate Cut Hopes Rise

Table of Contents

Weak US Economic Data: A Catalyst for Gold's Rise

Weaker-than-expected US economic data has emerged as a primary catalyst for the recent gold price rally. This suggests a potential economic slowdown or even a recession, significantly impacting inflation expectations and the Federal Reserve's future monetary policy decisions.

Inflation Concerns Ease, But Recession Fears Loom

Recent reports paint a mixed picture. While inflation, as measured by the Consumer Price Index (CPI) and Producer Price Index (PPI), shows signs of cooling, the picture is far from rosy. GDP growth has slowed, and while the unemployment rate remains relatively low, there are increasing concerns about potential job losses in the coming months. This combination of slowing growth and persistent inflation, though easing, creates an environment ripe for recessionary fears.

- CPI and PPI: Recent data shows a deceleration in inflation, but still above the Federal Reserve's target rate.

- GDP Growth: Lower-than-expected GDP growth figures signal a potential economic slowdown.

- Unemployment Rate: While currently low, future unemployment figures are closely watched for signs of a broader economic downturn. The impact of layoffs in the tech sector and other industries are important factors here.

This data fuels speculation about a potential recession, increasing the appeal of gold as a safe haven asset. The weakening economic outlook reduces the likelihood of further interest rate hikes and increases the probability of rate cuts, further bolstering gold prices. Keywords relevant to this section include inflation, CPI, PPI, GDP, unemployment rate, recession, and economic slowdown.

The Dollar's Weakening Influence on Gold Prices

Gold and the US dollar typically exhibit an inverse relationship. A weaker dollar generally makes gold more attractive and affordable for international investors holding other currencies, thereby increasing demand and driving up the price of gold (XAUUSD). The recent weakening of the US dollar index (DXY) has played a significant role in the gold price rally.

- US Dollar Index (DXY): A decline in the DXY indicates a weaker dollar, making gold cheaper for those holding other currencies.

- Gold Price in USD (XAUUSD): The inverse relationship between the dollar and gold is clearly reflected in the XAUUSD chart.

- XAUUSD Chart Analysis: Examining recent XAUUSD chart movements reveals a clear correlation between dollar weakness and gold price increases.

Rising Rate Cut Expectations Boost Gold Demand

The weakening US economic data has fueled market speculation about the Federal Reserve's future monetary policy decisions. The increased likelihood of rate cuts is a significant factor pushing up gold prices.

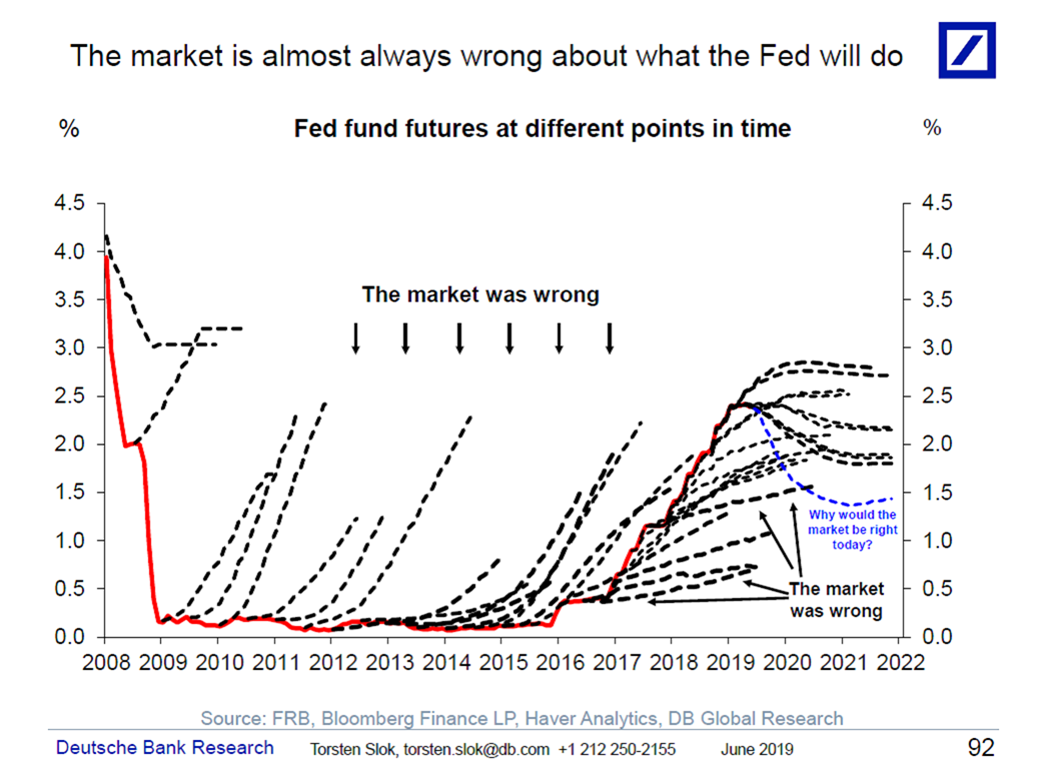

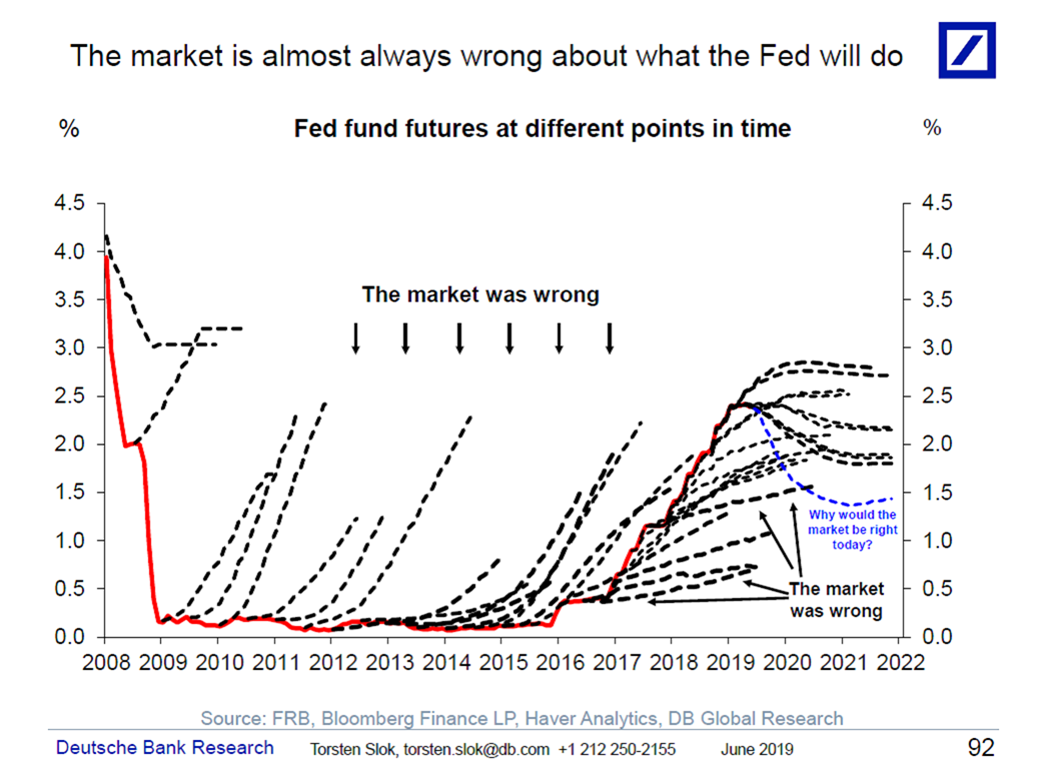

Market Speculation and the Fed's Response

Markets are increasingly anticipating rate cuts by the Federal Reserve in response to slowing economic growth. This expectation directly influences gold's appeal.

- Federal Reserve Rate Decisions: The market closely scrutinizes every statement and action from the Federal Reserve.

- Rate Cut Expectations: The probability of rate cuts is increasing, making gold a more attractive investment.

- Quantitative Easing: The possibility of renewed quantitative easing (QE) further boosts the allure of gold.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more appealing to investors compared to interest-bearing alternatives. Keywords here include Federal Reserve, interest rates, monetary policy, rate cut expectations, and quantitative easing.

Gold as a Safe Haven Asset

Gold consistently serves as a safe haven asset during periods of economic uncertainty. Investors often flock to gold as a hedge against inflation and recessionary fears. The current economic climate, characterized by weakening data and increasing recession risks, has fueled this safe-haven demand.

- Safe Haven Asset: Gold's traditional role as a safe haven is reinforced by current market conditions.

- Gold Investment: Investors see gold as a reliable store of value during turbulent times.

- Inflation Hedge/Recession Hedge: Gold serves as a hedge against both inflation and recession. Keywords include safe haven asset, gold investment, inflation hedge, and recession hedge.

Technical Analysis of the XAUUSD Rally

Technical analysis of the XAUUSD chart reveals several indicators suggesting further upward momentum for gold. Specific chart patterns and technical indicators support this bullish outlook. (Note: This section would ideally include specific chart examples and technical indicator data, which is beyond the scope of a text-based response.)

- XAUUSD Chart Analysis: Technical indicators show strong support for continued price increases.

- Support Levels: Price levels where buying pressure is expected to support the gold price.

- Resistance Levels: Price levels where selling pressure might slow the gold price increase.

- Chart Patterns: Identifying patterns on the chart can offer clues about future price movements.

- Trading Signals: Technical indicators provide signals to traders about potential buy or sell opportunities.

Conclusion: Capitalize on the Gold (XAUUSD) Rally Driven by US Data Weakness

The recent gold (XAUUSD) rally is a direct consequence of weakening US economic data and rising expectations of Federal Reserve rate cuts. The combination of these factors, coupled with gold's role as a safe haven asset, has created a compelling environment for gold price appreciation. While this trend looks promising, it's essential to acknowledge inherent market risks. Stay informed about the latest US economic indicators and monitor gold market trends to make informed investment decisions regarding XAUUSD. Track gold prices closely, consider your risk tolerance, and explore XAUUSD trading opportunities wisely. Learn more about how to invest in gold and capitalize on these potential market movements.

Featured Posts

-

Thibodeaus Frustration Boils Over After Knicks Game 2 Loss

May 17, 2025

Thibodeaus Frustration Boils Over After Knicks Game 2 Loss

May 17, 2025 -

Angel Reese Responds After Chicago Sky Matchup

May 17, 2025

Angel Reese Responds After Chicago Sky Matchup

May 17, 2025 -

University Of Iowa Basketball Announces Mc Collum As New Coach

May 17, 2025

University Of Iowa Basketball Announces Mc Collum As New Coach

May 17, 2025 -

Former D2 National Champion Ben Mc Collum Hired By University Of Iowa

May 17, 2025

Former D2 National Champion Ben Mc Collum Hired By University Of Iowa

May 17, 2025 -

Knicks Mitchell Robinson Makes Long Awaited Season Debut Post Surgery

May 17, 2025

Knicks Mitchell Robinson Makes Long Awaited Season Debut Post Surgery

May 17, 2025

Latest Posts

-

27 Puntos De Anunoby Impulsan A Los Knicks A Vencer A Los 76ers 9na Derrota

May 17, 2025

27 Puntos De Anunoby Impulsan A Los Knicks A Vencer A Los 76ers 9na Derrota

May 17, 2025 -

Victoria De Los Knicks Sobre Los 76ers Anunoby Brilla Con 27 Puntos

May 17, 2025

Victoria De Los Knicks Sobre Los 76ers Anunoby Brilla Con 27 Puntos

May 17, 2025 -

Knicks Derrotan A 76ers Anunoby Con 27 Puntos Sixers Sufren Novena Caida

May 17, 2025

Knicks Derrotan A 76ers Anunoby Con 27 Puntos Sixers Sufren Novena Caida

May 17, 2025 -

Anunobys 27 Puntos Guian A Los Knicks A La Victoria Sobre Los 76ers

May 17, 2025

Anunobys 27 Puntos Guian A Los Knicks A La Victoria Sobre Los 76ers

May 17, 2025 -

Anunoby Anota 27 Knicks Vencen A Sixers Novena Derrota Para Filadelfia

May 17, 2025

Anunoby Anota 27 Knicks Vencen A Sixers Novena Derrota Para Filadelfia

May 17, 2025