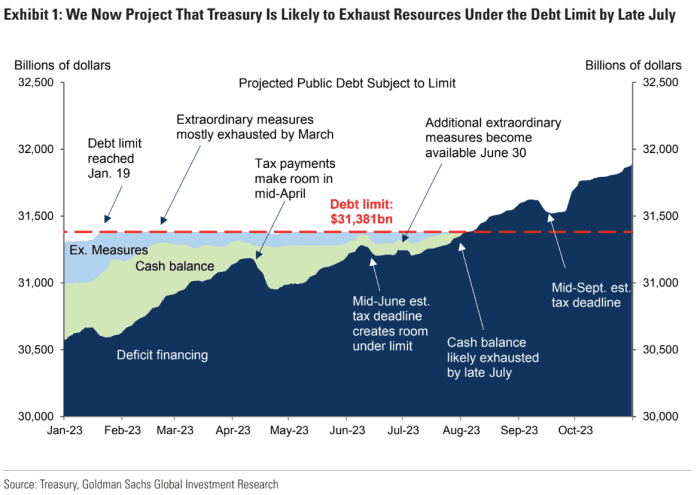

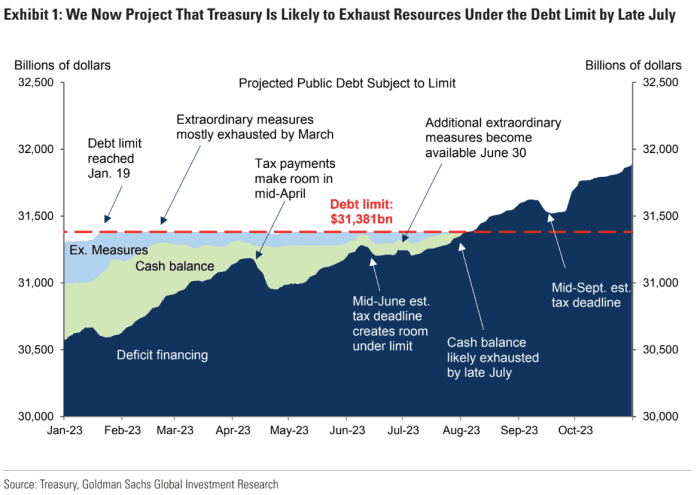

US Debt Ceiling: August Deadline Looms, Warns Treasury Official

Table of Contents

The Imminent Threat of Default

The US debt ceiling is the legal limit on the total amount of money that the US government can borrow to meet its existing obligations. It's a critical component of the US financial system, dictating the government's ability to pay its bills, from Social Security benefits to military salaries and interest on the national debt. Exceeding this limit, even temporarily, would have severe repercussions. A breach could lead to a government shutdown, halting essential services and impacting millions of Americans. Beyond this, it could trigger credit rating downgrades, increasing borrowing costs for the government and potentially causing a spike in interest rates for consumers and businesses. Market volatility would also be dramatically amplified, potentially leading to a financial crisis.

- Potential for delayed payments: Government contractors and employees could face significant delays in receiving payments.

- Increased interest rates on US Treasury bonds: This could increase the cost of borrowing for the government and ripple through the entire financial system.

- Negative impact on consumer and investor confidence: Uncertainty surrounding the debt ceiling could lead to a decline in spending and investment.

- International repercussions: A US default could shake global financial markets and negatively impact the US dollar's value.

Treasury Department's Warning and Proposed Solutions

The Treasury Secretary's recent warning highlighted the urgency of the situation, emphasizing the potential for a default as early as August if Congress fails to act. The administration has proposed a combination of budget cuts and revenue increases to address the issue, aiming to find a path to fiscal responsibility. However, Republican counter-proposals focus on significant spending cuts, and finding a bipartisan compromise remains challenging.

- Administration's proposed solutions: Details of the administration's budget proposals remain subject to ongoing negotiations and may include specific cuts to certain programs.

- Republican counter-proposals: These frequently emphasize a reduction in government spending without substantial increases in revenue.

- Potential for bipartisan compromise: The likelihood of a compromise hinges on the willingness of both parties to negotiate and find common ground. The current political climate makes this a significant challenge.

- Congressional Budget Office (CBO) analysis: The CBO's independent analysis of the various proposals plays a vital role in informing the debate and providing non-partisan estimates of their impact.

Economic Impact and Market Reactions

A breach of the debt ceiling would have profound economic consequences. The uncertainty alone could trigger a sell-off in the stock market and erode investor confidence. Interest rates would likely rise, making it more expensive for businesses and individuals to borrow money. The value of the US dollar could also decline, impacting international trade and investment. This uncertainty could lead to a slowdown in economic growth and potentially increase unemployment.

- Impact on the stock market: A decline in investor confidence could lead to significant market volatility and potential losses.

- Effects on interest rates: Increased uncertainty and reduced investor confidence could drive interest rates higher.

- Consequences for the US dollar: A weaker US dollar could make imports more expensive and hurt the purchasing power of US consumers.

- Impact on economic growth and employment: A default could trigger a recession, leading to job losses and reduced economic output.

Historical Context of Past Debt Ceiling Debates

The current situation is not unprecedented. The US has faced similar debt ceiling crises in the past. While past resolutions have averted immediate catastrophe, they often involved last-minute compromises and heightened political tensions. These past experiences highlight the potential risks of inaction and the need for timely and effective solutions.

- Summary of past debt ceiling deadlines and resolutions: Reviewing past instances reveals patterns and potential outcomes for the current situation.

- Analysis of the political climate during those periods: Understanding the political dynamics of past crises provides insight into the current negotiation challenges.

- Discussion of the long-term effects of past debt ceiling debates: Analyzing the long-term impacts helps assess the potential consequences of current inaction.

Conclusion

The looming August deadline for the US debt ceiling presents a serious and potentially devastating challenge. Failure to raise the debt ceiling could have severe economic consequences, both domestically and internationally. The proposed solutions and ongoing political maneuvering underscore the urgency of finding a bipartisan compromise to avoid a catastrophic default. Staying informed about the ongoing developments regarding the US debt ceiling is critical for all Americans. Continue to follow reputable news sources and engage in informed discussions to understand the implications of this critical issue and advocate for responsible fiscal policy. Understanding the intricacies of the US debt ceiling crisis and its potential impacts is paramount to responsible citizenship. Let's demand decisive action from our elected officials to prevent a national crisis.

Featured Posts

-

The Trump Factor How Threats Reshaped Greenland Denmark Relations

May 10, 2025

The Trump Factor How Threats Reshaped Greenland Denmark Relations

May 10, 2025 -

Noi Mosdo Hasznalata Miatt Letartoztattak Egy Transznemu Not Floridaban

May 10, 2025

Noi Mosdo Hasznalata Miatt Letartoztattak Egy Transznemu Not Floridaban

May 10, 2025 -

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025 -

U S Federal Reserve Holds Steady Rate Hike Pause Amidst Economic Pressures

May 10, 2025

U S Federal Reserve Holds Steady Rate Hike Pause Amidst Economic Pressures

May 10, 2025 -

High Potential Episode 13 Davids Actor And The Intriguing Casting Decision

May 10, 2025

High Potential Episode 13 Davids Actor And The Intriguing Casting Decision

May 10, 2025