US Economic Conditions And Elon Musk's Net Worth: A Correlation Analysis

Table of Contents

1. The Impact of US Stock Market Performance on Elon Musk's Net Worth

The most direct link between US economic conditions and Elon Musk's net worth is undoubtedly the performance of the US stock market. Musk's immense wealth is heavily reliant on the value of Tesla's stock, representing a significant portion of his overall assets.

H3: Tesla's Stock Price as a Key Factor:

Tesla's stock price is a powerful barometer of Elon Musk’s wealth. A significant rise in Tesla's share price directly translates to a substantial increase in his net worth, and vice versa. This close correlation is easily observable by tracking Tesla's stock price against major US market indices like the S&P 500 and the Dow Jones Industrial Average.

- Data Point: A 10% increase in Tesla's stock price can potentially add billions to Musk's net worth.

- Correlation: Historically, periods of strong US stock market growth have generally coincided with increases in Tesla's share price and consequently Musk's wealth. Conversely, market downturns often lead to declines.

- Chart Illustration: (Here, one would ideally insert a chart visually demonstrating the correlation between Tesla stock price and the S&P 500 or Dow Jones).

H3: Investor Sentiment and Market Confidence:

Investor sentiment plays a critical role in shaping Tesla's stock price and, ultimately, Musk's net worth. Positive economic indicators, such as low inflation, stable interest rates, and robust GDP growth, tend to boost investor confidence, leading to increased demand for Tesla stock. Conversely, macroeconomic factors like rising inflation, increasing interest rates, and fears of a recession can dampen investor enthusiasm and negatively impact Tesla’s share price.

- Key Factors: Interest rate hikes by the Federal Reserve, inflation reports, and consumer confidence indices all contribute to shaping investor sentiment towards Tesla and other tech stocks.

- Market Volatility: Periods of high market volatility, often reflecting uncertainty about the US economic outlook, can cause significant swings in Tesla's stock price and, therefore, Musk's net worth.

2. Influence of Specific US Economic Sectors on Musk's Enterprises

Elon Musk's business empire extends beyond Tesla, encompassing SpaceX and other ventures. The performance of specific US economic sectors directly influences the success of these companies and, by extension, Musk's wealth.

H3: The Automotive Industry and Electric Vehicle Demand:

The US automotive industry's overall health and consumer demand for electric vehicles (EVs) significantly impact Tesla's sales and profitability. Government policies, such as tax credits and subsidies for EVs, also play a crucial role. Strong US economic growth typically translates into higher consumer spending on vehicles, including EVs, benefiting Tesla.

- EV Adoption: The rate of EV adoption in the US is a key factor in Tesla's success. Increased demand boosts production and profits, contributing to a rise in Tesla's stock price.

- Competition: The rise of competitors in the EV market could affect Tesla’s market share and profit margins.

H3: The Aerospace and Space Exploration Sector:

SpaceX's success is closely linked to both government contracts and private investment within the US aerospace and space exploration sector. Government spending on space exploration and defense initiatives can directly benefit SpaceX's revenue streams. Strong US economic conditions often lead to increased government budgets for such ventures.

- Government Contracts: NASA contracts and other government partnerships are significant sources of revenue for SpaceX.

- Private Investment: The willingness of private investors to fund SpaceX's ambitious projects also depends on the overall health of the US and global economies.

3. External Factors Affecting the Correlation:

While the US economy plays a significant role, several external factors can influence the correlation between US economic conditions and Elon Musk's net worth.

H3: Global Economic Conditions:

Global economic downturns or upturns indirectly influence US markets and, consequently, Musk's net worth. International trade relations, supply chain disruptions, and geopolitical events can all create ripple effects impacting the US economy and investor sentiment towards Tesla.

- Global Supply Chains: Disruptions in global supply chains due to geopolitical events or pandemics can impact Tesla's production and sales, affecting its stock price.

- International Trade: Changes in trade policies and tariffs can affect Tesla's profitability, particularly if it involves the import or export of components or vehicles.

H3: Musk's Personal Actions and Public Statements:

Elon Musk's personal actions and public statements can significantly impact investor sentiment and Tesla's stock price. Controversial tweets or business decisions can create market volatility and affect investor confidence, directly influencing his net worth.

- Social Media Impact: Musk's frequent use of social media and sometimes controversial statements can impact investor confidence and Tesla's stock price.

- Brand Reputation: Musk’s personal brand and reputation play a significant role in shaping investor perception of Tesla and consequently his net worth.

4. Conclusion:

This analysis highlights the complex interplay between US economic conditions and Elon Musk's net worth. While the performance of the US stock market, particularly Tesla's share price, is a dominant factor, the health of specific US economic sectors (automotive, aerospace) and global economic conditions also play crucial roles. Furthermore, Elon Musk's personal actions and public statements introduce an element of unpredictable volatility. Understanding these factors is key to comprehending the dynamic relationship between US Economic Conditions and Elon Musk's Net Worth. To further explore this complex relationship, delve into macroeconomic data, analyze Tesla's financial reports, and follow market trends closely. Stay informed on the intricate dance between US economic performance and the fluctuating fortune of one of the world's most influential entrepreneurs.

Featured Posts

-

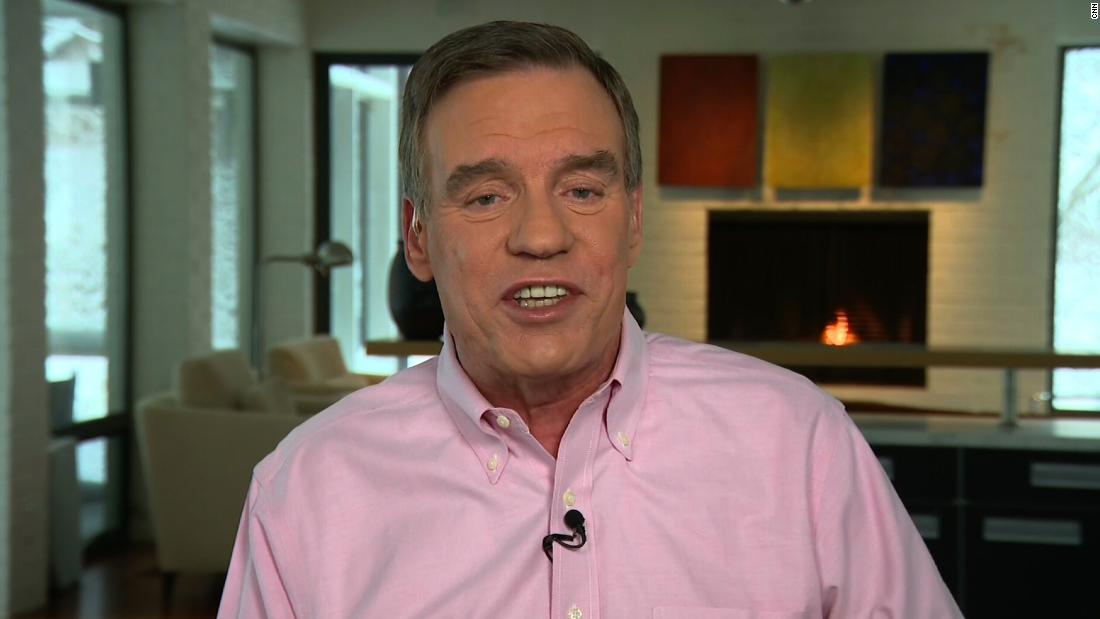

Mark Warner On Trumps Unwavering Tariff Stance

May 10, 2025

Mark Warner On Trumps Unwavering Tariff Stance

May 10, 2025 -

Woman Kills Man In Racist Stabbing Attack Details Emerge

May 10, 2025

Woman Kills Man In Racist Stabbing Attack Details Emerge

May 10, 2025 -

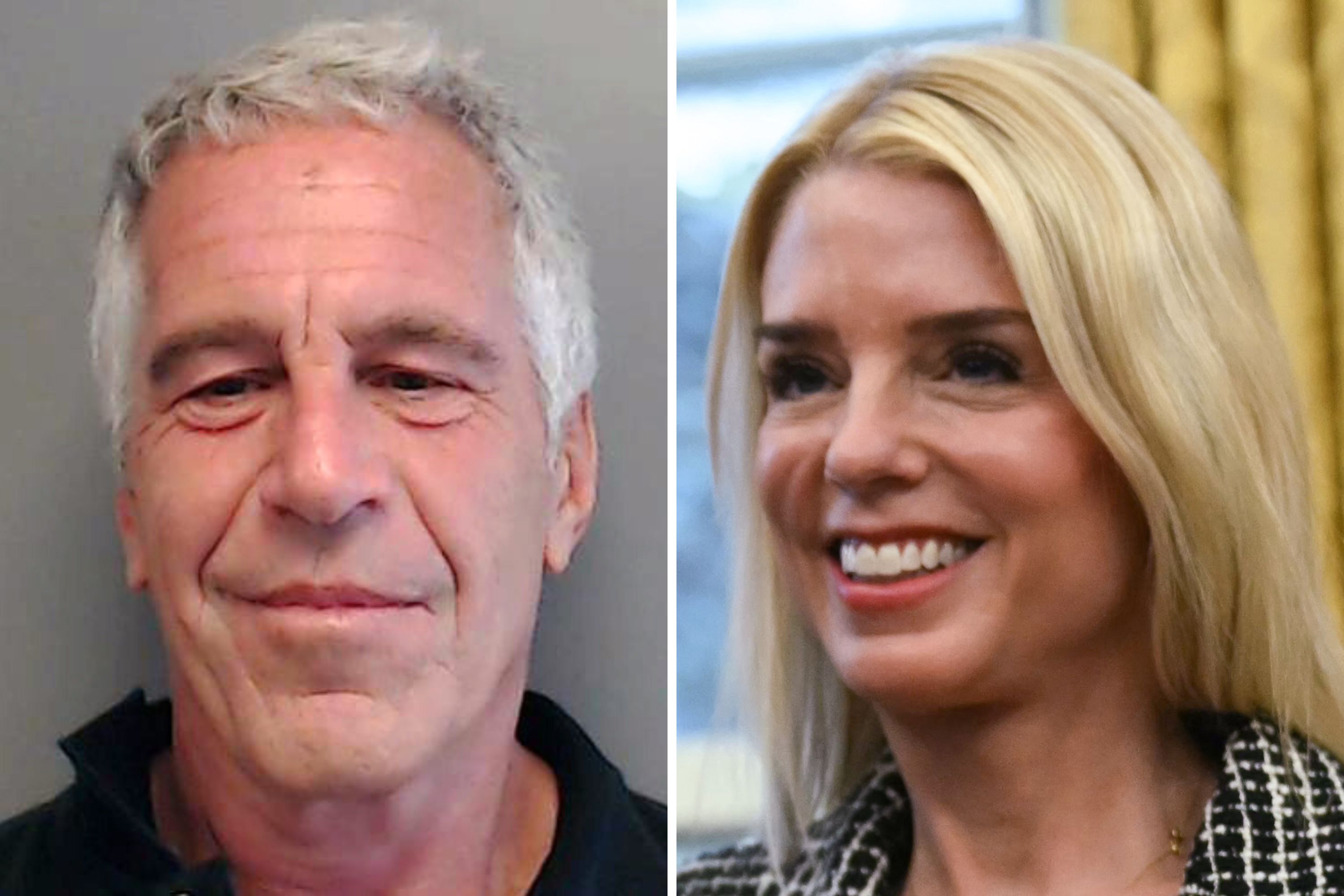

Pam Bondi And The Epstein Client List What We Know

May 10, 2025

Pam Bondi And The Epstein Client List What We Know

May 10, 2025 -

Analyzing A Book Cover The Medieval Legends Of Merlin And Arthur

May 10, 2025

Analyzing A Book Cover The Medieval Legends Of Merlin And Arthur

May 10, 2025 -

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025

Improving Wheelchair Access On The Elizabeth Line A Practical Guide

May 10, 2025