US Debt Ceiling: August Deadline Looms, Treasury Warns

Table of Contents

Understanding the Current Debt Ceiling Situation

The US debt ceiling currently stands at a specific amount (this needs to be updated with the current figure at the time of publishing). The US government is rapidly approaching this limit, with projections indicating it could be reached by [insert projected date, based on current estimates]. This impending breach has ignited a fierce political battle. Republicans, generally advocating for spending cuts in exchange for raising the debt ceiling, are at odds with the Democrats, who want a clean increase without conditions attached. This political gridlock threatens to derail any progress toward a timely resolution.

- Current debt ceiling amount: [Insert current amount]

- Projected date of reaching the ceiling: [Insert projected date – this needs to be updated]

- Key players in the debate: [List key political figures, including the President, Treasury Secretary, and key Congressional leaders from both parties]

- Potential scenarios for reaching a resolution: A clean increase, a compromise involving spending cuts, a short-term extension, or, worst-case scenario, a default.

Potential Economic Consequences of Default

A failure to raise the US debt ceiling would have catastrophic consequences. The US could default on its debt obligations for the first time in history, triggering a global economic crisis. The ramifications would be far-reaching and severe, impacting both domestic and international markets.

- Potential credit rating downgrade: A default would likely lead to a downgrade of the US credit rating, increasing borrowing costs for the government and the private sector.

- Increased interest rates: Higher interest rates would make borrowing more expensive for businesses and consumers, potentially slowing economic growth and leading to job losses.

- Potential government shutdown impact: A default could force a complete or partial government shutdown, halting essential services and disrupting the lives of millions.

- Impact on consumer confidence and spending: Uncertainty and fear surrounding a potential default would likely erode consumer confidence, leading to reduced spending and a further slowdown in the economy. This ripple effect could lead to a global recession.

Historical Precedents and Lessons Learned

The US has faced debt ceiling standoffs in the past. While some resulted in last-minute compromises, others brought the country perilously close to default. These past experiences offer valuable lessons:

- Examples of previous debt ceiling standoffs: [List examples of past crises and the years they occurred]

- Outcomes of previous negotiations: [Summarize the outcomes of past negotiations – compromises reached, near defaults, etc.]

- Analysis of successful and unsuccessful strategies: [Analyze the factors that contributed to successful and unsuccessful resolutions] Past compromises often involved concessions from both parties, highlighting the need for bipartisan cooperation.

Possible Solutions and Negotiation Strategies

Several potential solutions are on the table to address the debt ceiling crisis. However, reaching a bipartisan agreement remains a significant challenge.

- Potential compromise solutions: These could involve spending cuts, tax increases, or a combination of both, depending on the political will of both parties.

- Challenges to reaching an agreement: Deep partisan divides and differing economic priorities are major obstacles to finding a compromise that satisfies both Republicans and Democrats.

- Different negotiating strategies being employed: Negotiations may involve various strategies, from intense behind-the-scenes talks to public pressure campaigns. The success of these strategies hinges on the willingness of both sides to compromise.

The Urgent Need to Address the US Debt Ceiling

The US debt ceiling crisis is not just a political issue; it's an economic emergency. Failure to raise the debt ceiling before the August deadline will have severe and lasting repercussions for the US and the global economy. Understanding the debt ceiling debate is critical for every American. The potential consequences of inaction are too grave to ignore. The timely resolution of the raising the debt ceiling issue is vital for economic stability. Stay informed about the ongoing US debt ceiling crisis and urge your representatives to find a solution before the August deadline. Contact your Senators and Representatives to express your concerns and demand a responsible resolution to this critical issue. Let your voice be heard!

Featured Posts

-

The Next James Bond Jeff Bezos Fan Poll Delivers A Definitive Answer

May 11, 2025

The Next James Bond Jeff Bezos Fan Poll Delivers A Definitive Answer

May 11, 2025 -

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 11, 2025

Ryan Reynolds Mntn Ipo Launch Expected Next Week

May 11, 2025 -

Unlocking Ufc 315 Betting Odds And Predictions From Mm Amania Com

May 11, 2025

Unlocking Ufc 315 Betting Odds And Predictions From Mm Amania Com

May 11, 2025 -

Keanu Reeves Confirms Will There Be A John Wick 5

May 11, 2025

Keanu Reeves Confirms Will There Be A John Wick 5

May 11, 2025 -

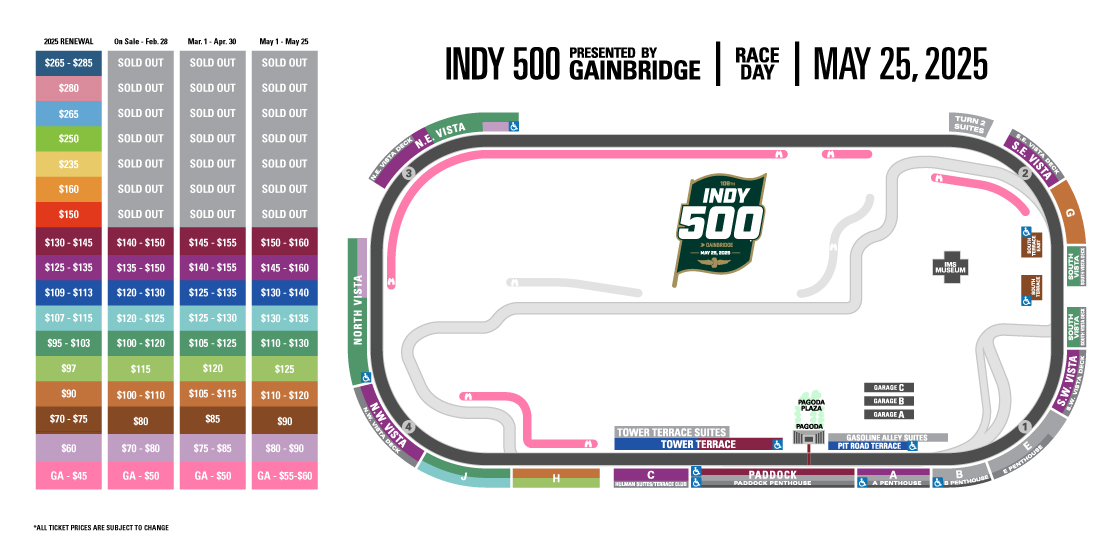

Full Indy 500 Field Sato Makes It 34 Entries

May 11, 2025

Full Indy 500 Field Sato Makes It 34 Entries

May 11, 2025